Ninita/iStock via Getty Images

A yield of ~10% and a P/E ratio of ~6x are simply ridiculous

Trust me, I understand why tobacco stocks have fallen so out of favor in recent years. Today’s topic is British American Tobacco (NYSE: BTI), provides a good example.as in As you can see in the chart below, BTI’s price is down 15.62% over the past year, while the overall market has seen one of its best rallies. BTI, like other tobacco stocks, does face many challenges, including declining smoking rates, shifting consumer preferences, regulatory pressure, and more.

Seeking Alpha

So I’m not here to deny these challenges. What I am trying to say here is that fears about these challenges are overblown and therefore present contrarian investment opportunities. The fear is so strong that BTI currently yields nearly 10% (9.7% to be exact) and trades at 6.4x FWD P/E, as shown in the chart above.Such a The combination is completely ridiculous except in one of two situations:

- Dividend payments are unsafe and cuts are imminent.

- The underlying business becomes unprofitable in the long term and may become permanently stagnant.

In the remainder of this article, I will argue that neither of these scenarios is possible for BTI.

Dividend safety

Let’s first look at the possibility of a dividend cut.

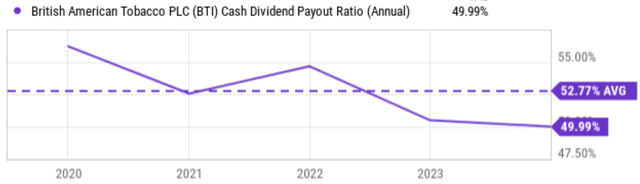

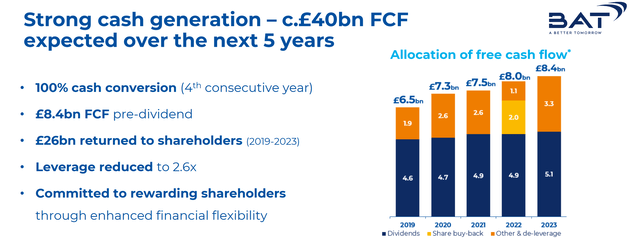

I’ll start with a simple reality check and look at its payout ratio. The chart below shows its cash dividend ratio over the last four years. We can see that the current dividend payout ratio is 49.99%, and the average dividend yield during this period is 52.77%. The average of about 52% is conservative to begin with (i.e. BTI only pays out about half of its cash flow in the form of dividends). The current payout ratio is further below average. In fact, after paying dividends, the company still has plenty of cash for stock buybacks and debt reduction, as shown in Figure 2 below.

Seeking Alpha

BTI Investor Introduction

Now when it comes to reducing debt, the strength of a company’s balance sheet is an important factor in the safety of its dividend. Unfortunately, this factor isn’t reflected in simple payout ratios. We’re always reminding dividend investors to look beyond these simple payout ratios whenever possible.

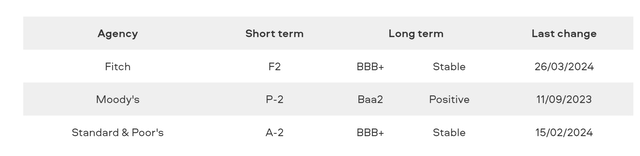

I think this is good news for BTI.As shown in the figure below, its debt rating Consistently in the mid-to-upper end of the investment grade range, with a stable or positive outlook. That is to say, Fitch Rating is F2 (short-term), the long-term outlook is stable; Moody’s rating is P-2 (short-term) Baa2, the long-term outlook is positive; Standard & Poor’s rating is A-2 (short-term), the long-term outlook is stable. So I don’t think there’s anything wrong here. Instead, I expect its balance to strengthen further as management uses the extra cash to pay down debt. For example, in 2023, the leverage ratio will only drop to 2.6x.

BTI Debt Rating

development potential

Now let’s examine profitability and growth issues. In my opinion, a P/E ratio of around 6x is only appropriate for businesses that are chronically unprofitable and/or likely to be permanently stagnant.

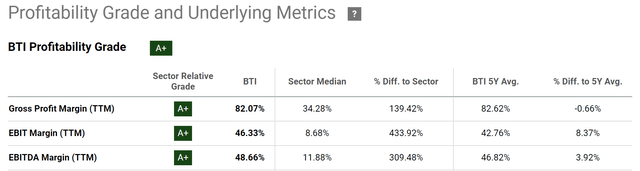

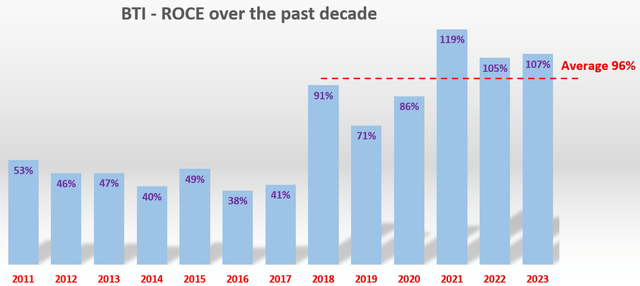

In my opinion, BTI is the polar opposite of lacking a track record and being unprofitable. As you can see from the first chart below, it has been enjoying astronomical profit margins. It has a profitability grade of A+ across all major metrics. For example, its gross profit margin is approximately 82.07%, which is significantly more than twice the industry median of 34.28%. Its EBIT margin and EBITDA margin exceed the industry median, and the gap is even wider. My own analysis of its return on capital invested (“ROCE”), shown in the second chart below, confirms the scale and consistency of profitability. As you can see, its average ROCE has remained around 96%, which is on par with some of the best technology companies such as Apple (AAPL).

Seeking Alpha

The author uses Seeking Alpha data

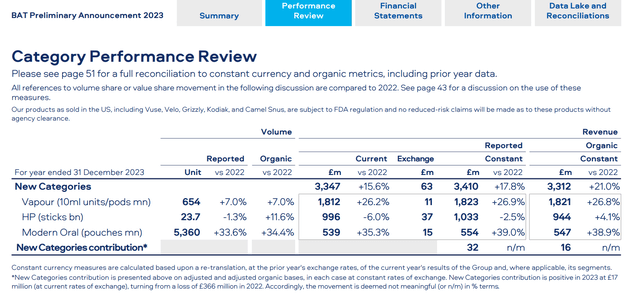

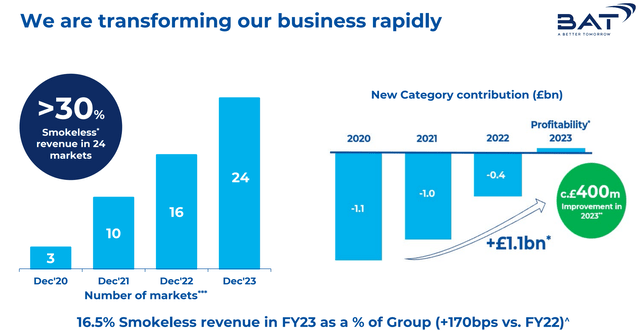

In terms of growth, global tobacco industry sales are indeed likely to continue their downward trend in the coming years.However, I am confident in the strength of its new category products Vuse and Willow. The former product currently has a 37% market share in major markets, while the latter has a 46% share in the United States. Sales of these products have been growing strongly.as in first chart As shown below, its steam products, heating products and modern oral products are expected to grow organic sales by 7%, 11.6% and 34.4% year-over-year in 2023.In terms of market share, new categories are also expanding into new markets at an alarming rate (as shown in the second chart the following). As of December 2023, these products have entered a total of 24 markets, compared with only this number three years ago. Finally, 2023 could be a key year for its new products, as the group is expected to post an operating profit for the first time, as shown in Figure 2 below. BTI plans to continue investing in smoke-free products so that by 2035 50% of total sales will come from non-combustible products. Currently, only about 10% of the world’s roughly 1 billion smokers use new category products, so I see very good long-term opportunities here and share management’s optimism.

BIT 2023 fourth quarter financial report

BTI Investor Introduction

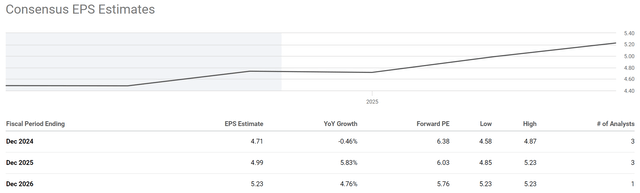

Wall Street analysts also appear optimistic. The chart below shows analysts’ consensus expectations for BTI’s earnings growth over the next three years. As shown, they expect earnings per share in December 2025 to be $4.99, representing annual growth of 5.83%. Earnings per share in December 2026 are expected to be $5.23, an annual increase of 4.76%.

For a mature company like BTI, an annual growth rate of about 5% cannot be underestimated. Especially when it’s trading at only about 6 times earnings, I think any growth is a huge plus. At this growth rate, its expected price-to-earnings ratio will shrink to only 5.76 times in 2 to 3 years. Such a low P/E ratio, coupled with superior profitability and healthy growth rates, bodes well for massive valuation expansion in my opinion.

Seeking Alpha

Risks and final thoughts

To review, it is undeniable that the tobacco industry is facing strong headwinds, and BTI is no exception. Smoking rates are likely to remain on a downward trend. The industry must also adapt to changing consumer preferences and respond to regulatory pressures. In addition to these common risks, I believe there are some more specific risks to BTI compared to other tobacco companies. First, BTI is more dependent on emerging markets. The company has a greater presence in some emerging markets than other peers such as Altria. These markets can be more volatile and unpredictable, with greater economic and political risks. In addition, as a global enterprise, its earnings may be affected by fluctuations in foreign exchange rates.

All in all, I think the positives far outweigh the negatives. So I think there’s a huge opportunity for contrarian investors. The current combination of its ridiculously high yield and low P/E ratio suggests that A) a dividend cut is imminent, and/or B) it is unprofitable in the long term and will be permanently stagnant. But as discussed above, given its strong cash flow, financial strength, profitability, and growth potential, especially in new categories, I see the exact opposite.