Teka77/iStock Editorial via Getty Images

Today here in the lab, we’re back with a review of CNH Industrial NV (NYSE: CNHI). For our new readers, the company is the second largest agricultural equipment company in the world after John Deere and is currently only available in the United States.Following 2022 spin off In partnership with Iveco (CNH’s commercial vehicle business), the company is now a pure player in the construction and agricultural machinery sector.Just a reminder, Iveco is another company Our team coversExor Holdings have.

In our last review, we expected softer sales in 2024; however, we still think CNH Industrial is a buy.As value investors, we like companies with solid fundamentals but incorrect pricing, and CNH Industrial’s long-term investment thesis is supported by 1) a growing population 2) $1 billion buyback program3) Cost of sales reduction trend, and 4) New product development Helping farmers produce more and consume less water and land. The new Holland CR11 is a prime example of CNH’s next generation solutions. According to the company, these new agricultural machines have the following features:

- Harvest time is accelerated by 25%

- Increase productivity by 20-40%

- Fuel consumption reduced by 20%

- Reduce soil compaction

New Holland CR11 Features (Image source: Case New Holland Industrial Group’s fourth quarter results presentation)

picture. 1

CNH Industrial’s fourth quarter results already demonstrate clear progress in our investment thesis. CNH Industrial’s US listing should be supported by a supportive balance sheet and clear focus on free cash flow generation. In addition to higher liquidity, we believe the valuation gap with its closest competitors will narrow.

what’s new?

- The positive arguments about CNH are starting to bear fruit. From a performance perspective, in the agricultural sector, the company’s core operating profit margin increased by 50 basis points from the previous quarter, while revenue fell by 8%. This positive performance was also achieved in the construction sector;

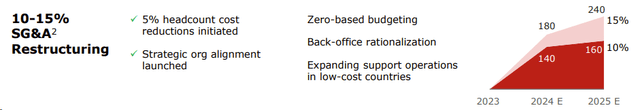

- Offshore RMB has a “Control what we can control” 2024 mentality. Our previous analysis was consistent with the company’s estimates, forecasting 70% of its $550 million cost savings target in 2024. In addition, SG&A savings plans and headcount reductions are now forecast (Figure 2). In our analysis, we are positive on CNH’s continued cost savings, but we do not believe its net basis levels will fall to the bottom line. To put the numbers into perspective, planned SG&A savings in 2024 are expected to be $180 million, with an additional $60 million in savings in 2025. CNH plans to host an investor day in May 2024, which we think could even be a positive catalyst;

-

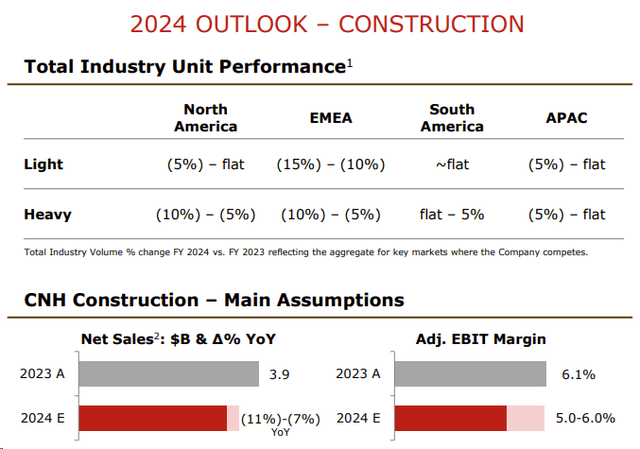

The company believes margins in the construction business could reach 10%. The corporate profit before interest and tax target for 2024 is set between 5.0% and 6.0%. Therefore, the company is its ambitious target. Additionally, we point out that competition from Asian peers has intensified and, for the company’s part, CNH needs to improve its large excavator offerings.We should also report Trimble News on CNH. The operator changed after-sales distribution and gave the company “With 12 months notice, we will no longer provide after-sales precision agriculture products through the CNH networkAt the lab, we take a contrarian view, even though the news may be viewed as negative. This change may provide benefits to CNH in terms of profits and revenue;

-

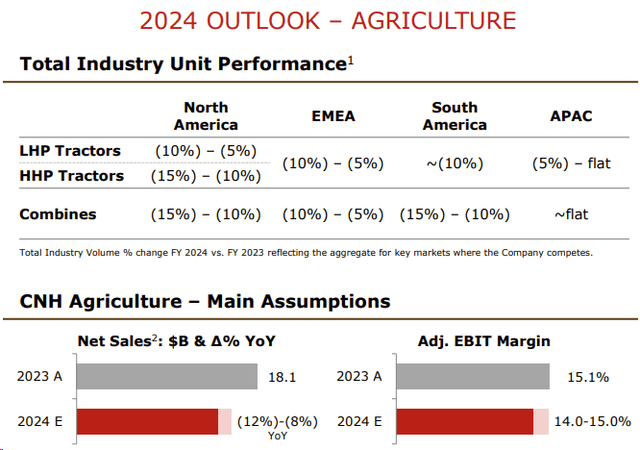

The company also provided support details for both of its divisions, even as we forecast a down-cycle scenario. CNH expects net sales to decrease by -12% to -8% annually. In addition, we now target operating margins for the agriculture and construction segments at 14.5-15.5% (Figure 3) and 5.5-6.5% (Figure 4), respectively. We also believe that the agricultural equipment cycle is more resilient than at any time in history. From a CNH customer perspective, farmers’ balance sheets are healthier, and we think we are bullish on the sector given aging equipment and CNH technology advancements;

- Ag dealer inventories will face about $1 billion in headwinds in the first half of 2024, according to the company. This is true in both North America and Europe. On the positive side, we still guide for a 1% price increase, including incentives for dealers. The CEO emphasized that price cuts are not considered in 2024. For this reason, we have now decided to reduce offshore RMB sales to $19.91 billion. Based on our profit and loss forecast, we arrive at EBITDA of $2.7 billion. Based on the capex plan of €450 and current D&A forecasts, our EBIT declines to $2.3 billion. Our adjusted net income was $1.93 billion, with earnings per share of $1.55 (previous estimate of $1.67);

- Impressively, CNH Industrial’s free cash flow guidance was confirmed to be between $12.0 billion and $1.4 billion. Our free cash flow is now up 29% compared to our previous estimate. The company is well positioned to reduce leverage while continuing buybacks to close the valuation gap.

CNH SG&A Savings Plan

figure 2

Agriculture Outlook 2024

image 3

Construction Industry Outlook 2024

Figure 4

Valuation

CNH expects its industrial activity to slow; therefore, we decided to lower EPS to $1.55. However, after years of blocking and overcoming supply chain constraints, dual listings, strikes and more, the company’s operating leverage may be bearing fruit.

Given CNH’s share price, management believes the stock is trading well below intrinsic value and believes stock repurchases are the most efficient use of capital. CNH will pay $0.47 per share in 2024, with the next ex-dividend date being May 10. However, there is a clear preference for buybacks.In detail, CNH board officially recognized The additional $500 million in repurchase programs will begin upon completion of the current $1 billion in share repurchases. The FCF target is 70%, and the company trades on an FCF yield above 10%. In our scenario, we do not consider CNH’s plans to reduce SG&A. The company trades at a significant discount to its peers in terms of free cash flow yield. Caterpillar and Deere currently have free cash flow yields of 5.91% and 5.80%, respectively. In terms of price-to-earnings ratios, both Caterpillar and Deere are trading at more than 12 times. Our estimates suggest the company is trading at a P/E ratio of 8.3x, compared with the five-year median of 10.37x. Therefore, valuing the company at a price-to-earnings target of 10 times, we arrive at a Buy rating of $15 per share.

risk

Our key risks include 1) increased competition with incoming Chinese players, 2) slowdown in farmers due to reduced order backlog, 3) execution risk in new product development, and 4) labor inflation, as is occurring in the U.S. auto industry That way.

in conclusion

At Labs, we believe CNH Industrial is an undervalued agricultural and machinery equipment company. While earnings growth is supported by a positive macro environment, we expect multiple expansions. Additionally, we believe CNH can weather the volume decline cycle in 2024. Fourth-quarter results have proven this. Our Buy rating is also supported by buybacks, which should help the company reduce its valuation gap.