Sutiphon Chandon

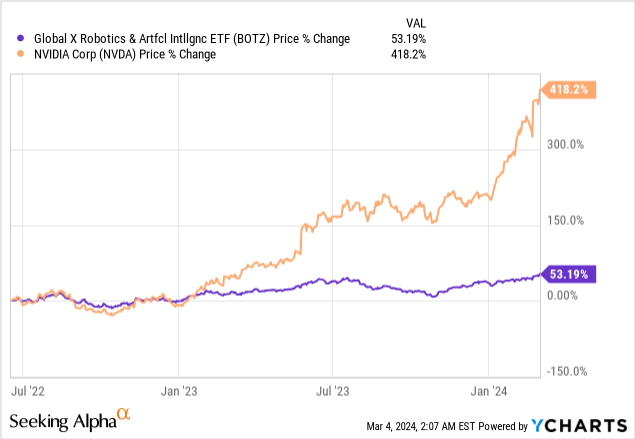

Since I last reported on the Global X Robotics & Artificial Intelligence ETF (NASDAQ: BOTZ) In June 2022, in a paper titled “A Strong Cocktail Of Robotics And AI For The Long Term”, it was Despite my hold stance, it’s still 50%.Since the Fed was in the middle of interest rates, I was cautious Hiking The ETF bottomed at $18.3 from $20.96 per share at time of publication, justifying my caution and demonstrating the important role that monetary policy plays in determining stock market performance.

BOTZ’s holdings have changed between then and now, one of which is a doubling of its weighting in Nvidia (NVDA).The semiconductor giant’s market capitalization now tops $2 trillion A gain of more than 400% in less than two years means it may not look attractive from a valuation perspective unless there are other ways to secure investment. That’s the purpose of this article. Using P/E multiples and diversification principles, I show that Nvidia stock is better owned through BOTZ.

First, after such a rally, it is necessary to make a strong case for investing in BOTZ, especially while financial conditions remain tight.

Reasons to invest in robotics and artificial intelligence now

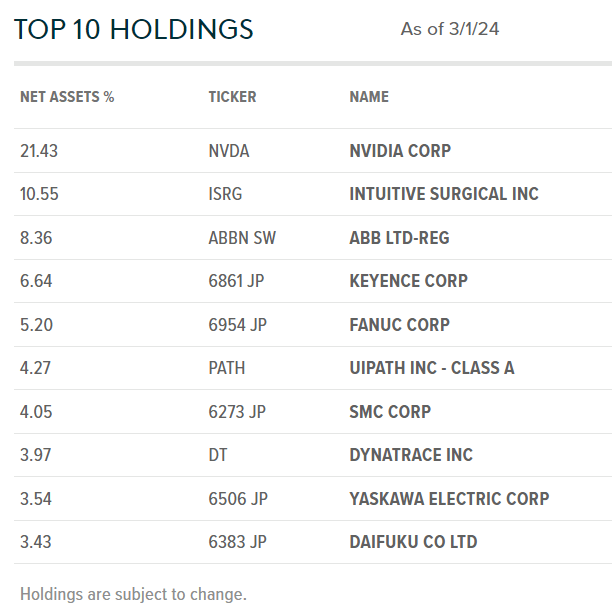

First of all, the global robot market is worth approximately US$305.9 billion in 2024 and is expected to reach US$738.8 billion by 2030, which means 15.83% Long term CAGR growth. Second, robotics, such as the robots that work in an automated manner in car factories, would not exist without artificial intelligence, or software algorithms that determine the tasks being performed. The smarter the algorithms, the more autonomous the robotic devices produced by companies like Fanuc Corp (OTCPK: FANUY ) or Keyence Corp (OTCPK: KYCCF ) , a Japanese company owned by BOTZ, will become, as shown in the chart below.

The list of holding companies also includes ABB Ltd (OTCPK: ABBNY) from Switzerland, which is focused on electrification for industrial and transportation applications. Additionally, the company’s solutions include a high degree of automation, reducing the need for human intervention, especially considering they need to operate 24/7. This level of automation requires innovation at the electronic circuit itself or at the wafer level to perform advanced tasks while consuming less power. Additionally, the automation is embedded in ABB’s products themselves, which makes them less visible than industrial or home appliance robots, but the company remains a key player in the field.

Globalxetfs.co.jp

Looking further, UiPath (PATH) is a robotic process automation company that specializes in using software to automate certain tedious functions, such as reading a large number of emails about job applications and executing a set of responses to each email. This is accomplished through software robots or robots based on advanced computer code with a high degree of autonomy. Others such as Dynatrace (DT) are involved in cloud automation and business analytics, while Nvidia offers accelerator GPU chips in the form of GPUs. H100 Build the infrastructure to generate artificial intelligence.

BOTZ can therefore be envisioned as providing exposure to the entire robotics and artificial intelligence ecosystem, meaning it is suitable for those seeking a broader exposure to the subject.At the same time, it remains highly concentrated in its top holding, Nvidia, which more than doubled its weight from 10.16% in June 2022 21.43% As of March 1, 2024.

Nvidia’s role as driver of artificial intelligence reaches inflection point

After the buzz caused by OpenAI’s ChatGPT, there is wider adoption of interactive chat-based applications that require an LLM or large language models built using artificial intelligence. It seems the technology has now reached an inflection point, with apps like Microsoft (MSFT) 365 Copilot and Google (GOOG) (GOOGL) Workspace, as well as AdAdobe (ADBE) Photoshop, both leveraging generative AI to enrich their product portfolios. To do this, they all must rely on Nvidia’s accelerator H100 GPU chips, which no competitor is currently able to mass-produce.

In this regard, rival Advanced Micro Devices (AMD) and its m 300 Chips are developing rapidly, but Nvidia has taken the lead. Its software platform called CUDA (Unified Computing Device Architecture) has been welcomed by AI developers, and the company is also innovating rapidly.

Now, judging from the continued chip orders received in the fourth quarter of 2023, in addition to cloud service providers, companies themselves have also begun to build their own smart infrastructure. So demand appears to be across the board, which is why I believe Nvidia should be able to sell every wafer it can produce without forgetting the huge backlog, and the supply chain is also improving with shorter lead times.

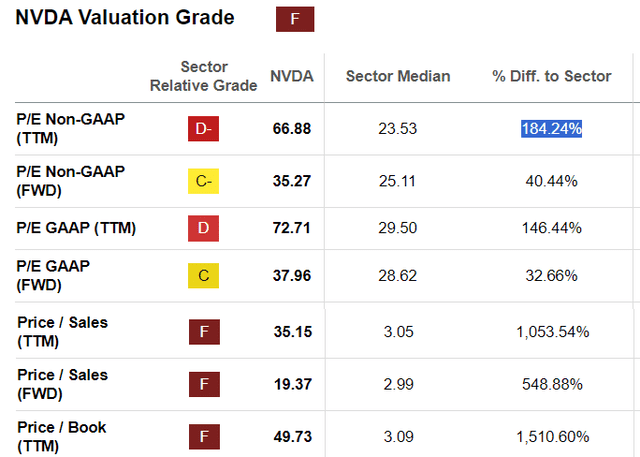

So, investing in Nvidia still makes sense, but the problem is that its price-to-earnings ratio is very high, as shown in the chart below. Therefore, its non-GAAP P/E ratio is above 180% relative to the IT industry median and may not be fully digested by more value-oriented investors. The same is true for other multiples, giving it an overall valuation grade of F.

Valuation indicators (seeking alpha.com)

BOTZ, on the other hand, trades at a P/E ratio of just 32.1 times 5.6 times lower than Nvidia. So even though it only accounts for 21.43%, or about one-fifth, of Nvidia stock, you’re effectively paying for your exposure at a lower P/E ratio, or more than five times lower than buying shares of the semiconductor giant outright. Moreover, because its price is relatively low, it has a good margin of safety and can appreciate faster when market conditions are favorable.

As for the target, I multiply the current stock price of $31.64 by 15.83%, which is the growth rate of the artificial intelligence market, and get $36.64 by the end of this year. That’s well below the 50% upside over the past year and a half, but being overly optimistic ignores the risk of volatility, just as it will in 2022.

Buy after considering the risks and considering the rationale for diversification

At the time, a sharp interest rate hike sparked volatility, with BOTZ losing about 48% of its value before recouping its losses.Now, in 2023-2024, in addition to the AI opportunity, some of the price action is also driven by the prospect of rapid easing of monetary policy, with many economists expecting the first rate cut to occur at the earliest March. However, realistically speaking, the Fed has said it will cut interest rates three times this year due to slowing consumer prices.However, in 3.1%inflation remains above the Fed’s 2% target.

Realistically, though, we’re still far from a 2022-like rate hike scenario, but rates could still remain higher for longer, which could lead to volatility.

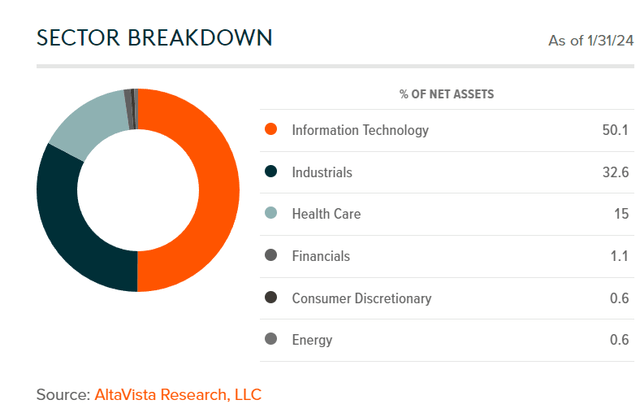

In this case, to further prove my bullish stance, apart from IT and industrials, BOTZ is also involved in the healthcare space, with the stock accounting for 15% of its weight as shown in the chart the following.

Globalxetfs.co.jp

In this context, through the application of artificial intelligence in the field of biomedicine, process The discovery of treatments can be accelerated by more accurately predicting the efficacy and toxicity of potential drug candidates, rather than relying solely on time-consuming and labor-intensive clinical trials.Hence, the global artificial intelligence in drug discovery market is expected to expand to $4.9 billion By 2030, BOTZ will grow from less than 1 billion in 2023, with a compound annual growth rate of 40%, which can help BOTZ further appreciate.

In summary, this article makes the case for an indirect investment in Nvidia through BOTZ, which allocates about 21% of the weight to the smart chip specialist, mainly because of its low valuation.

Looking further, the VanEck Semiconductor ETF (NASDAQ: SMH ) holds a higher percentage of the semiconductor giant’s stock, or 25.68% overall weight, but still highly focused on the chip name. BOTZ, on the other hand, offers a more diverse approach to AI through broader industry exposure, or inclusion of actors involved in building smart infrastructure and leveraging them. Such diversification is important at a time when higher financing costs due to rising interest rates pose risks to the stock market, especially technology stocks, which trade at higher valuations compared with the broader market.

To that end, the Goldman Sachs (GS) equities team said the S&P 500’s implied weighted average cost of capital has surged to 5.7%, well above the 3.8% bottom reached in the tech bubble year of 2001. Therefore, after Nvidia’s share price soared more than 400%, it would be best to invest in the stock in a diversified manner, which can be achieved through BOTZ.