Piccio

There’s an old adage on Wall Street that says to eliminate emotion when investing. While this may make sense from a purely financial perspective, it’s hard to ignore the fact that nearly all human behavior is driven by emotion.

That’s why I don’t necessarily agree with this adage, because I know most investors want to feel good about their investments. This may be the case with so-called ESG stocks like Brookfield Renewable Energy (NYSE: BEP), which allows investors to invest in assets that are both good for the environment and good for their wallets in the form of a growing recurring income stream.

I last covered BEPC (the non-K-1 version of the stock) in March of last year, highlighting its strong execution across multiple assets.BEP’s performance has been less than stellar over the past 12 months as the share price has fallen 23%, as income stocks appear to be out of favor in a growth-chasing market.

BEP inventory (Seeking Alpha)

This could be a good thing for value investors, as the apparent indifference to high-quality dividend payers gives them an opportunity to add to their positions and increase their long-term income.

In this article, I’ll take a fresh look at BEP, provide an important update on its business fundamentals, and discuss what makes it an attractive dividend stock to own at its current discounted valuation, so let’s get started!

Why BEP?

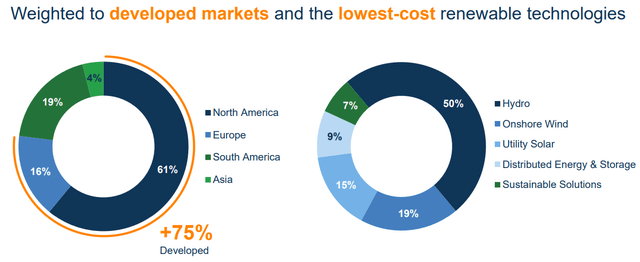

Brookfield Renewable Partners is one of the largest owners and operators of renewable energy assets, with operations in 20 countries in North America, South America, Europe and Asia Pacific. This includes wind, solar, hydroelectric and energy storage assets with a total energy capacity of 31,800 MW.

As shown in the chart below, half of BEP’s cash flow comes from hydropower, with the remainder coming from onshore wind (19%), utility solar (15%), energy storage (9%) and sustainable solutions (7%), including Biofuel production, recycling and global nuclear services.

Investor introduction

BEP sees stable and growing cash flow, helped by 90% of its generation on long-term contracts with an average term of 13 years, and 70% of its revenue indexed to inflation. BEP also has a strong track record of creating value 12% Distribution of FFO/share CAGR since 2016 and 6% CAGR per unit since 2001.

BEP continues to deliver results, achieving record business results in 2023, which were published on February 2. This includes record FFO/unit and the addition of nearly 5,000 MW of capacity, as well as $2 billion in growth capital deployed or committed with partners.

For full year 2023, BEP’s FFO/share is up 7% year over year, which is slightly lower than the 8% year over year growth for full year 2022 when I last visited the stock. Encouragingly, BEP accelerated slightly in the fourth quarter of 2023, with FFO/unit growing 9% compared with the same period last year. This is driven by the aforementioned inflation-linked protection for most of BEP’s assets. Other growth drivers in 2023 include the aforementioned 5,000 MW of new wind, solar and battery storage projects that will add to BEP’s diversified cash flow.

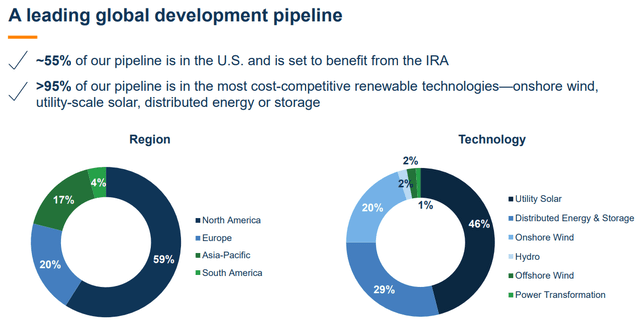

Looking ahead, BEP is well positioned to grow by deploying $2 billion of accretive capital in key markets with partners such as Westinghouse and Deriva Energy, which are expected to immediately increase their cash flow this year. BEP’s development case clearly reflects a shift more towards utility solar, as solar accounts for 46% of the pipeline, and less towards hydro, which as mentioned already accounts for 50% of BEP’s cash flow . This shift could be beneficial to BEP, as it makes the company’s cash flow more diversified while reducing its reliance on Hydro.

Investor introduction

It’s worth noting that BEP has good planning for its 3-year plan, supported by management’s update on its development pipeline during this timeframe during the last call:

Our advanced stage pipeline has significantly reduced risk, with more than 25% of planned capacity over the next three years already under construction, an additional 20% of revenue and input fully contracted, and more than 30% incremental in the final stages of securing a power purchase agreement % and construction contracts.

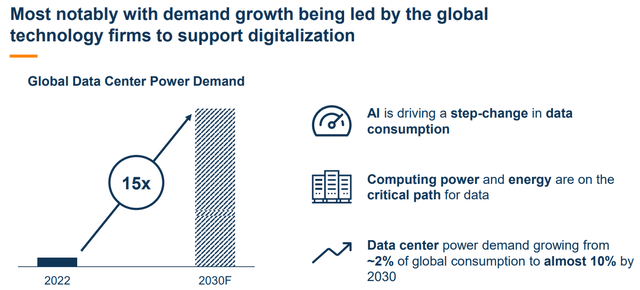

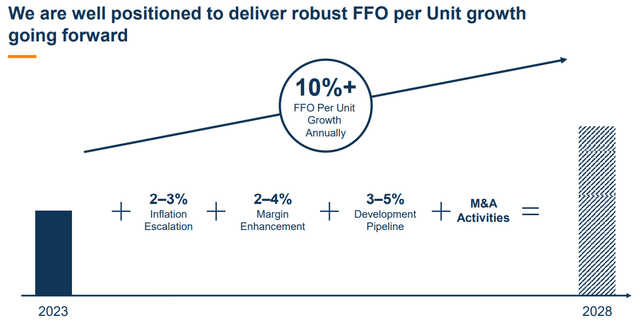

Longer term, management is targeting 10% annual FFO/unit growth between now and 2028. This is supported by a combination of escalating inflation, improving margins, development pipeline and M&A activity. Factors supporting the growth thesis include the digitization of the economy driven by artificial intelligence. As shown in the figure below, global data center power demand is expected to grow 15 times between 2022 and 2030, from approximately 2% of global consumption to nearly 10% in 2030.

Investor introduction

BEP’s growth prospects are supported by a strong balance sheet, with a credit rating of S&P BBB+ and $4.4 billion in available liquidity. It also has a long-term weighted average debt maturity of 12 years, and more than 96% of its total debt is fixed-rate. As shown below, BEP has no debt maturing this year and only $300 million due in 2025; which can be dealt with with available liquidity.

BEP risks include the unsigned portion of the assets (approximately 10% of cash flows), which may cause cash flow fluctuations. In addition, growth projections based on data center demand may not materialize given the uncertainty about the pace of technological advancement in the field.

In addition, if inflation is more severe than expected, interest rates could rise, which could cause debt financing costs to rise and make future investments less accretive than expected.

BEP’s lower share price compared to last year has also made equity financing costly for the company, but management has shown flexibility by repurchasing 2 million shares in the past year (rather than issuing new shares) amid depressed valuations . Over the next few quarters, I’ll be watching management’s comments on interest rates and how that might change their outlook for funding their development pipeline.

Importantly for income investors, BEP currently has a respectable 6.1% distribution yield and has a distribution ratio of 85% based on generating $1.67 in FFO per unit in 2023. Management is targeting annual distribution growth in the 5-9% range, which translates into estimated annual FFO/unit growth of 10% between now and 2028, as shown below.

Investor introduction

When it comes to valuation, I find BEP attractive at its current price of $23.23 and a forward P/FFO of 12.4. That seems pretty cheap for a company that expects to grow its FFO/unit profits by 10% annually on the back of a BBB+ credit rating.

Analysts estimate FFO/unit growth of 12.5% this year and 6-11% FFO/unit growth during 2025-2027, which I think is reasonable given the favorable factors and development pipeline mentioned above. Taking all of the above into consideration, I would target a P/FFO of at least 15x for BEP, which represents substantial upside potential from current valuations. Sell-side analysts have a unanimous Buy rating on BEP, with an average price target of $29.36, which implies a forward P/FFO target of 15.6x.

Important points for investors

BEP has a strong track record of delivering stable and growing cash flow, and its latest reported results further demonstrate this. With a diversified portfolio of renewable energy assets, a solid pipeline of development projects and a strong balance sheet, BEP is well positioned for continued growth in the coming years.

Finally, BEP presents an attractive investment opportunity for those looking to add a sustainable and growing income stream to their investment portfolio. With a distribution yield of 6.1% and currently undervalued compared to its growth prospects, now might be a good time to consider buying BEP for potentially strong total returns.