Megapixel 8

Commercial real estate has been caught in the eye of a perfect storm. Because the industry is highly sensitive to interest rates, it faces pressure from rapidly rising interest rates.

Additionally, lifestyle changes and pandemic-related shifts Hybrid and remote working have led to an oversupply of offices. The imminent demise of the commercial real estate market is well-documented, and overall risks are often brought to the forefront.

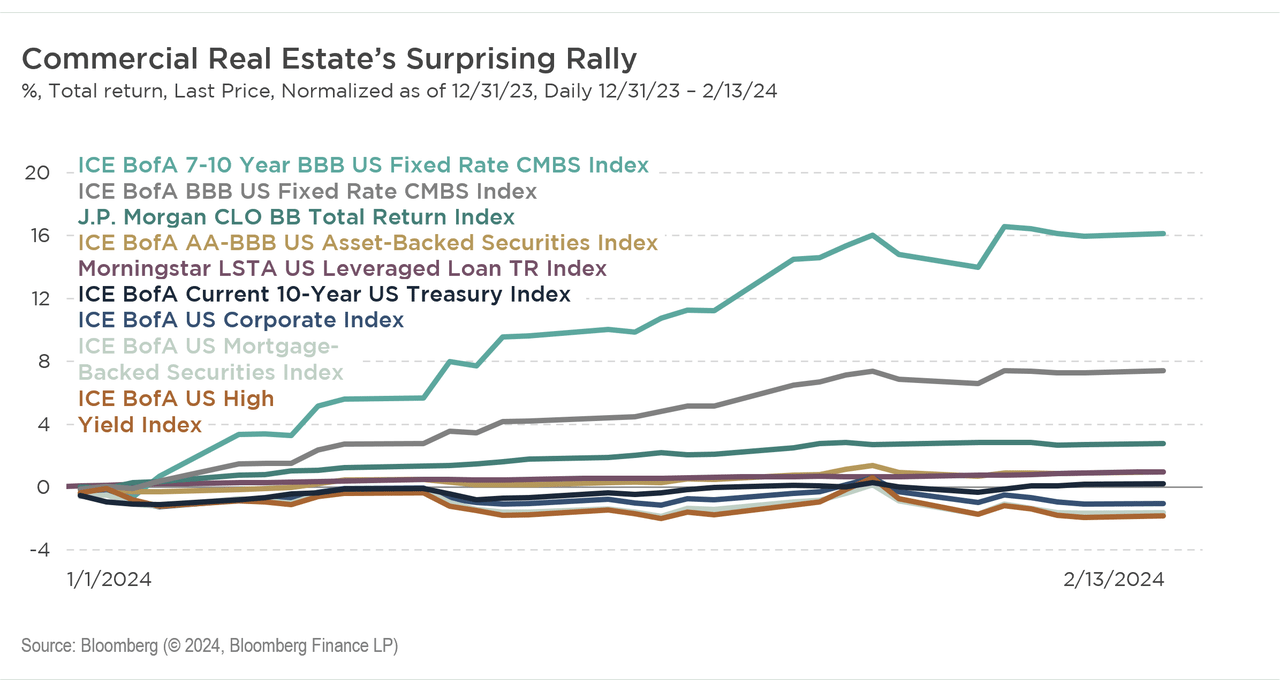

Yet despite all the “pessimistic” news, commercial mortgage-backed securities (CMBS) rated BBB have outperformed U.S. Treasuries, corporate bonds and other securitized credit sectors so far this year through mid-February.

The rise in CMBS may be driven in part by market expectations that interest rates will peak in conjunction with the Fed’s near-term shift.

Commercial real estate is one of the most leveraged industries – making it also one of the most interest rate sensitive – perhaps throughout credit markets.

The pessimistic sentiment is already priced in in the market, and cheap estimates will provide a catalyst for a rebound when the grim scenarios predicted do not materialize.

Other factors that may have contributed to the recent rally include tightening bank lending standards and a lack of supply for new stock issuances.

as we are Our latest podcastsit’s important to remember that there are multiple property types in the CMBS market, including multifamily, retail, hospitality, industrial, and self-storage; it’s not just about offices.

Each property type has its own unique characteristics, although these may often be overshadowed by the extremely negative market sentiment surrounding the office.

We’re not saying market fundamentals for CMBS have hit bottom, but we still see opportunities across the industry as it will take years to resolve the oversupply problem in the office tower industry.

At the same time, the plight of the office industry is no longer a surprise to the market, and we do not believe that a sudden market tightening will create systemic risks. So if these loans turn out better than expected, the CMBS market could rise significantly.

Index definition

ICE Bank of America BBB US Fixed Rate CMBS Index Tracks the performance of U.S. dollar-denominated BBB-rated fixed-rate commercial mortgage-backed securities publicly issued in the U.S. domestic market.

ICE Bank of America 7-10 Years BBB US Fixed Rate CMBS Index It is a subset of the ICE BofA BBB U.S. Fixed Rate CMBS Index and tracks the performance of BBB-rated fixed-rate commercial mortgage-backed securities publicly issued in the U.S. domestic market with maturities of 7 to 10 years and denominated in U.S. dollars.

ICE BofA AA-BBB Fixed Rate U.S. Asset-Backed Securities Index It is a AA- to BBB-rated subset of the ICE U.S. Bank Fixed-Rate Asset-Backed Securities Index, which tracks the performance of U.S. dollar-denominated investment-grade fixed-rate asset-backed securities publicly issued in the U.S. domestic market.

ICE BAML US Business Index Tracks the performance of U.S. dollar-denominated investment-grade corporate bonds publicly issued in the U.S. domestic market. Eligible securities must be investment grade (based on the average rating of Moody’s, S&P and Fitch), be at least 18 months from final maturity at the time of issuance, and be at least one year from final maturity as of the rebalancing date Remaining term, fixed coupon schedule, minimum amount outstanding is $250 million.

ICE BofA U.S. Mortgage-Backed Securities Index Tracks the performance of U.S. dollar-denominated, fixed-rate and hybrid residential mortgage pass-through securities publicly issued in the domestic market by U.S. institutions. The index includes a pool of 30-year, 20-year, 15-year and interest-only, fixed-rate mortgages, provided they have at least one year remaining until final maturity and the outstanding amount on each regular loan is at least $50 million coupons and $250 million per production year per universal coupon.

ICE Bank of America Current 10-Year U.S. Treasury Bond Index Tracks the performance of 10-year U.S. dollar-denominated sovereign debt publicly issued by the U.S. government in the domestic market. It is a subset of the ICE Bank of America U.S. Treasury Index.

Morningstar LSTA U.S. Leveraged Loan Total Return Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based on market weights, spreads and interest payments.

JPMorgan CLO BB Total Return Index Is the total return sub-index of BB-rated securities within the J.P. Morgan Collateralized Loan Obligation Index (CLOIE), a market capitalization-weighted index composed of U.S. dollar-denominated CLOs.

ICE BofA U.S. High Yield Index Tracks the performance of publicly issued U.S. dollar-denominated below-investment-grade corporate debt in major domestic markets.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.