Hero

introduce

Casella Waste Disposal System (Nasdaq: CWST) is a waste management company that provides solid waste collection, disposal and transfer services Serve. It also provides recycling and organic services for materials such as corrugated cardboard, plastic, glass and various metals.Casella just announced fourth-quarter results The company’s 2023 results were announced on February 15, and both the company’s revenue and earnings per share missed expectations. In this article, I’ll delve into the company’s latest results, financials, and discuss its valuation to see if the stock is worth buying at its current price.

background

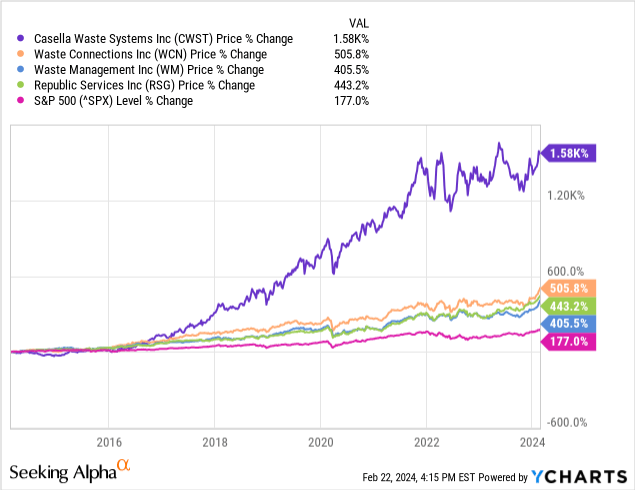

Casella has generated strong returns for shareholders over the years. Like most solid waste management companies, Casella has outperformed the broader market (S&P 500) and peers such as Waste Connections (WCN), Waste Management (WM) and Republic Services (RSG), with a total return of 1582% over the past ten years.in a On an annualized basis, this equates to a compound annual return of 32.6%, which is certainly impressive for a boring crap company!

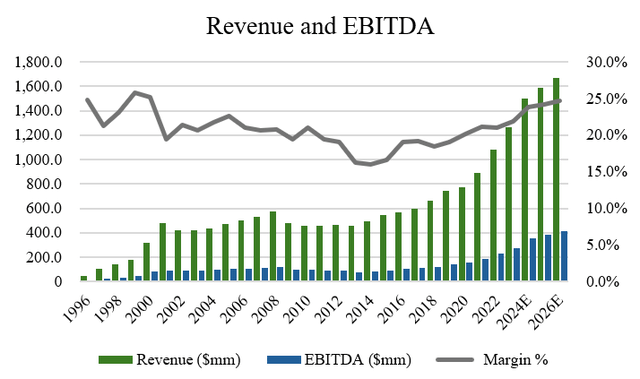

Looking at Casella Waste Systems’ historical financial performance, the company has achieved compound annual revenue and EBITDA growth rates of 5.7% and 6.0%, respectively, over the past two decades. Over the past decade, the company has grown revenue and EBITDA at a CAGR of 10.8% and 14.1%, respectively, highlighting increased margin expansion and faster growth over the past decade compared to the previous decade (Source : S&P Capital IQ).

Author, based on data from S&P Capital IQ

When looking at factors driving growth in financial performance, the company has been benefiting from strong industry momentum in the solid waste management industry. With annual revenue of more than $1 billion, Casella remains one of the smaller publicly traded waste management companies. That is to say, industry It is still largely fragmented, with only a few big players.

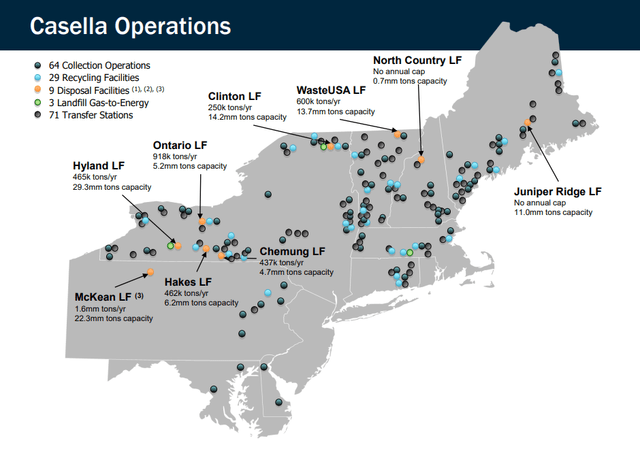

Casella is unique in that its services are primarily East USA. Why is this important?Because the collection of solid waste is generally Pricing Waste emissions in these areas are higher compared to other areas of the United States. For example, in places like New York, no new facilities are being built at all to meet the growing demand for waste generation. Therefore, due to limited supply, tips in the Eastern United States are generally 30% higher than the national average.

Investor introduction

recent results

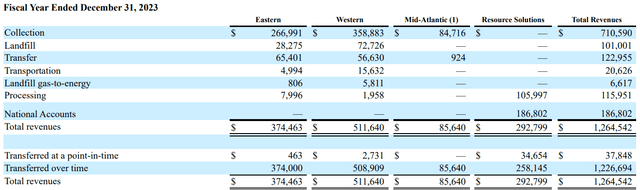

When looking at Casella’s most recent fourth-quarter 2023 results, the company reported both revenue and EPS below estimates, with revenue of $359.6 million and EPS of $0.13 (less than 3 cents).

Although it missed its target, revenue increased 32.1% year-over-year in the quarter, and adjusted EBITDA increased 46.1% year-over-year. Adjusted EBITDA margin expanded 70 basis points as the company’s operating efficiency improved and price increases were passed through the company’s pricing plan. Full-year revenue grew by 16%, and adjusted EBITDA grew by 20%.

Company filing

For full year 2023, I think the growth is pretty substantial considering the volume decline for the year. Declining production is certainly a headwind, but rising average landfill prices per ton and direct investment in the company’s infrastructure to demonstrate efficiency appear to be playing a role.

The North American waste management industry is a $208 billion The industry is generally growing at mid-single digits, slightly above long-term GDP growth rates. Waste management companies have benefited greatly over the past decade due to larger landfills, innovations in chemicals and sorting processes, and government support for municipalities to outsource waste management collection and transfer services.

Waste management is not a new industry, nor is it a record-breaking innovation that can materially change the market landscape. So companies like Casella must find other ways to grow.

A large part of Casella’s growth (both in recent years and this season) has also come from acquisitions. Operating in a fragmented industry where larger players enjoy economies of scale and better cost efficiencies, companies like Casella and its peers have been on an acquisition spree over the past decade to drive growth in the industry .

7 in total acquisition This year, the company has annualized revenue of about $315 and has been aggressively expanding its reach. The company has been on an acquisition spree to continue its growth-by-acquisition strategy by acquiring some of GFL Environmental’s (GFL) mid-Atlantic assets, with $800 million in acquisitions currently in the pipeline. Since only about half of the residential fleet is automated, there is significant opportunity to add more advanced fleet automation to these operations and demonstrate margin growth. Approximately $8 million in synergies have been realized in the Mid-Atlantic region. That may not sound like a lot, but incremental profit expansion will gradually translate into free cash flow and provide Casella with stable returns over the long term.

Importantly, Casella has also been reinvesting in its business. For example, in 2022, the company upgraded the factory equipment several times. Boston Mutual Recognition Fund The facility has shown signs of operational improvement and profit expansion (despite previous headwinds from outages). Likewise, the company will do the same at its Willimantic MRF facility in Connecticut later this year, and I expect that facility to see similar results given the company’s strong track record to date.

As for my outlook for the company, I think the recent acquisitions should lead to higher growth than analysts expect through 2024. Why? Because consensus estimates for 2024 growth are 17-18%, this only includes acquisitions the company has already made; it doesn’t include targets already in the pipeline. Therefore, the number is likely to be higher as any new acquisitions announced will increase revenue.

The expected synergies are likely to be cost synergies rather than revenue synergies, but the company has not yet provided a specific acquisition amount. On the conference call, Chief Financial Officer Brad Helgeson noted that adding up all acquisitions over the past year would add about 100 basis points to incremental margins. He also revised new guidance for 2024, expecting revenue to grow by 18% and EBITDA by 21% in 2024.

Therefore, I believe the company has a good chance of exceeding its target and approaching the 20% growth range. An average of $80 million has been spent on acquisitions over the past five years, with acquisition prices ranging from 9.0x to 1.3x EV to revenue, which should make up for the difference between management’s expectations and what can be reasonably explained through new acquisitions.

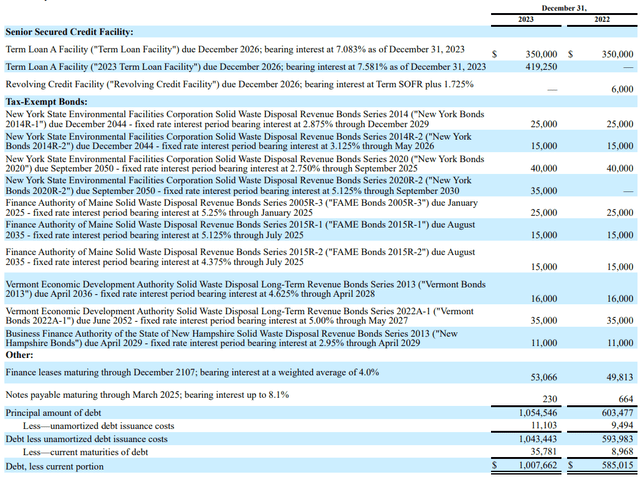

To fund these acquisitions, the company’s balance sheet is quite conservative. Looking at the company’s balance sheet, Casella ended the year with about $1.05 billion in debt, much of which has long maturities until 2029. Net debt to EBITDA is 2.7x, so the company does appear to have moderate leverage. But with a weighted average interest rate of just over 5% and most of the debt at fixed rates, the company’s financial position appears to be strong enough to withstand the unforeseen. situation and provide funding for the company’s M&A strategy.

Company filing

Finally, when it comes to margins, Casella noted that they “try to get their customer base to a certain profit point, and (they) are not willing to accept anything less than that.” I’m confident in the company’s ability to continue expanding EBITDA margins due to its focus on higher margin contracts. Additionally, because Casella operates in a higher-density area where new landfills are not being built, it is in the fortunate position of being able to charge higher prices.

Valuation

According to the 3 sell-side analysts covering Casella stock, 2 have a “buy” rating and 1 has a “sell” rating. Overall, these analysts have an average price target of $99.00, with a high estimate of $105.00 and a low estimate of $92.00 (Source: TD Estimates). This implies a potential upside of 8.5% from current prices to the average price target one year out, suggesting analysts are moderately optimistic about the company’s near-term prospects.

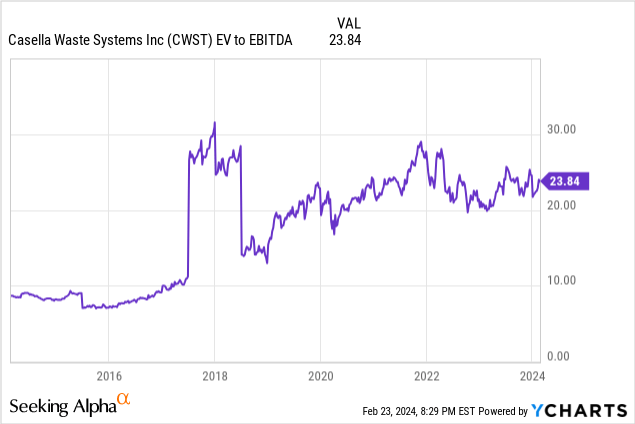

When looking at Casella Waste Systems’ valuation, the company trades at an EV/EBITDA multiple of 23.8x, which at first glance seems reasonable for a business that should be able to continue to grow above GDP and continue to control margin expansion. of.

However, compared to its peers, Casella appears to be at the higher end of the valuation range of publicly traded peers such as Republic, GFL, Waste Connections and Waste Management. Casella is much smaller than other large giants and also has more of a regional focus in the northeastern states, so that’s something to keep in mind. The regional focus allows them to command higher prices and position themselves for higher population growth, but for most of their business in markets such as Massachusetts, Maine, New Hampshire, New York, Vermont and Pennsylvania said, concentration risk is also an issue that needs to be considered.

Author, based on data from S&P Capital IQ

As for the remaining risks, they mainly revolve around the company’s M&A strategy. A large part of Casella’s growth should continue to come from acquisitions, and excessive acquisition fees, excessive leverage, and a failure to generate synergies from acquired targets are all things to watch. Over the next few quarters, I will monitor the company’s margin improvement and monitor the company’s leverage. Currently, as cash flow increases this year, I expect a combination of lower debt levels and acquisition of new targets.

in conclusion

Overall, I would say that despite the miss, Casella’s results didn’t seem that bad. While there are some short-term headwinds from declining sales, I think the long-term outlook suggests the company should be able to grow at an above-average rate. Seven acquisitions have been completed this year, with an additional $800 million in the pipeline, providing a clear path to continue to consolidate the fragmented solid waste management industry. In addition to delivering above-average organic growth due to strong industry momentum, Casella appears poised to continue steadily expanding its profit margins as cost efficiencies and competitive position allow them to gradually increase prices.

That said, Casella stock is expensive, so I would wait for a pullback to the $75-80 range, as that would be the midpoint of peer valuations and provide a more compelling margin of safety. If I already owned the stock, I would consider selling covered calls on my position to generate premium and downside risk. Currently, the $90 call option for September 2024 is selling for $11.40, which implies an annualized return of approximately 21.5%, which seems to be a good risk-reward for income-oriented investors, otherwise They may abandon the stock because it doesn’t pay dividends.