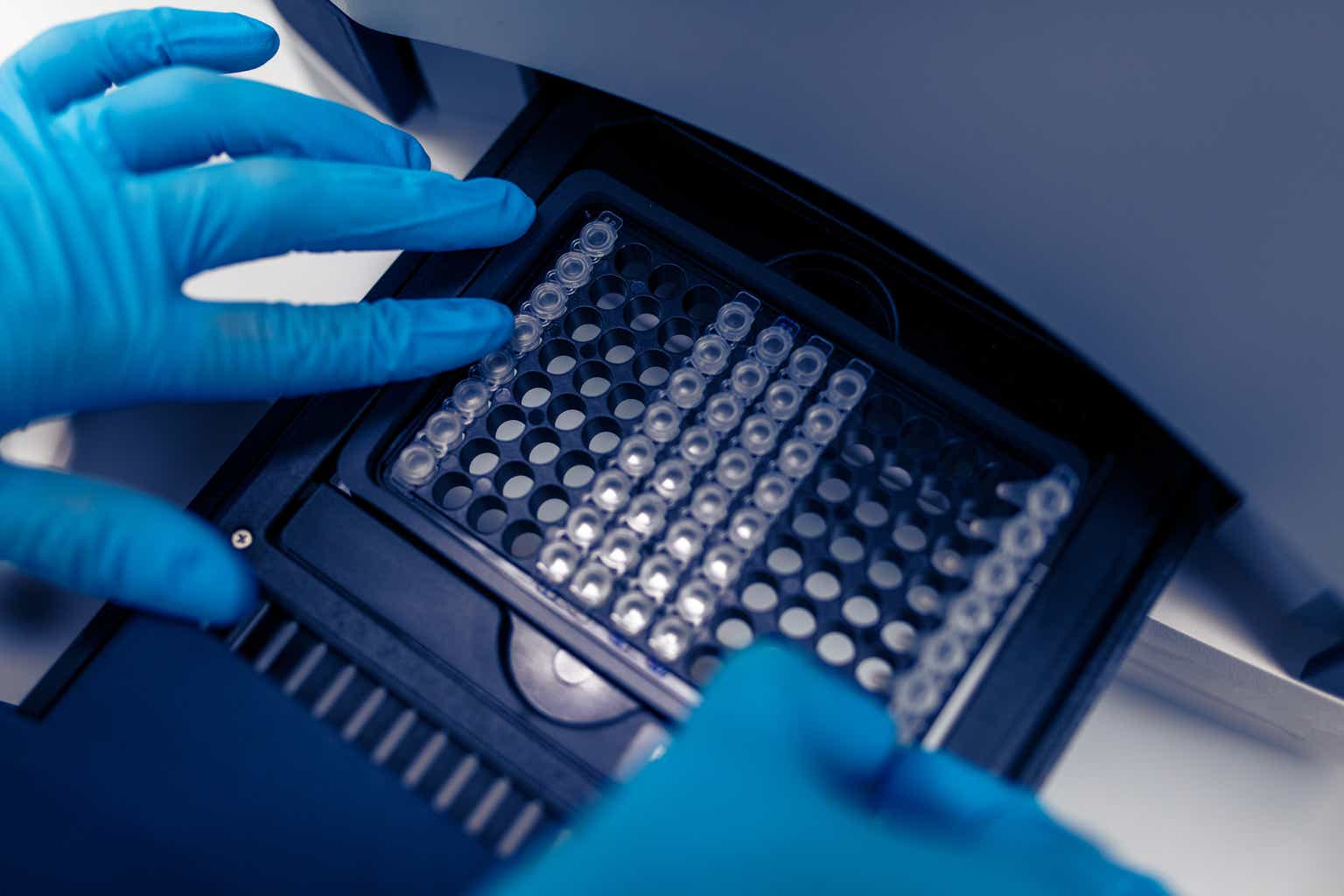

vitapix/E+ via Getty Images

I have a long history with Bole Company (NYSE:BIO) (NYSE:BIO.B), a life sciences company I covered long ago during my sell-side days.It has always been an odd duck in the life sciences It’s still the case in the world that the company is better thought of as a “pick and shovel” company, with broad exposure to biomedical research and clinical diagnostics, but not really high-value areas of expertise that allow it to grow, profit, or return. .

To that end, revenue has grown about 5% annually over the past two decades, and while Bio-Rad shares have outperformed the S&P 500, they have been outperformed by more dynamic players such as Agilent (A), bioMérieux, biotechnology company (science and technology), Danaher (DHR), and Thermo Fisher (TMO).

At this point, Bio-Rad is an odd stock to evaluate.I’m not that excited about “Core Bio-Rad” even though The company is undergoing a decade-long restructuring and transformation process, but I can’t ignore the value of the company’s holdings Sartorius (OTCPK:SARTF) (a leading German life sciences and bioproduction company) brings to the table. With this holding, I think there’s an argument to be made that Bio-Rad stock is worth a look from a sum-of-its-parts perspective.

This year (2024) doesn’t look like a banner year

Recent trends in the life sciences sector haven’t been great, as biopharmaceutical companies have exceeded previous capital spending budgets to meet a surge in demand during the pandemic, and academic and government labs have slashed spending in response to weak budgets.

To that end, Bio-Rad’s life sciences business has seen double-digit declines over the past two quarters (down 17% year over year in Q4 and nearly 14% year over year in Q3), with fairly broad-based weakness across categories. While Bio-Rad faces the challenge of a significant budget increase at the end of 2022, China’s demand for the industry’s life science tools and products has all but collapsed in the second half of 2023, and Bio-Rad has also seen significant weakness in this regard. Meanwhile, demand for biopharmaceuticals has been weak as companies delay purchases of new instruments and reduce inventories of consumables.

I don’t see much joy in the short term either. NIH’s budget allocation for 2024 is not ideal (growth below 1%), and Horizon Europe is considering a 2% cut. While China recently passed a stimulus measure targeting the tech industry, I don’t expect a quick rebound. The best-case scenario may be that Bio-Rad’s “pick and shovel” business finds stability before some of its peers, as customers still need consumables for core functions such as PCR, chromatography and cell counting.

Bio-Rad’s clinical diagnostics business performed strongly in the second half of 2023, and I expect this to continue into 2024. Businesses such as diabetes (HbA1c testing, etc.), blood typing, autoimmune testing, and QC are not growth markets, but they tend to be fairly stable when hospital patient volumes return to normal (as they are now).

Opportunity for growth but may blend into background

The good and bad thing about Bio-Rad is that the story is nothing special in terms of growth dynamics.

The company does have growth opportunities in areas such as liquid biopsy, cell/gene therapy, and proteomics with its digital PCR products (particularly Droplet Digital PCR), but there are many players in the digital PCR space, including Thermo Fisher and I. to the “can’t miss” aspect of Bio-Rad’s products, which will make it a clear winner in the market. Likewise, in areas such as cell biology and bioproduction, Bio-Rad offers products that make them a player in these attractive (at least in the long term) markets, but it doesn’t seem to me that this will bring Clear leadership position. Again, although it’s a cliche, I think the “pick and shovel” description fits here. Bio-Rad has instruments and consumables that are part of the future of a wide range of biomedical research fields, but nothing that really enhances their status as a “hot” brand. Well, I don’t think it’s a coincidence that Bio-Rad’s historical revenue growth is very close to the historical growth rate for the life sciences space that I often cite here (about 5%).

The same goes for clinical diagnostics.I like the company’s efforts to expand its PCR-based molecular diagnostics offerings (a large market that Bio-Rad has never historically had a large presence in), including the 2022 deal with Curiosity Diagnostics, but I think the company dislike Roche (OTC: RHHBY), dickinson becton (BDX) or Danaher is losing sleep over Bio-Rad’s quest to capture a larger share of the MDx space.

Sartorius is the elephant in the room

You can’t really talk about Bio-Rad without paying attention to Sartorius, at least not as an investment candidate. Over 20 years, Bio-Rad has accumulated a considerable position in the company, owning 38% of the common stock and 28% of the preferred stock.

Sartorius is a large German life sciences company with considerable influence in research tools (including sample preparation, cell analysis and cell counting, calibration/quality control and process filtration) as well as biological production.

Seemingly bottomless demand for biologic manufacturing capacity (to produce antibody therapies, cell therapies, gene therapies, etc.) drove stock prices more than 4x from early 2020 to the fall of 2021, but as with other companies in the space (Dan Nacher, Thermo, etc.) There are painful hangovers as biopharma companies cut spending and investor enthusiasm wanes.

The current Sartorius shares held by Bio-Rad are worth approximately $6.8B (or approximately $235/share), and the future performance of Sartorius will obviously have a huge impact on Bio-Rad. I remain bullish on the balance of the bioprocessing/bioproduction space as the biopharma pipeline remains full of antibody drug candidates and other areas such as cell therapy, gene therapy and RNA therapy are still in their early stages, but the market is digesting after the initial surge in demand phase (in part to address opportunities for generic antibody treatments as well as pandemic-related products), and a more cautious pace of growth is likely to emerge from here.

Outlook

On its own merits, I expect Bio-Rad’s long-term growth rate to be about 3% to 4%. The potential to grow at a faster rate is there, but it seems like this company will always end up lagging slightly behind its peers/competitors, and I think 5% long-term growth is probably overly ambitious. In the 20+ years I’ve followed this company, it has always been conservative, risk-averse, and it’s hard to catch up, let alone surpass, your market when your competitors are willing to take more risk .

With a vast distribution network and relatively high SG&A and R&D spending, Bio-Rad has never really stood out in terms of margins — the company’s average free cash flow margin has been around 9% for more than two decades. There have been periods of “windfall” over the years when demand for products like BSE Test surged, but this is a long-term record.

Lately, the company has been taking steps to try to boost its long-term operating profit potential as part of a three-phase, decade-long transformation plan, but SG&A expenses are still over 30% of sales in 2023, and that’s a lot number. Ask to get closer to less than 20% of your peers. I’d also like to point out that it’s difficult to achieve parity due to the wide variety of products the company offers, as these product lines require R&D and sales, general overhead expenses to stay viable. Therefore, I think it may be difficult for EBITDA margins (excluding Sartorius dividends) to exceed 20% in the next few years.

Even if I trust management and assume they will hit (and maintain) their improvement targets, I have a hard time seeing free cash flow margins sustainably growing well beyond the low teens (11%-12%). That’s enough to support “high-single-digit” free cash flow growth, but that alone doesn’t make for an attractive valuation.

I value Bio-Rad by discounting these cash flows through the profit/return-driven EV/EBITDA approach I use for other life sciences companies, and then adding the present value of Sartorius Holdings. This gives me a value range of $405 to $440.

bottom line

Comparing today’s price to my value estimate makes me think that Wall Street either really doesn’t like the Bio-Rad business and values it even less than I do, or it’s very skeptical of the long-term value of Sartorius Holdings (or some combination) . Obviously Bio-Rad can’t cash out today and get all that value (I’m assuming taxes are required), but even accounting for taxes, I got a fair value of $350 to $380.

Something wasn’t quite right, and it piqued my interest. Being this high on the watch list doesn’t interest me enough, and after watching Bio-Rad for decades, I just don’t agree with management’s core approach to the business, and I’d rather own other businesses that I like better , but even I admit that the price is attractive enough for almost any business.