nastco

Welcome to another installment of our weekly CEF market review, where we discuss closed-end funds (CEF) from the bottom up, focusing on individual fund news and events, and the top down, providing an overview of market activity in closed-end funds (CEFs) Fund (CEF) market activity. A wider market.We also try to provide some Historical background and relevant themes that appear to be driving the market or that investors should be aware of.

This update covers the period ending in the second week of March. Be sure to check out our other weekly updates covering the business development companies (BDCs) and preferred stock/baby bond markets for a broader income perspective.

market action

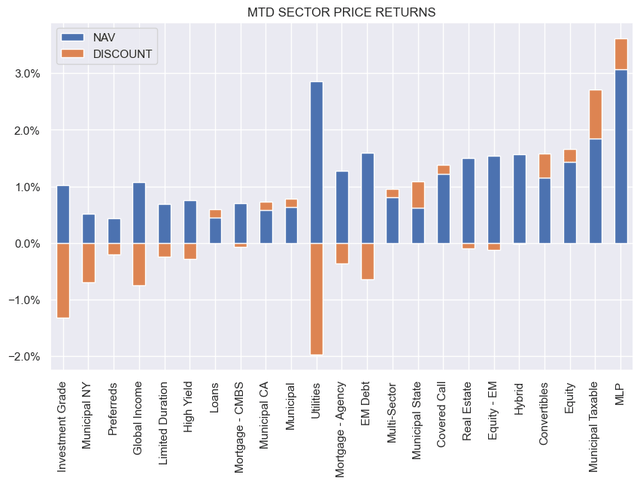

It was a good week for CEFs, with net asset values rising across all sectors, but discounts were mixed. Most equity-related sectors outperformed.

systematic income

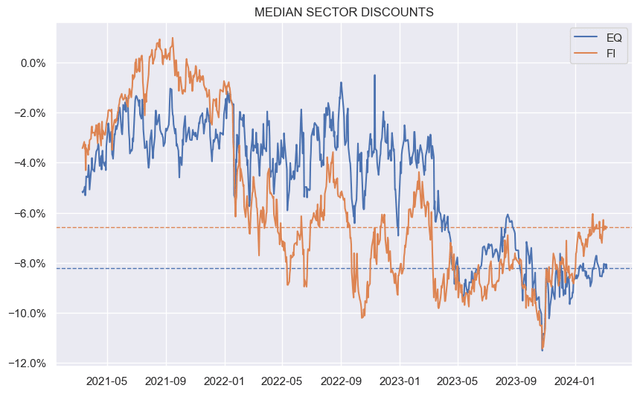

The gap between fixed income and equity CEF sector discounts remains. Total CEF discounts remain above their long-term averages; however, this is largely due to a few sectors such as municipal bonds and covered calls, as well as the rest of the CEF space currently trading around their long-term averages.

systematic income

market theme

If you don’t succeed at first… Nuveen is trying to increase Muni CEF discounts by increasing allocations. The rationale in the press release was the same – to improve market liquidity and tighten discounts. The former is a catch-all, universal rationale that managers use for everything they do. For the latter, keep in mind that previous big increases didn’t have much of an impact on discounts. If anything, the recent broad market rally has tightened Muni CEF’s discount somewhat.

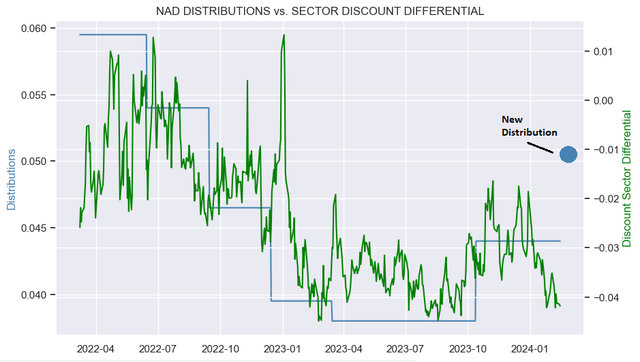

The chart below shows that while NAD’s distribution has grown (blue line/point), its relative discount has actually widened – NAD’s trading discount is 4% above the industry average, its widest over the past year level. In other words, Nuveen’s move has so far been a failure for NAD and many of its other funds.

systematic income

Realistically, we may have to wait for leverage costs to fall before the Muni CEF discount can be convincingly tightened. The increase in distributions without an increase in net income did not convince the market.

Market comments

Virtus Convertible & Income 2024 Target Term Fund (CBH) slashed its distribution. CBH is a target-period CEF with an expiration date of 2024. The press release mentioned that the fund has moved into short-term securities in anticipation of termination. As we all know, the term CEF does not always terminate. Management companies like Virtus, which have been busy acquiring existing CEFs from smaller shops (e.g., Allianz, Voya), may not be particularly keen on losing assets and fees.

However, converting a target-term CEF structure (as opposed to a regular term structure) into a perpetual fund is somewhat difficult, as it requires almost a complete turnover of the portfolio and a change in strategy. If the fund does terminate, it’s likely this feature is to blame. In this sense, target term CEF is more likely to terminate than ordinary term CEF.

The PIMCO Dynamic Income Strategies Fund (PDX) made a series of changes to its allocation. First, it increased the allocation from $0.22 to $0.26, an increase of more than 18%. It then changed from quarterly to monthly distributions. Finally, the monthly distribution also increased from $0.0867 (new $0.26 quarterly distribution / 3) to $0.1133, an increase of over 30%.

Net net distribution increased by 55% and changed to monthly distribution. These changes were anticipated and discussed in our last update. While the upgrade seems large, we’re starting from a very low base with a NAV distribution yield of just 3.8%, which gives us a yield of just 5.84%, which is slightly more than half the yield on the company’s other taxable CEF distributions. . While allocations should continue to rise, we shouldn’t expect it to match other taxable funds given the fund’s higher energy industry profile (which keeps net income lower than more pure credit funds) and its higher management fees.

Positions and Points

Municipal CEF discounts are still very large in both absolute and relative terms. Managers of these funds have tried to tighten capital by increasing allocations. As we discussed recently, this was partly due to Capps’ underlying activist pressure, specifically sniffing out many funds. Ultimately, we believe the Muni CEF discount will tighten; however, investors may need to wait for the Fed to start cutting interest rates first.

Check systematic income and explore our income mixdesigned with return and risk management in mind.

Use our powerful Interactive investor tools Navigate the BDC, CEF, OEF, senior bond and baby bond markets.

read our Investor Guide: CEFs, Preferred Stocks and PIMCO CEFs.

Check us out on a risk-free basis – Sign up for a 2-week free trial!