SDI Productions

We initiate a Hold rating on Coloplast (OTCPK: CLPBY ) (OTCPK: CLPBF ), a leading global provider of intimate care products.We were attracted by Coloplast’s strong product portfolio, high market share and customer stickiness, but we found that inventory Pay full attention to it. We will provide a description of the company, analyze its business model and product portfolio, value the company, and discuss the risks of our ratings.

Introduction to Coloplast

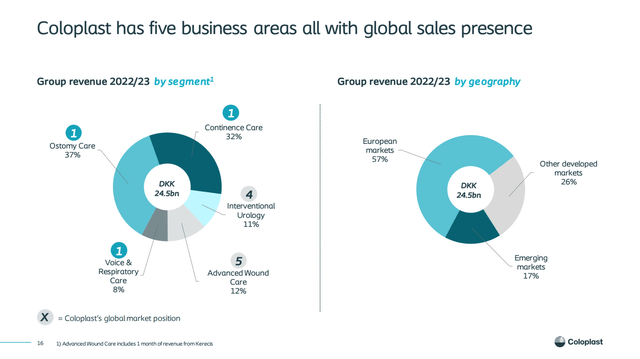

Coloplast is a Danish multinational medical device company that develops, manufactures and markets products and services for people with very personal and private medical conditions. Coloplast’s businesses include ostomy care (for people with a stoma/ostomy, a procedure that bypasses body waste), continence care (for people with urinary problems), and wound and skin care (for treating chronic wounds) dressings), interventional urology, voice and respiratory care (for people who have had their larynx removed or have an opening in their neck) to facilitate breathing). Approximately 57% of the Group’s revenue comes from Europe, 26% from other developed markets, and 17% from emerging markets. Coloplast is listed on the Danish Stock Exchange and currently has a market capitalization of nearly DKK 188 billion (USD 27 billion).

Coloplast Investor Introduction

Strong product portfolio and high-quality business model

Coloplast has a strong, diversified portfolio of high-quality, clinically differentiated products in stoma care (35 – 40% market share), continence care (40 – 45% market share) and speech and respiratory care (approximately 85% market share) occupy a leading market position). Coloplast’s chronic care model ensures a predictable revenue stream and stable growth. Approximately each new patient per year provides 10-30 years of predictable revenue. Coloplast has a low customer churn rate and has built long-term relationships with its customers.

The business benefits from a variety of trends, including demographics (an aging population increases the company’s customer base) and expanding health care coverage for patients in emerging markets. The company estimates its addressable market will grow 4-5% annually, but the company itself will grow at nearly twice that rate. Coloplast has an impressive organic growth record: its slowest growth occurred in 2019/2020, at 4%. The company’s growth is highly consistent and above its peers, demonstrating strong execution and an excellent competitive position. Coloplast’s growth stands out in the European medical technology industry.

Margin pressure and recovery

Coloplast has faced profit pressure over the past few years as rising costs have not yet fully abated. Because Coloplast patients rely on reimbursement, raising prices is challenging and involves significant lags. Input costs are expected to fall during the current financial year as raw materials inflation slows and freight and energy costs are now stabilizing.Recreation’s capital-guaranteed financial year has started well with positive results Q1 printing Organic growth and EBIT margins beat sell-side analyst consensus estimates by 100 basis points and 80 basis points, respectively. All departments are in good shape and targets have been reiterated. Coloplast’s chief financial officer expressed his optimism about cost developments. Due to the lag effects mentioned above, we expect these positive cost developments to be reflected in the next financial year.

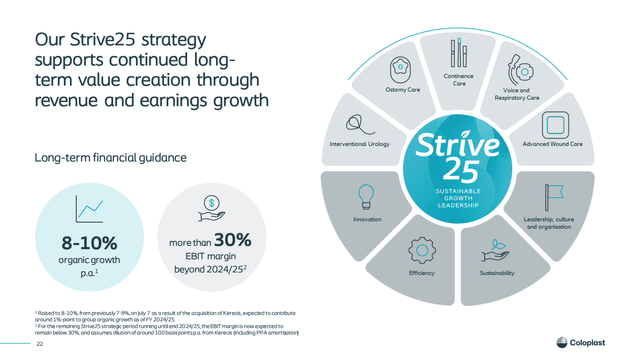

Effort 25

Coloplast announced its Effort 25 strategies and provide long-term financial guidance. It aims to achieve annual organic growth of 8-10% after the 2024/25 financial year and an EBIT margin of over 30%. The group’s organic growth will be supported by a series of initiatives, including the launch of clinical performance programs and product portfolio expansion, as well as double-digit growth in China’s chronic care market. Coloplast also emphasized its commitment to M&A to play a more important role in ensuring value creation and long-term growth. The company expects to be opportunistic towards larger players such as Atos or Kerecis, while continuing to systematically screen opportunities for channel expansion, product portfolio expansion and adjacencies, and innovative technologies. Coloplast expects free cash flow to continue to be strong, in line with historical conversion rates, and post-tax return on invested capital to grow 1% annually after the trough caused by the Atos and Kerecis acquisitions.

Coloplast Investor Introduction

Acquisition of Kerecis

In July 2023, Coloplast announced Acquisition of Kerecis, an emerging category leader in biologics wound care, with $1.2 billion in upfront cash and top earnings set at $100 million. The implied multiple for the deal is 11x EV/sales. Kerecis was founded in 2009 and has its headquarters and manufacturing operations in Iceland. Kerecis has a proprietary product portfolio based on intact fish skin and is the only FDA-approved manufacturer of patented fish skin technology. Its setup is cost-effective and scalable, and Kerecis is the fastest growing company in the industry. The company is actively developing second- and third-generation products. Kerecis generates 98% of its sales within the United States and the company expects to continue strong growth across U.S. wound types and care settings, as well as expand its presence outside the United States in the medium to long term. The company expects that by fiscal year 25-26, the post-integration three-year compound annual growth rate will reach 30%, and the EBIT margin will stabilize at 20%. While the P/E ratio is high, EPS growth is approx. With growth of 1% by FY26/27, we have a constructive outlook on the deal given Kerecis’ significant growth prospects, high profitability and portfolio fit and diversification. However, the acquisitions of Kerecis and Atos add further complexity and execution should be closely monitored.

Valuation and investment advice

We value Coloplast using a P/E multiple. We expect sales of DKK 29.5 billion, EBIT of DKK 8.5 billion and profit before tax of DKK 6.2 billion in FY24/25. Our estimates are in line with analysts’ consensus estimates. Additionally, we expect free cash flow of DKK 6.1 billion and earnings per share of DKK 28. We forecast earnings per share of DKK 24 in fiscal year 2023/24. This implies a price-to-earnings ratio of 37 times and a forward price-to-earnings ratio of 32 times. This valuation is significantly higher than the 5-year historical historical P/E median for the European medical technology industry and Coloplast. While Coloplast offers higher growth than its peers, its costs are also higher than those of its peers in terms of PEG ratio. We believe the stock is priced perfectly and there is no room for error at the current valuation. Additionally, Coloplast’s current FCF yield valuation is 2.8%. We value Coloplast at 30 times expected earnings per share, which implies a share price of DKK 840 and room for a 6% downside. Therefore, we assign a Neutral rating to the stock. While we like Coloplast’s quality and growth, we find its valuation unattractive and would avoid buying the stock at this price. We will keep a close eye on Coloplast and if corrections are made, we will revisit the investment case.

risk

Downside risks include, but are not limited to, slower-than-expected profit recovery, slower market share growth in core markets, failure to achieve Kerecis targets, reimbursement cost pressures, declining demand due to the development of new surgical technologies, chronic disease care by new entrants, foreign exchange risks, etc.

in conclusion

We rate the stock a Hold given the unattractive risk/reward profile at current very high valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.