borrow

Can ETFs and stocks coexist in a portfolio and make that portfolio better? ETF or index ETF investing versus self-directed dividend growth investing is always a big debate. You know I love stock investing, but I keep an open mind.have Even if you invest in stocks, there is room for ETFs.

I think both ETF investing and dividend growth stock investing strategies are very effective. Should you have both in your portfolio? it depends. Let’s elaborate on this.

So, yes, I think it makes sense to combine individual stocks with an ETF or a few ETFs.

Add different asset types to your portfolio

If you want to own multiple types of assets, invest in multiple markets, and don’t need to spend as much time setting up and monitoring, then combining an ETF with some dividend growth stocks works well.

You could start with an all-in-one ETF that invests in fixed income, maybe some basic materials stocks, international markets and U.S. markets. Use it to build your core portfolio without much effort. Maybe 50% of your portfolio is a split between this ETF or two non-overlapping ETFs. Your ETFs automatically rebalance, giving you exposure to the markets and other types of assets you want, such as bonds or preferred stocks.

You would then add a few stocks that you like and want to follow regularly, maybe a dozen stocks to complete the portfolio. This can be very effective because you are highly diversified; a very smart way to build a portfolio.

It’s just like cooking; you have the basic recipe and then add some spices on the side, your special ingredients to make the soup even better. Start with an ETF that holds multiple components and add some dividend growth stocks as special components.

Increase investment in specific markets or sectors

Combining ETFs and stocks is also logical in the opposite situation, where you have a diversified stock portfolio (perhaps around 30 stocks) but you want to invest in a specific market or a specific industry.

You can use ETFs to invest in emerging markets, maybe 5% or 10% of your portfolio. Investing in emerging dividend growth stocks can be quite difficult. Adding an ETF that tracks emerging markets could do the job.

For example, you can also add ETFs to invest in a certain sector or industry, stocks artificial intelligence, or the entire information technology sector. If you don’t know how to select individual stocks in this sector, or you’re worried about their current high valuations and price-to-earnings ratios, adding an ETF can work well. It can round out your portfolio and add more diversification without having to spend a lot of time and energy trying to understand an industry you’re unfamiliar with.See our post Departments and Industries learn more.

Remember, investing has a lot to do with having confidence in your strategy so you don’t worry when the market drops.The best way to have confidence is to make sure you understand what you have and why you have it

Two ways to make ETFs and stocks work well together in your portfolio are to have a core ETF portfolio and add a few stocks you like and want to monitor, or to have a stock portfolio and choose specific assets you want to invest in Or a specific industry, go with ETFs.

However, there are situations where combining stocks and ETFs into your portfolio is a bad thing.

Repeat carefully

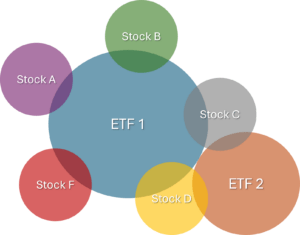

A common investing mistake is overlapping ETFs with stocks in a portfolio. For example, you invest in an ETF that tracks the Canadian market. Then add stocks in Canadian banks, pipelines, telecommunications and utility companies. Many of these stocks are already included in your ETF, so you just add more of the same stocks.

The problem is that you don’t know your full exposure to each stock you own because you also hold some stocks through ETFs. You could end up depositing 10% of your portfolio with TD Bank without knowing or wanting to. Combining index ETFs with individual stocks in the same market requires more work to avoid overlap between them; look at the top 10 or 20 ETFs you own to make sure you’re not buying those individual stocks.

Just like cooking: adding kosher, sea, and Himalayan salt won’t make your dish better, just saltier. If you add too much, you can’t eat it.

Don’t overdiversify

More and more often it becomes… too much! The second mistake is a shopping spree. Let’s say you buy a bunch of ETFs because you like moving from one idea to another, or because they all look great! Then, you add stocks over and over again. You end up holding too many stocks in your portfolio.

Owning 40 stocks plus 10 ETFs doesn’t make your portfolio any better. You lose yourself in diversity and strategy because you have so many different things. Some of the stocks you hold, especially stocks, will be less than 2% of your portfolio; they won’t add much value to your portfolio returns; and you won’t even notice if they double in price.

Combining a bunch of ETFs with a bunch of stocks is over-diversification, or “diversification,” and will make your portfolio worse. You’ll spend a lot of time and effort monitoring everything in your portfolio without necessarily gaining any added value. You can become paralyzed by analysis because too much information to track and analyze can lead to suspicion. On top of that, critical information can be missed. As an investor, you are responsible for your portfolio and you must know what is going on. Losing track is bad.

takeout

If you can build a core portfolio of ETFs and add some non-duplicate stocks, it’s a good idea to have ETFs and stocks coexisting in the portfolio. Buying ETFs can also increase your exposure to specific asset types, industries or markets that you have no exposure to.

Duplicate holdings are a problem, as is overdiversification. Having 60 lines in the statement is bad. It can lead to doubt, analysis paralysis, and a loss of control over your investments.