J Studios/DigitalVision via Getty Images

Overview

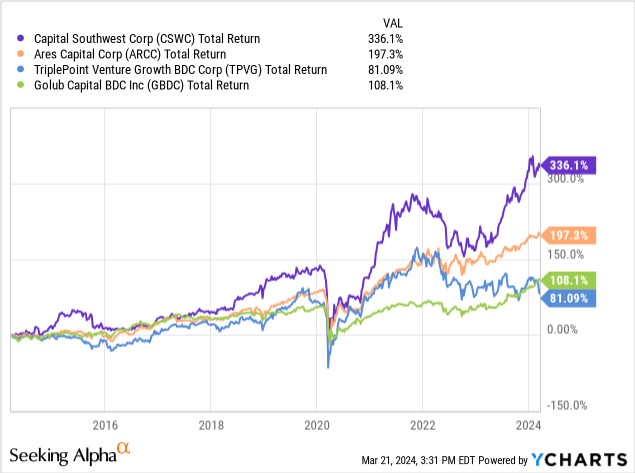

I’m a big believer in BDCs (Business Development Companies) because of the strong dividend cash flows they can provide. Southwest of the capital (NASDAQ: CSWC) has been one of my strongest BDC stock holdings, and has always provided me with a growing source of income. As a bonus, CSWC’s price has also grown nearly 130% over the past decade. The current dividend yield is 9.5%, although lower than some BDC peers such as Ares Capital (Asian Studies Center), TriplePoint Venture (TPVG), or Golub Capital (GBDC), CSWC provides higher total returns due to price increases.

We can see how CSWC has outperformed its peers and delivered a total return of over 336% over ten years.With prices creeping closer to all-time highs, I think this is a great option There’s an opportunity to see if a price point above $24 per share would be a solid entry point. Despite the recent price increases, I would like to emphasize that BDC’s primary focus is revenue generation. Looking at the financials proves the efficiency of their portfolio, so I’m not worried about the sustainability of the dividend.

Simply put, CSWC is a business development firm specializing in credit, private equity and venture capital. Their focus is on providing loans and assistance to middle market companies. CSWC’s goal is to provide growth financing, acquisitions, refinancings and buyouts to companies in industries such as industrial and healthcare. BDC looks for profitable companies with more than $10 million in revenue and may also invest in the mid- to high-end market.

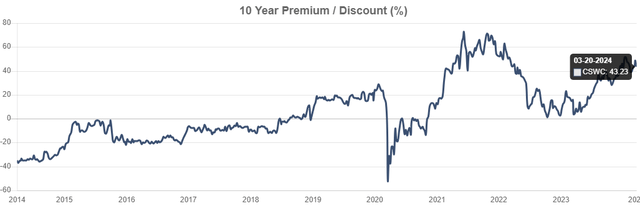

I previously covered Capital Southwest on December 1, 2023. I rate CSWC a Hold as it is trading at a significant premium of 36.21% to NAV at that time. However, I admit I was wrong and over-emphasized this as a risk. Total returns have exceeded 12% since my last report, and the dividend continues to be solid. Not only is the dividend coverage ratio very good, CSWC has since announced two additional payments of $0.06 per share. The first policy is paid in December and the next policy will be paid at the end of March 2024. I have spent some time reviewing a number of different BDCs since my initial underwriting and I have concluded that the premiums here are excellent due to a well-functioning debt portfolio, a growing net investment record and excellent management. .

The stock is currently trading at a premium to NAV, but that’s nothing compared to some peers. For example, Hercules Capital (HTGC) trades at a premium of over 60% to NAV. Main Street Capital (MAIN) typically trades at a premium of more than 50% to NAV. While we all want to enter these positions when prices are discounted, the reality is that top BDCs rarely do so. The only factor that warrants maintaining the current Hold rating again is interest rate cut expectations. While I think CSWC will be able to successfully navigate these changes, I believe the industry may react to the downside.

Portfolio and Finance

CSWC Q3 Demo

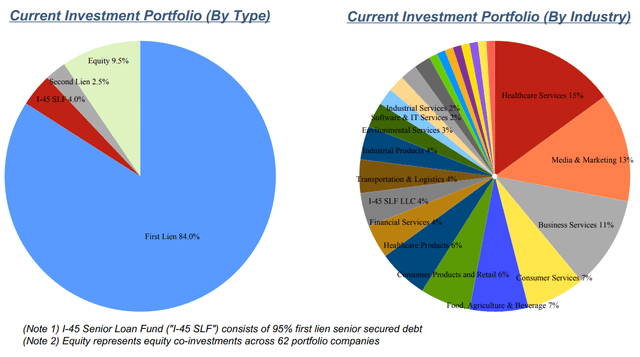

CSWC’s investment portfolio is diverse in nature, the majority of which are first lien loans. Approximately 84% of the portfolio is first lien debt, which is reassuring from a risk perspective. From a risk perspective, this is great because first-lien debt has advantages in terms of paying down the capital structure. First lien debt has the highest priority for repayment during the default, bankruptcy, or liquidation of a company doing business with CSWC.

Its portfolio is also diversified by the number of different industries it operates in. Healthcare services dominate with 15%, followed by media and marketing with 13%. While there is great diversity in the industry, I want to ensure that debt investments in these areas are actually beneficial and high quality for CSWC. Thankfully, most debt investments are highly rated, with only a handful of loans rated below average. CSWC’s rating system is 1 – 4, where 1 indicates “highest quality” and 4 indicates the lowest rated investment. The breakdown of the portfolio is as follows:

- 1 – Rating: 15.4%

- 2 – Rating: 79.6%

- 3 – Rated: 5%

- 4 – Rating: 0%

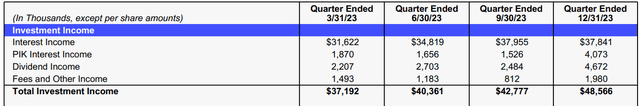

Overall, the portfolio is very solid and well-rated, with a total of 120 debt investments having an average rating of 1.91. In addition to ongoing gross investment income, this portfolio composition is likely the reason why the price has risen so much and why CSWC is currently trading at a substantial premium to NAV. We can see that total investment income continued to grow throughout the year.

CSWC Q3 Demo

As a bonus, CSWC is also actively working to add Roar opportunities to its portfolio. During the quarter, they added $110 million in new committed credit investments. The current weighted average yield on debt investments is also 13.53%.

CSWC reported third-quarter earnings, with net investment income rising to $0.70 per share. Compared to last year’s third quarter net investment income of $0.62 per share, that’s an impressive 13% increase. The dividend is $0.57 per share, which means the net investment income easily covers the distribution! In addition, total investment income increased to $48.6 million from $32.8 million in the third quarter of last year.

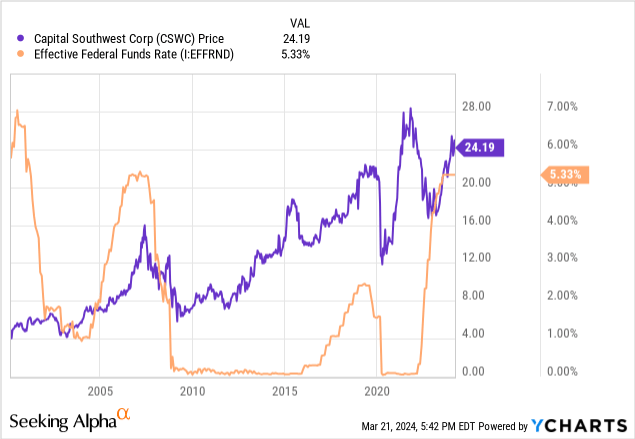

Risk – Interest Rate Sensitivity

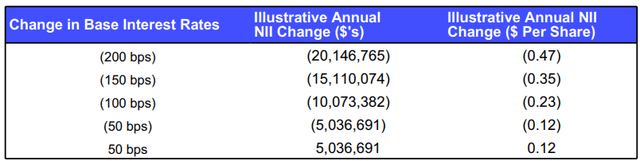

A rate cut is expected in the second half of the year.The Fed is still predict There have been about three interest rate cuts this year, despite a slight rise in inflation. CSWC’s investments primarily include floating rate credit risk. 97% of the credit portfolio is floating rate and the remaining 3% is fixed rate.

This does give us confidence that CSWC will remain profitable if rates do fall. However, it does raise some concerns about what will happen to dividends if interest rates fall and CSWC begins to collect less net investment income.

CSWC Q3 Demo

While the upside is that interest rate cuts typically result in a decline in BDCs’ interest payments and borrowing costs, it also means that yields on new investments tend to decline as interest rates fall. This will definitely lead to a decrease in NII. We can see a handy table provided in the Q3 earnings slide that gives estimates of interest rate sensitivity. A change of (50) basis points would result in NII’s annual loss of approximately ($0.12) per share. While I do suspect that large supplemental dividends may end, it remains to be seen how CSWC will operate and earn enough NII to cover current distributions.

NII reported for the third quarter was $0.70 per share. The current distribution is $0.57 per share. If we follow the interest rate sensitivity table provided, this means that if interest rates fall by 50 basis points, NII could fall to approximately $0.59/share. While the distribution in this case is still covered, the margin of safety is significantly lower than current coverage in Q3.

Finally, lower interest rates may lead to increased borrowing. Technically, this would increase the likelihood of more defaults. In theory, this could lead BDCs such as CSWC to lower their standards and accept lower-quality loans in order to improve the yields on their portfolios. However, judging by management’s excellent investment rating to date, this isn’t a cause for concern.

Dividend comparison

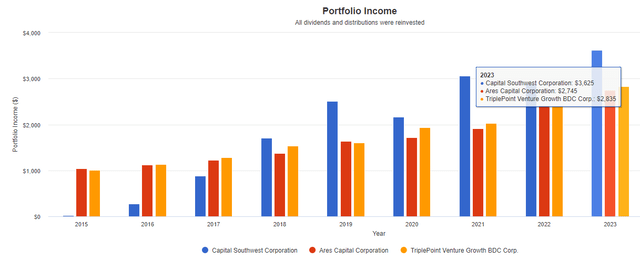

As of the latest announced quarterly dividend of $0.57 per share, the current dividend yield is 9.5%. In addition to this dividend, CSWC also announced that it will pay a supplemental dividend on March 31st at $0.06 per share due to the high level of income they collect. I wanted to take a moment to measure how the dividends received from CSWC compare to some of its peer BDCs, such as:

- Ares Capital (ARCC)

- Three Points Venture Capital (TPVG)

Using the Portfolio Visualizer, we can see each BDC’s dividend growth. CSWC leads ARCC and TPVG in dividend income growth. This figure assumes an original investment of $10,000, with dividends reinvested and no additional capital deployed. We can see how CSWC’s dividend growth has outpaced its peers since 2015. Your initial investment of $10,000 will now earn you $3,625. By comparison, a $10,000 investment in ARCC will increase to pay you $2,745, while TPVG will now pay you $2,835.

- Combination 1 = CSWC

- Portfolio 2 = ARCC

- Portfolio 3 = TPVG

Portfolio Visualization Tools

To solidify this, CSWC’s dividends have grown at an average CAGR of 10.33% over the past 5-year period. Zooming out to a 10-year time frame, the dividend compound annual growth rate is an impressive 21.26%. Considering that this is a BDC with a dividend yield of close to 10%, such growth is very amazing!

In comparison, ARCC’s dividend CAGR over the 5-year period was only 4.24%, and the 10-year period was just 2.36%. TPVG doesn’t have the same length of historical data for its dividends, so the CAGR over the 5-year time frame is just 2.13%. Therefore, CSWC is the clear winner here, showing the best growth. Additionally, CSWC’s NII earnings are sufficient to withstand a drop in interest rates (50 basis points) and still fully cover distributions.

Valuation

CSWC currently trades at a substantial premium to NAV (net asset value) due to its high-quality portfolio and excellent dividend growth history. The current trading price represents a premium of 43.23% to the NAV over the past 3 years. average premium 35.07%. We saw premiums climb to 73% in mid-2021, while discounts during the pandemic-era crash of 2020 were as low as 52%.

Continuing Education Fund Data

While I do believe this BDC is a top-tier stock based on excellent performance, management, and dividend growth, I remain cautious about adding to positions in these grades. I think most BDC prices are likely to fall back slightly in the second half of the year when interest rates finally come down. When this happens, I believe we will have the opportunity to add to or establish positions at more attractive entry prices.

FYI, we can see the relationship between CSWC’s price movements during the recent period when interest rates were cut. 2020 may be labeled as a bit of an anomaly due to current circumstances, but prices did rise with the interest rate cuts. Likewise, as interest rates began to fall in 2009, we saw the price of CSWC follow the same pattern. Every time interest rates rise, CSWC manages to increase NII and the stock price rises along with the net asset value (NAV). While I don’t expect rates to fall significantly, I do think we will have opportunities for more attractive entry opportunities in due course.

take away

Capital Southwest remains one of the best BDCs out there thanks to excellent management, a well-rated portfolio, and excellent total returns from price appreciation and dividend growth. CSWC did benefit from rising interest rates and rewarded shareholders with increased dividends and multiple dividend top-ups.

The stock is currently trading above NAV due to its strong performance. The current premium to NAV is 43%, much higher than the 3-year average premium. NII fully paid its dividend due to increased interest margins. However, CSWC may be vulnerable to expected interest rate changes in the second half of the year. During the third quarter, NII-covered distributions were sufficient to offset any potential losses in NII due to interest rates, but this may not always be the case going forward. I am still invested in CSWC and will continue to reinvest my dividends. However, I plan to keep the extra money on the sidelines and wait for better entry opportunities following interest rate cuts.