dump pad

paper

Credit Suisse Asset Management Income Fund (NYSE:CIK) is a name we’ve covered extensively before, with our last article on CEF covering the UBS/Credit Suisse merger and its impact on its funds.In this article we will Revisit this name against the backdrop of the vicious rally in risk assets over the past six months, with high yield spreads tightening significantly and names such as CIK rebounding to levels we deem unsustainable.

This CEF contains a large number of CCC names

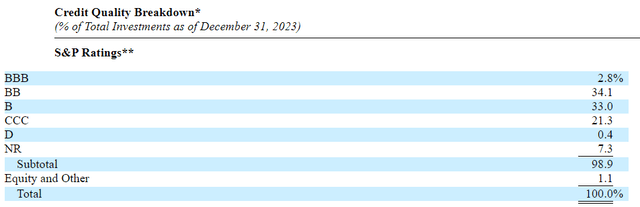

If we look at the rating breakdown of CEF, we can see that this is a very risky instrument:

Rating (Annual Report)

CEF has a very large “CCC” bucket, sitting at 21.3% as of December 2023. This implies high volatility and sensitivity to default cycles.When CEF leverage It is thought that, currently at 27%, we can get a better idea of how the fundamentals are changing from a pricing perspective.

The fund has a rough “one-third” allocation to BB, B and CCC names, but be aware that most funds have a 10% asset cap on riskier CCC debt. Such bonds are the riskiest form of high-yield debt, and Standard & Poor’s describes them as:

Obligations rated ‘CCC’ are currently vulnerable to nonpayment and are dependent on favorable business, financial and economic conditions for the obligor to meet its financial commitments on the obligation.

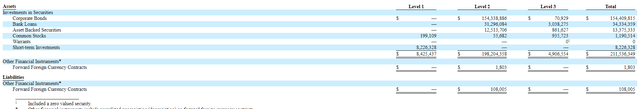

Most of the fund’s names are fixed-rate bonds, so CEF is also exposed to certain interest rate risks:

Composition (Annual Report)

From this perspective, the fund is well set up and our “inside view” is that despite the sticky inflation seen over the past few weeks, peak rates are behind us.

Eye-popping rally has sent CEFs into premiums

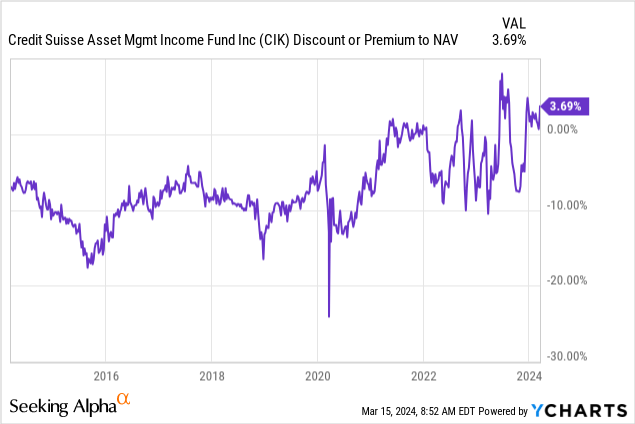

CIK has historically traded below NAV:

Looking back 10 years, we can see that the name typically trades at a discount of around -10%. However, for a short period of time, it was trading at par with NAV, especially during the zero interest rate environment of 2020/2021. Shockingly, CEF is currently trading at a premium of 3.69% to NAV. We believe these levels are too high and high-yield CEFs should not trade at the top of their ranges when risk-free rates remain above 5%.

The fund’s premium to NAV Z statistic is 1.07, which represents the standard deviation above the mean of the fund’s premium/discount to NAV. The culprit here is the “soft landing” narrative that has fueled calls for risk in any form (high yield, growth stocks, Bitcoin). We believe in mean reversion and introduce a narrative that casts doubt on a “perfect” soft landing. We expect underperformance of -5% in this scenario as the premium will be slightly below NAV.

Spreads rise sharply

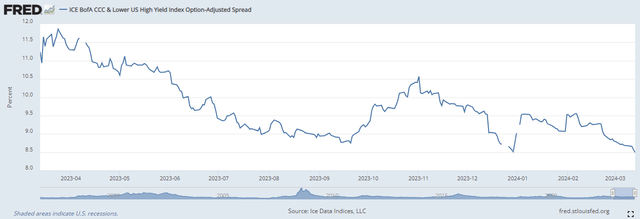

The fund’s key risk factors are represented by the CCC spread:

CCC Spread (Fed)

According to the chart above, provided by the Federal Reserve Bank of St. Louis, the CCC spread has now increased from 11.5% to 8.5%. Given that the federal funds rate is 5.3%, the credit risk component is now only 3.2%, which we believe is insufficient to compensate the fund for the risk it assumes.

In fact, CIK currently yields just 8.7%, which is a very low number considering the leverage. It is believed that many short-term bond funds can now deliver interest rates in excess of 6% to investors. Should you take the 8.7% leveraged CCC risk? We think not.

We believe that CEFs should pay out more than 10% as distributions to make the risk/reward scenario attractive. At current levels, investors would be better served by lower-volatility options or floating-rate ETFs or CEFs, which yield over 10% and have lower risk metrics.

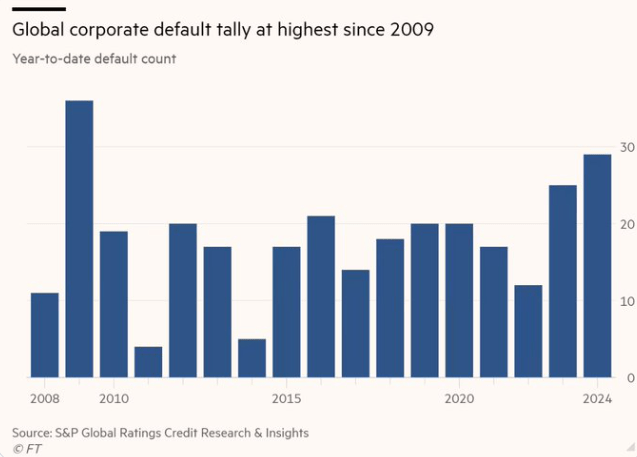

Defaults are climbing

The rise in CCC spreads has been largely driven by the “perfect landing” narrative, while the fundamentals are not moving in the same direction:

Default value(FT)

As an investor, you typically want credit spreads to tighten as defaults improve. The opposite happens here. Corporate defaults are still climbing, while credit spreads have tightened. Something has to give and we think credit spreads will be soft.

Our view is that credit spreads will widen from here on out as the “secular higher” interest rate environment begins to take its toll on companies with floating rate financing or maturity rate caps. We are yet to feel the full impact of the high interest rate environment as many businesses were able to lock in cheap long-term financing during 2020/2021. After the trauma of the COVID-19 maturity wall, many treasurers realized the importance of maturing their debt and ended up doing so. It just translates into a long-term default environment.

For many people, the current fluctuations in transmission can be confusing. Too many retail investors believe credit spreads move linearly. The real world is different, and it often relies on narrative. If the market believes that the economy and consumers will do well, it will price high-yield credit for a benign default scenario, even if our default rates remain much higher. Just like equities, credit spreads are forward-looking, highlighting the implicit forward market view. We currently believe the market is too optimistic and needs a correction.

in conclusion

CIK is Credit Suisse’s fixed income CEF. The fund focuses on fixed-rate high-yield bonds and holds a large number of CCC names. CEFs have historically traded at a discount to net asset value, but are now priced at a 3.6% premium, underscoring the sharpness of the move in risk appetite over the past six months. The instrument is priced against the backdrop of a significant increase in CCC credit spreads, which are currently just 3.2% above federal funds. We believe there will be a correction in both credit spreads and CEF premiums to NAV, and therefore expect a ~-10% sell-off. We were a holder of this name earlier this year but have now sold our position.