Anusonakdi

I’m following up on my previous analysis of Bluebird Bio (Nasdaq: blue) based on recent funding news.

Last November, just before the FDA announced Bluebird’s sickle cell treatment, I rated Bluebird a Buy Here’s why:

- FDA approval may be based on signaling.

- Cash flow is tight but controllable.

- In terms of intellectual property rights alone, the stock’s floor price is about $300 million.

Although the FDA does this Approval of treatment, which comes with a black box security warning and costs 40% more than the competition. This caused the stock to plummet, down 64% from my last analysis.

Blue Price Trend (Seeking Alpha)

Despite these challenges, I believe Bluebird Bio is still priced below what it would have sold for based on the intellectual property rights alone.Additionally, the company secured $175 million in debt financing Try to achieve profitable growth, which will provide additional upside. With this in mind, I continue to give Bluebird Bio a Buy rating.

potential sales value

As shown above, Bluebird’s market capitalization is currently just over $280 million. I believe this could be less than the likely sale value if Bluebird were dissolved and the intellectual property rights were sold.

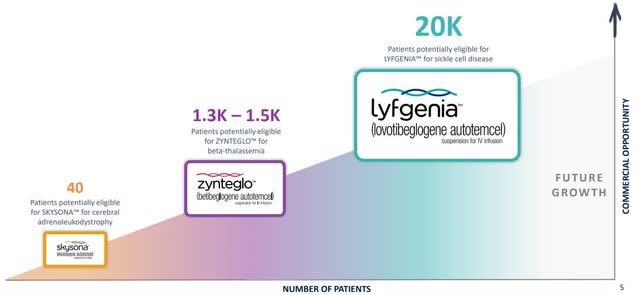

Bluebird Bio has three approved gene therapies with more in development and thousands of potentially eligible patients.

Bluebird Biotherapeutics (BLUE Investor Relations)

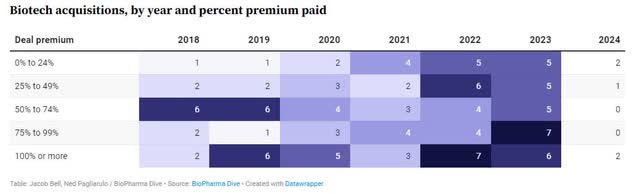

Additionally, biotech acquisitions accelerate in 2022 and 2023, with average deal premiums increasing to 50-60%.

Biotech Acquisition Premium (Biopharma Diving)

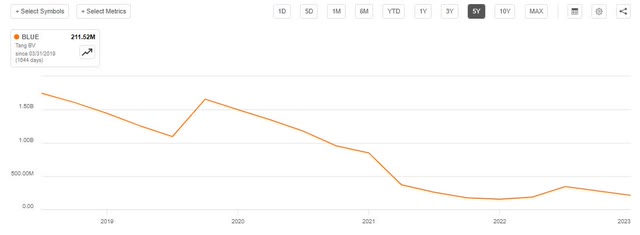

Bluebird’s tangible book value has been declining as it burns through cash, and is currently about $200 million.

Blue Book Value (Seeking Alpha)

At an average trading premium of 50-60%, and with no debt, that would imply a current value of $300-$320 million, a significant increase from the $280 million market cap.

Cash runway extended

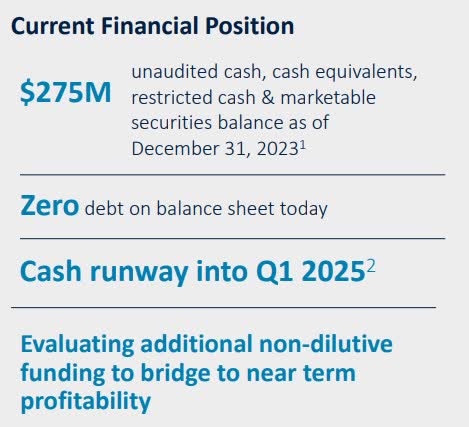

As of the company’s last presentation in January, it had $275 million in cash on hand and zero debt, expected to end in the first quarter of 2025.

Cash Position (Blue Investor Relations)

On Monday, March 18, Bluebird announced that it had secured an additional $175 million in financing from Hercules Capital.

Adjusting for cash burn since January (about $20 million) and $50 million in restricted funding, the Bluebirds should have about $380 million in available cash. This would extend them into 2025 and beyond if profitability improves. This gives the company some breathing room to continue executing on its strategy and expand distribution.

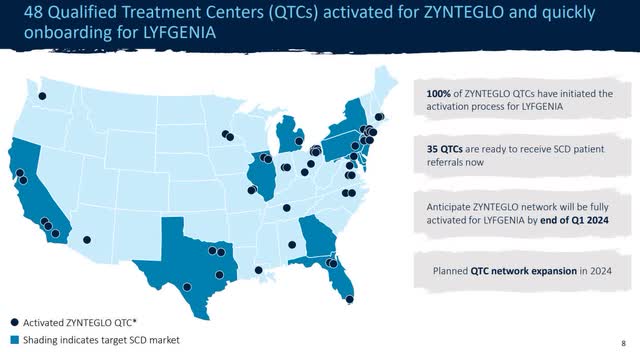

Distribution Strategy (Blue Investor Relations)

path to profit

While IP value is a benefit in and of itself, we still want to consider the additional value a company brings by expanding its cash runway to become profitable.

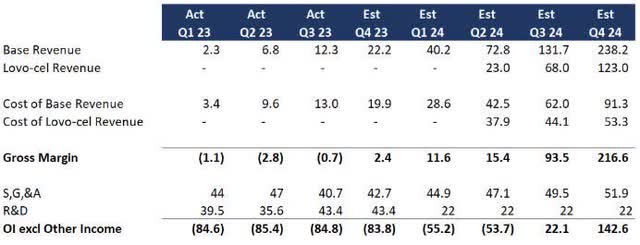

Company reiterates 2024 business guidance The first patients with LYFGENIA will be available in the first quarter of 2024, with a total of 85 to 105 patients by 2024 (lifetime value of approximately $180 million). In the absence of new financial data, Bluebird’s performance is consistent with my previous analysis. As a review, I’m assuming the following:

- Therapies will show linear growth, with cost of revenue improving as they scale.

- Lyfgenia (formerly known as Lovo-cel) will grow at the same rate as the prior treatment, but the 10x reflects the larger market.

- Following approval of Lyfgenia, there were no significant changes to SG&A and R&D expenses were significantly reduced.

BLUE Profit Forecast (Data: SA; Analysis: Mike Dion)

A lot of work needs to be done on the distribution and purchasing side. Additionally, Bluebird will need to convince payers to pay, although initial discussions are reportedly going well. Bluebird has signed outcomes-based agreements with payers covering more than 200 million people in the United States.

Regardless of the specific results, existing revenue based on new treatments will be profitable in the short term, or at least reduce cash burn. Near-term profitability would represent a huge upside from current prices, but I will reserve profitability specific price targets until further earnings are released.

Downside risks

While it’s possible, I think it’s extremely unlikely that the intellectual property will be worth $0 when sold. The more likely downside risk is that Bluebird won’t command the same premium as other biotech companies and won’t be able to hit the 50-60% premium mentioned above.

Another downside risk is the FDA withdrawing approval now that Bluebird’s treatment has passed Accelerate approval process.The good news is that only 20-25% of medications accept Accelerate approval was withdrawn, relegating it to a lower risk category.

judgment

Bluebird Bio’s stock price plummets following safety warnings and highs for innovative gene therapy for sickle cell disease. In fact, it’s down 64% from my last analysis in November.

However, I believe there is significant upside potential. Bluebird Bio’s pricing appears low even for IP sales with a market capitalization of $280 million, compared with a potential sales price of $300-$320 million based on comparable biotech sales.

In addition to the floor value of its intellectual property rights, the company has expanded its cash runway and is still likely to be profitable next year based on patient trends and payer negotiations.

Given the above factors and with considerable risk mitigation, I maintain a Buy rating on Bluebird Bio.