Thomas Barwick

Investment Outlook

Cognizant Technology Solutions, Inc. (NASDAQ: CTSH) provides a range of consulting and outsourcing capabilities to clients around the world.

I previously wrote about the prominent advisory firm in August 2023, taking a stance on the prospect of client spending deferrals and focused on cost-cutting activities that led to slower growth.

These market conditions continue while CTSH seeks to retain the majority of its employees and reduce other operating costs during a “sit-down” period while it waits for customer spending to rebound.

I maintain a Neutral (Hold) stance on CTSH due to uncertainty about the company’s near-term growth prospects due to the global demand outlook.

Cognizant’s Market and Methodology

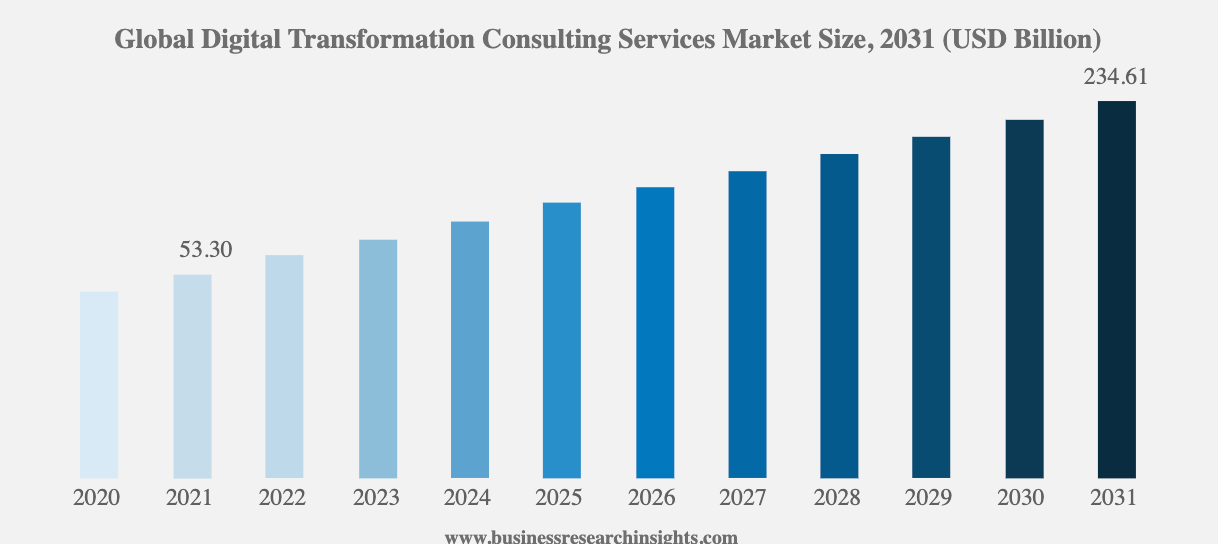

According to the market in 2024 research report According to Business Research Insights, the global digital transformation strategy consulting market is estimated at US$53 billion in 2021 and is expected to reach US$235 billion by 2031.

This means that the CAGR from 2022 to 2031 is expected to be 13.16%.

The primary driver of this expected growth is the dramatic shift from on-premises legacy systems to cloud-based environments with complex architectures.

The chart below shows the historical growth and expected future growth of the global digital transformation industry through 2031:

business research insights

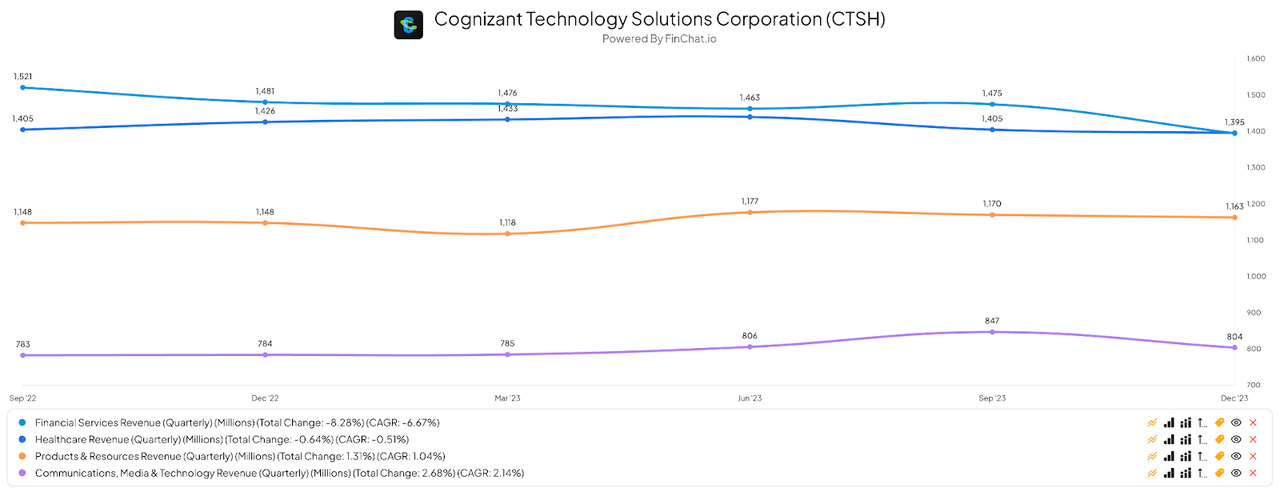

Cognizant generates revenue primarily from four industry categories:

Financial chat network

Financial services and healthcare industry revenue account for the majority of CTSH’s revenue base and contributed the same dollar value in the fourth quarter of 2023, at nearly $1.4 billion each.

However, financial services revenue has declined at a CAGR of 6.67% since the third quarter of 2022, which was the main reason for the company’s revenue decline.

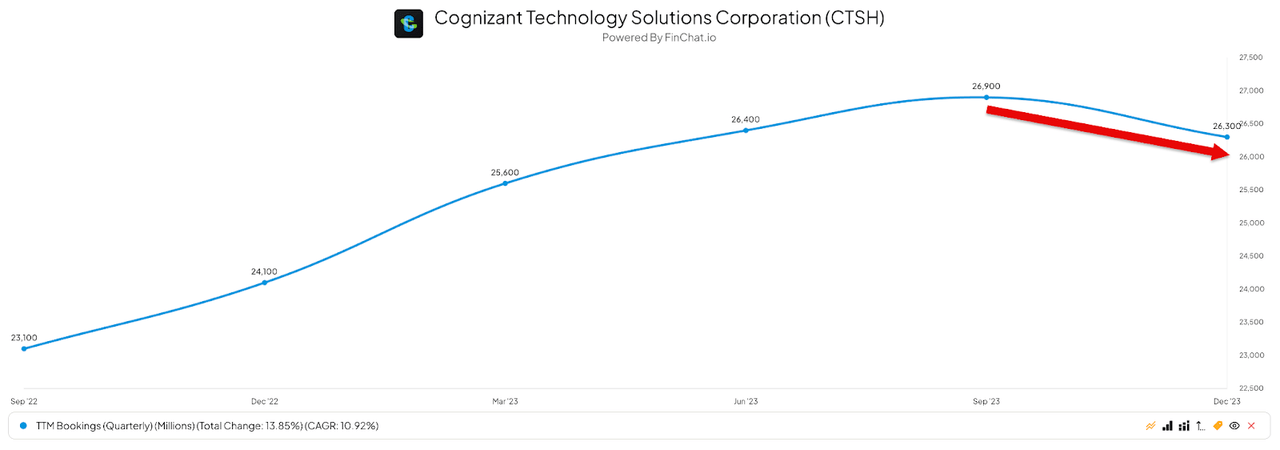

Additionally, the company’s booking growth has declined recently, which is a worrying sign for revenue recognition in the coming quarters:

financial chat network

Recent financial trends and valuations

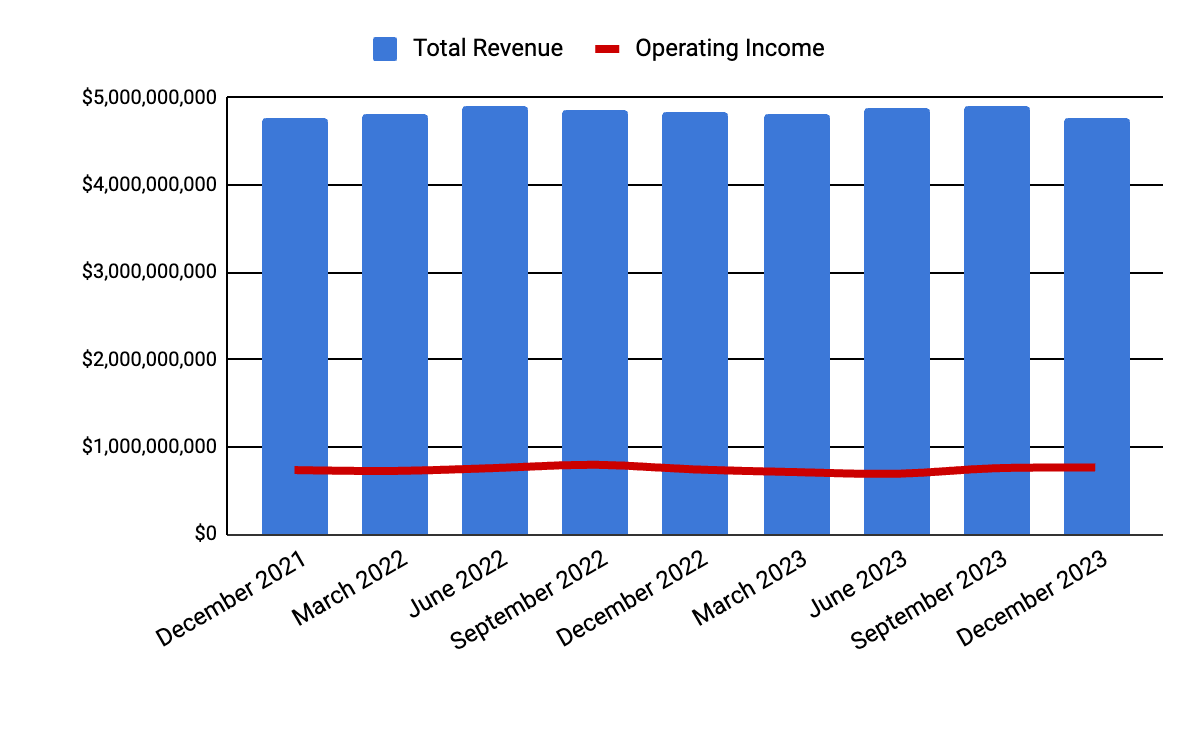

Total revenue on a quarterly (column) basis declined as customers were cautious in spending across verticals; operating income on a quarterly (line) basis remained strong as leadership implemented cost control measures.

Seeking Alpha

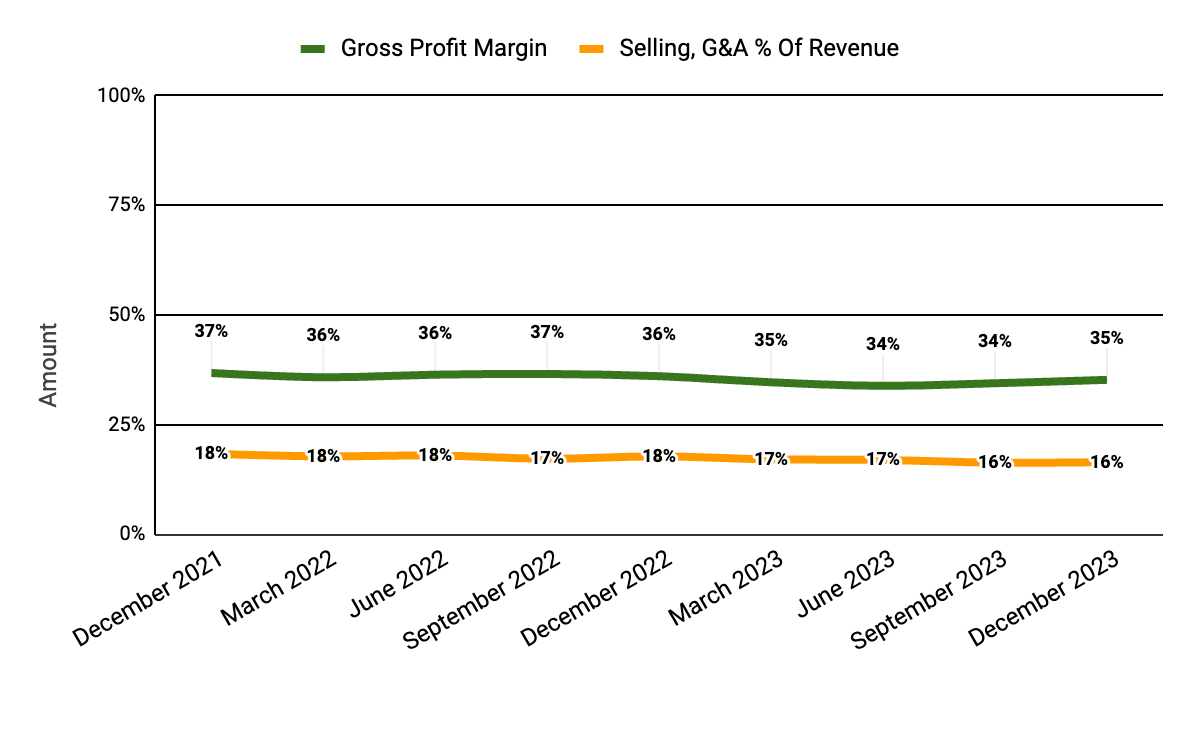

Quarterly gross margin (green line) is likely to trend downward as the company seeks to bridge the current soft market environment and preserve cost structure and headcount; Selling and general administrative expenses accounted for the quarter’s total as the company’s NextGen cost containment program lowered operating costs The percentage of revenue (orange line) is trending downward (positive sign).

Seeking Alpha

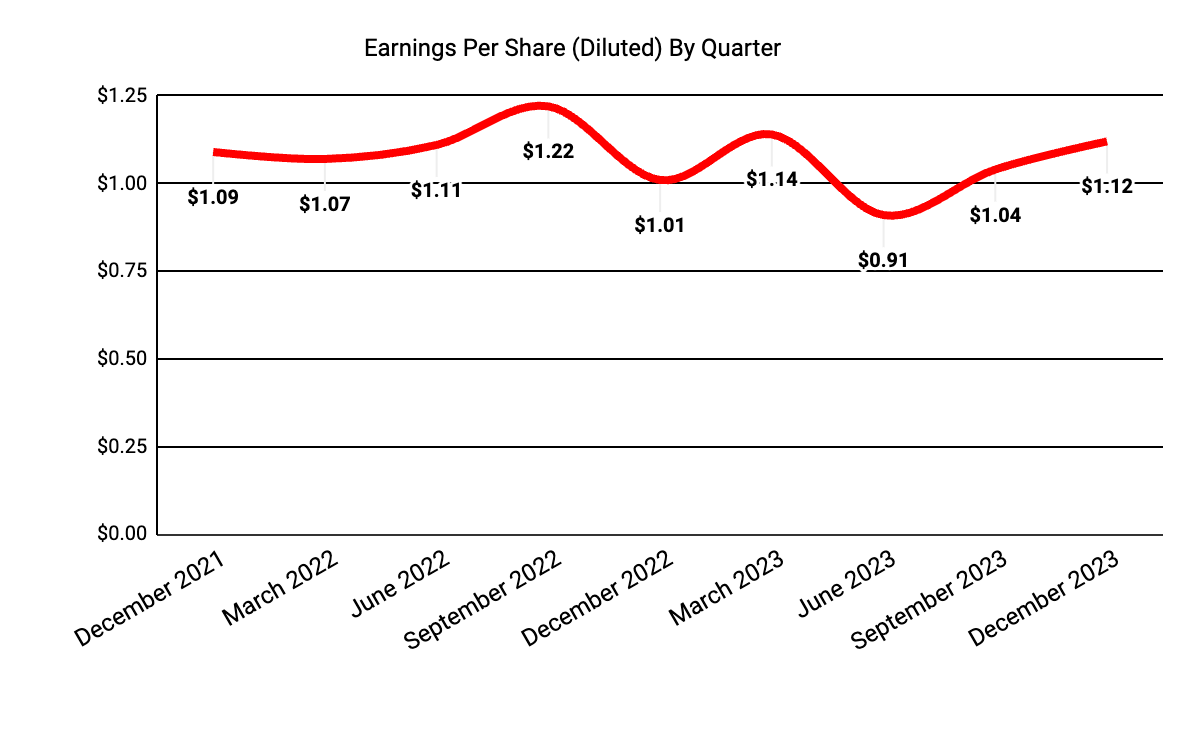

Earnings per share (diluted) have been uneven and choppy, with lows in recent quarters lower.

Seeking Alpha

(All data in the charts above are GAAP.)

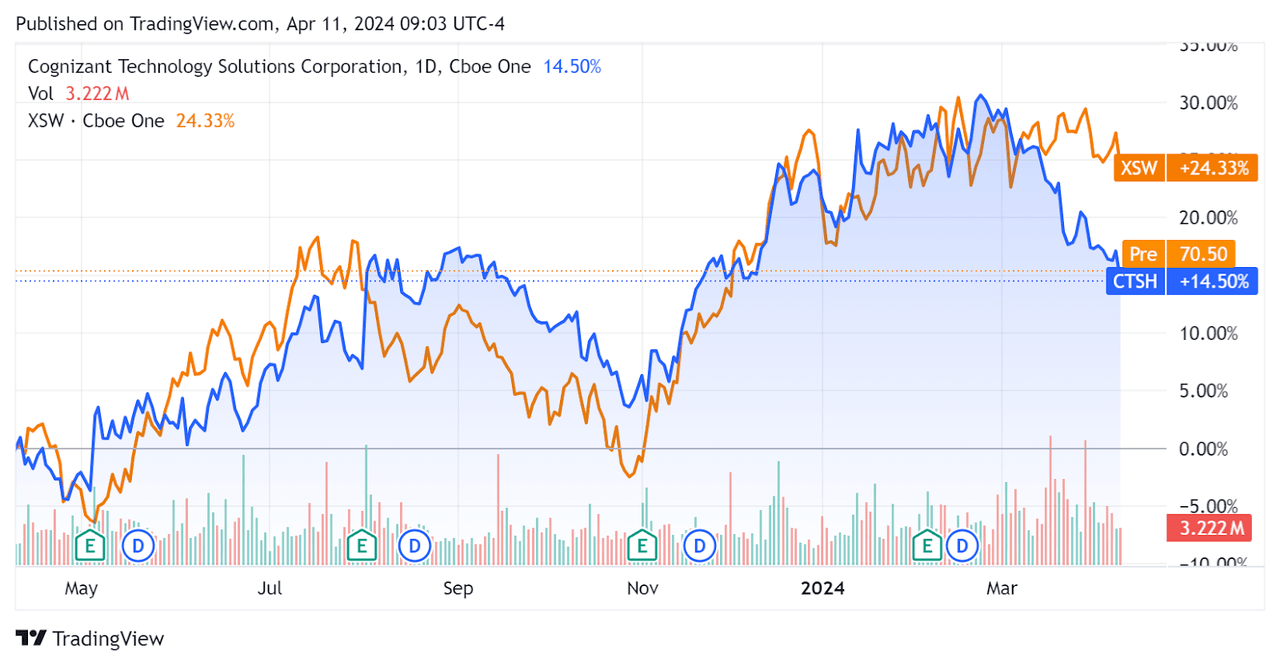

Shares of CTSH have gained 14.5% over the past 12 months, while shares of the SPDR S&P Software & Services ETF (XSW) have gained 24.3%. However, CTSH has recently deviated from the benchmark to the downside:

Seeking Alpha

Here’s a handy table of key financial metrics I’ve prepared:

|

Metric |

quantity |

|

EV/Sales (“FWD”) |

1.8 |

|

EV/EBITDA (“FWD”) |

9.7 |

|

Price/Sales (“TTM”) |

1.9 |

|

Revenue Growth (“YoY”) |

-0.4% |

|

Net profit rate |

11.0% |

|

EBITDA margin |

17.7% |

|

Market value |

US$35,630,000,000 |

|

Corporation value |

US$34,330,000,000 |

|

operating cash flow |

US$2,330,000,000 |

|

Earnings per share (fully diluted) |

$4.21 |

|

2024 FWD EPS Forecast |

$4.59 |

|

Revised Growth Forecast (“FWD”) |

1.6% |

|

Free cash flow/share (“TTM”) |

$3.99 |

|

Seeking Alpha Quant Score |

Purchase – 3.76 |

(Source: Seeking Alpha.)

Why I’m Neutral on Cognizant

The stock has risen significantly since I last covered CTSH, but has recently fallen back to the same levels as my last coverage.

Facing delays in client spending on discretionary projects, consulting firms have been looking to retain staff added during the pandemic as they hope clients rebound after a period of weakness and cautious spending.

However, we are starting to see large companies offering employee buyouts in some cases, so there is some evidence that companies are starting to crumble as customers continue to defer spending.

While some see the latest technology trend of “artificial intelligence for everything” as a boon for consulting firms, most firms report clients participating only in pilot programs focused on cost-cutting efforts.

Consulting giant Accenture (ACN) is an important example, and its CEO recently said that the company has more than 300 artificial intelligence projects underway.

Therefore, I think AI projects will eventually bring growth potential to consulting firms, but not meaningful growth anytime soon.

As I explained above, Cognizant appears to be struggling with soft bookings. Bookings growth is often something management takes pains to emphasize because it serves as an indicator of future revenue growth.

However, I have seen examples of consultants growing bookings, only to find that the bookings growth failed to translate into revenue growth in subsequent quarters.

Therefore, even showing growth in bookings does not necessarily lead to growth in revenue. In the case of Cognizant, their bookings declined in the most recent quarter, suggesting a greater likelihood of revenue declines going forward.

If macroeconomic conditions continue to improve, my skepticism about CTSH may prove to be unfounded.

However, the company operates globally and seeks to continue its international expansion, so it will be affected by different economic conditions outside the United States.

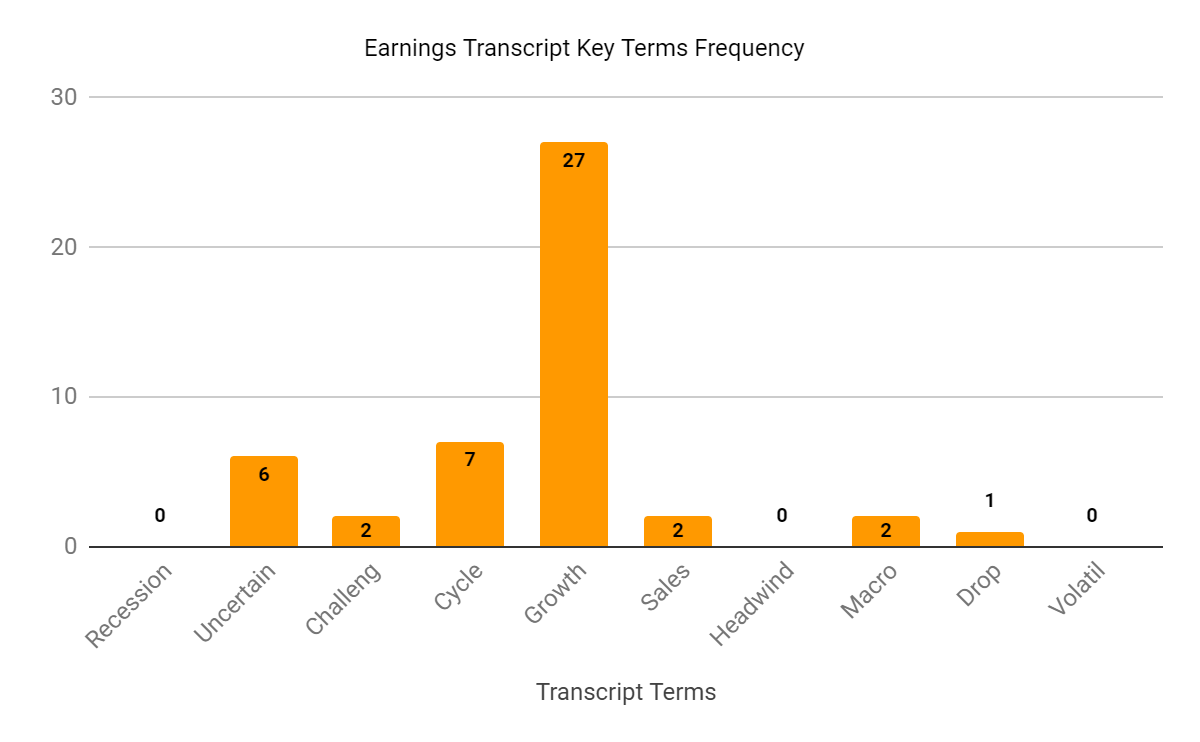

I prepared a “sentiment” chart that visually displays the frequency of certain keywords and terms in the company’s last conference call with analysts:

Seeking Alpha

The chart clearly shows that the company is facing macro challenges of “uncertain” relationship and business conditions.

So the current outlook for consultants like Cognizant is that they will continue to struggle to retain employees, even at the expense of reduced utilization and lower profits, while minimizing other operating costs.

I view this as a “hunker down” period and hope that customer discretionary spending increases in strong regions and industry verticals.

But for now, I’m neutral on Cognizant Technology Solutions Corporation stock due to weak customer demand and the lack of meaningful cost reductions.