Michael Way

Chinese tech giant Tencent (OTCPK: TCEHY) shares rose 1.5-2.0% report Fourth quarter and fiscal 2023 results. Although revenue was slightly lower than expected, profit increased by 23% year-on-year, easily exceeding market expectations. In addition, Tencent surprised the market by announcing a selling price of US$12.8. Billion dollar share repurchase plan (expected to increase 100% annually), and dividend payment growth of 40%.Personally, I view an increase in allocations as a major bull signal, as I have previously argued with sound Negative comments about Tencent”An unattractive shareholder distribution that is certainly below what is reasonable to invest in such a risky equity asset.” Taking into account updated valuation metrics, especially the lower risk requirements for equity, I now estimate Tencent’s intrinsic value to be approximately $49 per share. I upgraded the stock to “Buy.”

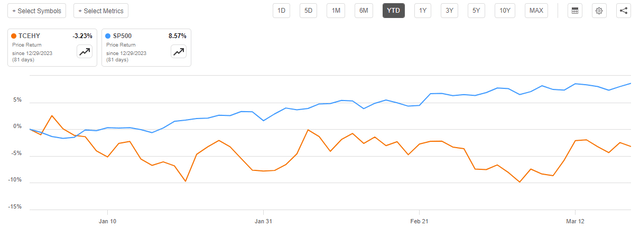

for Background: Tencent stock has significantly outperformed the U.S. stock market overall so far this year. TCEHY shares are down about 3% since the beginning of the year, while the S&P 500 is up nearly 9% (SP500)

Seeking Alpha

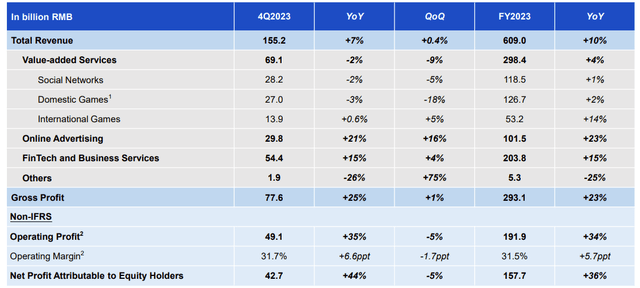

Tencent’s fourth-quarter revenue fell short of expectations, but profits exceeded expectations

Tencent Q4 2023 Revenue was not as good as expected, but the rise in profit was surprising: Between September and the end of December, the Chinese technology giant’s revenue increased by 7% year-on-year, achieving sales of 155.2 billion yuan. That was slightly lower than analysts’ expectations, which had expected revenue of about 157.4 billion yuan, according to data compiled by Refiniv.

In terms of profitability, it is worth noting that Tencent’s gross profit increased by 25% year-on-year to 77.6 billion yuan. Against this background, Tencent management pointed out that throughout 2023, the company has been promoting the expansion of high-quality revenue streams while gradually phasing out low-quality revenue streams. In addition, Tencent also emphasized the value-added impact of value-added revenue on platforms that have already incurred costs (similar investments) in the early stage. Overall, Tencent expects the company’s “cost discipline commitment” to continue to have a positive effect in the future.

The company’s fourth-quarter operating profit margin was 31.7%, an increase of 660 basis points from the same period last year. In U.S. dollars, after tax, Tencent’s non-GAAP net profit was RMB 42.7 billion, a 44% surge from the fourth quarter of 2022.

Tencent fourth quarter report

Higher shareholder distributions favorably change the stock story for investors

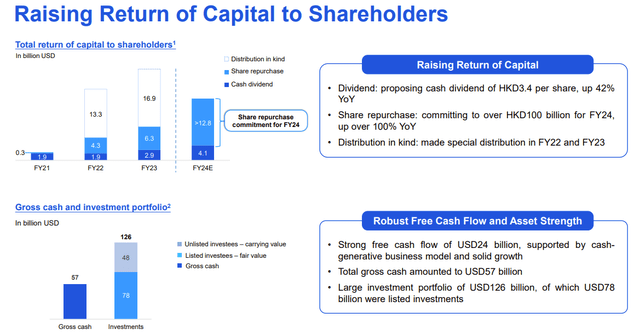

Looking back at Tencent’s latest results, I think one of the major positive investor highlights in the report was the company’s announcement of increased shareholder distributions.Overall, Tencent plans to significantly increase its stock repurchase program to at the lowest limit Buybacks in 2024 will reach $12.8 billion, twice the size of similar buybacks in 2023. In addition, Tencent also proposed plans to increase annual dividends to equity investors by 40% year-on-year in 2022, distributing nearly $4.1 billion in the next 12 months.

Assuming Tencent acts on the announcement and does allocate $16.9 billion to investors in 2024, I note that the company’s return on equity will tend to be around 5% (referring to a market cap of $339 billion as of March 20, 2024 Dollar).

Tencent fourth quarter report

When discussing the increase in shareholder distributions, I highlighted Tencent’s removal of a major obstacle preventing me from investing in the company’s stock. In fact, at the end of 2023, I said:

I caution that Tencent stock itself is cheap. One of the main issues I see with Tencent stock has to do with the company’s unattractive shareholder distribution, which is certainly below what is reasonable for investing in such a risky equity asset. Over the past 12 months, Tencent distributed approximately $6.2 billion in the form of share repurchases and $1.2 billion in the form of dividends, partially offset by -$3.4 billion in equity incentive dilution, bringing net equity expenses to just is approximately US$4 billion. Compared to a market capitalization of $375 billion, the dividend yield is quite unattractive, yielding about 1%.

Granted, the fact that Tencent is beefing up shareholder distributions reflects not only positive argument value, but may also reflect a negative argument about growth: When a company returns significant capital to shareholders through dividends or stock buybacks, it may indicate that the company has More cash it can effectively reinvest in its own business. This can be seen as a sign that there are few growth opportunities available, or that the company is unable to find investments with attractive returns. But the evidence for the negative growth thesis remains to be seen. For reference, investors should note that major U.S. companies such as Google (GOOG) (GOOGL), Apple (AAPL), and Microsoft (MSFT) have been distributing 50-100% of FCF to shareholders for nearly a decade, and these companies have still managed to achieve that. Organic growth attractive to investors. That said, overall, I think the shareholder distribution is a significant positive sign for investors.

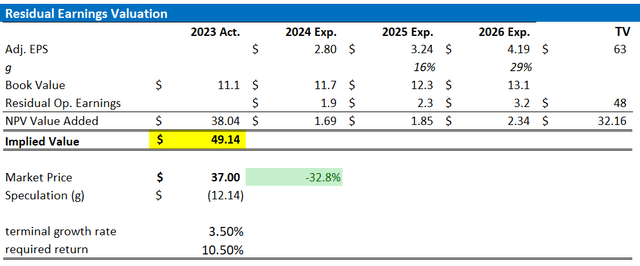

Valuation Update: Price Target Lowered

Based on data compiled by Refinitiv, I’ve updated my EPS forecast for the Chinese tech giant to bring my forecast in line with analyst consensus revisions over the past 3 months: I now expect fiscal 2023 Earnings per share were $2.80, compared with the previous estimate of $2.50. Additionally, I am projecting 2024 and 2025 EPS projections of $3.24 and $4.19, respectively.

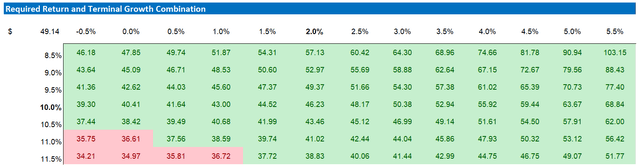

In my opinion, my valuation model continues to be based on a reasonable terminal growth rate of 3.5% (one percentage point higher than estimated global nominal GDP growth). However, since the capital distribution was announced, I lowered my cost of equity estimate by 150 basis points to 10.5%. Overall, I still think Tencent’s risk estimates are significantly higher than those of its U.S. peers, reflecting heightened regulatory risks in China. For reference, my cost of equity estimates for Google and Microsoft are around 9% and 8.5%, respectively.

Given the above adjustments, I now calculate a fair implied share price for TCEHY of $49, which represents a significant upside of approximately 33% compared to where the company will trade as of late March 2024.

Refinitiv; Corporate Finance; Author’s calculations

Also below are sensitivity tables testing different assumptions on cost of equity (rows) and terminal growth rate (columns).

Refinitiv; Corporate Finance; Author’s calculations

Important points for investors

Although revenue was slightly lower than expected, Tencent’s profit increased by 23% year-on-year, exceeding market expectations. In addition, the company surprised investors by announcing a $12.8 billion stock repurchase plan, which is expected to double year-over-year, while increasing dividend payments by 40%, with return on equity likely to reach 5% in fiscal 2024. Taking into account updated valuation metrics, especially due to the reduced risk assessment on the stock, I now estimate Tencent’s intrinsic value to be approximately $49 per share, prompting me to upgrade my recommendation on the stock to “Buy.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.