Bloomberg/Bloomberg via Getty Images

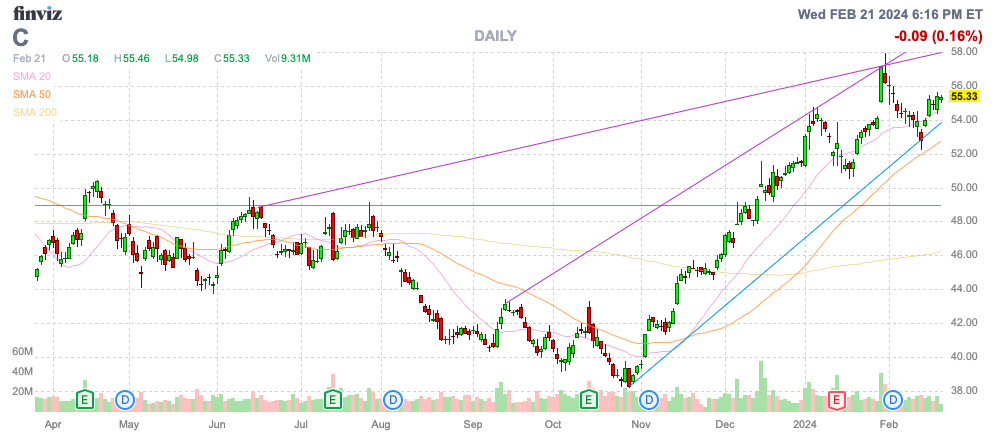

In an unexpected move, financial stocks end the year at new highs Citigroup (NYSE:C) will trade at nearly $60 by the start of 2024.although Valuation is cheap. My investment thesis remains very bullish on the stock, which still trades below tangible book value, but the big bank has been unable to execute on its turnaround plan.

Source: Finviz

Improve efficiency

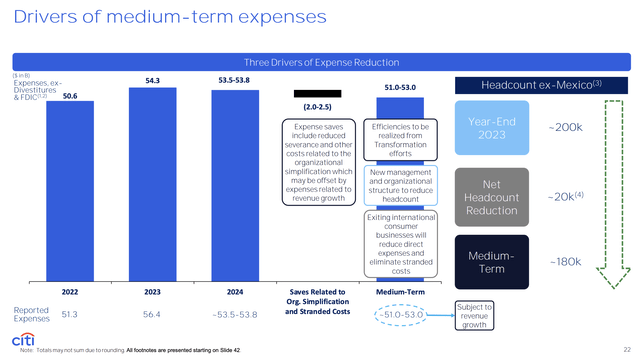

Citigroup hopes to transform its business by reducing costs while continuing to focus on technology investments. Full-year spending is expected to be cut in 2024, and long-term operating expenses will be reduced by at least US$2 billion, with spending likely to drop to US$51 billion from US$54.3 billion last year.

Source: Citigroup Q4’23 Presentation

Meanwhile, revenue is expected to grow approximately 4% annually Provides businesses with powerful leverage. The biggest problem is that even with expense cuts and revenue reaching more than $8 billion in 2024, the 2024 efficiency target remains at a relatively high level of 67%.

a peer JPMorgan (JPM) efficiency is around 50%. Citigroup needs to significantly improve the giant bank’s profitability to be in line with its peers to achieve a higher valuation.

The bank spent nearly $13 billion on technology last year, but Citigroup needs to find better ways to match employee efficiency. As part of the target, the bank will lay off 20,000 employees, or 10% of its 200,000 employees, over the medium term.

If the bank can grow revenue at 4% again in 2025, revenue will reach at least $83 billion and operating expenses are expected to fall to $51 billion, pushing the efficiency ratio to a more realistic 61%, although for the larger bank is still very high. bank.

The market doesn’t believe it

Citigroup has attempted so many turnaround plans that the market rightly doesn’t believe them. During the Q4’23 earnings call, respected Wells Fargo analyst Mike Mayo highlighted the history of failed restructurings as follows:

By my count, Citigroup has reorganized 12 times. By my count, Citigroup has had 12 failed restructurings. You may disagree with the number 12. It could be 5, it could be 8, it could be 12. It could be more, but I haven’t spoken to a single investor who would say Citi was successful with its previous strategy. Reorganization.

Citigroup did not specify why the change was successful. Considering analysts only forecast 2% revenue growth over the next few years, the stock’s key upside opportunity comes with a turnaround.

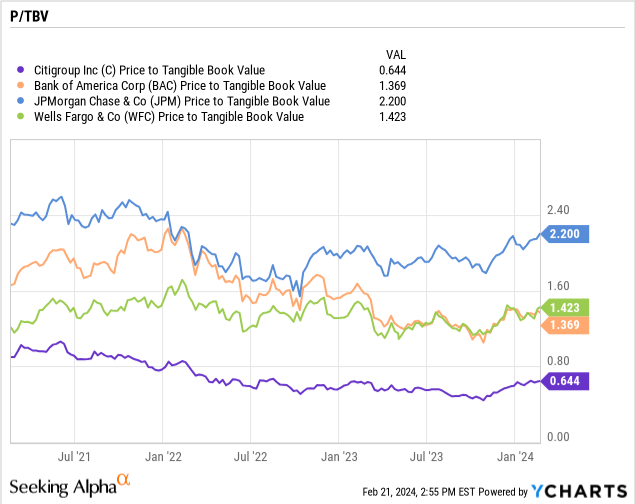

Citigroup continues to trade large banking sectors at deep discounts. JPMorgan Chase trades at nearly 3 times Citigroup’s TBV, while Citigroup trades at just 0.64 times.JPMorgan trades at 2.2x TBV, while both Bank of America (BAC) and FuGuo bank (WFC) trades at approximately 1.4x TBV. Note that Wells Fargo is still subject to the Fed’s asset caps that limit growth, but the market values its assets significantly higher.

By 2023, the bank’s return on capital will be just under 5%. Citigroup’s profits are high, but the company’s return on capital isn’t as high as other banks.

Citigroup forecasts RoTCE of 11% to 12% and earnings per share above $10. Analyst consensus estimates for 2025 earnings per share jumped to $7.11, somewhat accepting of the profit growth, but the forecast remains well below target.

Despite significant gains through the end of 2024, the stock trades at just 8 times EPS estimates. If the restructuring plan works, future upside potential will be significantly higher.

Piper analyst R. Scott Siefers recently raised his price target on the stock to $63 from $56. In a prime example of analysts not believing in Citigroup’s turnaround, they raised their price target to $63, which is still well below the target value of $86.

The CET1 ratio rose strongly to 13.3%, above the regulatory requirement of 12.3%. The huge upside potential is the impact of Basel III rules, and the key here is whether Citigroup can aggressively repurchase shares at a sustained discount to TBV.

The big bank returned $6 billion to shareholders last year while increasing its CET1 ratio by 180 basis points. Share repurchases are only $2 billion, the dividend yield is as high as 3.8%, and the repurchase opportunities are much higher.

take away

The key takeaway for investors is that Citigroup has a long-term opportunity to trade above $100 based on TBV and the bank’s profit potential. If profitability is $10, the stock only needs a P/E ratio of 10x to reach $100. Furthermore, given that Citigroup increased its TBV per share by $4.54 in 2023, excluding any earnings in 2024, the stock price would be only 1.2 times current TBV.

Investors should continue to hold Citigroup at a discount and may actually turn a profit this year.