Sean Zanni

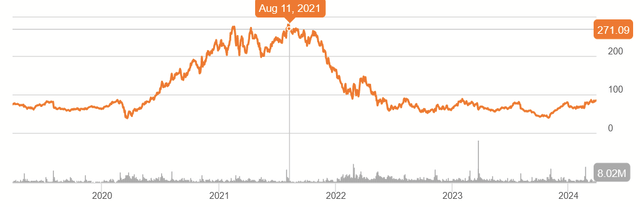

Block, Inc. stock (NYSE:SQ) has had an interesting run over the past few years.

SQ 5Y Price History (Seeking Alpha)

After enjoying the tremendous optimism of the 2021 bull market, these feelings quickly faded. 2022 also brings challenges. Last fall, the stock hit $40 and has since roughly doubled on a new wave of optimism.

Shortly after this rally, founder Jack Dorsey laid out his vision for the future in a very special speech Letter to shareholders and fourth-quarter earnings. However, I found myself asking more questions. Ultimately, as a long-term investor, I have a hard time justifying Block’s $52 billion price tag, and I think it’s worth revisiting.

Confusing market capitalization

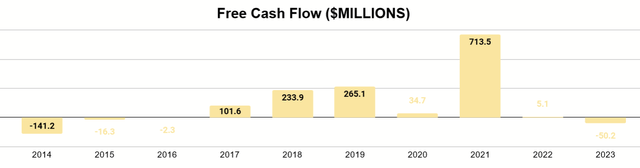

Long-term investors must decide whether a given market cap is a The reasonable present value of a company’s future earnings. What you mean by “earnings” depends on the company, but for a company like Block, I’m talking about free cash flow. Let’s take a look at the company’s financial history.

The author shows 10K data

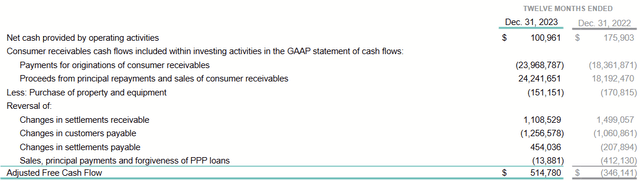

While revenue has grown steadily during this period, our view of free cash flow has been inconsistent. If you do the math, though, Block generated just over $1.1B in cash over the ten years from 2014 to 2023. The company did give us a better idea of current FCF levels:

shareholder letter

Looking at the projects it addresses (which I think are fair), Block’s adjusted FCF is about $515 million.

The current market leads us to believe That Business now worth $52B. That’s a price/free cash flow multiple of 100. Yes, “that business” has come a long way. Originally a Square service and Cash App, it had to spend money to acquire customers (i.e. $5 referral promotions) and earned mostly transaction-based fees. Bitcoin (BTC-USD) services were later added. It’s also made other acquisitions (Tidal being the most important), so its revenue streams are more diversified than in the past.

Sources of Income (2023 Form 10K)

Still, with all of these pieces taken into account, we’re talking $52B in exchange for $515M in FCF. Needed something to increase their cash flow.

Ecosystems and Banking

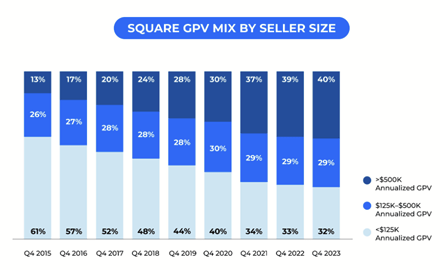

Let’s review some of the key trends shared by management. We first improved sellers through Square.

2023 10K Form

Square is gradually bringing in larger customers, suggesting it is acquiring higher-quality customers in this segment.

2023 10K Form

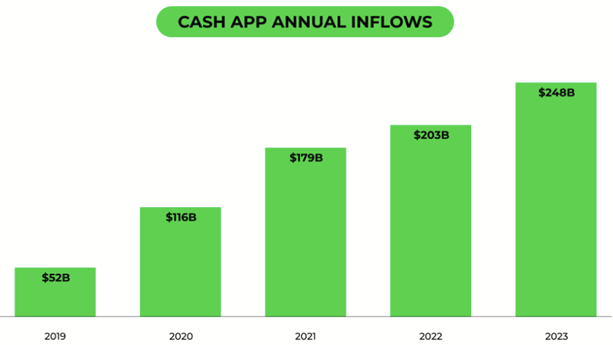

Likewise, cash inflows on Cash App are nearly five times higher than five years ago. These are signs that the business can and is growing. But crucially, as different product lines continue to gain scale, management believes the key to growth is through the Square ecosystem. Quoting from their 2023 10K form (page 8):

Our Square ecosystem consists of more than 30 different software, hardware and financial services products that provide tightly integrated commerce, customer relationship management, employee management and banking capabilities.

“Ecosystem” is a term often used in the business world today. Back in 2014, hearing this news was still new. It’s great that Amazon (AMZN) has developed its own retail ecosystem. Meanwhile, Disney (DIS) has built an ecosystem in intellectual property franchises and entertainment media. However, ultimately we have to realize that not everyone can have an ecosystem, or some people overuse the term.

Yes, Block has multiple parts that provide some synergy with each other. Enterprises have had this capability for a long time. In my opinion, a true ecosystem is one where companies have both the scale and the vertical model to operate self-sufficiently. This means that not only do they fund everything through their own operations, they avoid borrowing money to achieve their goals or even think too much about competition. They are inwardly focused and intrinsically driven.

However, I want to highlight what Dorsey said about the banking industry. He stated in the shareholder letter:

Just like peer-to-peer (P2P) payments are the gateway to Cash App Cards, we see Cash App Cards as the gateway for customers to adopt Cash App as their primary banking solution.

After noting the numbers suggesting this possibility, Dorsey added:

So how do we seize this opportunity? The first step is to win the trust of your customers.

Trust is kryptonite. The shift from offering electronic payments to banks is a major shift. It’s not an ecosystem that can do that either. At this point, the card (and some adjacent services) that holds the account balance and processes payments is your standard bank. I doubt Bullock can compete with the established banks.

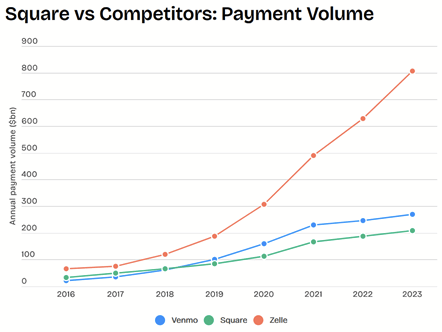

Businessofapps.com

As you can see from the picture above, Square didn’t even dominate at home. Zelle does, who owns Zelle? Some private companies called Early Warning Services, LLC, collective ownership By the big banks.

You need qualified personnel in the regulated industry of banking. However, Dorsey doesn’t seem keen on expanding his workforce, explaining in his shareholder letter:

We are below the 12,000 cap. This limitation forces us to prioritize more impactful work, which we believe will lead to growth. We will operate under this cap until we feel it is holding us back, which may take a few years, and continue to take a critical look at our organization and priorities.

One thing that has made digital payment apps notorious from the beginning is their poor customer service. If Block wants to succeed in banking, they need to attract large deposits, but someone with that much money is hesitant if they have a problem and can’t easily talk to anyone about it.

A few years ago, I was unable to get a refund through PayPal that shouldn’t have been processed, although I quickly resolved the issue. There was essentially no customer service to resolve my situation. My reply? I stopped using PayPal entirely. When I go to my local branch, I can handle this with the bank staff within minutes without any hassle. I still use that bank.

Customers care about what happens to their money. Cash App is built on Millennials splitting the dinner bill or pooling their money to buy gas. The banks have a lot to do and I don’t believe Bullock realizes what a step this is and how tight the competitive squeeze will be.

That’s certainly not how ecosystems work.

Share-based compensation

Even if we can put aside these strategic and operational issues that impact fair market value, we still have to remember that SQ stock is what’s on the table. Their value as part of ownership is what matters. That being said, the trend of diluting shareholders by offering stock-based compensation to employees is very concerning.

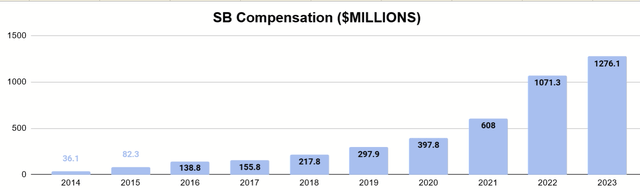

The author shows 10K data

If there’s one area where the company is really growing rapidly, it’s SBC.Driven by this, outstanding shares increased from 154.6 million shares in 2014 to 615.8 million shares in 2023

In 2022 and 2023, SBC’s annual sales will exceed $1 billion. While Block was kind enough to provide us with ideas for improvements to the 2023 FCF, the 2023 SBC is more than twice as large. Even if Block’s fundamentals improve at all as the current market around Dorsey and SQ would like, it begs the question of how long-term investors will benefit if they are diluted faster than cash is generated each year.

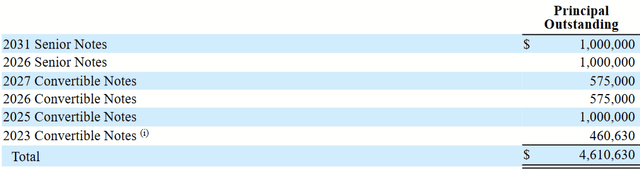

Long-Term Debt (2023 Form 10K)

Relatedly, Bullock has billions of dollars in long-term debt coming due over the next horrific years. Most of these are low interest rates, so perhaps they can be refinanced later at a favorable rate, but these are also convertible bonds, and they may also increase dilution. Even if no conversion occurs, principal repayments will naturally compete fiercely with current free cash flow levels. It’s not a big deal, but it’s one more thing to add to the picture that I already dislike.

in conclusion

Given these issues, I don’t know how to build a discounted cash flow model to provide a valuation for SQ. This calculation relies on realistic growth assumptions. It’s hard to say what that will look like as Bullock is trying to position itself as a bank, which I think is a risky and ambitious step. There’s no sign that it can or will increase its cash generation enough to make the P/FCF look reasonable.

Potential dilution from stock-based compensation and convertible debt also complicates how much of a stake SQ’s individual shares ultimately own in those future cash flows.

Long-term investors deserve a firmer grip than SQ Investing. Without room to assess and determine margins of safety, action cannot be taken. Until Block’s FCF profile, its growth, and stock dilution more clearly and convincingly present an attractive opportunity, I can’t consider SQ a buy.