JHVEPhoto/iStock Editorial via Getty Images

Business overview

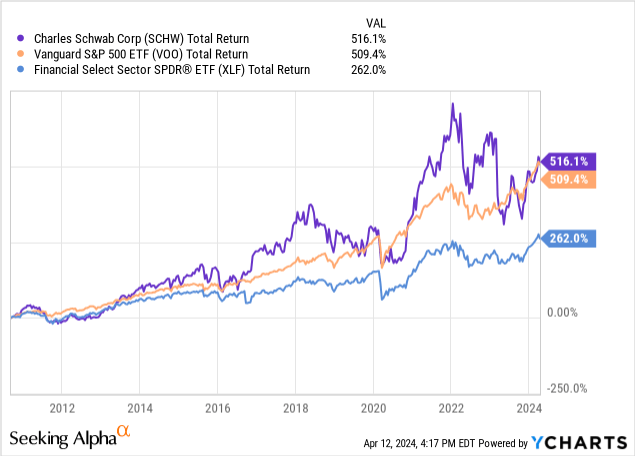

I initiated coverage of Charles Schwab (NYSE: SW) with a Strong Buy rating in August 2023, selling for $56.46. Since then, Schwab has consistently outperformed the S&P, posting a total return of 25% compared to the index’s 16% total return.Historically, Schwab has outperformed the broader The index rose slightly, while industry peers rose significantly:

Schwab is the third-largest company in the sector by market capitalization and eighth-largest by 10-year total return. Morgan Stanley ( MS ) and Goldman Sachs ( GS ) are other companies of similar size with similar returns.

Charles Schwab is a strong financial institution with a differentiated business model. It was the first to launch commission-free trading and quickly followed Vanguard Group through low-cost index investing. In October 2020, Charles Schwab completed the acquisition of its main competitor TD Ameritrade. Financial institutions may rely more on acquisitions to drive assets under management (AUM) Under management) future growth will continue to drive market-beating performance. AUM growth may be related to stock returns. Industry consolidation will be a defining feature of the future of finance, as larger players gobble up smaller rivals, inorganically increasing AUM.

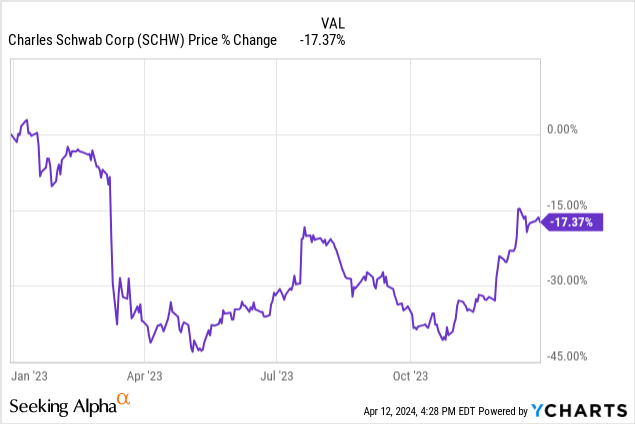

Schwab spent much of 2023 mired in low sentiment and negative talk about financial stocks. At the beginning of 2023, the Federal Reserve’s record rate hikes are indiscriminately putting pressure on depository institutions, and the collapse of Silicon Valley Bank in March 2023 added fuel to the fire of financial stocks.

While the SIVB story is about poor risk management and over concentration Sentiment across Wall Street quickly turned against banks and depository institutions across the region as the deposit base was affected. Schwab was hurt by this.

Schwab has historically posted market-beating returns because it is a depository institution. It moves uninvested client cash into interest-bearing instruments, using net interest income to continue lowering client fees and ETF fees. Schwab differs significantly from banking institutions in that its cash scans come from uninvested brokerage cash balances rather than deposit account balances.

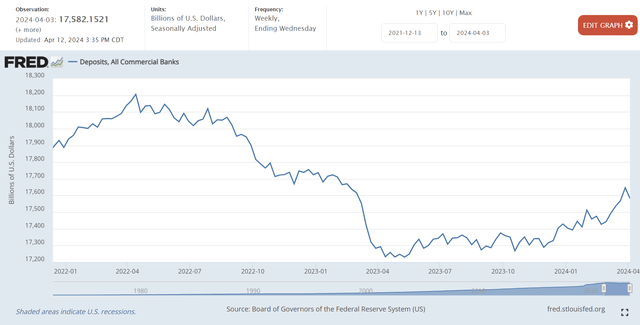

The entire banking sector has suffered from deposit flight in 2023, a trend that has only recently begun to reverse:

fred

Banks record deposits as liabilities and make loans against deposits as assets. The spread between deposit rates and lending rates becomes the bank’s net interest margin (NIM). As the loan balance increases, NII, or net interest income, tends to increase as well. The problem Schwab faces is not deposit flight but cash classification. As government bonds become a more profitable investment, clients are left with less uninvested cash in their brokerage accounts. The recent stock market bull run, which began when the Federal Reserve began guiding for rate cuts in 2024, has exacerbated the problem.

This cash disaggregation hurt Schwab, but the company’s total interest and dividend income was still up 31% from the same period last year. Meanwhile, total revenue fell 11% as interest expenses surged 332%.

Against this backdrop, let’s delve into the upcoming report.

Earnings Preview: First Quarter 2024 Earnings

Charles Schwab will announce its first quarter 2024 financial results on April 15, 2024. Analysts expect non-GAAP earnings per share for the quarter to be $0.74 on revenue of $4.72b. However, Wall Street sentiment has turned more negative recently, with just two EPS estimates raised versus 18 EPS estimates cut.

Meanwhile, analysts expect full-year non-GAAP earnings per share of $3.41 in 2024 and $4.33 in 2025. Schwab’s expected price-to-earnings ratio in 2024 is 20.73 and in 2025 it is 16.32. The five-year average estimate for Schwab is a P/E ratio of 18.88, so Schwab’s P/E ratio has returned to the average of recent price performance. My first post called for this mean reversion – in the title itself I said “Buy Earnings Contraction””.

Now that mean reversion has been achieved, the likelihood of future outperformance has diminished. Analysts still unanimously expect growth in the coming years, but the question now is whether that growth will outperform the market. Revenue growth will be inextricably linked to two things: AUM growth and cash disaggregation. Let’s explore it.

Asset management scale growth

As of February 29 this year, Schwab’s total brokerage accounts reached 35.1 billion, and its assets under management reached US$8.88 trillion. In February, core net new assets reached US$31.1 billion, and assets under management increased by 20% year-on-year and 4% quarter-on-quarter. The company expects revenue to grow slightly by 5% to 6% next quarter, with trading balances declining slightly, but a strong stock market will increase trading activity, thereby increasing transaction fee income. Overall, AUM growth is a huge positive and reflects Schwab’s core strengths. With the TD Ameritrade acquisition closed and most natural customer churn eliminated, Schwab will reliably compound AUM going forward. Its scale and trusted brand will allow its AUM to continue to grow, especially if equity markets remain strong.

However, cash classification remains an issue.

Cash classification

Client cash as a percentage of client assets was 11.6% in February 2023 and has now fallen to 10.2% in February 2024. This number hasn’t grown since October 2023, so changes here will be critical for Schwab stock returns. It represents a significant opportunity or risk for future interest income growth.

What factors factor into consumers’ cash sorting decisions?

The first and most important is the interest rate. The Fed’s interest rate policy has a two-fold impact on Schwab: 1) as interest rates fall (as they do in the stock market generally), it generally benefits stock valuations; 2) it benefits Schwab’s business model because customers will stay More uninvested cash remains as interest rates fall.

With interest rates on 1-month Treasury bills as high as 5.39%, clients have a strong incentive not to leave uninvested cash in a brokerage account. Following a recent series of popular CPI prints, Seeking Alpha News editor Liz Kiesche noted:

Interest rate traders are withdrawing bets that the Federal Reserve will start cutting interest rates in June. According to CME Group FedWatch data, the chance that the federal funds rate will remain at 5.25%-5.50% rose to 73.2% on Wednesday, compared with 42.6% on Tuesday. tool.

The longer interest rates remain at current levels, the lower the likelihood of an inflection point in cash classification. This is a nasty and ongoing headwind for Schwab’s net interest income, as it leaves less cash to earn interest while interest expenses remain high. While Schwab’s capital markets income has benefited from a strong stock market, the headwinds to net interest income may be too strong to generate market-beating returns in the short to medium term.

A pattern of higher long-term interest rates will make it difficult for Schwab stock to outperform the market.

On top of that, a prolonged bull market could also weigh on Schwab’s cash classification issues. Retail investors are fickle; they are known to increase their participation in the stock market during bull markets and exit during bear markets. The longer the bull market lasts, the more participation we can expect from retail investors.

Schwab is not immune. If technology stocks, especially semiconductor stocks, continue to run rampant, Schwab’s retail base may find it difficult to combat the “FOMO” (fear of missing out) on stock investing. This will certainly keep Schwab’s cash classification issues under pressure going forward.

Overall, I don’t see any solid data to suggest that Schwab has moved on from the cash classification issues that weighed on the stock in the first half of 2023. Therefore, I don’t see any reason to use cash to purchase additional shares of Charles Schwab stock in its current state of sorting.

Important points for investors

While the broader stock market bull market has benefited the stock and led to mean reversion in its P/E ratio, the fundamental issue remains that higher long-term interest rates will keep interest income suppressed by higher long-term interest payments. This is a fundamental question for Schwab’s future prospects, and I have no reason to believe Schwab will generate market-beating returns in the foreseeable future.

On top of that, Charles Schwab kept its quarterly dividend unchanged at $0.25 in its most recent report, breaking a streak of annual dividend increases dating back to 2021. It’s possible that Schwab will increase its dividend in an upcoming report, but given the headwinds in the cash disaggregation, I find it unlikely.

Therefore, I rate Schwab a Hold at its current price of $70 and its 1.42% dividend yield. There are no signs here of an imminent collapse or serious underperformance, on the contrary, AUM growth is overwhelmingly positive, so I wouldn’t recommend any selling. But investors should carefully monitor the “customer cash as a percentage of customer assets” provided in Schwab’s monthly business update to gauge the value of additional purchases.

A change in this data point would significantly change my thesis, but the current state of Schwab’s business makes the stock unattractive for additional buying at this time. My thesis will be affected by two fundamental changes, either: 1) prices fall back into the $50-60 range and P/E ratios fall back below historical averages, or 2) customer cash percentages persist (3 months or more) Changes in customer equity.

If either of these two changes occur, I will revisit my thesis and likely upgrade Schwab to a Buy. I currently downgrade Schwab stock to a Hold rating for at least the next quarter.