Product Doctor

Brazilian Agriculture (NYSE:LND) is a farmer and land developer from Brazil.

I have been covering the company since December 2021.My most recent article, published in January 2024, maintains the argument that when Compare its market capitalization to its period average profitability. Additionally, investing today is risky given the recent bullishness in commodity markets and the fact that the company exploits these markets in a variety of ways (production, land prices, fair value changes in accounts receivable).

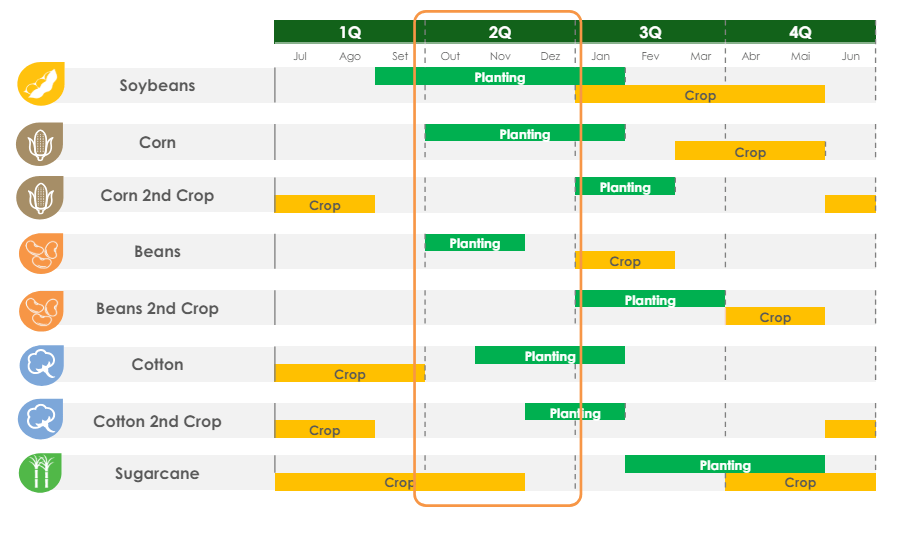

In this article, I review the company’s 1H24 results and 2Q24 earnings call. This period marks the end of the planting season and the beginning of 2H24 harvesting and sales; therefore, it peaks our FY2024 profitability.

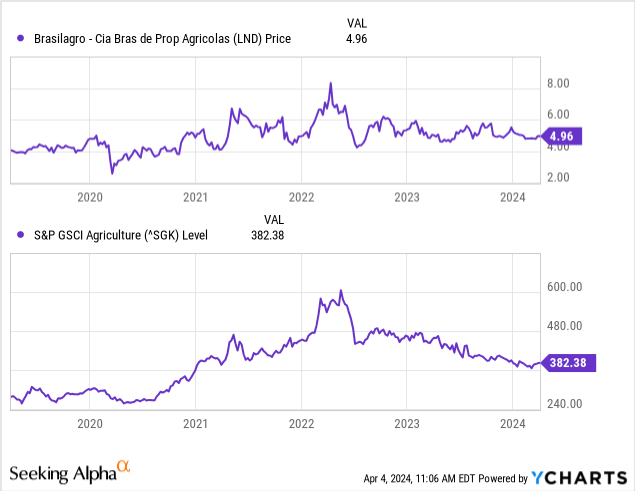

With the company’s stock price essentially unchanged since January and agricultural markets turning lower, BrasilAgro remains not an opportunity. these prices.

Sowing and harvest peak

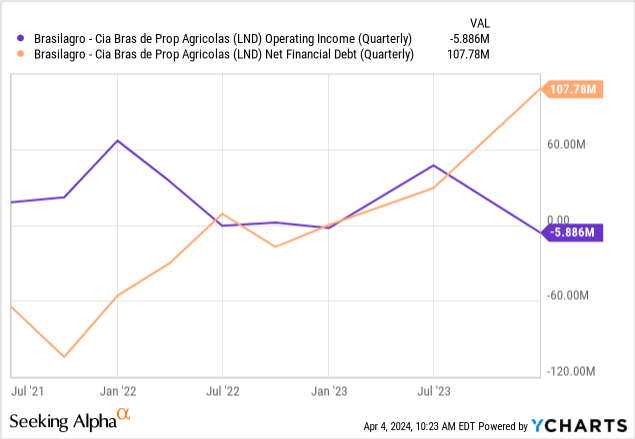

Seasonal losses and working capital accumulation: Anyone reading the company’s first-half 2024 financials will notice a decrease in cash reserves, an increase in debt, and an operating loss.

This process is seasonal and standard. The first half of the fiscal year (July to January) is the growing season for cereals (soybeans and corn), which requires significant working capital investments.company’s Financial Statements Biological assets from cereals alone (soybean and corn crops in the ground) are shown to have increased by $50 million. Without a lot of sales, the fixed cost structure (mostly SG&A) doesn’t cover it. The score difference should be recovered in the second half. The image below illustrates this process very well.

Brazilian Lagro Cultivation and Harvest Cycle (LND 2Q24 performance report)

The situation is expected to be not good in 2H24: There are signs that the second half of 2024, and the entire fiscal 2024, won’t be a good time for the company.

First, the company decided to plant less corn during the first harvest and less during the second harvest because, according to management, profits were “negative.” Secondly, there is a drought (negative) Niño phenomenon in Brazil, resulting in lower yields.

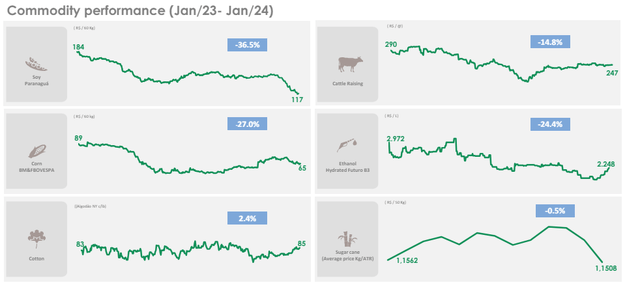

Third, agricultural product prices have generally fallen (Figure 1 below). They will continue to do so, at least for the important soybean culture, as the huge increase in Argentinian production is not offset by increased global demand (quite the opposite of China’s slowdown). For key soybeans, 60% of production is hedged at $13.20 per bushel through the first half of 2024 (10% below last year’s harvest price). This year, soybeans have been trading below $12 per bushel (S_1:COM) since January.

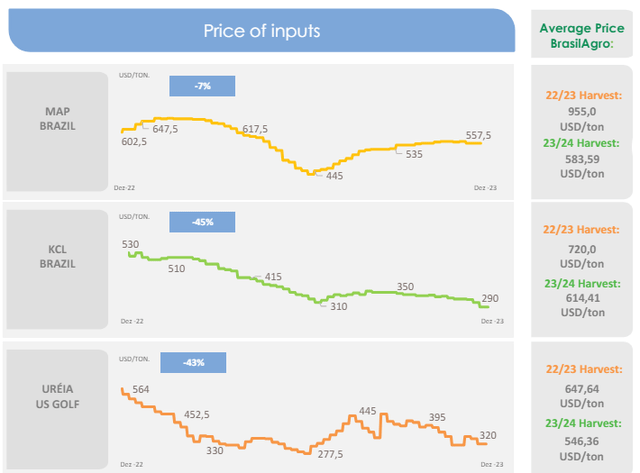

Fourth, although fertilizer prices have fallen by more than 40% since their peak in 2022/23, most purchases have already been made in the 2023/24 season, which means that the savings are not high (second chart below, right column) .

Agricultural product prices (Brazilian real) (LND 2Q24 performance report)

Fertilizer prices (LND 2Q24 performance report)

Other developments: Management also discussed other areas of important, longer-term impact.

BrasilAgro is investing in technology and infrastructure. On the technology front, the company is applying an agricultural ERP system called Agrobit (SAP partner) and installing wireless connectivity at its main farms to further expand into precision agriculture. This helps save fuel and fertilizer to a great extent. The company is also installing biofungicide preparation plants on its farms, thereby saving on inputs. In terms of infrastructure, the company is building irrigation facilities on 4,000 hectares of land in Bahia and plans to continue the project in the arid regions of northeastern Brazil. Irrigation was particularly beneficial to cotton production in the region.

On the real estate side, the company said it will likely remain a net seller of land, which is good given Brazil’s cycle. Commodity prices have risen over the past five years and so have land prices in multiples of cash or produce bags (BrasilAgro’s preferred sales method). Management said it would take about three to five years for the P/E ratio to fall into negative territory, at which point buying land would become more attractive. BrasilAgro is replacing land sales with mature land (shifting from ranching to farming, land activities that are more productive) and entering into long-term leases on less developed land, which (possibly) will eventually be purchased, although this is not a possibility in my opinion definite. View.

Revisiting Valuation

Not much has changed from my latest valuation and article. The company’s shares were flat as agricultural markets continued to deflate after a post-pandemic boom.

As I proposed in my latest article, under an optimistic scenario, the company could generate $60/70k operating profit, which is average since 2021 (ignoring land sales). After interest ($15 million) and taxes (30% in Brazil), $40 million remains. We can see that even in the optimistic scenario (a continuation of the commodities bull cycle of the past three years), LND offers a relatively high P/E ratio of 12x (given a market cap of $500 million). Such a high price-to-earnings ratio is justified by the high net asset value per share based on current land prices.

However, in a pessimistic scenario, LND cannot generate much profit. Between 2014 and 2020, the company’s average operating profit was US$18 million, barely covering interest expenses for the period. In this case, the P/E ratio is very high (annual revenue is less than $5 million, but the P/E ratio is as high as $500 million). In this scenario, the NAV gap will also disappear as land prices recalibrate after several years of bearishness (as management commented on the latest earnings call).

This means BrasilAgro is still priced based on optimistic results. This does not represent an opportunity. However, things could change in the second half of the year, as relatively disappointing results, combined with a prolonged bear market in commodities, could lead to more opportunistic prices. For now, I prefer to wait.