Richard Drury

We previously reported on British American Tobacco (NYSE:NYSE: BTI) in January 2024, discussed management’s strong success in renewing its tobacco product portfolio, with accelerating revenue growth in new category segments well balancing long-term declines in traditional cigarette segments.

With the worst of the long-term decline ahead and bottom holdings following writedowns in October 2023, we believe the discount levels offer an attractive opportunity for dividend-oriented investors looking to buy and hold indefinitely. forward yield.

BTI has recovered modestly at +4.2% since the painful writedown, compared with the broader market’s +12.8%, and we take a look at its detailed financial results for FY23.

BTI’s new category business is now on track to deliver positive margins in its first year, exceeding expectations, further supported by growing free cash flow generation and a healthier balance sheet.

we believe this is It’s only a matter of time before the stock’s valuation increases, triggering huge upside potential. Currently, because forward yields are higher, investors can simply average cost while getting paid for their wait.

BTI continues to provide compelling investment thesis for opportunistic tobacco investors

For now, BTI continues to deliver a compelling tobacco business, thanks to its successful transition from traditional cigarettes to the non-combustion segment so far, especially in its highly defined fiscal 2023 earnings results.

As we discussed in our previous article, we continue to believe the large combustibles writedown has reinvigorated its balance sheet while underscoring management’s confidence in its new category unit.

For example, BTI reports strong growth in new category segments Revenue is £3.34B (+17.8% year-on-year), sales of steam products in fiscal year 2023 increased by 7% compared with the same period last year, sales of heating products increased by 11.6% compared with the same period last year, and sales of Modern Oral increased by 34.4% compared with the same period last year.

These figures naturally balance out the long-term decline in combustibles revenue of £22.84B (-0.8% year-on-year) and volumes -4.8% year-on-year, as more and more “smokers continue to switch to smoke-free products”.

BTI’s new categories division also achieved an operating profit of £17 million (up 104.6% year-on-year), with a profit margin of 0.5% (up 14.2 percentage points year-on-year), two years ahead of schedule.

While still far from its top/bottom line drivers, the combustible segment’s operating profit was £12.54B (up 4.5% year-on-year) and margins were 52.3% (up 3.9 percentage points year-on-year), but it’s clear that cash Consumption is a thing of the past.

This naturally resulted in the company’s overall operating profit of £12.78B (+3.1% year-on-year) and a profit margin of 45.6% (+0.4 percentage points year-on-year).

The most important indicator is BTI’s free cash flow, which remains strong at £8.36B (up 3.9% year-on-year before dividends), and margins expanded to 37.6% (up 1.9 percentage points year-on-year), which means it has the ability to continue to move forward. There is shareholder return value while paying down debt.

For context, the tobacco company reported lower long-term net debt of £33.94B (-10.9% year-on-year) and a healthier balance sheet, with net debt to EBITDA of 2.6x in FY23 compared to 2.9 times per year. Fiscal Year 2022 and Growth of 3.5 times in fiscal year 2019.

Compared to peers, Phillip Morris (PM) trades at 2.68x and Altria (MO) trades at 1.86x, while tobacco industry average 2.47 times.

With BTI still set to accumulate £40B of free cash flow before dividends over the next five years, we believe its dividend investment thesis remains solid, thanks in large part to the significant upside potential arising from its inherent undervaluation.

Finally, management clearly took a page from MO’s playbook and sold ITC shares to potentially resume share repurchases, which have been relatively small since the last major buyback at $2.09B in FY22.

Due to the recovery in market sentiment, we believe BTI’s future prospects are good.

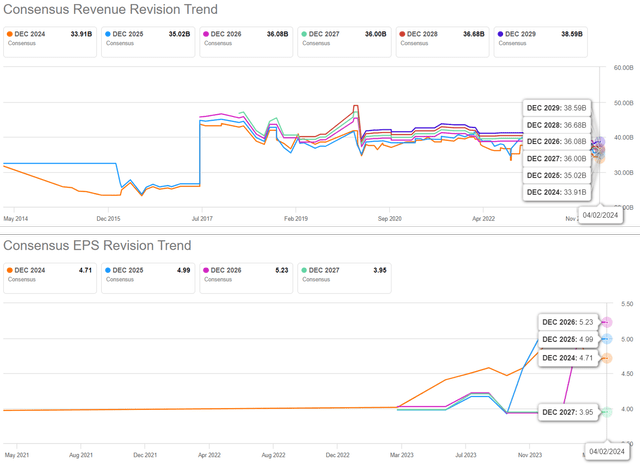

Consensus forward estimate

Seeking Alpha

The same optimism is reflected in the consensus forward forecast, with BTI expected to accelerate earnings expansion at a CAGR of +3.3%, despite forecasting slower revenue growth (+1.8%).

This compares to previous top-line/bottom-line forecasts of +4.6%/-6%, while building on historical growth of +9.2%/+6.2% between fiscal 2016 and fiscal 2023, respectively.

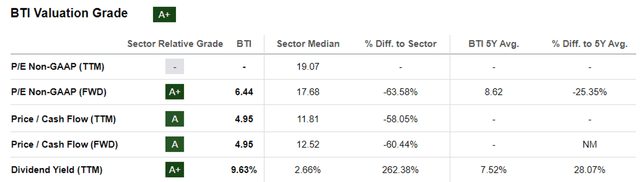

BTI Valuation

Seeking Alpha

It is for this reason that we believe BTI currently trades at 6.44x FWD P/E and 4.95x FWD price/cash flow, compared with its average 2022 writedown level of 6.92x/4.92x. They are 8.44 times/7.100 times (pre-write-down) respectively and the average of 13.02 times/12.51 times in the three years before the epidemic.

The same story holds true when compared to its tobacco peers, such as PM at 14.41x/12.70x and MO at 8.55x/8.49x, providing huge upside potential to interested investors assuming BTI’s valuation is revised upwards.

We believe the market erred in creating this buying opportunity, as BTI has delivered positive profit contribution to the new category segment, becoming the runner-up to PM, while MO remains far behind.

For context, PM reports that the smokeless segment has successfully achieved profitability, “with profitability exceeding 40% of gross profit, with adjusted smokeless product gross margin exceeding that of combustible products both quarterly and annually.”

Since BTI has already achieved its break-even target two years earlier than expected, we believe the same profitable performance is likely to follow in the future, especially Vuse In the four weeks ending February 24, 2024, it still led the US market with 42.2% (up 0.2 percentage points month-on-month).

However, readers may want to pay attention to the potential risks of PM launching IQOS 3 in the United States starting in the second quarter of 2024 and IQOS ILUMA in the United States starting in 2025, as this may adversely affect BTI’s dominant position in the e-cigarette market.

This is in view of PM’s global expertise in smoke-free methods, as management completes the “global rollout of ILUMA” (the last market being the United States), and following the recent settlement and reallocation between PM/BTI, sales are growing . U.S. IQOS Rights Protection From Mo.

So, is BTI stock a buy?sell, or hold?

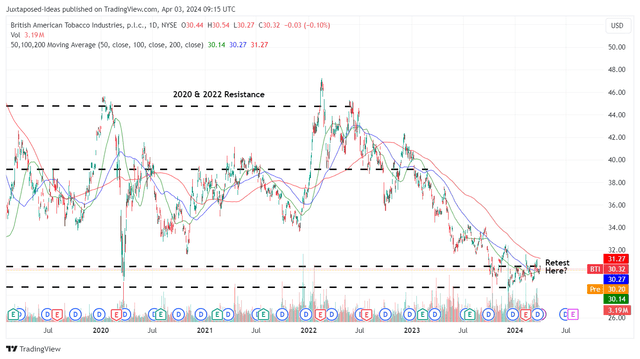

BTI 5-Year Stock Price

trading view

Currently, BTI has recovered slightly by 4.2% since the painful writedown, with the stock appearing to retest previous resistance at $30.

Based on fiscal 2023 adjusted EPS of $4.74 and a FWD P/E valuation of 6.44x, the stock appears to be trading close to our fair value estimate of $30.50.

At the same time, given the successful monetization of its smoke-free approach and the accretive impact on BTI, we are confident that BTI’s P/E valuation may be revised upward to 8.44x the 2022 average (pre-writedown). Its overall profits grew.

Based on consensus FY2026 adjusted EPS of $5.23 and an upward revision to an average 2022 P/E of 8.44x (before writedowns), our long-term investment appears to have significant upside potential of +46.4%. The short-term price target is also $44.10.

In addition to this, BTI’s forward dividend yield expanded to 9.63%, compared with its 5-year average of 4.81%, PM of 5.66%, and MO of 9.13%, thanks to its valuation discount, recent adjustments and a recently increased dividend. +6.1%.

We maintain our Buy rating on BTI stock due to the twin-pronged returns of (expected) capital appreciation and dividend income.

Waiting for huge upside.