ask for breeze

Citigroup (NYSE:C) recently released their annual report, which is 313 pages long. This thing looks like a college textbook.

Frankly, looking at the Q1’24 earnings, the banking and financial services industry seems to be in pretty good shape From a credit perspective, aside from regional banking and commercial real estate issues, net interest income should stabilize to be high, net interest margins (NIMs) should be stable, loan losses are under control, and prospects for Basel III regulatory reforms cool (possibly (due to an election year), regulatory enthusiasm appears to be waning.

One metric to check monthly is credit card losses, since credit cards are unsecured credit. Mar 24, Citi, JPMorgan (JPM) and Bank of America (BAC) report lower credit card losses in Feb 24 year, and some other indicators are slightly worse.

Crucially, this indicator of “unsecured credit” still raises no red flags.

Citigroup:

What Citi brings to my attention is that they face increasingly easier competition in 2024. Here’s Citi’s actual EPS progress from Q1’23 to Q4’23:

- Season 1, 23: $2.19

- Year 23 Season 2: $1.33

- Year 23 Season 3: $1.53

- Season 4, 23: $0.84

Here are Citi’s current estimates for quarterly 2024 earnings per share:

- Season 1, 24: $1.20

- 24 Years Season 2: $1.49

- Year 24 Season 3: $1.56

- 24 Years Season 4: $1.40

Obviously Q1’24 has been the toughest performance for the bank, but Citi currently expects full-year EPS of $5.70 in 2024, with actual EPS of $5.88 in 2023.

Adding to the confusion are consumer banking divestitures taking place in India, Taiwan, the Philippines and even South Korea. I believe these are still included in Citi’s financial statements as “legacy businesses,” so 2023 and 2024 may not be homogeneous.

When Citi reported before the market opened on Friday morning, April 12, Wall Street consensus forecasts were for earnings of $1.20 per share and revenue of $20.4 billion, with “expected” year-over-year growth rates of -45% and -5%, respectively. It’s been a tough first quarter of ’23 for the banking giant.

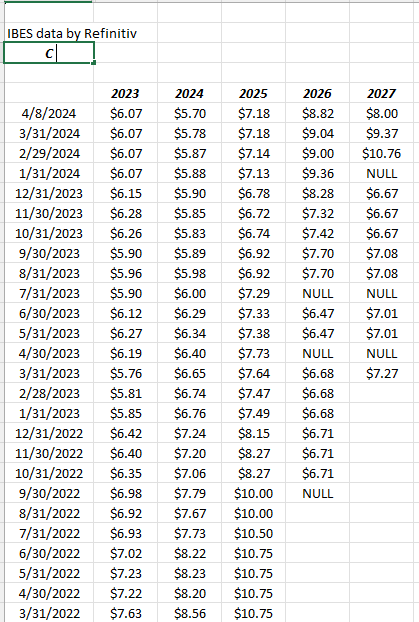

EPS Forecast Revisions:

Source: London Stock Exchange

Somewhat worryingly, 2024 EPS estimates are still declining, and although the rate of decline has slowed somewhat since December 31, 2023, 2025 and 2026 EPS estimates continue to rise.

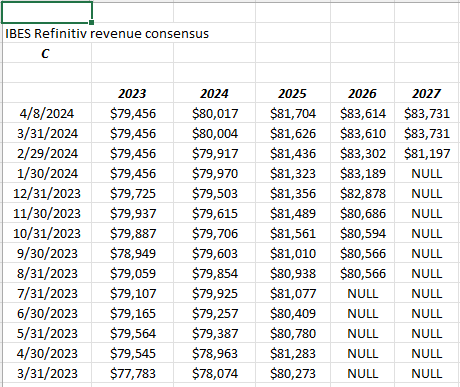

Revenue Forecast Revisions:

Source: London Stock Exchange

Frankly, 2024-2026 revenue revisions are slowly trending higher, which is a positive for the banking giant.

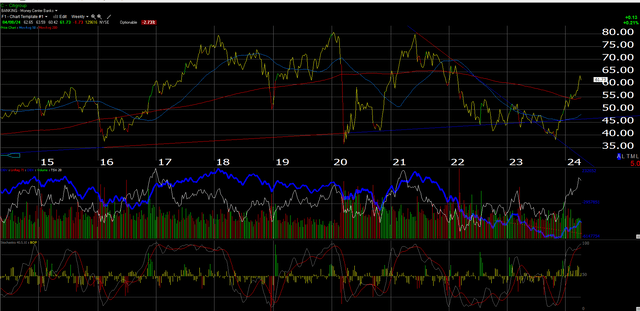

technical analysis:

What fascinates me about this weekly chart from Worden is that Citi has risen to the $80 level 3 times from 2018 to 2021, only to pull back and bottom around the $40 level on the last two rallies.

The stock is moving higher again despite being overbought. A pullback to $50-55 would be perfect.

Here’s how Citi has performed relative to the S&P 500 since the mid-2000s:

- 2005: -8% vs. +10.19%

- year 2010: 5.86% vs. 13.49%

- 2015: 5.12% vs. 12.85%

- 2020: -1.44% vs. 13.77%

- Season 1, 2024: 24.11% vs. 10.56%

Performance returns from YCharts

Valuation: Value investors who have been talking about the stock for years have always pointed to Citi’s book-to-book value and tangible-to-book value ratios of 0.65x and 0.75x respectively at a price of $61 a share, which are quite good for a banking giant like this. Cheap. Citi.

Citi’s problem is its return on equity (ROE), which is 7%, less than half the ROE of JPMorgan Chase and Bank of America.

Jane Fraser is solving this problem by selling off some of these underperforming segments.

We discussed these issues here and here in our early Citi earnings preview and summary on this blog.

Based on an average earnings per share ratio of 9 times, Citigroup expects earnings per share (three-year average) to grow by 15% in the next three years, and revenue to grow by an average of 2%.

The stock currently trades at a steep discount to its projected growth rate, but the near-term question may be how that materializes in 2024.

Summary/Conclusion: Citigroup (stock) is off to a strong start in 1Q24, considering the stock’s first-quarter performance compared to the S&P 500. Jane Fraser ultimately downsized the business to some extent, but we need to see Citi’s various businesses generate sufficient revenue returns.

Today, banking (presumably investment banking) accounts for 5% of Citi’s revenue, while wealth and U.S. personal banking account for 38% of total revenue. The TSS business (treasury and securities services) accounted for about 25% of revenue in the past five quarters and is one of Citi’s better-performing businesses.

Some of the segment analysis is a bit confusing given all the divestitures and the loss of certain businesses, so hopefully the reporting will improve towards the end of ’24.

The client holds a 1.2% long position in the stock and will buy more on the pullback. JPMorgan remains the No. 1 financial holding company by its customers, so acquiring Citi is a good value investment to balance out JPMorgan’s momentum.

If Citi could be summed up in one sentence today, I’d say Jane Fraser is trying to move Citi from “cheap on book value” to “cheap on PEG (or growth price-to-earnings)” fundamentals as a bank. “

We’ll see.

None of this is advice or advice. Past performance is no guarantee of future results. Even short-term investments can result in a loss of principal. This information may or may not be updated, and even if it is updated, it may not be updated in a timely manner. All EPS and revenue figures come from previous IBES data from LSEG or Refinitiv.

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.