Velishchuk

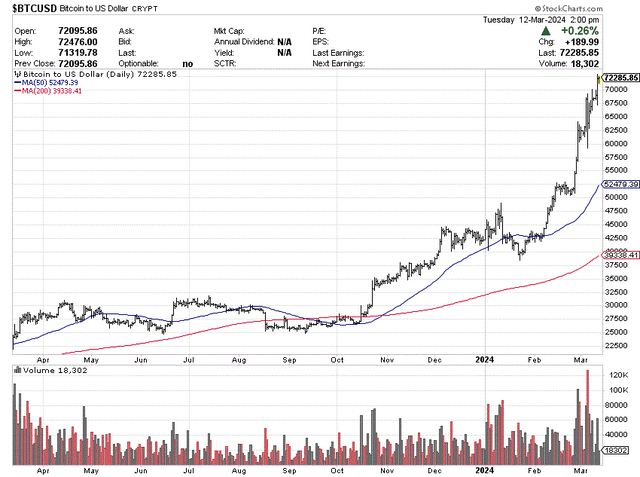

I wrote a strong sell Article about Coinbase Global Corporation (Nasdaq: Coin) price per share in November was $128. since then, Bitcoin (BTC-USD) price surges to new all-time high The SEC approves ETF products that are easy to access and trade in the United States, with prices exceeding $70,000. This situation has in turn triggered a frenzy of investor buying and speculation in Coinbase, one of the world’s leading cryptocurrency exchanges. All in all, COIN’s share price has once again doubled from the November quote, reaching a high of $271 a few days ago!

StockCharts.com – BTC/USD, 12-month daily price and volume changes

However, the company still expects business to grow slightly and be less profitable, mainly due to its own account holdings of rising cryptocurrencies.Net investment and interest income in the last financial year was $99 million, exceeding final net profit by $94 Ten thousand yuan, which means that the actual operating business is a profit-and-loss balance for the loser.

As far as overvalued bubble trends go, a COIN bottom of $33 in early 2023 looks far away. I will point out that when I correctly mentioned in this article in January 2023 that Coinbase’s price was overdue for a major rebound, few analysts at the time were willing to touch the security. The problem is that this reversal has evolved into something different. The frenzied buying pushed the price all the way back to around the $243 level where I first became bearish on the stock in September 2021.

Trading above $250 per share, I now rate Coinbase as the “most overvalued” large-cap stock on Wall Street in March 2024. It even surpassed the crazy valuation levels of March 2024. Nvidia (NVDA) and Costco (COST), as the next in line for too much irrational investor confidence.

In terms of relative size, there are only about 10 traditional banks/brokers in the United States with a stock market capitalization greater than Coinbase’s $65 billion. Surprisingly, with minimal revenue and profits, COIN’s market capitalization is close to the company’s market capitalization. Charles Schwab (SCHW) or Citigroup (C), capitalization is slightly more than $100 billion.

Therefore, the only logical investment rating I give this stock is my continuation of strong sell view. Let me explain why.

Corporate valuations are seriously overvalued

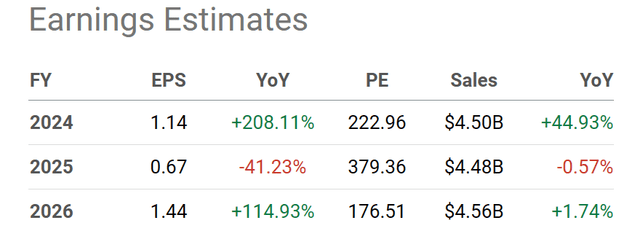

My main problem with stock price bubbles rising sharply is that business fundamentals do not support rising stock prices. A stock bubble is defined as prices rising much faster than the underlying business is growing. In fact, most analysts believe that the arrival of cryptocurrency ETFs will actually cause Coinbase to lose accounts and sales. Business is expected to improve nicely in 2024 due to the surge in interest in Bitcoin (and other computer-based currency creation), but sales and earnings per share are expected to stagnate or decline in 2025-26.

Seeking Alpha – Coinbase Global, Analyst Forecasts 2024-26, Published March 11, 2024

Keep in mind that actual revenue in 2023 is lower than in 2022, and 2022 sales are less than half of 2021!

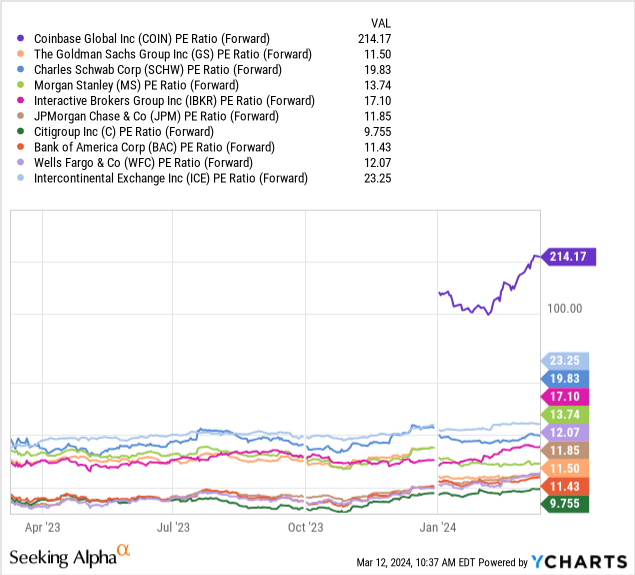

Is a non-growth business really worth 5 times more than it was 12 months ago? Here’s a chart of Coinbase’s insane “forward” P/E multiples versus the regular brokers/banks/exchanges you could use as alternatives (each broker/bank/exchange has decades of real earnings).My ranked peer group includes Goldman Sachs (GS), Charles Schwab, Morgan Stanley (Multiple Sclerosis), Interactive Brokers (IBKR), JPMorgan (JPMorgan Chase), Citigroup, Bank of America (BAIC), FuGuo bank (World Financial Center), and intercontinental exchange (ice). If 200x proves the best P/E ratio you can get from COIN (assuming the crypto bubble burst is imminent), then a new investor with $250 will not be happy with future investment returns.

YCharts – Coinbase Global vs. Prime Broker/Bank Peers, Forward Estimated P/E, 1 Year

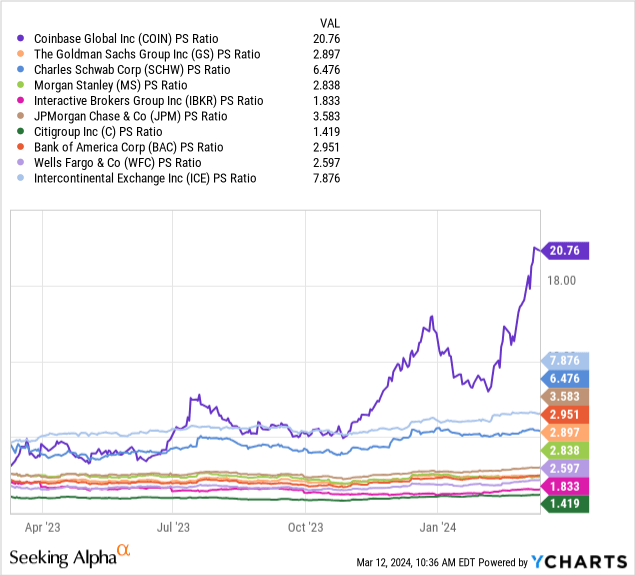

A year ago, when prices were below $50, you could assume there was some value between price and sales, a figure comparable to Charles Schwab and Intercontinental Exchange. But $250 is a different story. Tracking sales of 20.8x (note, not expected to grow much over time) is 600% higher than today’s median group average of less than 3x!

YCharts – Coinbase Global vs. Prime Broker/Bank Peers, Price to Sales Ratio, 1 Year

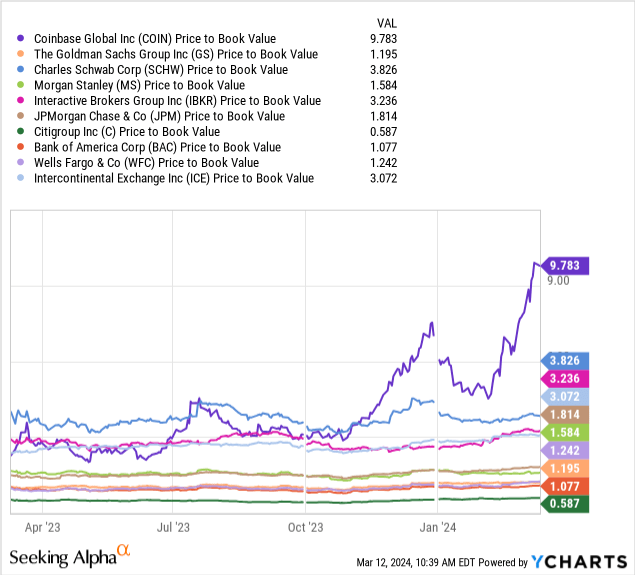

Another way to look at the valuation of banks and brokerages, especially low-margin businesses, is to compare stock prices to underlying accounting book values. Believe it or not, a year ago, Coinbase was in the middle of the peer average on this metric, at 1.3x. Today, BV’s price has soared to nearly 9.8x, far away from the average median of 1.7x (a 470% premium).

YCharts – Coinbase Global vs. Prime Broker/Bank Peers, Price vs. Book Value, 1 Year

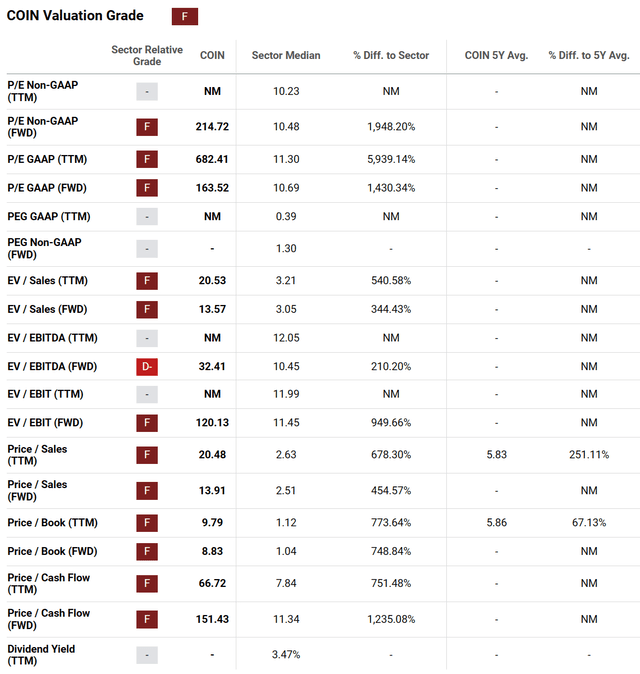

Seeking Alpha Quantitative Valuation Level Coinbase Global has an “F” rating, with all but one of 19 statistics not being an F or worse (fundamentals in negative territory). So if you’re looking for an investment backed by solid real-world capital, Coinbase above $250 is a complete failure.

Seeking Alpha Table – Coinbase Global, March 12, 2024 Valuation Grades

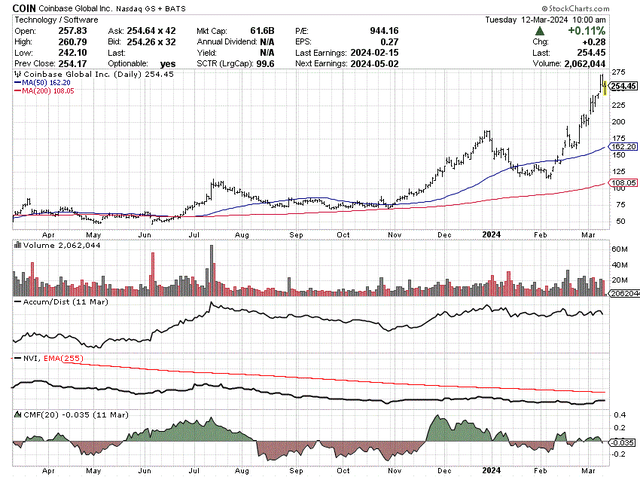

Technical indicators weak

If you can ignore the huge jump in the share price and just focus on the underlying momentum statistics, a monster 400% increase in quotes in less than 52 weeks isn’t very impressive for long-term technical support.

For example, accumulation/distribution line It peaked again in July and December, when prices were $115 and $185 respectively.this negative volume index It has been emphasized that there will be heavy selling on low volume days.Moreover, these 14 days Chaijin Fund Flow The readings have been net negative (total) since the second week of January, which means a lot of money has been withdrawn from the $140 price.

What the chart tells me is that astonishing blind buying inflows are the underlying theme that has delivered gains for two months in a row. Isn’t this the definition of unsustainable price prosperity?

StockCharts.com – Coinbase Global, 12-month daily price and volume changes

final thoughts

If Coinbase were to experience impressive business growth rates, you might be able to justify a significant increase in share. Of course, Bitcoin is rising rapidly, but I’m specifically talking about the fate of COIN. The company actually faces increasing competition from traditional brokerage firms, and now ETFs threaten to steal much of the assets under its management. Profits are almost non-existent and are more a result of the rising value of the inventory held rather than a highly profitable business model.

As a result, COIN may be considered one of the most misunderstood and overvalued ideas on Wall Street. Don’t be shocked by another sharp pullback to $50 in 2024 or 2025. That’s a level consistent with normal valuations for a slow-growing brokerage business. Regardless, it’s food for thought, especially if you’re chasing this stock and pricing it in late in the cycle heading into a wild peak of exuberance.

thanks for reading. Consider this article the first step in your due diligence process. It is recommended to consult a registered and experienced investment advisor before entering into any transaction.