3D_Generator

Xian Investment (NYSE: CION) has performed exceptionally well in 2023, posting a total return of 32% compared with the S&P 500’s 24% return.However, 2024 could be a challenging year for business development companies as their net investment income could decline More than a year. Additionally, significant debt maturities in 2024 and 2025 could also negatively impact the company’s ability to invest in growth opportunities. Therefore, I maintain my Hold rating on CION stock.

Dividends stable but growth questionable

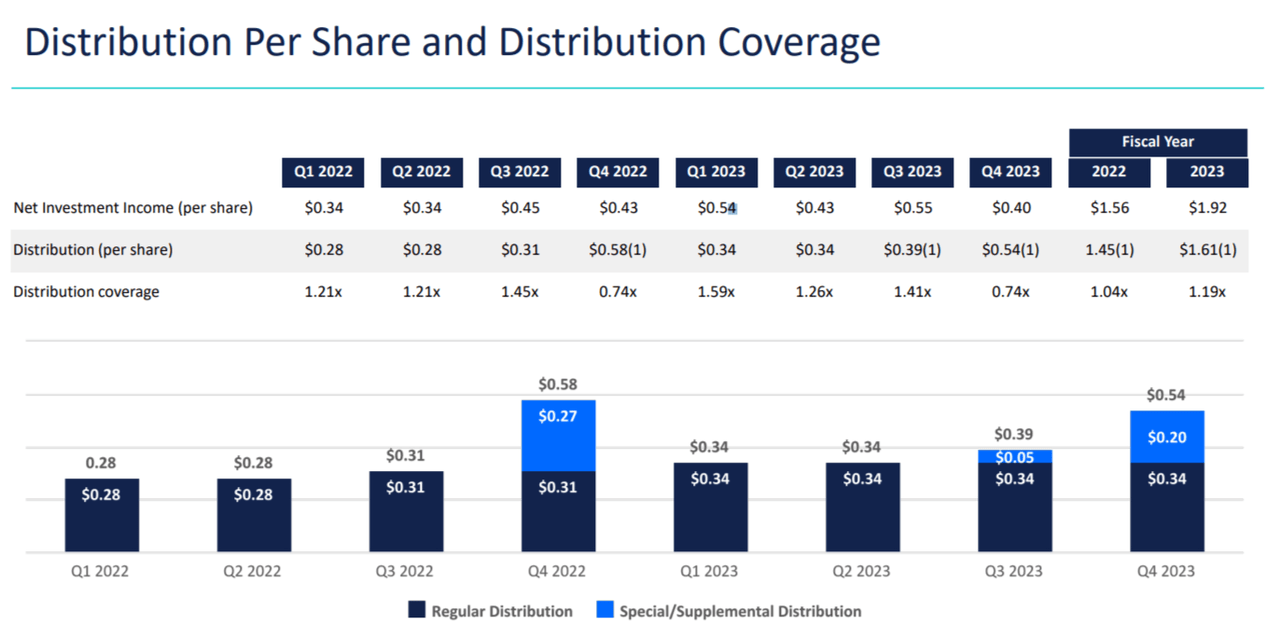

In my previous article, I expressed concerns about CION’s ability to sustain financial growth over the long term. The sharp decline in its revenue in the last quarter of 2023 proves my point. Its investment income in the December quarter was $60 million, down from $67 million in the previous quarter.In addition to low income, interest rates are also high Debt charges also had a negative impact on its net investment income. Net investment income per share was $0.40 in the December quarter, compared with $0.55 per share in the prior quarter. The concern is that the downward trend may continue in the short to medium term, which could have a negative impact on its dividend growth and share price upside potential.Wall Street expects quarterly net investment income of wander Net investment income per share in 2024 is approximately $0.40 to $0.42. Full-year net investment income is expected to be $1.65 per share, down from $1.92 per share in the prior year.

Dividend Coverage (Q4 Presentation)

Negative growth means that CION’s dividend coverage will decline significantly even if the company maintains its current dividend distribution. Last year, the company paid a dividend of $1.61 per share, which included regular, supplemental and special dividends. Annual investment income is expected to be $1.65 per share in 2024, and current dividend payments appear sustainable. However, CION has less room to deliver higher cash returns in 2024 compared to last year. In fact, due to the impact of interest rate cuts on its 80% floating rate portfolio, the risk of dividend coverage falling below 100% is also high in the long term.The Fed is likely to reduce There will be three rate cuts in 2024, with further cuts next year. In addition, the increased confidence in the syndicate market will also compress syndicate spreads. future dormitory. Wall Street currently expects CION’s investment income to fall below the $1.60 level in 2025 due to interest rate cuts, which means its dividend coverage ratio will also fall below 100% based on a dividend of $1.61 per share.

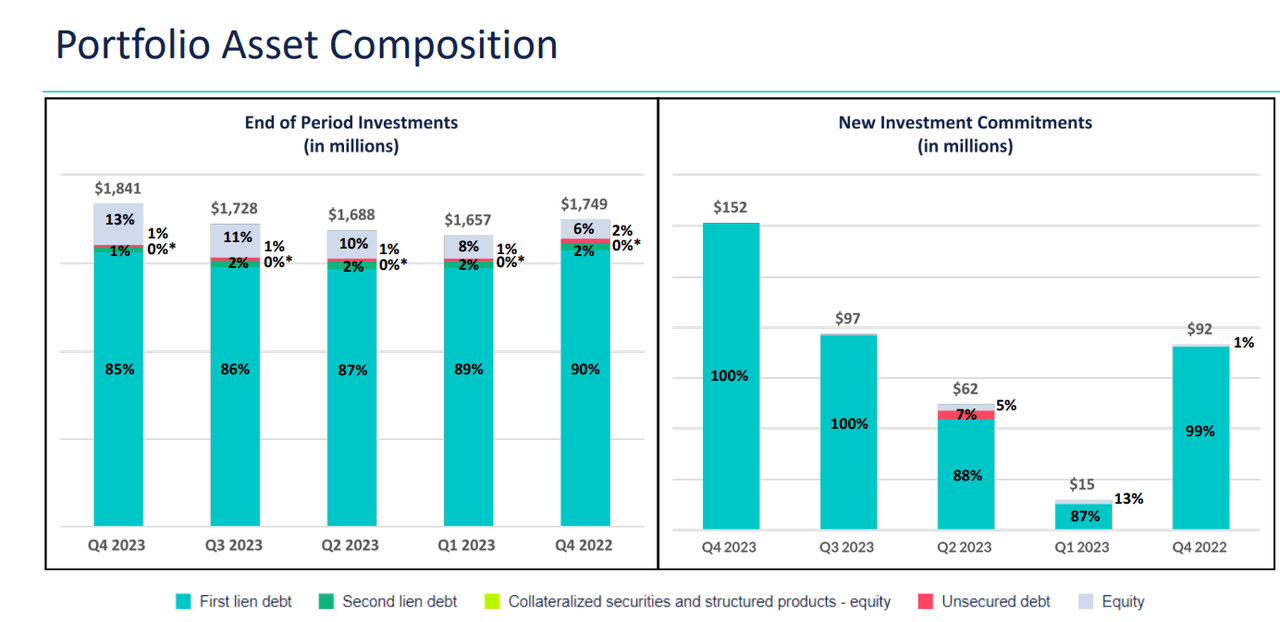

New investment commitments (Q4 presentation)

On the positive side, after three quarters of lackluster investment activity in 2023, the company’s investment commitments surged to $152 million in the final quarter from $97 million in the previous quarter. The credit quality of its portfolio also appears to be strong, with only 0.9% of the portfolio classified as non-accrual. In addition, the proportion of investments that require close monitoring fell to 6.5% of the portfolio from 8.2% in the previous quarter and 15% in the same period last year.

Currently, the company has $117 million in cash and short-term investments and $153 million in available credit lines. CION continues to raise additional debt to fund its investments and seeks to repay existing debt. Last year, its debt increased by $134 million, or 14% annually, to $1.08 billion. It completed a $33 million Series A offering of unsecured floating rate notes and a $100 million private placement of floating rate unsecured notes. As of the end of the December quarter, its net debt-to-equity ratio was 1.10 times, up from 1.03 times in the previous quarter. CION’s $180 million of debt matures in 2024 and $675 million of debt matures in 2025. It appears the company needs to be selective in its investment strategy, as it is already heavily indebted and will need to repay a huge amount of debt in the coming quarters.

Valuations and share prices rise

CION Stock Price vs S&P 500 (Seeking Alpha)

While CION’s hefty dividend helped it generate healthy total returns for shareholders in 2023, its stock price underperformed compared to the S&P 500. In addition, there is a significant increase in share price underperformance in 2024 due to the risk of negative financial growth. Its shares are down 6% year to date, while the broader market index is up 9%.

However, from a bargain buyer’s perspective, CION’s share price appears to be significantly undervalued based on valuation and NAV. Currently, its stock’s expected price-to-earnings ratio is only about 6.60 times, while the industry average is 8 times and the industry median is 10 times. Its book value is 0.62x, which is also lower than the industry median of 1.13x. Additionally, CION’s NAV has grown for the past three consecutive quarters as earnings are higher than dividends and unrealized gains. As of the end of the December quarter, its net asset value was $16.23 per share, a significant increase from the current share price of $10.50.

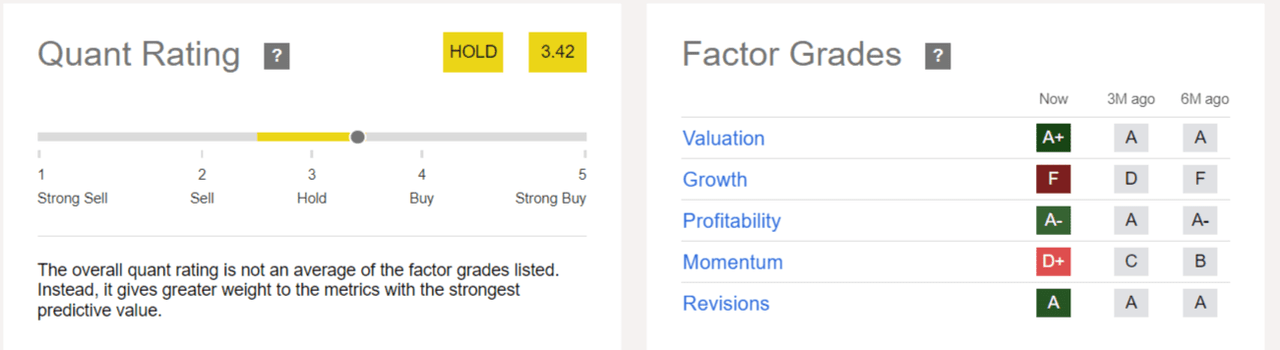

Quantitative rating

Quantitative Ratings (Seeking Alpha)

Quantitative ratings remove emotion because the system relies on actual numbers. CION gets a Hold rating and a Quantitative Score of 3.42. Consistent with my view, Seeking Alpha’s Quantitative Scorecard also suggests that CION stock is attractively valued, but negative growth and poor share price momentum lower its overall rating score. A downward trend in its key financial data could negatively impact its share price and dividend performance in the short to medium term. Based on quantitative ratings, the company ranks 30th out of 92 companies in its industry.

In summary

If CION Investment finds a way to keep its investment income growing, it could become a solid investment. Challenges related to its potential to fund investments and repay debt over the next quarter could cause share price volatility and negatively impact its revenue growth potential. Dividend growth is also at risk due to negative growth.