photography link

We have introduced C3.ai before (NYSE: Artificial Intelligence) in December 2023, highlighted its improving near-term outlook, which it attributed to lower average contract values (lower price points) and shorter sales cycles reducing sales friction.

Combined with the growing subscription ratio With revenue and higher expected conversion rates, it appears management’s new business model is working as expected.

Nonetheless, we maintain a Hold rating as we believe there is a minimal margin of safety at these excessive levels and the stock has been overly boosted by generated AI hype.

In this article, we discuss why C3.ai remains too high despite improved fiscal 2024 guidance, rising customer engagement, and long-term generative AI tailwinds.

Management’s over-reliance on stock-based compensation and equity dilution makes the investment thesis unattractive here, fully negating the high-growth prospects of SaaS companies, which is further exacerbated by uncertainty. Profit trajectory and dizzying short interest.

We maintain our hold rating.

C3.ai’s investment thesis remains too lofty

Currently, C3.ai’s 3Q24 earnings conference call results have doubled, with total revenue of US$78.4 million (quarterly growth of 7%/ +17.6% year-on-year) and adjusted earnings per share of -$0.13 (-116.6% quarter-over-quarter/year-over-year).

Management also contributed to the continued generative AI hype, raising fiscal 2024 revenue guidance to a low of $308 million (+15.4% year-on-year), the median adjusted operating loss narrowed slightly to -$119 million (-74.8% annual decrease).

This compares to the midpoint guidance provided in the Q2 2024 earnings call of $307.5 million (+15.2% year-over-year)/-$125 million (-83.6% year-over-year) and original guidance of $307.5 million ( +15.2% YoY)/- $62.5 million raised during the 4Q23 earnings call (8.1% YoY).

C3.ai’s revenue growth was largely driven by booking growth of 50 pilots in the latest quarter (-19.3% QoQ/+85% YoY), including 29 new pilots (-19.4% QoQ/+71% year-on-year).

If we include expanded customer engagement of 445 (up 10.1% QoQ/80% YOY), management’s shift away from subscriptions to a consumption-based pricing model is clearly working very well.

Although C3.ai is still loss-making on a GAAP basis, with free cash flow of negative $45.14 million (+16.2% quarterly/+37% year-over-year), it’s clear that cash burn has slowed so far.

However, anyone hoping to break even soon will also have to adjust their medium-term expectations, as the SaaS company continues to report a non-GAAP operating loss of -$25.8 million (-72% QoQ/YoY) on an operating margin of -32.9% (+1.2 points quarterly/-10.4 points year-over-year).

While management guided for “full-year free cash flow positive in fiscal 2025,” it was equally clear that net cash on the balance sheet continued to deteriorate to $723.32 million in Q3 2024 (-5.1% QoQ/-6.3 % year-on-year)), the only bright spot is no debt.

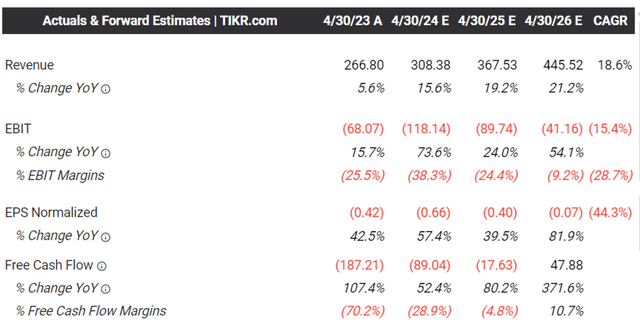

Consensus forward estimate

Tikkel Pier

At present, the revenue growth in the past few quarters is optimistic, and C3.ai’s losses are expected to narrow in the next few years, and its compound annual growth rate will reach +18.6% until fiscal year 2027 (CY2026).

This builds on revenue growth of +27.4% CAGR between fiscal 2019 and fiscal 2023, further demonstrating good consumer demand for its future products.

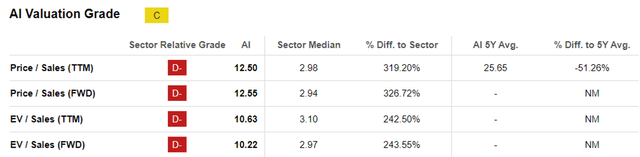

C3.ai Valuation

Seeking Alpha

Currently, due to the lack of profitability, the only metric we can use to measure C3.ai’s FWD valuation is the FWD price/sales valuation improving to 12.55x compared to its 1-year average of 8.26x and the industry median of 2.94X.

As generative AI becomes increasingly mainstream, its SaaS peers are also commanding similar premiums, such as NVIDIA (NVDA) at a FWD price/sales valuation of 20.46x, Palantir (PLTR) at 20.40x, and Microsoft (MSFT) at 13.57 times. The buzzwords that drive the stock market.

However, due to the shift to a pricing model based on lower profit consumption and high growth trends, it is uncertain when C3.ai will achieve breakeven, let alone GAAP profitability.

Readers must also note that stock-based compensation also accelerated over the past 12 months to $207.1 million (up 1.4% from $21.74 million in the previous fiscal year / 852.6% from $21.74 million in fiscal 2021 ), which was disproportionate to slower revenue growth of $296.4 million. (11.1% increase from the previous quarter/61.7% increase from $183.22 million in fiscal 2021).

Based on 120.49 million shares reported in Q3 2024 (up 1.83 million shares quarterly/up 9.75 million shares annually/up 53.64 million shares from 66.85 million shares in fiscal 2021), this will naturally lead to dilution for long-term shareholders and Erosion to book value per share was $7.38 (-2.8% sequentially / -12.7% / -28.9% compared to the fiscal 2021 level of $10.39).

So, since C3.ai appears to be quite expensive here, and management has yet to provide fiscal 2025 guidance, we think it could be a little longer to monitor its execution more carefully.

So, is C3.ai stock a buy?sell, or hold?

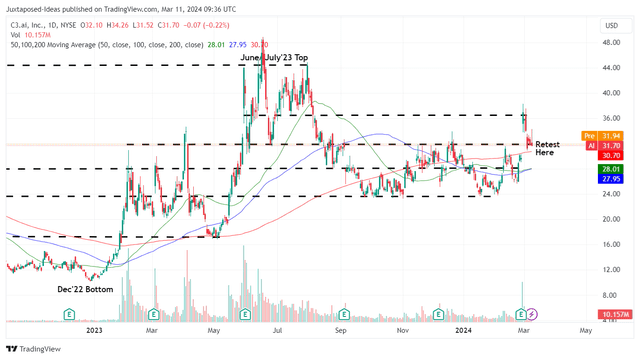

C3.ai 1 year share price

trading ideas

For now, it’s no surprise that C3.ai has failed to retain most of its recent gains while appearing to retest previous resistance at $30, as Short-term interest rates rise It is 28.1% at the time of writing and inherently lacks bullish support.

This is in stark contrast to another generative AI SaaS stock, PLTR, which continues to hit new highs despite similarly high SBC fees, a large share count, and very low GAAP profitability.

If anything, it remains to be seen that C3.ai will need to continue to provide promising forward guidance while beating consensus estimates to maintain its relatively high valuation.

as market dynamics Given the potential for a market correction in the near term, we believe it may be prudent to maintain a Hold (Neutral) rating.

Just wait and see.