Diloch Cressatabon

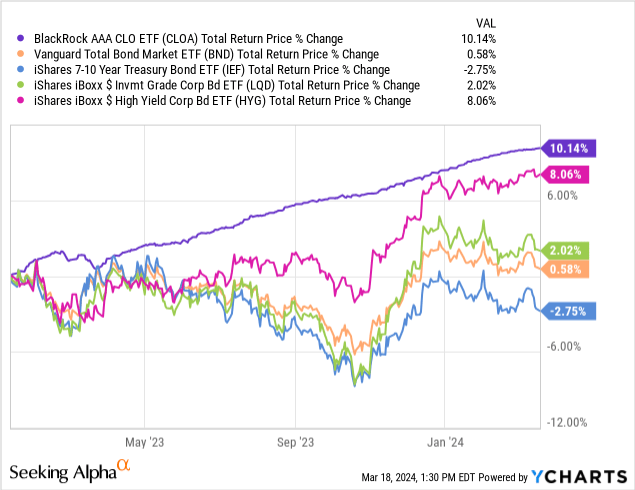

I’ve been bullish on CLO ETFs over the past few years because of their strong, above-average yields and proven track record. BlackRock AAA CLO ETF (NASDAQ: CLOA) is one of BlackRock’s attempts in this area Funds focusing on the AAA CLO segment. CLOA’s above-average 6.1% yield, strong track record, and extremely low credit and interest rate risk make this fund a buy.

CLOA is very similar to the larger and better-known Janus Henderson AAA CLO ETF (NYSEARCA:JAAA). CLOA has slightly higher returns, but JAAA has slightly higher returns. The differences are minimal and, at least in my opinion, the funds are essentially interchangeable.

AAA CLO – Overview

Before discussing CLOA itself, a quick overview of CLOs as an asset class. If you already know how CLOs work, feel free to skip this section.

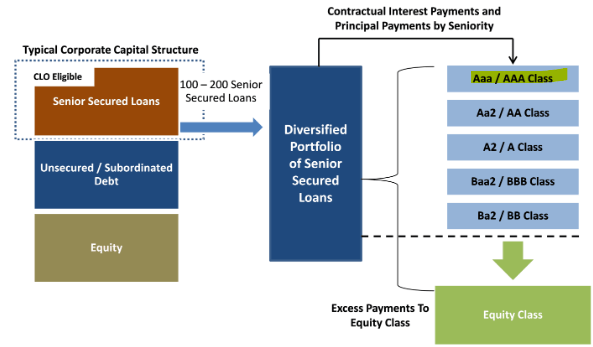

Priority secured loans are Banks offer variable-rate loans to smaller, riskier companies. These loans are senior to other debt and are secured by the company’s assets.

Senior loans are sometimes bundled in CLOs. Each CLO (or senior loan portfolio) is divided into several tranches. Proceeds from the senior loan are used to make all payments. The senior tranche gets paid first and the junior tranche gets paid last. Investors, including CLOA, can purchase these tranches for income.

In visual form. Parts of CLOA highlighted.

Stanford Chemist SA Articles

As a result, CLOA invests in a portfolio of senior loans and earns income as a result that is higher than most other investors.

With the above in mind, let’s take a closer look at the fund.

CLIA – Overview and Analysis

Very low credit risk

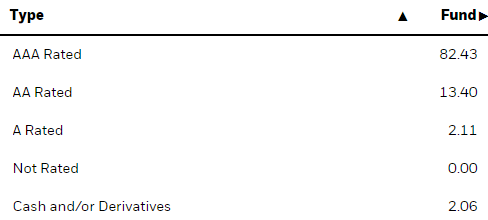

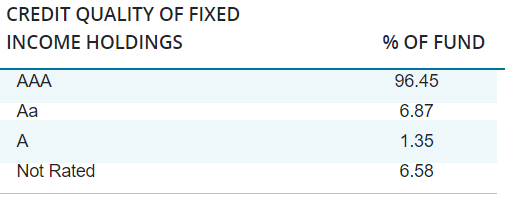

CLOA focuses on the AAA CLO segment, with smaller investments in AA and A classes.

Cloa

As mentioned earlier, the senior CLO tranche is paid before the junior tranche. AAA ratings are the most advanced, so they get paid first among all ratings. The securities effectively backing these CLOs always generate enough income for the most senior tranches to make these investments incredibly safe. The securities backing these CLOs do sometimes default, but at least initially, the lower tranche of investors must bear any losses.In practice, investors in the lower tranche almost always effectively assume all loss.

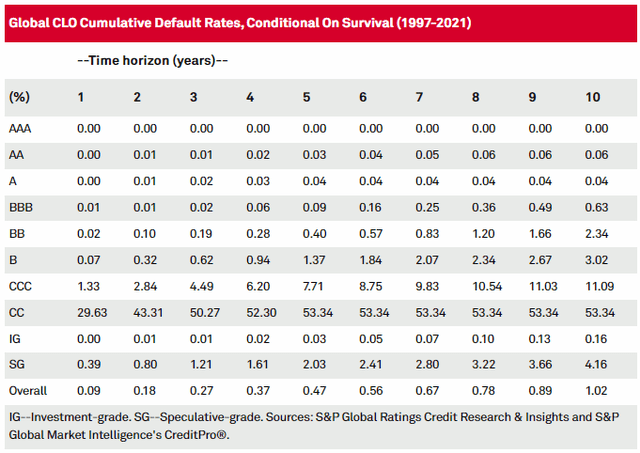

In fact, no AAA CLO has ever defaulted, and these investments have been around for decades. Default rates for Class AA and Class A are also extremely low, but not zero.

Standard & Poor’s

For the reasons stated above, CLOA has extremely low credit risk, which should result in below-average losses/better-than-average performance during downturns and recessions. Since the fund was founded in early 2023, it’s still fairly young, so I can’t really analyze how it would perform in any such scenario. Still, I’m pretty confident that’s going to be the case.

Very low interest rate risk

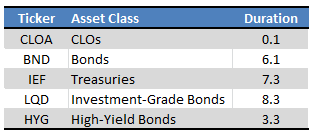

CLOA’s CLOs are variable rate investments, which means term and interest rate risk are extremely low. Specifically, the fund’s duration is 0.10 years, which is well below most bonds and bond sub-asset classes.

Fund Filing – Form by Author

When interest rates rise, CLOA’s duration should result in much lower losses than its peers, leading to outperformance. Since the fund’s inception in early 2023, interest rates have continued to rise and its performance has been in line with expectations.

Data comes from YCharts

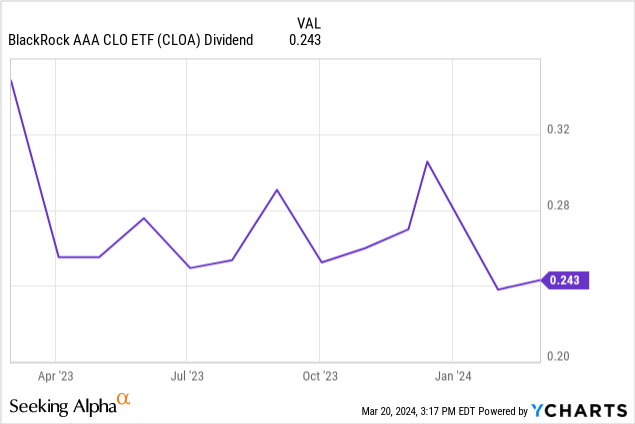

As interest rates rise, the coupon rate on CLOA’s floating-rate loans should steadily rise, leading to dividend growth.Here is no This has been true since inception, but dividend volatility and an unusually large dividend in March 2023 make it difficult to be sure.

Data comes from YCharts

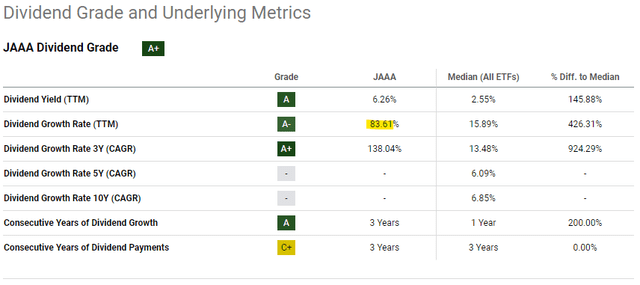

JAAA has increased dividends, and CLOA is very similar to that fund.

Seeking Alpha

Nonetheless, I remain very confident that CLOA should see strong, rapid dividend growth during any future rate hike cycle. The fund’s underlying holdings structure simply ensures this, as do its closest peers.

The corollary to the above conclusion is that fund dividends should increase with Fed cuts interest rates. This brings me to my next point.

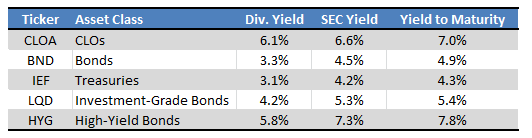

Dividend analysis

CLOA’s current dividend yield is 6.1%, which is quite good in absolute terms and higher than most bonds and bond sub-asset classes. High-yield bonds do have higher yields, but the credit risk is also significantly higher. The same goes for other related yield indicators.

Fund Filing – Form by Author

A higher dividend yield is almost always good for investors, and CLOA includes that.

As the Fed cuts interest rates, CLOA’s dividend should decline. In my opinion, the dividend should remain competitive over the next few years as the fund trades at a spread that compares favorably to its peers.

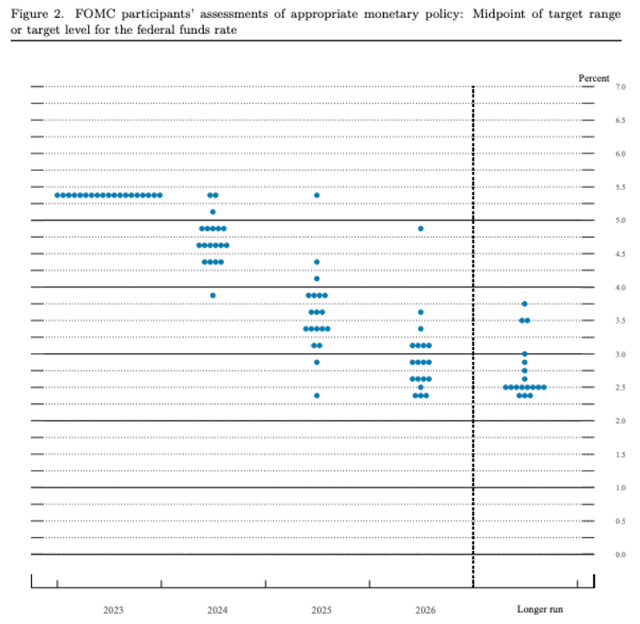

Specifically, the Fed must reduce CLOA’s dividend yield by 2.8% to match the dividend yield of the Vanguard Total Bond Market Index Fund ETF (NASDAQ: BND), the largest bond ETF by market and industry benchmark. The Federal Reserve is expected to cut interest rates by 0.75% to 1.00% this year and by approximately 1.00% to 1.25% next year. In this case, the yield of CLOA will continue to be higher than that of BND in the next two years. While further significant rate cuts are likely, guidance rates will remain stable in the 2.5% range, keeping CLOA yielding (slightly) higher than BDN for the foreseeable future.

United States Federal Reserve

Considering the above, I think CLOA’s dividend should remain competitive in the coming years. More dovish investors may disagree.

As long as the dividend remains strong, the fund will likely continue to outperform even if interest rates fall. For example, if the Fed cuts interest rates by just 0.25% this year, I would expect CLOA to outperform as the fund would continue to trade with a much higher dividend than its peers. Such a small rate cut could also weigh on bond prices, as the market is currently pricing in a larger rate cut. However, significant interest rate cuts will almost certainly lead to underperformance.

Performance Analysis

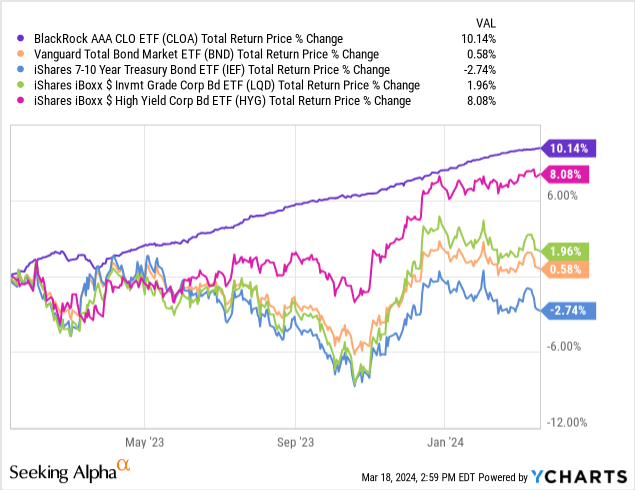

CLOA’s track record is very strong, with the fund outperforming most bonds and bond sub-asset classes since inception by a wide margin. The outperformance is largely due to the fund’s short duration, but its above-average dividend also plays a role.

Data comes from YCharts

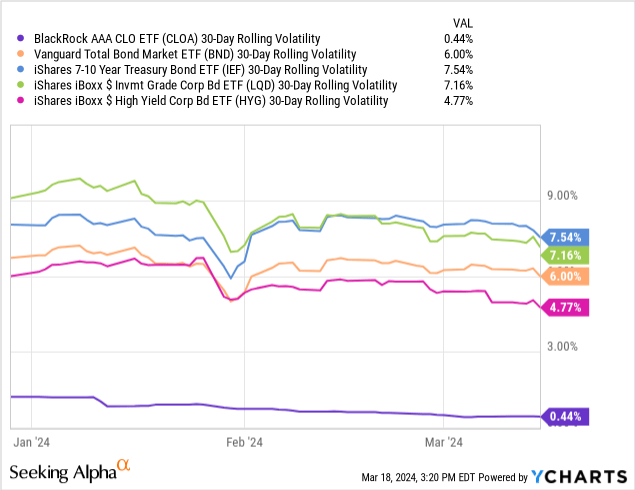

As you can see above, CLOA is also a very stable fund when comparing the fund’s volatility to similar funds.

Data comes from YCharts

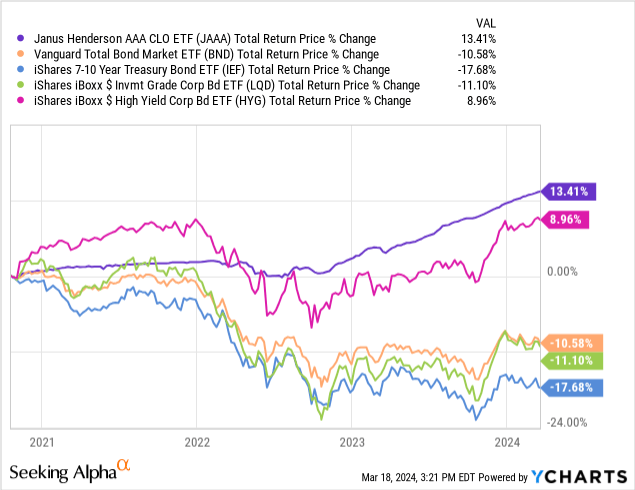

On the more negative side, CLOA has a very short track record, as the fund was founded in early 2023. JAAA, which is very similar to CLOA but older, was founded in late 2020 and has also performed well since its inception. The high-quality CLO segment has performed extremely well over the past few years, although CLOA has only seen one of them emerge.

Data comes from YCharts

I don’t want CLOA significantly With interest rates stabilizing, outperformance will be expected going forward, but I do expect minimal risk and good returns.

CLOA vs JAAA – Quick Comparison

Like JAAA, CLOA offers investors strong, stable returns and above-average yields. Since there are significant similarities between these two funds, I wanted to do a quick comparison.

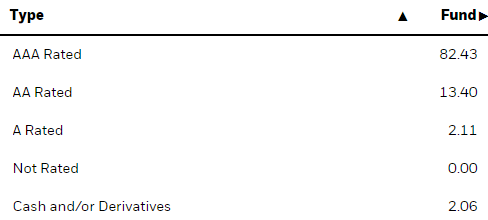

Both funds focus on the AAA-rated CLO tranche, with smaller investments in the AA-rated and A-rated tranches. The credit quality of JAAA is indeed slightly higher than that of CLOA, but the difference is small. Compare JAAA’s credit quality:

Yes

Same situation as CLOA:

Cloa

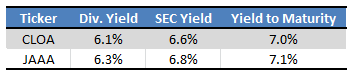

For the above reasons, the characteristics of the two funds are similar. This includes credit and interest rate risk, dividend yield:

Fund Filing – Form by Author

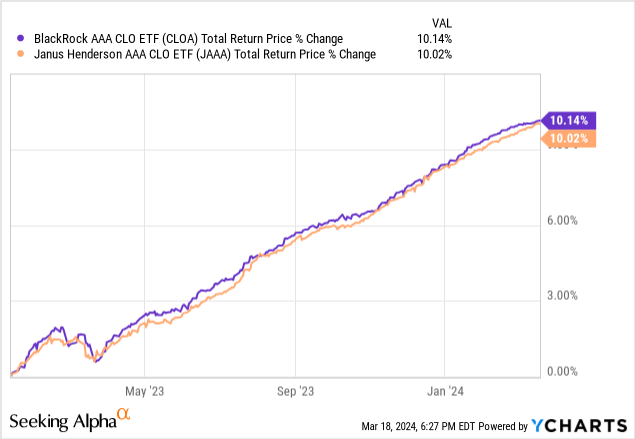

and track record:

Data comes from YCharts

As you can see from the chart above, JAAA has a slightly higher return, while CLOA has a slightly higher return since inception. However, these are minor differences.

JAAA’s fees are slightly higher, with an expense ratio of 0.21%, while CLOA’s expense ratio is 0.20%.

JAAA is the larger, more liquid fund with $7.2B in AUM, while CLOA’s AUM is only $108M. Both funds have sufficient trading volume and the bid-ask spread is similar, both at 0.02%.

Overall, I slightly like JAAA’s higher yield and additional liquidity, but these are extremely minor differences, and neither will have a significant impact on the fund’s future. JAAA and CLOA are functionally interchangeable funds, at least in my opinion.

in conclusion

CLOA’s above-average 6.3% yield, strong performance record, and extremely low credit and interest rate risk make this fund a buy.