dark blue4you

investment thesis

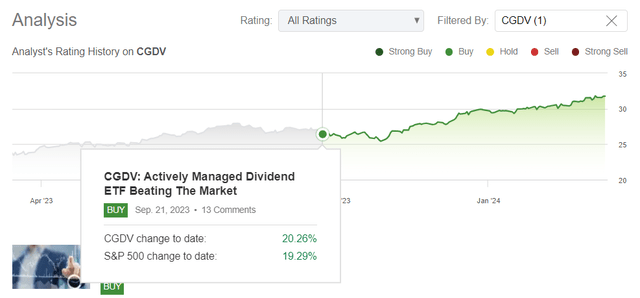

Six months ago, I began covering the Capital Group Dividend Value ETF (NYSE:CGDV), lists impressive performance, a unique multi-manager structure and solid fundamentals as reasons for my “Buy” rating.Since then, it has gained slightly more than the S&P 500, the only During this period, a handful of large-cap value ETFs did just that.

Seeking Alpha

As an actively managed fund, CGDV managers can trade stocks as they see fit. However, they have only slightly changed their portfolio over the past six months and have maintained high expected profit growth to ensure continued participation in this growing market. This is a nice feature, but perhaps even better is that CGDV complements an S&P 500 index fund very well.As well as a detailed fundamental analysis comparing CGDV to Vanguard Dividend Appreciation ETF (VIG) and WisdomTree US Quality Dividend Growth ETF (DGRW)), this article includes an analysis of fund overlap by weight, showing that adding CGDV is an effective move. I look forward to telling you about this in more detail below and explaining my decision to reiterate my “Buy” rating on this exciting dividend ETF.

CGDV Overview

strategy discussion

According to its Fund pageOne of CGDV’s primary goals is to “generate consistent income that exceeds the average yield of the S&P 500 by focusing on companies that pay dividends or have the potential to pay dividends.” The ETF is managed by five portfolio managers who follow a “capital system” that “combines independent, highly committed decision-making with diversity from multiple perspectives.” In my previous review, I profiled five managers and determined that there was minimal overlap in the managers’ respective areas of expertise. As a refresher, here’s some brief background:

1. Christopher Buchbinder: Telecommunications services, automakers, auto parts and equipment.

2. Martin Jacobs: Industrial machinery and electrical equipment.

3. James Lovelace: Beverages, tobacco, restaurants, and home and personal products.

4. Keiko McKibben: Aerospace and defense, information technology, industrial machinery and business services.

5. James Terrile: Healthcare supplies, medical equipment, biotechnology and pharmaceuticals.

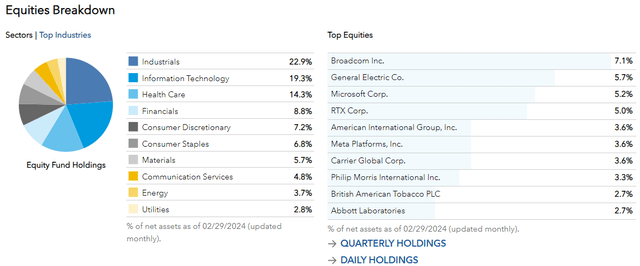

Each manager selects stocks from their respective areas of expertise, but it’s worth noting that The Capital Group doesn’t focus on energy, financials, materials, real estate or utilities. These five sectors are underrepresented in the fund, accounting for only 21% of the current portfolio as of February 29, 2024.

capital group

Broadcom (AVGO) is the top holding, but CGDV is overweight the Industrials sector by 22.9%, perhaps due to the expertise of portfolio managers Jacobs and McKibben. Popular stocks in this sector include General Electric (GE), RTX Corp. (RTX) and Carrier Global (CARR). However, the industrial sector’s earnings are relatively low. CGDV’s select products yield only 1.45%, while consumer staples have the highest yield at 6.82%.

Dividend analysis

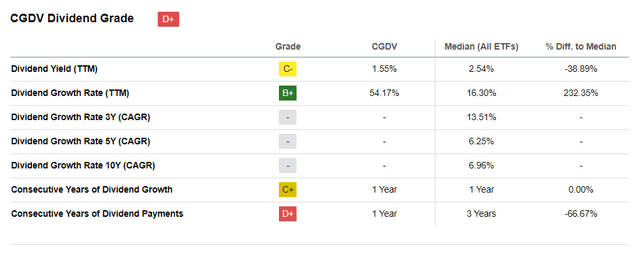

Beating the S&P 500 on dividend yield isn’t challenging. The SPDR S&P 500 ETF (SPY) has a yield of 1.29%, and about 90% of large-cap value funds have a yield higher than this number. CGDV’s 1.55% trailing yield isn’t much better, and Seeking Alpha assigned it a poor “D+” overall dividend rating.

Seeking Alpha

CGDV is a relatively new ETF, only launching on February 22, 2022, so it hasn’t had a chance to establish any dividend growth history yet. However, based on its current options, dividend growth could reach mid-to-high single digits over the long term. The three-year and five-year weighted average dividend growth rates of its constituent stocks are 10.97% and 6.24% respectively, and the current index yield is 2.14%. After deducting CGDV’s 0.33% expense ratio, the net yield is 1.81%, which is roughly the same as DGRW and VIG.

CGDV fundamental analysis

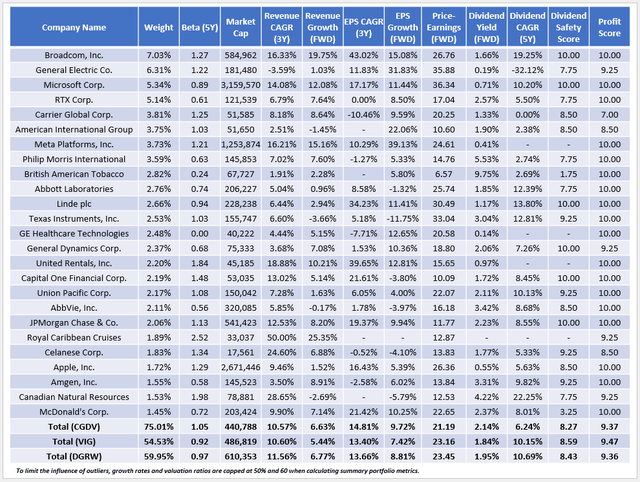

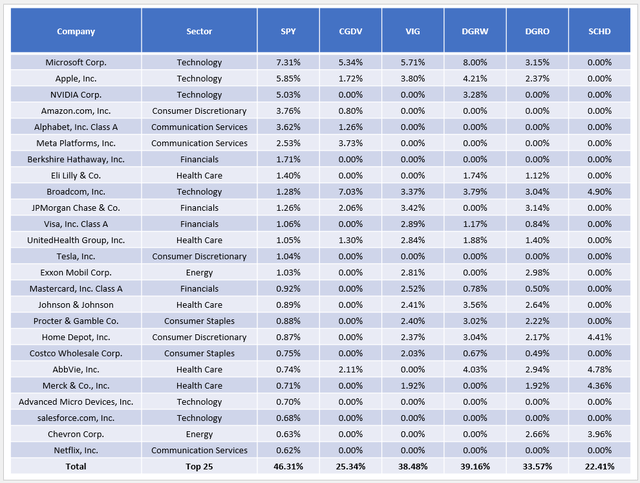

The table below highlights selected fundamental metrics for CGDV’s top 25 holdings, which together represent 75.01% of the portfolio. Note that these are cash-adjusted weights as of March 14, 2024, as CGDV has a 3.52% stake in Capital Group Central Cash Fund (CMQXX).

Sunday Investor

Here are four key points:

1. CGDV holds 50 stocks, so it is a very concentrated portfolio compared to VIG and DGRW (which hold 311 and 296 stocks respectively). It also has 92.15% of the stock allocated to its top 25 sub-sectors, compared to 75.54% for VIG and 82.36% for DGRW, so it might not make for the best core holding in your portfolio. However, it complements multiple ETFs well, and I would compare it to VIG, DGRW, iShares Core Dividend Growth ETF (DGRO), Schwab US Dividend Equity ETF (SCHD), and Vanguard High Dividend Yield ETF (VYM) .

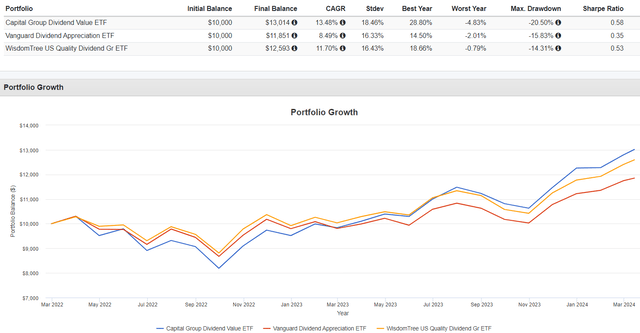

2. CGDV has a five-year beta of 1.05, which is high for a large-cap value ETF. The average for this category is 0.97, and funds with betas above 1 tend to be high-value funds with little to no earnings growth. Examples of such funds that you may be familiar with include the Pacer US Cash Cows ETF (COWZ), the Invesco S&P 500 Enhanced Value ETF (SPVU), and the newly launched VictoryShares Free Cash Flow ETF (VFLO), but CGDV is different. While it’s slightly more volatile than most of its peers, its 9.72% expected earnings growth rate ranks 4th/97th in the category. Such a high ranking is why CGDV has performed so well in this growth-friendly market, outperforming VIG and DGRW by 4.99% and 1.78% annually since February 2022, respectively.

Portfolio Visualization Tools

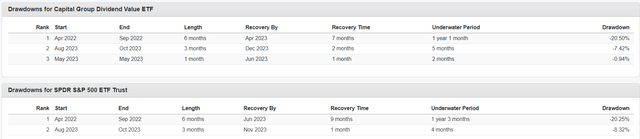

3. The downside is that CGDV has a forward P/E ratio of 21.19x, which is #86/97 in the large-cap value category. With its relatively high valuation ratios and beta, it’s no surprise that CGDV underperforms when markets decline. The chart above shows that between April and September 2022, it fell by 20.50%, matching the decline in SPY.

Portfolio Visualization Tools

4. CGDV selects quality stocks and the portfolio has a profit score of 9.37/10, which I calculated using Seeking Alpha Factor Grades. However, CGDV’s weighted average free cash flow margin is only 13.02%, ranking #47/97. This could limit future dividend growth, as we can see in the fundamental analysis table that CGDV’s constituents have lower five-year dividend growth rates and lower Dividend Safety Scores than VIG and DGRW. Therefore, this may not be the best option for DGI investors. Instead, the main goal is capital appreciation, with yields slightly higher than SPY.

How complementary is CGDV to other ETFs?

Although CGDV is actively managed, I would expect its holdings to remain broadly consistent given the strong conviction of its managers. In contrast, passive ETFs like SCHD must change their holdings every time a plan reorganizes. For example, I expect SCHD to drop last year’s best-performing stock, Broadcom, on Monday. The deletion will increase SCHD’s yield but may reduce future dividend growth and total returns, and the change is likely to draw mixed reviews. CGDV is not bound by such a timeline, which may be an advantage depending on your goals.

While we have no control over the behavior of other ETFs, CGDV appears to be a solid addition to broad market funds. The table below highlights each ETF’s allocation compared to the SPY’s top 25 holdings.

Sunday Investor

Note that CGDV’s allocation to the top 25 SPY stocks (25.34%) is much smaller than VIG and DGRW. CGDV has a total weight overlap of 35.15% with SPY, compared to 44.77% and 49.08% for VIG and DGRW, so it is a better complement. SCHD is the most different, but it’s important to note that it lacks a significant earnings growth component, currently estimated at just 0.94% next year. CGDV’s 9.72% growth rate means it’s much more likely to outperform in a bull market.

Investment Advice

CGDV is one of the few large-cap value ETFs with a high projected earnings growth rate. This feature is why it’s outperformed most of its peers since its launch in February 2022, but I caution readers that it’s a bit risky for the category. CGDV has an above-average five-year beta of 1.05, a forward P/E ratio in the bottom decile, and a short drawdown history that’s only as good as SPY. Its 1.81% forward dividend yield isn’t competitive with most dividend ETFs either, but with earnings growth rates declining across the board, I appreciate that CGDV’s managers aren’t just picking the hardest-hit stocks because of their high yields . Managers emphasize quality and growth factors, which should please long-term investors.

CGDV’s growth and valuation combination outperforms VIG and DGRW. It’s also a better complement to SPY based on my holding analysis. Investors should weigh CGDV’s weaker diversification at the company and sub-industry levels, and remember that it’s easier to build a fundamentally strong portfolio with fewer holdings. Nonetheless, CGDV is a well-structured ETF that I think is a good match for broad market ETFs like SPY, and as such, I decided to reiterate my Buy rating. Thank you for reading and I look forward to your comments below.