Editor’s note: Seeking Alpha is proud to welcome Thomas Shields as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also have free access to SA Premium.Click Learn more here »

Spencer Pratt/Getty Images News

investment thesis

I evaluate companies through a value investing lens and focus on fundamentals. Taking a page from Warren Buffett’s approach, I want to buy great companies at fair prices and focus on earnings, free cash flow, and debt levels. If an initial scan of their fundamentals warrants further research, I would continue reading about the company in order to make a final decision before investing. Based on current fundamentals, CAVA Group, Inc. (NYSE:CAVA) is at extended valuation today and has a At this price, the risk of permanent loss of capital increases. I expect the share price to fall back in the near term (next 12 months), which will lead to better buying opportunities with a greater margin of safety than the asset’s current price. Additionally, CAVA’s expected valuation is higher than that of Chipotle Mexican Grill, Inc. (CMG) although based on 2007 fundamentals, their profitability is lower than CMG’s post-IPO profitability. However, CAVA’s revenue grew significantly, which is interesting because they grew faster than CMG did around the same time post-IPO. Since my personal investment analysis starts with fundamentals, we’ll start with CAVA.

Company Profile

CAVA Group is a growing Mediterranean restaurant chain with a business structure similar to Chipotle Mexican Grill, Inc., which has an assembly line for custom bowls and pita wraps. Currently, CAVA Group, Inc. is approximately one-tenth the size of Chipotle Mexican Grill, Inc. based on enterprise value and is rapidly growing the restaurants it operates in a highly competitive but growing industry. CAVA’s test markets in Boston, Dallas and the Carolinas are going well and will continue to expand in 2024, with new rewards programs offered by the company that will increase customer loyalty. The restaurant’s rapid growth and growing customer base have led to a sharp rise in the stock price over the past six months, and last quarter’s profit-beating expectations also helped. However, given current economic conditions, there are currently risks associated with investing in CAVA that should be considered before investing at this price.

Current Fundamentals: CAVA

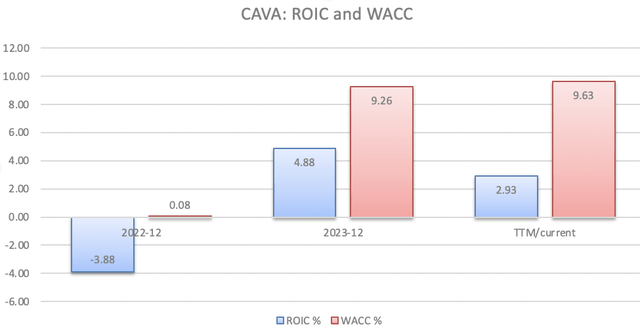

We’ve seen the stock see incredible price gains over the past 6 months, and it’s also had decent returns since its last earnings call. As of this writing, CAVA currently has a forward price-to-earnings (PE) ratio of about 300 and an EV/EBITDA ratio (enterprise value/earnings before interest, taxes, depreciation, and amortization) of over 83. Free cash flow per share is currently negative, free cash flow margin is negative, and their TTM price-to-sales ratio is over 5x. The current forward price to book value ratio is 12.67 times, and the current debt per share level is higher than the cash on hand.Furthermore, the current returns investment capital Just 2.93%, while the weighted cost of capital is three times that number, at 9.63%. In my investment strategy, companies with these numbers do not make good initial investments. With CAVA losing money on invested capital (ROIC-WACC) and continuing to grow rapidly, I don’t want to pay more than 300x P/E for the net debt position (cash debt). While CAVA may be a great company, the risk here is the asset’s current price. Everything needs to go as planned for the price to be reasonable, and even then, I’m not sure it makes sense compared to the previous winner, CMG.

CAVA ROIC% and WACC% since IPO. (Master Focus)

CMG post-IPO fundamentals

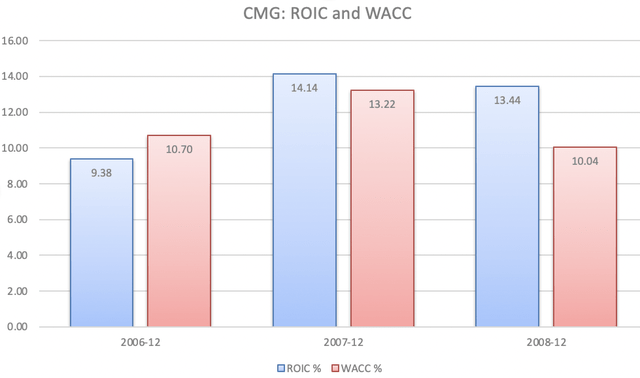

I think we can all agree that if we could have gone back and bought Chipotle Mexican Grill, Inc. at its IPO, we would have purchased it in a heartbeat given the incredible price returns since then. If you had purchased CMG at the IPO, the return today would have been over 6,000%. Since CMG and CAVA have similarities in their overall business operations, I wanted to compare CMG’s prior fundamentals to see if investing in CAVA makes sense today at its current valuation. Some fast fundamentals for CMG during the IPO period and early high-growth stage; in 2007, CMG had a price-to-earnings ratio of 69, an EV/EBITDA value of just over 29, revenue growth of 32%, and positive free cash flow. That year, CMG’s return on invested capital was also just over 14%, with a weighted cost of capital of 13%. In about the same amount of time since its IPO, CMG has not been trading as overvalued as CAVA is today. Given that CMG’s fundamentals in 2007 were positive free cash flow and positive return on investment net (ROIC-WACC), CMG needed further analysis to see whether the estimated returns would be better than the then risk-free rate. time. CAVA currently trades at about 4.3x P/E, 2.9x EV/EBITDA, and negative free cash flow compared to what we saw with CMG in 2007, when it was considered a long-term business to consider the restaurant chain a long-term business. Makes sense. Long-term investment.

CMG: Post-IPO ROIC and WACC values from 2006 to 2008. (GuruFocus)

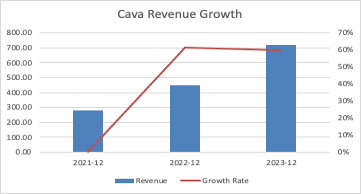

Risk-free interest rate and risk

When our current risk-free investment rates for short-term bond investments and money market funds are around 5%, it’s difficult to justify investing in CAVA when overall cash flow and invested capital are negative in the short term. However, the only thing to note is that CAVA’s revenue growth is higher. From 2005 to 2007, CMG’s revenue grew by only 73%, while CAVA’s revenue grew by 158%. If CAVA can continue to grow significantly, profits and revenue should be able to outweigh its high new store growth costs, but keep in mind that this financial situation is different from what we saw at CMG, which also rapidly grew its restaurants in its early days. Based on this comparison, and the current state of CAVA’s overall fundamentals, I would not continue reading the company’s current news articles and financial statements for further analysis, as the risk of losing an investment here is greater than investing in other great companies or the current risk-free interest rate. However, I will continue to highlight areas of concern that need to be kept in mind when considering investing today and keeping a close eye on the bottom line.

CAVA’s revenue growth (GuruFocus)

short term company growth

Back in 2018, CAVA acquired one of its direct competitors, Zoe’s Kitchen, which helped supplement growth by converting Zoe’s Kitchen stores into CAVA stores. CAVA currently has 309 restaurants and plans to open 48 to 52 new stores in 2024 to expand, according to data from its last earnings call. This means that the number of new stores will increase by approximately 15%; however, pre-opening costs are expected to be between 11.5 million and 12.5 million. The costs associated with opening new stores could be a drag on the company’s short-term profitability and earnings. Over the past few years, CAVA has benefited from acquisitions by converting Zoe’s Kitchen locations into CAVA restaurants, which has added to the company’s near-term growth, and this expansion was highlighted in its Aug. 15 10-Q filing. However, CAVA will complete the renovation of Zoe’s Kitchen stores this year, leaving only a few stores. Given the lack of remaining Zoe’s Kitchen stores to remodel and the associated pre-opening costs of planning new stores, I expect new store growth to slow rapidly in the near term. Given that current fundamentals point to negative overall free cash flow and negative ROI, I’m concerned about accruing significant debt to fund short-term new restaurant growth given pre-opening costs and a lack of restaurants to convert.

Increase in labor costs

During the earnings call, there was mention of a 3% price increase on restaurant menus and improved packaging, which helped reduce packaging costs by nearly 29%. While the 3% price increase likely represents some pricing power given that same-store sales are still growing, labor costs increased nearly 28%, or 50 basis points since the same quarter in 2022. Additionally, there is currently a risk of cost inflation that applies to food items such as olives, chicken and olive oil. CAVA found that the cost of these items will increase throughout 2023, and they expect costs to rise further by single digits. With sales per store expected to grow by single digits in 2024 and the risk of food inflation persisting in the near term, there could be an impact on profits if labor costs don’t offset costs further as they have in previous quarters.

in conclusion

In summary, CAVA Group, Inc. is a growing Mediterranean restaurant food chain focused on hospitality and providing quality Mediterranean cuisine. However, CAVA is trading at a higher valuation and based on fundamentals, I expect the share price to fall. I like the overall story behind CAVA because I don’t know of any other Mediterranean restaurant chain that’s been so successful, and I love the food. That, coupled with the rapid revenue and restaurant growth the company showed last year, may be why the market is overpricing the asset for fear of missing out on another CMG-like restaurant company. However, based on my analysis above, I would not take a position at CAVA now because there are better opportunities there with less risk. This article is just my opinion based on my brief analysis.

If the company’s growth plans don’t pan out (which we’ll see over the next few quarters), I’d expect a negative reaction in the stock price, which could lead to investment opportunities given the high revenue growth. Personally, I wouldn’t consider starting a position until we see a significant decline in the stock price due to increased levels of risk at the current valuation.