Igor Kudyaev

go through Song Lin

China’s GDP growth unexpectedly rose at the beginning of the year

The National Bureau of Statistics of China released the main economic activities for March and the first quarter of 2024. Annual growth was 5.3%, stronger than expected and much higher than market consensus and our respective forecasts of 4.8% and 4.7% growth. The good start to the year bodes well for the economy, which is expected to achieve its 5% growth target in 2024.

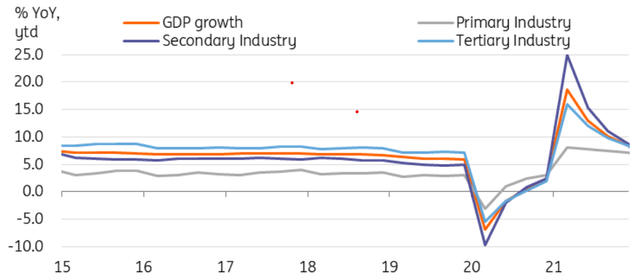

Over the past few months, we have discussed the shift in China’s growth dynamics, and this month’s data further illustrates this development. Investment is key to the outperformance of GDP in the first quarter of 2024, while consumption, the main growth driver last year, has slowed. Net exports also remain weak and have not become a major contributor to economic growth. In terms of industries, the secondary industry led the way in growth, growing by 6.0% compared with last year. The highest level since the fourth quarter of 2021, reflecting growth in manufacturing and investment. Due to weak consumption, the performance of the tertiary industry was weak, growing by 5.0% compared with last year, and the annual growth rate of the primary industry hit a multi-year low of only 3.0%.

We suspect the GDP deflator may have also played a role in the quarter’s outperformance, as inflation remained subdued at the start of the year. Detailed data may be worth a closer look when released.

Strong performance of secondary industry boosts economic growth in first quarter

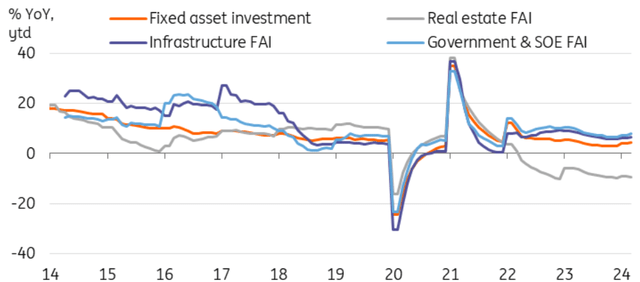

Fixed asset investment grows in first quarter of 2024

Fixed asset investment increased by 4.5% year-on-year in the first quarter, significantly exceeding market expectations. In line with our expectations, infrastructure investment continued to outperform the market, increasing 6.5% year-to-date. Infrastructure investment will remain a highlight of the year as policymakers shift fiscal investment towards infrastructure investments in strategic areas. Year-to-date, manufacturing investment has also remained strong, growing 9.9% compared with the same period last year. Key industries include food manufacturing (19.0%), non-ferrous metals (18.8%) and non-automobile transportation equipment (24.8%). Investment in the automobile manufacturing industry was relatively modest, with an annual increase of 7.4%, as price competition and concerns about overcapacity in the new energy vehicle industry may hinder new investment.

Public investment has led as expected, rising 7.8% year-to-date, in sharp contrast to private investment, which has only grown a meager 0.5% year-to-date. The slump in private investment suggests that caution remains high. We expect public-led investment to continue to outperform this year.

China’s fixed asset investment leads in first quarter

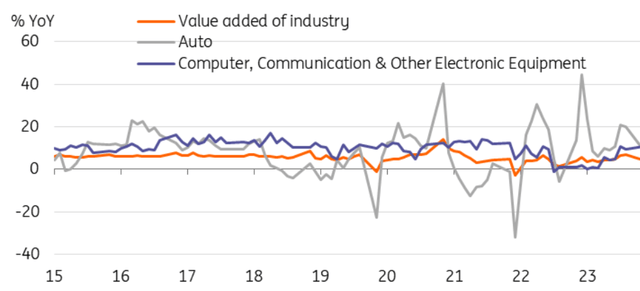

Industrial activity slowed in March but was stronger than expected at the start of the year

Industrial added value increased by 4.5% year-on-year in March, bringing the annual growth rate in the first quarter to 6.1%. They followed strong PMI data, which were weaker than market forecasts but ended the season at a higher level than most expected a month ago.

The manufacturing industry performed better than the overall data, with an annual increase of 6.7% in the first quarter of 2024, of which high-tech manufacturing increased by 7.5% annually. The “Computers, communications and other electronic equipment manufacturing” category grew by 13.0% year-on-year in the first quarter of 2024, possibly reflecting China’s drive for semiconductor self-sufficiency. The expansion of China’s high-tech manufacturing industry is consistent with larger efforts to move up the value-added ladder. Since the beginning of the year, automobile production has increased by 9.7% annually, which continues to be higher than the overall growth rate.

Industrial capacity utilization fell to 73.6% in the first quarter, the lowest level since 2020. Under fierce price competition, the pressure for industrial consolidation will continue to increase.

China’s industrial activities are shifting towards high value-added industries

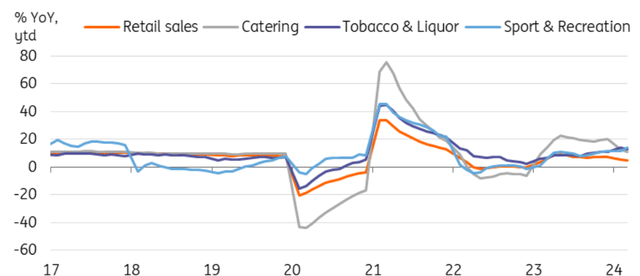

Retail sales not as good as highlighting sluggish consumption

As expected, after book growth in 2023, March data showed that it will be difficult to rely solely on consumption to drive growth this year. Retail sales fell to 3.1% annually in March, bringing the annual growth rate in the first quarter of 2024 to 4.7%.

By subcategory, our “Eat, Drink and Play” theme continued to outperform in the first quarter. Catering (10.8%), tobacco and alcohol (12.5%), and sports and leisure products (14.2%) are significantly stronger than the overall category. With the change in consumption patterns, the annual growth rate of online retail sales in the first quarter of 2024 continued to outperform the market, reaching 11.6%.

The introduction of trade-in policies is likely to support home appliance and automobile sales in the coming quarters. In the first quarter of 2024, these figures increased by 5.8% and 3.8% respectively on an annual basis.

The theme of eating, drinking and having fun has become the highlight of the overall slowdown in consumption

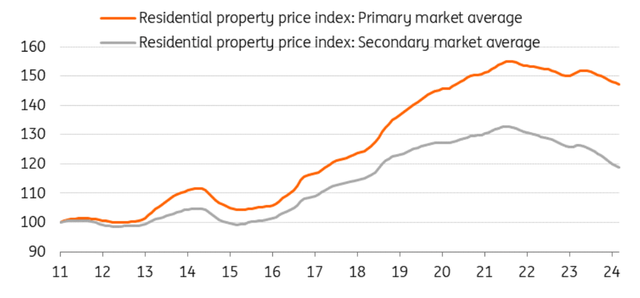

The property market has not yet bottomed out and continues to be a drag on growth

Data on average housing prices in 70 cities show that housing prices have not yet bottomed out, with prices for new homes falling by -0.34% from the previous quarter and second-hand housing prices falling by -0.53% month-on-month. The silver lining is that the overall month-on-month decline was slower than in previous months, the smallest decline since September 2023. The secondary market remains sluggish, with house prices still falling in 69 of 70 cities.

In the first quarter of 2024, the sales value of new residential properties shrank significantly by -30.7% compared to the same period last year. Office buildings and commercial real estate continue to outperform, with year-to-date growth of 6.3% and 1.5% respectively.

Since the beginning of this year, housing inventory has continued to increase, sales have been sluggish, and it is not surprising that real estate investment has continued to experience negative growth. Year-to-date real estate investment slowed further to -9.5%, down from -9.0% in the previous two months. Year-to-date housing starts are down -27.8% year-to-date, while completions year-to-date are down -20.7% year-to-date.

In light of these developments, it is not surprising that the sentiment index has not yet hit bottom, falling further to 92.07 from 92.13 in February, continuing to hit new lows. Identifying troughs in real estate prices can go a long way toward stabilizing confidence indicators.

With the bottom yet to be determined, we expect real estate to remain a major drag on economic growth this year. Policies to stabilize markets may still be needed in the coming months.

House prices have not yet bottomed out

Source: CEIC, ING

Content disclaimer

This publication has been prepared by ING for information purposes only and has no bearing on the economic situation, financial situation or investment objectives of a particular user. This information does not constitute investment advice, investment, legal or tax advice or an offer or solicitation to buy or sell any financial instrument. read more