Coldsnowstorm/E+ via Getty Images

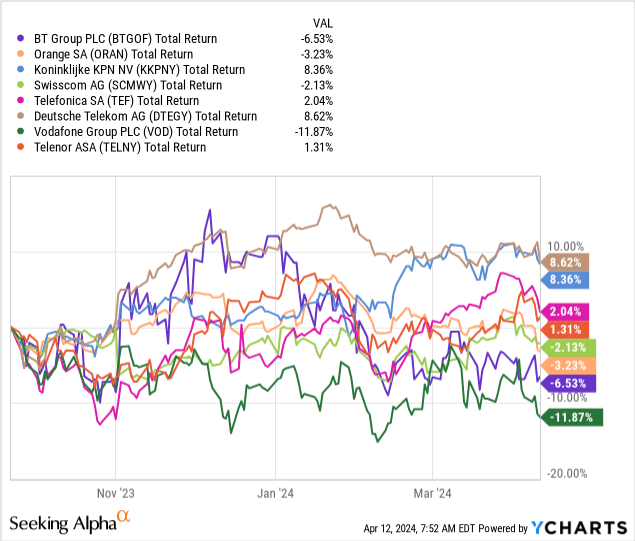

Incumbent UK telecoms player BT Group ( OTCPK:OTCPK:BTGOF ) continues to perform dismally, with its share price recording small losses in the mid-single digits since my last article on the company in September.BT is already one of the cheapest brands in the industry The poor performance at the time was particularly disappointing compared to other European telecoms companies.

Although discouraging, business-level results don’t appear to be driving this trend, with the company’s results largely in line with expectations thanks to good results in the consumer and Openreach segments.

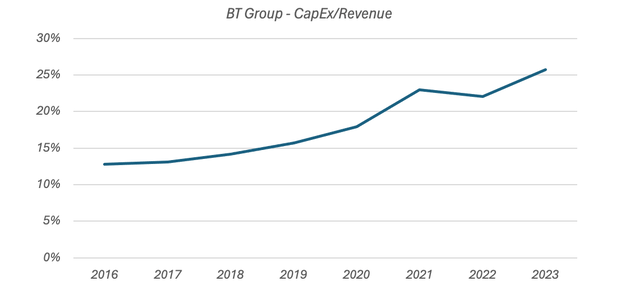

Anyone who follows BT knows that the company’s cash flow is under severe pressure. One of these is the nationwide rollout of Fiber to the Premises (“FTTP”), resulting in increased capital expenditure in the medium term and additional payments required to fill gaps in pension plans.These have suppressed free cash flow (“FCF”), and expectations for growth later in the decade have essentially overwhelmed everything else In terms of the value case here, it’s heavy lifting. That said, given the nature of BT’s free cash flow growth drivers, I don’t think there’s much risk here, and the stock is at a significant discount to peers and well below my fair value estimate for patient investors Still attractive.

Operating performance remains good

Offsetting its struggling business units through consumer and Openreach growth was a key theme last time and remains so throughout the company’s 2023/2024 financial year (NB BT’s financial year starts in April). To recap, the latter two customer-facing divisions have some decent growth momentum, primarily in the form of the aforementioned fiber rollout. The consumer segment is largely self-explanatory, including business lines such as residential broadband and mobile. Openreach is the UK’s largest fixed line network, providing essentially nationwide coverage. It sells access to other providers such as Comcast-owned Sky (CMCSA) and Vodafone (VOD), as Virgin Media O2’s (“VMO2”) cable network, the only other fixed network with nationwide coverage ) closes the provider to other services.

BT’s business units continue to struggle, facing rising costs and continued structural decline in its traditional high-margin businesses such as fixed voice. Corporate EBITDA fell 13% year-on-year to £1.2b in the first nine months of 2023/24, and fell 17% year-on-year in the third quarter.

Consumer and Openreach continue to perform much better. As they account for approximately 33% and approximately 45% of the group’s EBITDA respectively, they are also driving moderately positive growth across the group.

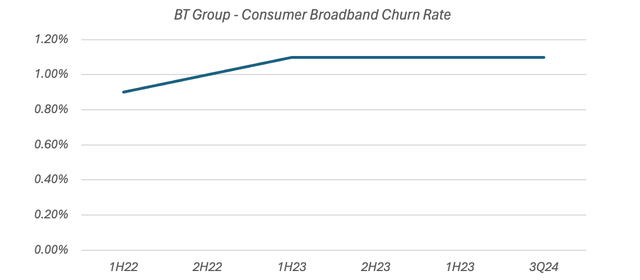

In the consumer sector, 9M EBITDA grew 4% year-on-year to £2 billion, with the same EBITDA growth in the third quarter. Inflation-related contract price increases and the continued rollout of FTTP helped, with consumer broadband average revenue per user (“ARPU”) rising 5% year over year. The utilization rate continues to increase, with the retail FTTP base in the third quarter of 2023/24 increasing by approximately 45% annually and approximately 10% quarterly. With recent price increases largely driven by inflation (and these rivals raising prices by similar margins), BT has seen steady customer churn, with broadband rates at 1.1% in the first half of the year.

Source: BT Group Results Release

The benefits of increased FTTP usage are twofold. Firstly, fiber optic connections offer much faster internet speeds and therefore generate higher ARPU compared to products based on traditional copper connections. Additionally, cost requirements are much lower because fiber optics requires much less maintenance than copper cables (e.g., fewer calls to engineers to fix line faults). Therefore, BT aims to reduce its workforce by 25% to 40% over the next five years, which will support the generation of EBITDA and FCF.

Openreach EBITDA rose 11% year-on-year in both the third quarter (to £967m) and the first nine months of 2023 (to £2.9b). Like consumers, the Openreach sector continues to benefit from increased FTTP usage. The number of net new users in the third quarter was approximately 430,000, and the overall FTTP usage rate increased slightly by 1 percentage point from the previous quarter, reaching 34%. As prices rise, Openreach ARPU increases by 10% year over year. With the steady growth of consumer and Openreach businesses, the group’s overall EBITDA increased by 1% (to 2.03 pounds) in the third quarter and 3% (to 6.12 pounds) in the first nine months of 2023/24.

Valuations remain severely depressed

At the start of the 2023/2024 financial year, BT guidance expects EBITDA growth, capital expenditure of 5 billion to 5.1 billion pounds, and normalized free cash flow of 1 billion to 120 million pounds. As mentioned above, EBITDA did rise slightly, while capex and free cash flow were also around £5 billion, at the upper end of guidance of £1 billion to £120 million. All in all, BT’s performance was largely in line with previously reported expectations.

Normalized FCF looks to be around £100m higher than I expected, but that doesn’t really change my estimate of DCF’s fair value. Therefore, I maintain a price of £2.10 (~$2.60) per share, based on a cost of equity of 9% and normalized free cash flow, with upside of at least £1.50 by 2030/31. As this is driven by normalization of capex levels following peak FTTP investment and cost reductions from the decommissioning of copper connections, I still believe the risk of achieving this target is relatively small.

Source: BT Group Results Release

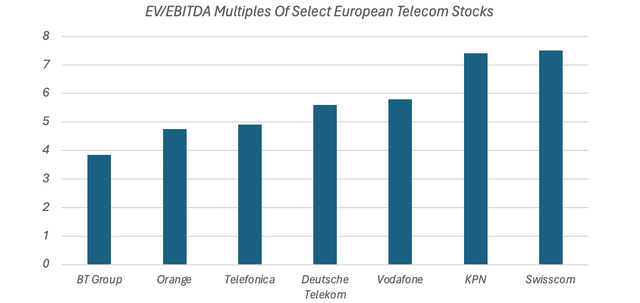

While the ~100% implied upside looks eye-opening for a mature developed market telco, I would point out how depressed BT’s valuation is compared to its European peers. Annualized EBITDA is around £8, with a market capitalization of £10.5, net debt of £19.7 (including lease liabilities), and BT’s EV/EBITDA of less than 4x. That’s a full double lower than French and Spanish peers Orange (ORAN) and Telefonica (TEF), both of which trade at just under 5 times forward EBITDA, according to Seeking Alpha. Compared with top European operators such as KPN and Swisscom (OTCPK:SCMWY)(OTCPK:SWZCF) , both of which trade at over 7 times forward EBITDA, the discount is even more pronounced.

Source: Seeking Alpha; Company Annual Report

At my fair value estimate of £2.10 per share, BT trades at around 5x EV/EBITDA, roughly in line with Orange and Telefonica mentioned above. So I don’t think it’s too much. Meanwhile, with the stock offering a 7%+ dividend yield (and no withholding tax for non-UK investors), BT still looks attractive despite its disappointing performance to date, and I maintain Strong Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.