Romain Morris

Celsius Holdings (NASDAQ: CELH), owner of the world’s fastest-growing energy brand, saw its shares hit a record high after fourth-quarter revenue data beat expectations.

In the words of the CEO, energy drinks The category is now three-team competition.

Basically, the company is firing on all cylinders and it may be the best non-AI growth story on the market today. As always, the only question is valuation.

Introduction to Celsius Holdings

I started covering Celsius on Seeking Alpha back in July 2023, claiming it was a strong competitor to Monster Beverage (MNST), which was, and still is, one of the best-performing investments in history.

Celsius’ investment thesis remains very simple. Celsius is by far the fastest growing consumer staples business in the world.Celsius continues to capture share of growing energy drink market, and With its unique formulations and superior marketing, the company is driving new opportunities to expand its TAM.

So, in terms of Celsius’ revenue, we have a rapid growth trajectory, but that’s not the end of the story. As the company builds on PepsiCo’s unrivaled distribution (PEP) strength and continues to build scale, we’re seeing margins expand rapidly as well.

I believe Celsius will provide investors in 2024 with a rare opportunity to feel what investors felt like in the nineties.with all the old consumer goods group For companies that currently rely primarily on pricing to drive growth, Celsius shows us that there is still room for disruption in the industry.

Significant Growth and Looking to the Future

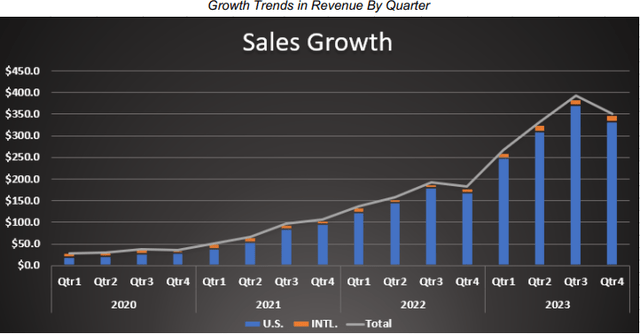

In the first quarter of completing the Pepsi-Cola distribution agreement, Celsius defeated tougher competitors and generated fourth-quarter revenue of $347 million, a year-over-year increase of 95%. Full-year sales exceeded $1.3 billion, achieving triple-digit growth for the third consecutive year.

Celsius Holdings releases fourth quarter financial report for 2023

Growth did slow down, but it was still much better than expected, with Celsius beating expectations by $15 million. Of course, growth will slow further as we look toward 2024, with full-year growth currently expected at 41%.

That said, I believe consensus estimates will rise in the coming weeks as analysts adjust based on recent results. I think Celsius could achieve 50% growth this year, and recent tracking data has Celsius in the 75% growth range.

Additionally, the company is increasing its marketing investment slightly, and its international growth should accelerate significantly after its official launch in Canada earlier this year.

Additionally, I believe the Celsius brand is at an inflection point where it is gaining significant organic awareness.

If that wasn’t enough, 2024 will be the first year that Celsius enters with careful planning and preparation with PepsiCo and an even stronger position among sellers.

With all of this in mind, I would be shocked if the Celsius temperatures didn’t exceed the highest expectations.

Profit expansion and operating leverage

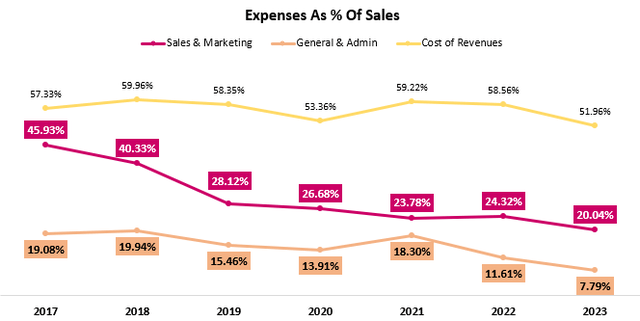

If we’re going to be picky, Celsius did miss estimates by $0.01 per share as higher selling and marketing expenses led to lower-than-expected margins. Despite this, Celsius still generated operating profit of $266 million in 2023, more than six times the previous year, with margins increasing 1,630 basis points to 20.2%.

Created and calculated by the author using data from Celsius Financial Reports.

Margin growth was driven by scale advantages in cost of revenue and operating leverage in Sales & Marketing and General & Administrative. Looking ahead to 1Q24, management stated that margins should be consistent with 4Q23, which means we expect operating margins should be in the 17%-18% range.

That doesn’t mean margin expansion is over; margin stagnation is due to increased marketing spend as the company launches new territories and takes advantage of high ROI opportunities, such as Super Bowl ads.

I believe that Celsius can reach Monster-level profit margins in the long run, but it will take time, especially on the operational side, as Monster is still trading at close to 6x sales.

Updated Monster Drinks Comparison

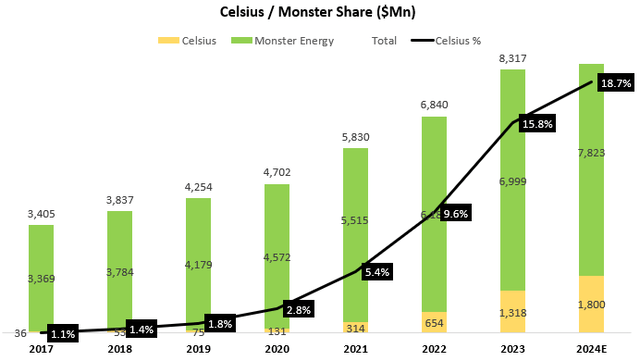

As a rule, we have to compare Celsius’s performance with its most important competitor, Monster, which remains the world’s top energy brand.

Created and calculated by the author using data from the company’s financial reports and consensus estimates; Monster Energy’s data excludes revenue from Monster Beverage’s non-energy operations.

As of 2023, Celsius sales will account for nearly 16% of total revenue. Based on current consensus estimates (which I think are slightly positive for Monster), Celsius’ share is expected to reach nearly 19% by 2024. It should be noted that Monster’s data also includes the acquisition of Bang energy.

Importantly, Celsius’ overall market share reached 10.5% in the four weeks to 2023, and in the four weeks to February 11, according to the CEO 11.5%.

In addition, Celsius also surpassed Monster to become the top-selling energy drink on Amazon, accounting for 19.7% share.

CELH stock valuation and how high is too high?

So, clearly Celsius is killing it. The company continues to exceed already high expectations and continues to take share from competitors. It did so while growing TAM and expanding margins.

It’s almost a perfect storm. However, the market appears to have ultimately priced the stock accordingly.

In a previous article, we could argue that Celsius was trading at less than 1x PEG. This is no longer the case.

At $81.6 per share, Celsius trades at 78 times 2024 forecasts. Even if we estimate our own sales of $2 billion in 2024 and a profit margin of about 14%, it is still about 67 times and the expected growth rate is 50%.

Compared to Monster’s 2024 and 2025 EV/Sales of 7.6x and 6.9x respectively, Celsius trades at 10.2x and 7.5x, a significantly higher premium compared to my previous article.

Despite the higher valuation, if Celsius does live up to expectations and reach at least 20% share within the next five years (which I believe it will, and sooner than that), the near-term valuation won’t prevent the stock from offering significant market-beating returns.

As a current shareholder, I will share what I think is the right strategy going forward. If Celsius is a large part of your portfolio and you have attractive options, I think Celsius stock will be range-bound at least until first-quarter results are released. Therefore, I would consider cutting back.

If Celsius was a normal-sized position in a portfolio, I would ignore any near-term noise and focus on maintaining appropriate exposure, with a long-term target (I’m targeting 2027).

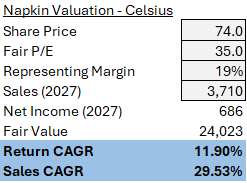

Finally, if you don’t have a position in Celsius, I would wait for the stock to drop to the $74 range, which is a price target of 12% annual returns based on my base case assumptions below.

Created and calculated by the author based on the author’s assumptions

As you can see, if sales grow at a 30% CAGR through 2027, margins will be 19% and an exit multiple of 35x will give us a fair value of $24 billion, reflecting An annual return of 12%. Shares are trading at $74, but represent only 8.5% of today’s price.

in conclusion

Celsius is one of the most compelling growth stories in the market, as the company continues to capture share of the rapidly growing energy market. As its international expansion is still in its early stages and its scale advantage is just starting to have an impact, I believe Celsius will continue to exceed expectations and outperform its peers.

After another better-than-expected report and shares soaring 20%, I think investors should recalibrate their strategies. While I believe CELH stock still has plenty of upside, its current valuation is much higher.

I maintain a Buy rating on the company, but encourage investors who are not already holding a position to wait for the decline, which will inevitably come.