photo_world/iStock via Getty Images

introduce

In an article published on Seeking Alpha in early 2024, I wrote:

Over the next 24 months, I will adjust my portfolio based on several events, including a reacceleration of inflation.Although I believe the experts on Wall Street Washington wants to pretend we’re headed for 2% inflation, but the numbers tell a different story — and earlier this month, we learned consumer price index (“consumer price index”) The growth rate accelerated for the second consecutive month in February 2024. consumer price index It rose 0.4%, up from 0.3% in January, and core inflation, which excludes food and energy, rose 0.4% for the second consecutive month, or 3.8%.besides producer price index February rose 0.60%, compared with expectations of 0.30%.National debt rises by $1 trillion Every 100 daysand reach gold record high, I think the market is telling us that inflation is going to be a problem going forward. From my perspective, what options does the US government have (other than inflating away excessive federal debt?): It can’t slow down spending (let alone pay down the debt) without crushing the economy, and politicians Nor would they allow this to happen (if they could help it). In short, a second wave of inflation is coming. “

Jerome Powell follows up on the previous post Dovish He called the March meeting and said the Fed wanted to cut interest rates even if inflation did not reach the Fed’s 2% inflation target. In short, the inflation thesis is starting to emerge, and my energy holdings are doing well.

In response to the re-acceleration of inflation, in addition to energy holdings, my current focus is on metals and mining investments, e.g. iShares MSCI Global Metals and Mining Producers ETF (bat:choose) (this”fund“).

There are things about this fund that I like. First, it has the potential to hedge against the aforementioned inflation. Secondly, the fund’s management fee is competitive at 0.39%. Third, in a recent Seeking Alpha article, respected investor Jeremy Grantham said:

Believe it or not, raw materials are not only limited! – Becoming increasingly scarce, so prices will definitely rise, but in the long run (10 years), resources are the only sector in the stock market that is negatively correlated with the stock market as a whole. They are certainly the most diverse industry… They are also particularly cheap today…”

While I like some aspects of the fund, I’m less fond of other aspects of it, including the following:

First, I’m concerned about the iShares ETF (“black stone“), does not put shareholders first when managing shareholder funds. As we all know, BlackRock has always been one of the biggest advocates of shareholder rights. ESG investing.There’s a lot to like about this, at least in my opinion, with Strive Asset Management’s Matt Cole recently criticizing BerRock in its latest ESG push article. I found Cole’s sustained criticism persuasive. Second, the fund has a very low weighting in precious metals (just over 1%), It specifically excludes gold and silver companies. Third, in my opinion, this fund has a better performance than one of its main competitors, the SPDR S&P Metals & Mining ETF (XME) (“XME”) (see more below).

For the reasons stated above, I prefer XME and consider the fund a Hold, although I think the fund should do reasonably well over the next 24 months.

Fund basics

As mentioned above, the fund is operated by BlackRock, the world’s largest asset management company, with over $10 trillion in assets under management. Manage assets end of 2023.

According to its websitethe fund seeks to “track the investment results of an index consisting of global stocks of companies primarily engaged in the mining, mining or production of diversified metals, Excludes gold and silver” Specifically, according to prospectusthe fund tracks the MSCI ACWI Select Metals and Mining Producers (excluding Gold and Silver) Investable Market Index (“index“). The index is developed by MSCI Inc. (MSCI) (“index provider“). According to the prospectus, “The index includes large, mid-sized and small companies and may change over time. Under normal market conditions, the Fund will invest at least 40% of its assets in companies organized or located outside the United States.” issuer, or conducts business outside the United States” When the Index is rebalanced, the Fund’s portfolio is also rebalanced.

Since its inception in the first quarter of 2012, the fund has grown to approximately $1.1 billion in assets under management, with a portfolio consisting of more than 300 stocks, according to Seeking Alpha.

Fund holding

The fund’s top ten holdings account for approximately 50% of its total assets, and as of March 19, 2024, these holdings were as follows (according to the previously linked fund website):

|

BHP Group |

13.40% |

|

Rio Tinto shares registered shares |

6.57% |

|

Freeport McMoran Corporation |

5.90% |

|

Glencore |

5.13% |

|

Nucor |

4.36% |

|

Vale SA |

3.87% |

|

Anglo American |

2.74% |

|

Rio Tinto |

2.71% |

|

fortescue |

2.52% |

|

POSCO Holdings |

2.15% |

Exposure breakdown

The fund diversifies investments in the following areas.

|

Diversified metals and mining industry |

45.21% |

|

steel |

37.64% |

|

copper |

11.09% |

|

aluminum |

4.04% |

|

Precious metals and minerals (other than gold and silver) |

1.02% |

|

cash |

1.00 |

competition

A big reason the metals and mining industry has fallen out of favor is that there are few competing exchange-traded funds (“ETF”). The main ETF that competes with this fund is XME (as defined earlier in this article), and even that’s not a perfect comparison because 1) the fund doesn’t invest in gold and silver companies (whereas XME invests in gold and silver companies, including its ten Two of the big holdings) and 2) XME is almost entirely focused on US stocks (even though many of these companies have significant international exposure).

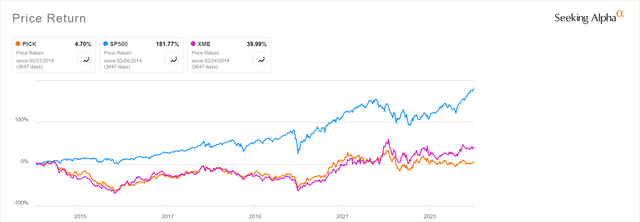

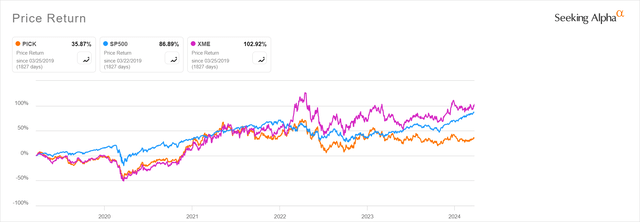

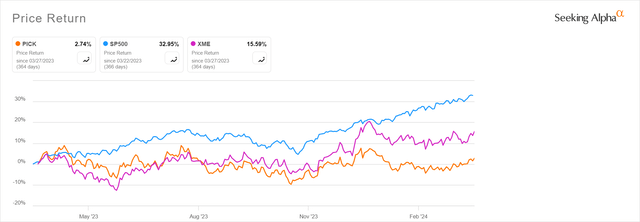

In terms of the performance of the two ETFs, over the past 10, 5, 3 and 1 year periods (as of March 25, 2024), the funds no XME has performed particularly well relative to XME or the broader market, as measured by the S&P 500 Index. In fact, XME has outperformed PICK in every relevant period. See chart below.

10-year performance (seeking Alpha)

Over the past 10 years, we have seen mining stocks significantly underperform the S&P 500.

5-year performance (seeking Alpha)

Relative to the broader market, XME’s 5-year returns are excellent. The fund underperformed both.

3 Years of Performance (Seeking Alpha)

The same was true for 3-year returns; XME beat both the fund and the S&P 500.

One Year Performance (Seeking Alpha)

One-year returns reflect the dominance of the tech-heavy S&P 500, with PICK down (4.10) year-to-date (through March 25, 2024), while XME is down (1.44) and the S&P 500 is up Nearly 10%.

It’s worth noting that international stocks have fallen out of favor relative to U.S. stocks, which may partially explain XME’s strength.In this regard, as the table below shows, nearly all of XME’s holdings are domiciled in the United States, while the majority of the Fund’s holdings are domiciled outside the United States

The table below further compares the two ETFs.

| fund | XME | |

| management fee | 0.39% | 0.35% |

| Quantity held | Chapter 329 | 33 |

| dividend yield | 4.40% | 0.92% |

| pay dividends | quarterly | quarterly |

| US exposure | twenty three% | 99% |

| Shareholding ratio of top 10 | 50% | 44% |

| average.daily trading volume | 143,931 | 3,314,458 |

* Data comes from Seeking Alpha, except for “US Exposure”, which comes from Morningstar Corporation. Morningstar gives the fund and XME only two stars.

The fund’s management fees are slightly higher than XME, but its dividend yield is much higher. The fund’s average daily trading volume is sufficient, but its liquidity is significantly lower than XME. The fund is more concentrated in its top 10 holdings than XME. In some ways, given this concentration, I think the fund could easily be replicated by simply buying BHP Group and Rio Tinto Group, which together account for nearly 25% of the fund. Alternatively, you could allocate 90% to XME and 5% to BHP Group and Rio Tinto Group to create your own global metals mining portfolio.

Notably, both the fund and XME hold two of the top 10 stocks, Nucor (NUE) and Freeport-McMoRan (FCX).

In my opinion, as currently constituted, the fund is both too concentrated in the top 10 holdings and too diversified (i.e., dozens of holdings add little to the performance-wise). With inflation accelerating, I also believe the fund’s lack of allocation to gold and silver mining companies is a significant disadvantage compared to XME.

risk

The risks of investing in the Fund are set out in the prospectus (linked above). For me, the biggest risks of investing in this fund include the possibility of long-term underperformance (or continued underperformance), mining and metals companies are capital intensive and tend to rely on debt and capital markets, geopolitical risk, currency risk etc. The fund has significant exposure to international companies and cases of asset seizures by foreign governments, even the U.S. government.

in conclusion

It seems to me that long-term inflation is coming, and given the profligate behavior of most governments around the world, I see no other way out. Keeping pace with inflation requires hedging, including investments in metals and mining companies. While I expect this fund to perform well in an inflationary environment, and I like the dividends, I currently prefer XME to this fund (and own XME stock) on a relative basis. Therefore, I think the fund is a Hold. However, if international equities start to gain some momentum relative to U.S. equities, I might revisit the fund again.