Afternoon pictures

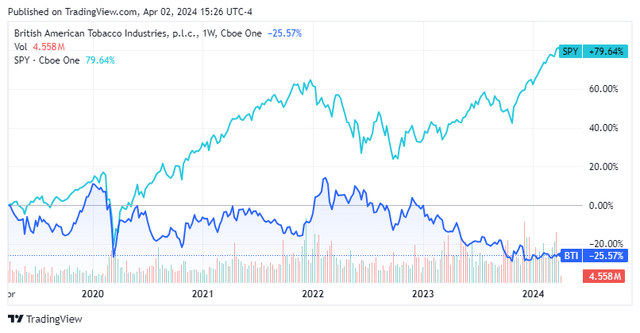

The past 12 months have not been easy for British American Tobacco (NYSE: BTI), the stock price fell -14.91%, and it was an even worse decade, with the stock price falling -46.46%.Tobacco industry, synonymous with health, continues to face pressure Risks and Government Regulations. Despite my personal opinions, the fact is that BTI’s sales exceed $10 billion. operating income and free cash flow (free cash flow) since 2018 on an annualized basis, while yielding a massive dividend yield. When I look at BTI from a business perspective, it looks seriously undervalued and I have recently added it to my repertoire. Like Altria Group (Mo), I believe it is the perception of BTI’s business, rather than its actual operating performance, that is the reason why its stock has not been acquired.Although technology controls narrative and fueling the rally, I think the broader market will catch up next year and BTI will be viewed as an opportunity that has gone away rather than continuing to be a value trap. I will continue to add to my position at these prices and happily sit back and collect dividends while I wait for my investment thesis to unfold.

Seeking Alpha

Following my previous article on British American Tobacco

It’s been a while since I’ve written about BTI, as my last post was on July 19thday, 2021 (can be read here). BTI shares have fallen -20.83% since then, while the S&P 500 has gained 20.98%. I’ve been wrong so far, Mr. Market has other plans for BTI stock. Even high dividend yields don’t complete the picture for shareholders. When dividends are taken into account, BTI’s total return was -3.75%, as the stock has lost value significantly over the past 2.5 years. In that article, I discussed BTI’s business and why I thought its profitability would lead to a better valuation and a larger dividend. Well, I was wrong about the better valuation, and while the dividend has grown, BTI is not a good investment. I will write a new article next to discuss why I am still bullish on BTI and believe the stock price has bottomed.

Risks to my investment thesis in BTI

BTI is not suitable for individuals with low risk tolerance. The tobacco industry has been under intense scrutiny for decades as companies in the industry have had to constantly adapt to changing regulations. The latest news from the FDA is that they are proposing to ban menthol-flavored cigarettes in the United States. BTI is at risk from legislative authorities as health issues continue to create a negative stigma and push for changes in existing laws. Since S&P 500 index funds have outperformed BTI over the past five years, there’s a huge opportunity cost, and there’s no technology narrative about artificial intelligence or cloud computing to excite investors. BTI faces operating risks from the global economy and its competitors. If we endure adverse tobacco harvest conditions, BTI may face reduced supplies and reduced tobacco availability. BTI is also likely to face greater competition as we move toward a smoke-free industry, as Altria Group and Philip Morris (PM) allocate billions of dollars toward oral and heated tobacco products rather than combustible products.

Seeking Alpha

Explaining why I’m bullish on BTI despite tobacco’s negative stigma

Several people have asked me how to invest in tobacco companies. Tobacco has been around for centuries, and despite the health conditions associated with tobacco products, it is legal. I look at this business from a profit perspective, and before tobacco products were considered illegal, I had no problem investing in them if I thought there was potential benefit in allocating capital. Currently, I view BTI as a value play rather than a value trap and believe there are significant opportunities in its stock from a forward-looking perspective. Anyone looking at the chart will see that the stock price is down nearly 50% over the past decade, but it’s not about where the stock price came from; it’s where the stock price came from. It’s about where they are today and where they have the potential to go. This reminds me of the MLP industry, where many companies such as Energy Transfer (ET) and Enterprise Products Partners (EPD) saw their stock prices plummet from 2014 to 2016 when oil prices fell rapidly, and then plummeted again once the pandemic began . While the fuel transition narrative continues, investors who began investing in ET and EPD during 2021 have already generated significant income from distributions and capital appreciation. I think BTI is in a similar situation and the fundamentals are too strong for the stock to trade at such a low valuation.

BTI’s operating businesses have a solid foundation, starting with the balance sheet. BTI has $5.94 billion in cash on hand and another $766.2 million in traded asset securities. BTI also has $2.66 billion in long-term investments, which brings its liquidity on its balance sheet to $9.37 billion. This represents 20.86% of the $44.91 billion in long-term debt on its balance sheet. BTI has total assets of $151.34 billion and total liabilities of $67.01 billion, which brings the company’s equity to $67.48 billion. BTI also has a book value of $29.08, which is a solid foundation for its $30.32 share price, which trades at a less substantial premium.

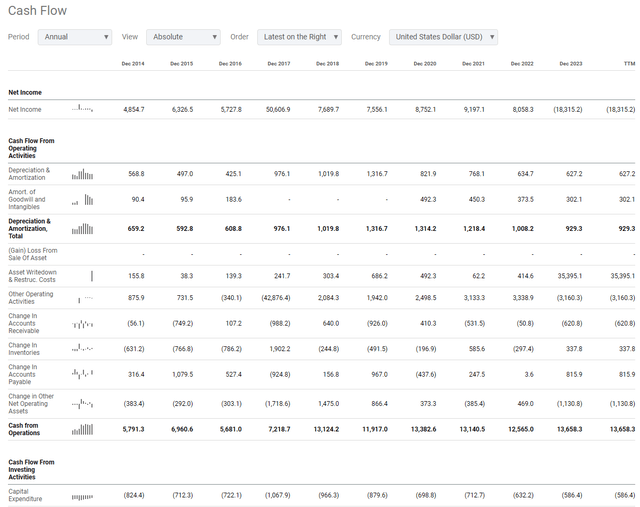

From an operational perspective, BTI is running an extremely profitable business.back BTI In 2017, it acquired the remaining 57.8% shares of Renault USA, and its revenue and profitability increased significantly. While revenue and profitability have been stagnant, BTI is worth tens of billions of dollars in both areas. In 2022, BAT generated revenue of $33.43 billion, and its cost of revenue was $5.81 billion. This brings BTI’s gross profit to US$27.62 billion and its gross profit margin to 82.63%. BTI operates at the same level as a SaaS company, and honestly, if this was a SaaS company, I bet the valuation would be much different. BTI’s EBITDA was US$14.96 billion, with a profit margin of 44.75%. BTI’s free cash flow was US$11.93 billion, with a profit margin of 35.69%, and net profit after deducting all taxes and interest was US$8.28 billion, with a profit margin of 24.67%.

In 2023, due to Non-cash impairment charge Mainly for the American brands it acquired. That’s why I focus on both net income and free cash flow, because free cash flow is not affected by GAAP accounting principles like net income is, which is just cash receipts minus cash expenses. BTI’s revenue increased 4.01% year-on-year to US$34.78 billion. Gross profit was US$28.55 billion, an annual increase of US$921.8 million (3.34%). This brings BTI’s gross margin to 82.07%, EBITDA to $16.92 billion, and free cash flow to $13.07 billion. In 2023, BTI’s expenses were -$21.75 billion and income tax expense was -$3.66 billion, resulting in its net income of -$18.09 billion. Due to the impairment, which is an anomaly, looking at 2023 operating income ($16.11 billion), BTI is operating like a well-oiled machine.

Seeking Alpha

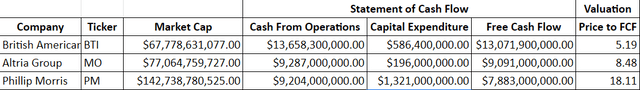

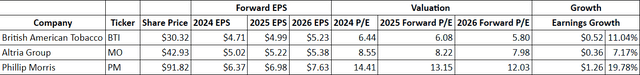

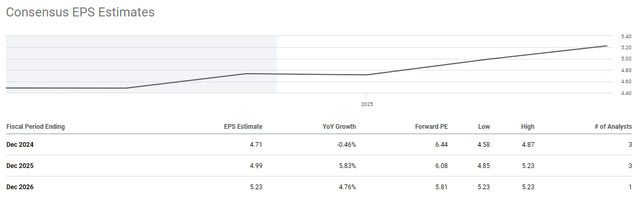

It’s not often you buy a company at a P/E ratio of 6.44, but in the case of BTI, that’s the reality. Because of the industry it’s in, the market has discounted its profitability significantly. This could be a red flag or it could be an opportunity, which I see as an opportunity to acquire stock in a very profitable company at a low valuation. BTI’s current price-to-earnings ratio is 6.44 times its 2024 price-to-earnings ratio and 5.8 times its 2026 price-to-earnings ratio. In the next two years, BTI’s earnings per share are expected to grow by 11.04%. While BTI appears undervalued by this metric alone, it trades at a discount compared to peers like Altria Group and Philip Morris. Altria’s price-to-earnings ratio is 8.55 times 2024 earnings, while Philip Morris’s price-to-earnings ratio is 14.41 times 2024 earnings. I also looked at their price to FCF to see how many years it would take for these companies to generate their full market cap in FCF. BTI trades at 5.19x current FCF, Altria trades at 8.48x, and Phillip Morris trades at 18.11x. No matter what industry BTI operates in, this cash cow generates billions of dollars in profits, even at a discount to its peers.

Steven Fiorillo, “Searching Alpha”

Steven Fiorillo, “Searching Alpha”

Seeking Alpha

BTI is preparing a major capital distribution plan for shareholders

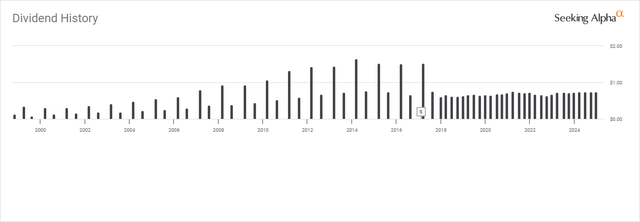

In addition to generating huge profits, BTI pays a $2.92 dividend and currently yields 9.63%. BTI has established a 20-year track record of incremental dividend growth, changing its payment frequency from semiannual to quarterly after acquiring Reynolds American in 2017. In 2023, BTI paid $6.52 billion in dividends to shareholders, which represented only 49.87% of the free cash flow generated. Management has plenty of room to continue increasing the dividend while finding other ways to reward shareholders.

On the fourth-quarter conference call, management said it would end the year with adjusted net debt to adjusted EBITDA of 2.6x, closer to the middle of the 2-3x target range. Management also revealed that once the midpoint of the target range is reached, they will evaluate other options for returning excess cash to shareholders, including discussions to introduce a sustainable buyback program. BTI expects to generate $43 billion in free cash flow before dividends over the next five years. If BTI increased its dividend by 2% per year, it would pay out approximately $34.61 billion in dividends over the next five years and still have approximately $8.4 billion in free cash flow remaining. They can easily increase their dividend by 2% per year and buy back $1 billion worth of stock annually while using the remaining free cash flow to grow the business.

Seeking Alpha

in conclusion

The tobacco industry has seen better days, but it remains an extremely profitable business for industry leaders. If you can look at the industry as a whole, BTI looks like an opportunity at today’s level, not a value trap. BTI pays a 9.63% dividend and trades at 6.44 times 2024 earnings. In 2023, BTI generated $13.07 billion in FCF, equivalent to 5.19 times its price. The main risk is that regulations continue to evolve, making it more difficult for tobacco companies to do business. I’m willing to accept this risk because tobacco companies have been adapting to changing regulations for decades and are still generating billions of dollars in profits. BTI appears to be significantly undervalued by traditional standards, and when I compare them to their peers, I see that they trade at a discount. I think current levels have the opportunity to lock in a yield on cost of 9.63%, and that BTI has the potential for capital appreciation. They’re investing money, and if they can implement their buyback program, forward earnings per share should be accretive, and I think it’s going to be an investment opportunity that a lot of people won’t ignore. I’m long BTI and adding to my position.