pixel image

Blackstone Secured Loans (NYSE:BXSL) Net investment income exceeded dividends in the fourth quarter, which in turn led to a 1% sequential increase in BDC’s net asset value per share.

BDC’s Large Floating Rate The debt portfolio continues to deliver top performance for Blackstone Secured Lending, and BXSL is the rare BDC for which I’m willing to pay a premium.

New investment commitments increased significantly in the fourth quarter of 2023, and the BDC’s credit quality is very strong, especially compared to the credit trends we’ve seen for other BDCs this earnings season. purchase.

My rating history

Inflation accelerated again in the fourth quarter, and Blackstone Secured Lending’s large portfolio of floating-rate loans was finally rated a “buy” in October.

Blackstone Secured Lending’s net investment income continued to exceed its dividend payments in Q4 2023, which is Driven by higher interest rates.

Given excess dividend coverage, I expect another dividend hike in 2024.

Portfolio and credit quality

Two passive income BDCs I have held have been very disappointing recently: Oak Tree Specialty Lenders (OCSL) and FS KKR Capital Corporation (FSK)the two companies triggered investor panic after they disclosed a sharp rise in non-accrual ratios in the latest quarter.

As a result, I’ve learned that credit quality trends are currently the most important metric for passive income investors to follow. Fortunately, Blackstone Secured Lending does not disappoint in this regard.

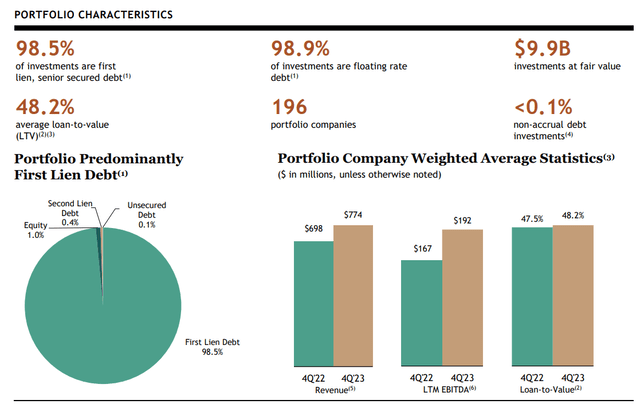

Blackstone Secured Lending is a BDC focused on senior secured debt with substantial first lien rights. In fact, first lien accounted for 99% of BDC’s Q4 2023 portfolio investments, which I think is a distinguishing feature of Blackstone Secured Lending.

Most of the BDCs I reviewed last year tended to incorporate significant amounts of equity, subordinated debt, and second liens into their portfolio structures to enhance their return potential. Since Blackstone Secured Lending doesn’t do this, BDC stands out with a more concentrated first-lien-focused portfolio.

Portfolio Characteristics (Blackstone Secured Loan)

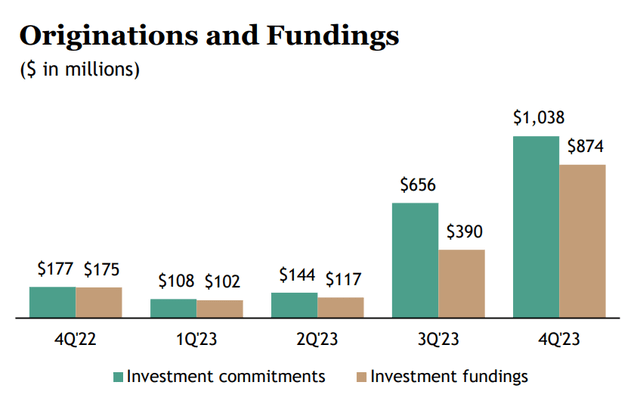

Blackstone Secured Lending’s investment commitments continued to surge in Q4, continuing a trend that began in Q3’23. Lower expected short-term interest rates are weighing on business spending and demand for new loans, which is why the company’s investment commitments have increased significantly.

Although repayments also increased, BDC’s portfolio grew strongly: Blackstone Secured Lending’s portfolio value was $9.9 billion at the end of Q4’23, up 4% quarter-on-quarter.

Origin and funding (Blackstone Secured Loan)

As I mentioned in the introduction, credit quality is of paramount importance right now, especially after the disappointment of Oaktree Specialty Lending and FS KKR Capital: Oaktree Specialty Lending’s latest quarter after reporting exceptional loan results, the company’s The stock sold off, which resulted in a non-accrual ratio of 4.2%. FS KKR Capital fared even worse, with its non-accrual ratio surging to 5.5% in the fourth quarter of 2023.

But Blackstone Secured Lending outperformed in terms of loan performance in Q4 2023, as BDC had only one non-accrual debt investment in Q4 2023. BDC’s current credit quality is comparable to Hercules Capital Corporation (HTGC).

Hercules Capital’s credit quality was perfect last quarter, with a fair value-based non-accrual ratio of 0.0%. As a result, Blackstone Secured Lending’s debt investments have a non-accrual ratio of 0.1%, which compares with the best in the sector.

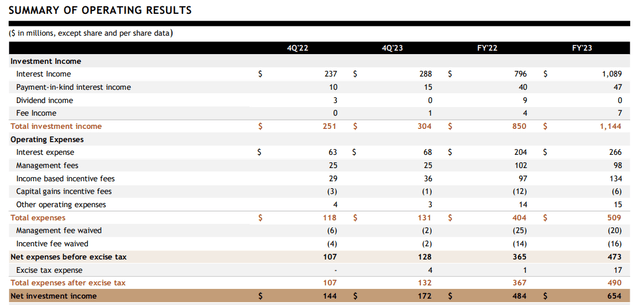

In terms of Blackstone Secured Lending’s net investment income performance, the BDC with a 99% floating interest rate has been as solid as expected. As the central bank raised interest rates last year, BDC earned $288 million in interest income in the fourth quarter of 2023, an annual increase of 22%. This is equivalent to net investment income of US$172 million, an increase of 19% year-on-year.

Summary of operating results (Blackstone Secured Loan)

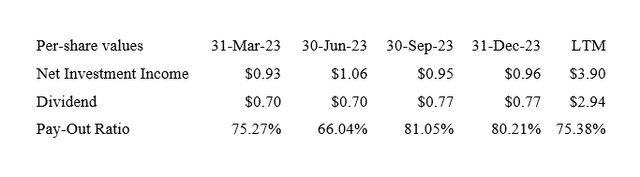

Despite a 10% increase in dividends, dividend coverage improved sequentially and the margin of safety remained solid

Blackstone Secured Lending’s net investment income per share in the fourth quarter of 2023 was $0.96, up 7% annually, thanks to BDC’s bet on higher interest rates and delivering strong returns for BDC.

The boost from net investment income allowed Blackstone Secured Lending to significantly increase its regular dividend by 10% in the third quarter of 2023. The dividend hike explains why the dividend payout ratio rose to a low 80% in the third quarter despite higher net investment income related to BDC’s floating-rate loans. BXSL’s 2023 dividend yield is 75%, which leaves room for further dividend increases in 2024.

dividend (Table created by the author using BDC information)

A premium worth paying

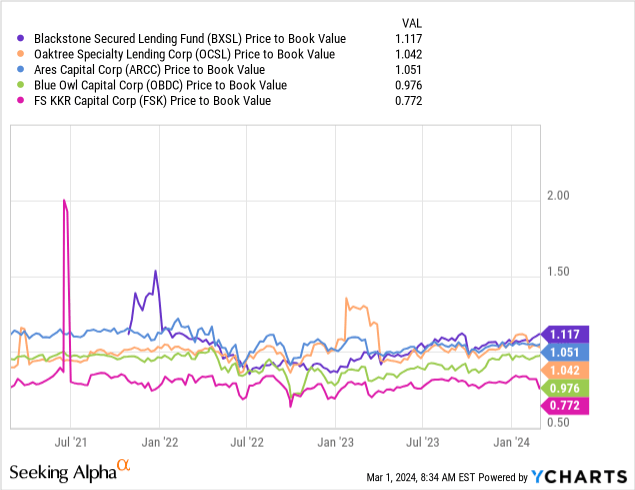

Blackstone secured loans sell at a reasonable premium to net asset value. Passive income investors currently have to pay a premium of 11% to access the 10.4% dividend yield, which is directly related to BDC’s superior credit quality.

Blackstone Secured Lending’s NAV rose 1% from the prior quarter to $26.66, supported by the factors discussed in this article.

I rarely recommend BDCs that sell at a premium to NAV, primarily because I like to enhance my total return potential through capital gains. However, in the case of Blackstone’s secured loans, I am willing to make an exception due to BDC’s solid credit quality profile and significantly excess dividend coverage.

Why Blackstone Secured Loans May Trade at Higher or Lower NAV Multiples

Since BDC’s credit quality is near-perfect, Blackstone Secured Lending’s key lever to increase net investment income is the central bank’s interest rate policy.

Although the bank said it was considering lowering short-term interest rates in 2024, the January inflation report was stronger than expected, raising questions about the central bank’s timetable for rate cuts.

However, lower short-term interest rates will create net investment income challenges for Blackstone Secured Lending, as the company relies heavily on floating-rate loans to its portfolio companies.

my conclusion

Blackstone Secured Lending’s Q4 2023 earnings were quite solid, especially against the backdrop of very disappointing credit trends for other BDCs.

BDC paid a dividend of $0.77 per share out of net investment income, while Blackstone Secured Lending’s net asset value also rose, helped by higher interest income from floating-rate investments.

Blackstone Secured Lending is currently selling for an 11% premium to NAV, a premium that I think is well deserved.

Given BDC’s net investment income trend, strong non-accrual positioning, and coverage yield of 10%, I retain the stock classification of BXSL as a Buy.