hail

Solid Biosciences Inc. (Nasdaq: SLDB) is a pre-profit company focused on gene therapy innovations for neuromuscular and cardiac diseases.Its flagship single-dose drug therapy, SGT-003, for the treatment of Duchenne muscular dystrophy (DMD), is expected to be tested in the first patient with preliminary data in the second quarter of 2024 Functional data for mid-2024 and functional data for Q4 2024. If the results are positive, SLDB’s DMD drug could become the company’s foothold in a sizable market. In addition, SLDB has a cardiac research and development program designed to address serious unmet needs in rare heart diseases. However, this part of their product portfolio is still very much in the early stages of development. SLDB has recently received additional liquidity from PIPE investments, significantly improving its risk-return equation. So, despite the inherent biotech risks, I believe SLDB is a viable investment for those who are aware of the risks.

Betting on DMD: Business Overview

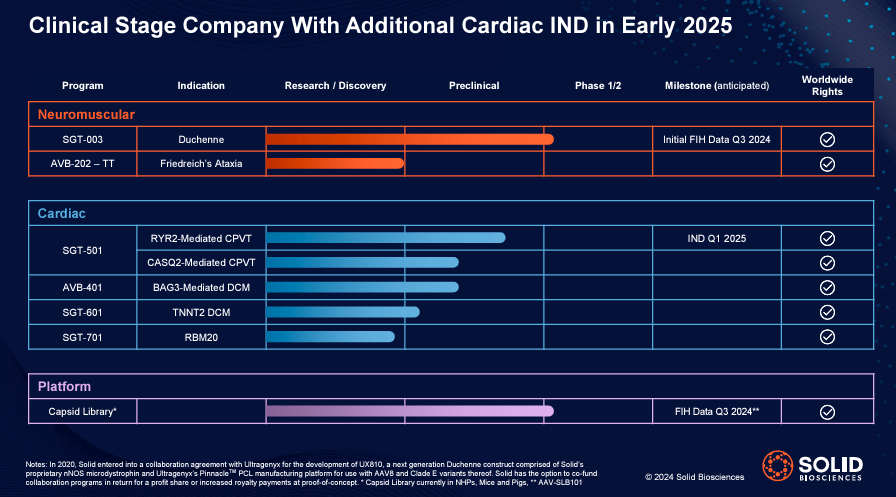

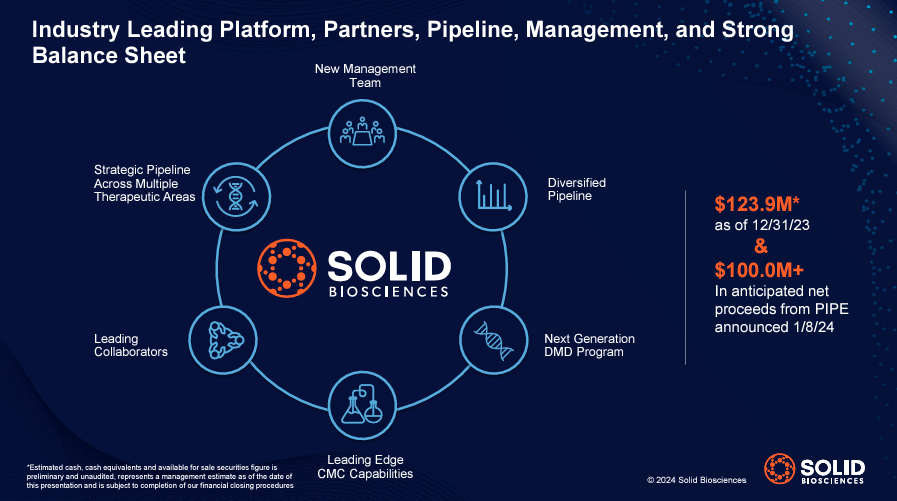

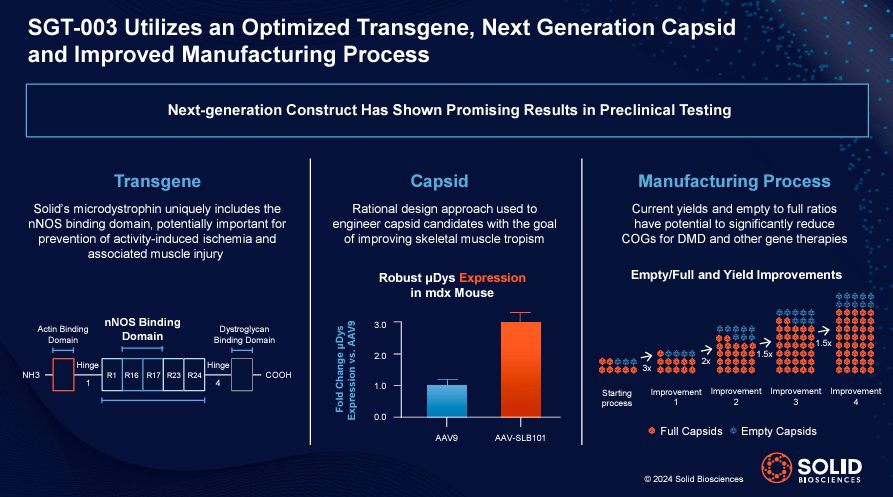

solid state bioscienceC. (SLDB) Yes A life sciences company founded in 2013 and headquartered in Charlestown, Massachusetts. SLDB is in the early stages of developing gene therapies for neuromuscular and cardiac diseases.The company’s main value proposition is research platform Its capsid library can deliver Phase 1/2 gene therapies, with first-in-human (FIH) data expected in the third quarter of 2024. However, SLDB’s main value driver today is its potential solution for DMD, which essentially involves using modified vectors to deliver copies of the defective gene to the muscle cells that cause the underlying disease. This, in turn, could help patients produce the dystrophin protein they are missing, which may significantly impact the progression of DMD.

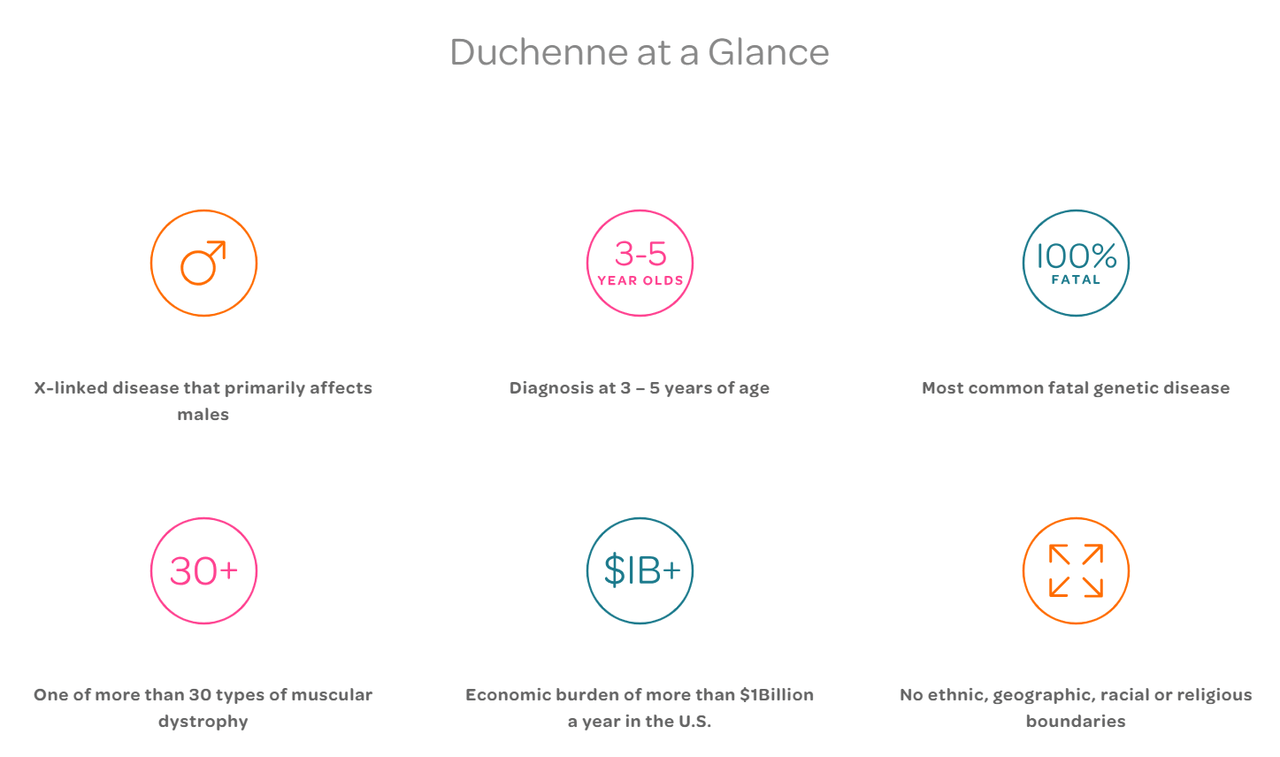

Source: Company website.

Main parts of SLDB product pipeline is its neuromuscular R&D program, primarily SGT-003. It is a one-time gene therapy for Duchenne muscular dystrophy (DMD), a genetic disorder characterized by progressive muscle degeneration and weakness. SGT-003 uses a designed capsid (AAV-SLB101) to deliver a DNA sequence encoding a shortened form of dystrophin (microdystrophin), thereby improving muscle function. The FDA designates it as Expressway and rare pediatric They became ill on December 7, 2023 and April 5, 2024 respectively. SGT-003 is beginning clinical trials in Phase 1/2, with the first patient set to receive the drug in the second quarter of 2024. SLDB expects to have preliminary safety data in mid-2024 and functional data in the fourth quarter of 2024. Since this is likely to be SLDB’s primary value driver for the foreseeable future, there are multiple potential positive catalysts expected in the near term.

Additionally, SLDB’s other neuromuscular programs are AVB-202-TT Friedreich’s ataxia (FA). FA is an inherited progressive neurodegenerative disease that produces neurological symptoms such as difficulty walking and speech problems. FA is also linked to heart disease, diabetes, and bone deformities. However, AVB-202-TT is currently in the research/discovery phase. Therefore, while this is also a potentially promising research project, it should not be considered an important value driver at this time.

On the other hand, SLDB also has a Heart Project. SLDB’s IP portfolio for cardiac applications is more diverse and includes four drug candidates: 1) SGT-501, 2) AVB-401, 3) SGT-610 and 4) SGT-701.

Source: Solid Biosciences January 2024 company presentation.

SGT-501 targets arrhythmias that can lead to fainting or even sudden cardiac death. This drug is in the research/discovery stage. When the Ryanodine Receptor 2 (RYR2) gene and the Calsequestrin 2 (CASQ2) gene are mutated, it regulates calcium in heart cells. Such mutations produce mediated catecholaminergic polymorphic ventricular tachycardia (CPVT). The RYR2 gene codes for a protein that regulates calcium in heart muscle cells to control normal heart contractions, and the CASQ2 gene provides instructions for making a protein that binds and stores calcium in heart cells to maintain the release of this mineral. These mutations disrupt calcium regulation, causing irregular heartbeats and, if left untreated, potentially leading to serious heart complications.

Likewise, SLDB’s AVB-401 drug compensates for dysfunctional BAG3 gene mutations that cause dilated cardiomyopathy (DCM), which impairs the heart’s ability to pump blood efficiently. The drug is currently in the preclinical stage. As for SGT-610, which is also in the preclinical stage, the application is designed to treat DCM caused by mutations in the TNNT2 gene, which encodes cardiac troponin T. This protein is essential for heart muscle contraction. Finally, SGT-701 is also in the preclinical stage for the treatment of DCM caused by mutations in the RBM20 gene. These genes are involved in RNA splicing in heart tissue, so by correcting the effects of the mutations, the drug could improve the heart’s reduced ability to pump blood due to enlargement.

Groundbreaking gene therapy with strong financial backing

In addition, SLDB’s pipeline spans multiple therapeutic areas, with a series of drugs in early stages of development that may maintained at As of December 31, 2023, they had $123.9 million in cash. They also received an additional $108.9 million from a private equity investment (PIPE) deal announced on January 8, 2024. However, I believe that most of SLDB’s short-term investment potential lies in the overall potential of its SGT-003 program and its capsid library.

Source: Solid Biosciences January 2024 company presentation.

In March 2024, SLDB announced an agreement with armored creature Develop treatments for facioscapulohumeral muscular dystrophy (FSHD) using SLDB’s AAV-SLB101 capsids to reduce the toxicity and improve the efficacy of AAV gene therapy. AAV-SLB101 is the SLDB capsid for Duchene’s SGT-003. SLDB will provide expertise required for Armatus’ drug development and in return will receive upfront and milestone payments as well as tiered royalties on net sales. The agreement is part of the company’s licensing strategy for its muscle disease technology.

For context, Armatus’ drug candidate is ARM-201, a potential best-in-class single-dose treatment that addresses the genetic cause of FSHD and has demonstrated a favorable safety profile in preclinical studies. The collaboration highlights SLDB’s technological advantages and innovation in gene therapy, expanding its applications beyond its internal pipeline and generating additional revenue streams. If they generate additional vertical revenue through licenses or agreements based on current intellectual property rights, this could become an important value driver for the company. However, as of today, SLDB is still unprofitable, so while the outlook is promising, justifying investing in the stock based solely on this possibility remains highly speculative.

Source: Solid Biosciences January 2024 company presentation.

It is also worth noting that overall, Duchenne muscular dystrophy market The valuation in 2023 is US$3.5 billion and is expected to reach US$11.7 billion. This means that by 2033, the compound annual growth rate will be 13.16%. Today, the market is dominated by competitors such as Pfizer Inc. (PFE), Sarepta Therapeutics (SRPT), PTC Therapeutics (PTCT), and FibroGen Inc. (FGEN). . However, SLDB has a positive differentiation advantage due to its low-dose approach, enabling high expression levels of therapeutic genes. Additionally, SLDB’s strategy of controlling all aspects of in-house manufacturing, if implemented properly, can provide greater control over the quality of its products. On the other hand, the FDA’s Fast Track and Rare Pediatric Disease designations for SGT-003 highlight the urgent need for this drug for the treatment of DMD.

Financially sound and affordable: Valuation analysis

From a valuation perspective, it’s worth noting that SLDB currently has a market cap of $436.5 million. It holds about $123.6 million in cash and equivalents on its balance sheet, compared with total debt of $26.3 million. I estimate its latest quarterly cash burn in Q4 2023 to be about $20.9 million. I arrived at this number by adding Chief Financial Officer and Net Capital Expenditures. If we annualize its latest cash burn, the implied annual figure is US$83.6m. This means the company has the cash balance to support a cash runway of about 1.5 years, which is generally not terrible.However, as I noted before, SLDB does have a right to the January 2024 proceeds pipeline investment. This has resulted in a significant increase in cash balance to $232.5 million, with a cash runway of 2.8 years. Such a cash runway should be sufficient to fund SLDB’s SGT-003 project for the foreseeable future.

It’s difficult to estimate SLDB’s balance sheet after the PIPE investment, but if we just assume this cash investment, then the equity would have increased from $126.5 million to $235.9 million, assuming the cash increased SLDB’s book value by the same amount as the investment . Under this assumption, the stock’s price-to-earnings ratio would be 1.85. This is generally a reasonable P/B ratio, but compared to SLDB’s industry median P/E of 2.45, it suggests the stock may be undervalued at its current price. Additionally, since the company’s lead research program on SGT-003 is particularly promising for DMD, and the FDA designation signals that the regulator is in its favor, I’m inclined to be bullish on the stock. Therefore, I think it makes sense to give SLDB a Buy rating based on SGT-003 and its lower valuation relative to peers post-PIPE investment.

Investment considerations

Of course, my investment thesis for SLDB hinges on SGT-003, which is speculative in nature. This is still a relatively early development project, but assuming everything goes according to plan, the FDA designation I mentioned earlier could expedite its progress and potential approval. Additionally, if the company’s cash burn increases post-PIPE investments, we must reassess the precise cash runway estimate. If it’s much shorter than my initial assessment, SLDB may need additional funding sooner than I expected, which would also make it less attractive as an investment.

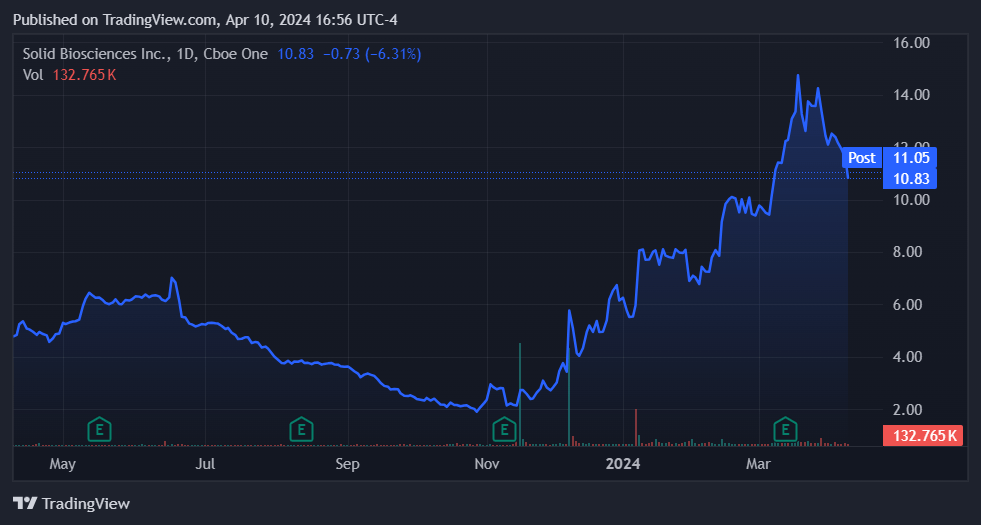

Source: TradingView.

It’s also worth noting that SLDB’s product pipeline will compete with well-capitalized pharmaceutical giants, and market and pricing dynamics could severely limit its revenue potential. Note, however, that SLDB’s approach is different, as a one-dose treatment would have significant appeal to patients, which could quickly disrupt the market. This is good for short-term revenue if it gets the required FDA approvals, but also limits its long-term revenue potential due to its limited recurring revenue potential. Digging deeper into how market acceptance will play out is highly speculative. However, I believe that, overall, SLDB’s current valuation is too cheap relative to its potential, making it a viable investment for investors who are aware of the inherent risks.

Speculative Buying: Conclusion

Overall, I think SLDB is a promising biotech company, especially for investors seeking a treatment for DMD. Of course, SLDB is highly speculative at this stage. Still, it has the ingredients for long-term success, especially following the cash infusion from its recent January 2024 PIPE investment. The increased liquidity significantly improves its risk-reward equation, and despite the risks I mentioned earlier, it makes SLDB a viable investment for those who are aware of the risks.