JHVEPhoto/iStock Editorial via Getty Images

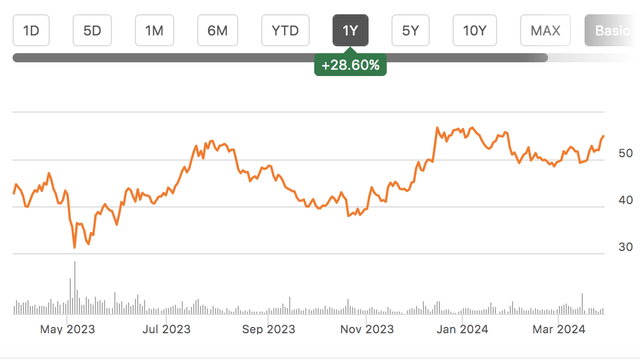

LianSheng (NYSE: CMAShare prices have rebounded strongly from a year ago as regional banks move past the worst of the funding crisis. Still, the share price is down 25% over the past five years due to its deposits. In 2023, the base took a serious hit.Since upgrading the stock to Buy NovemberComerica returned more than 28%, a strong absolute return that also beat the S&P 500’s 20% gain. However, some of the numbers in the March investor update didn’t impress me and I will now take profits once the $55 target is achieved.

Seeking Alpha

Before we dive into its updates, it’s worth taking a look back at its most recently reported quarterly performance. Excluding one-time items related to the FDIC’s special assessment and other items, CMA’s fourth-quarter profit was $1.48, down from $1.84 in the third quarter and $2.58 a year ago.Proceeds have been Mainly constrained by interest rates rather than credit challenges. Net interest income was $584 million, down from $601 million in the third quarter and $742 million a year ago. Net interest margin (NIM) increased 7 basis points to 2.91% in the fourth quarter, but fell sharply from 3.74% in the same period last year. Even as net interest margins continue to expand, net interest income is partly under pressure from balance sheet shrinkage.

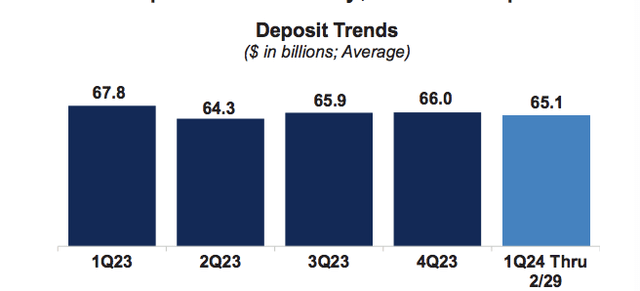

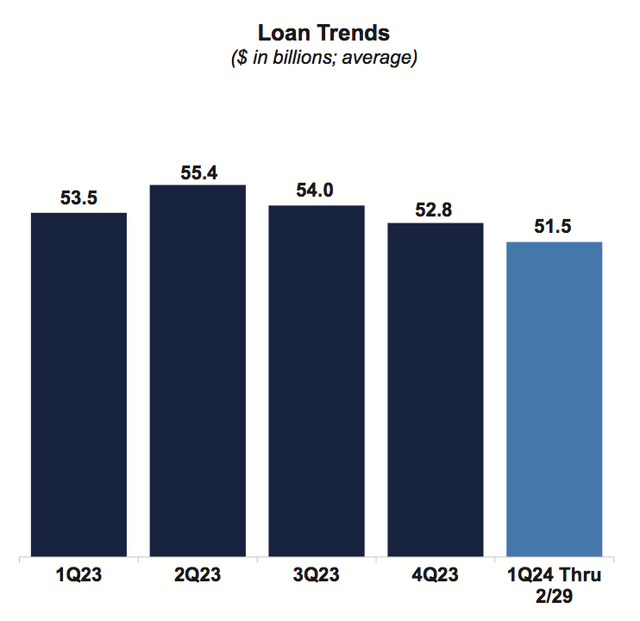

Deposits fled many regional banks after the collapse of Silicon Valley banks in the first and second quarters of last year, and CMA was not immune. In fact, deposits will fall by an average of $9.5 billion in 2023. Despite the decline, lending increased by an average of $3.4 billion, putting pressure on banks’ liquidity and forcing them to increase more expensive wholesale funding to $8.8 billion. Contrary to the full-year data, in recent months we have seen banks cut lending and stabilize deposits to restore liquidity and improve net interest margins. In fact, deposits increased by $162 million sequentially in the fourth quarter, while loans decreased by $1.2 billion.

As a result, $1.8 billion of wholesale funding was repaid in the fourth quarter, which created a 33 basis point tailwind to net interest margin, offsetting a 15 basis point headwind from rising deposit rates. Wholesale financing costs are 5.5-6%, while CMA pays 2.52% on interest-bearing deposits, so paying for this high-cost financing is quite advantageous for NIM. The CMA currently holds $3.6 billion in short-term borrowings, and I expect this to increase to $2-2.5. There will be further balance sheet reductions this year.

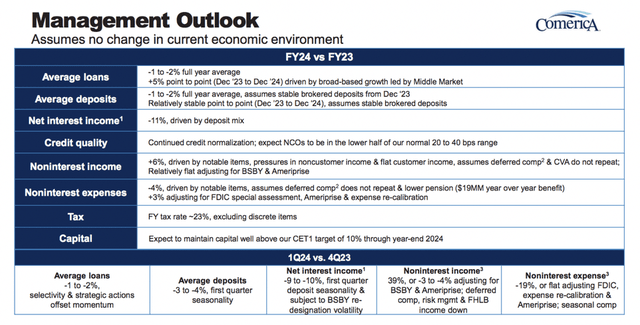

Now, as you can see below, in addition to the results, management also provided guidance assuming that deposits will roughly stabilize at Q4 levels and loans will grow 5% from year-end 2023 levels, even though Q1 Both are slightly weaker. Based on this guidance, net interest income will average approximately $550 million per quarter this year, down from fourth quarter levels. This goes against my previous hopes that season 4 might be the bottom. While management reiterated Q1 guidance in its March update, I see some warning signs in this interim update.

Allied Signal Corporation

First, deposits tend to be seasonally weaker in the first quarter than in the fourth quarter as taxes come due, companies pay bonuses, and the window dressing of year-end cash balances is reversed. I would note, however, that average balances fell $1 billion in the first quarter primarily due to lower brokerage deposits and balances among middle market clients. Stable deposits are vital in this area, especially as I would like to see banks move away from more expensive wholesale funding. While CMA’s solid deposit performance in the second half was encouraging, leading me to give it a Buy rating, the results were a bit weaker than I had previously expected.

Allied Signal Corporation

However, given seasonality, my concern is not the movement of deposits but the composition of deposits. Interest-bearing loans increased by $0.5 billion and non-interest-bearing loans (NIB) decreased by $1.5 billion. In a world of higher interest rates, NIB accounts are extremely valuable to banks, but customers have struggled to minimize their balances because they obviously want to earn interest on their cash. Most NIB accounts are transactional accounts (i.e. salary accounts), which is why they do not earn interest. Therefore, the balance theoretically has a lower limit, as the company needs enough cash to meet daily transaction needs. With big drops still happening, it looked like the floor might be farther away than I had previously hoped.

Additionally, the longer interest rates remain high, the more incentives customers have to minimize their NIB balances to earn more than 5% in money market funds. CMA’s share of NIB deposits has been declining, but CMA’s NIB exposure is quite high at 42%; while this supports the current rise in net interest margins, the risk is that net interest margins will come under pressure as the deposit mix shifts towards interest-bearing financing . For every $1 billion transferred from NIB to IB, quarterly net interest income decreases by approximately $6-7 million. The worsening mix is why net interest income will likely not bottom out until sometime in the first half of 2024.

Additionally, Comerica disclosed in its investor update that its loan balances have decreased by $1.3 billion and its business structure has shifted from corporate lending to commercial real estate. As you can see, while loan balances are higher than a year ago, they have been falling steadily as the CMA addresses falling deposits. The current loan-to-deposit ratio is 78%, which is quite conservative. Assuming total deposits are stable, loan growth should accelerate.

Allied Signal Corporation

Here, I would note that credit quality remains strong. In the fourth quarter, provisions for credit losses were only $12 million. CMA’s distressed assets of just $178 million were actually down from $244 million a year ago, despite the aging economic cycle. Additionally, it has $728 million in reserves, which is about 4x its NPL coverage and above my healthy reserve benchmark of 2.5x. Therefore, we may see a significant increase in delinquency rates before a significant increase in reserves is required.

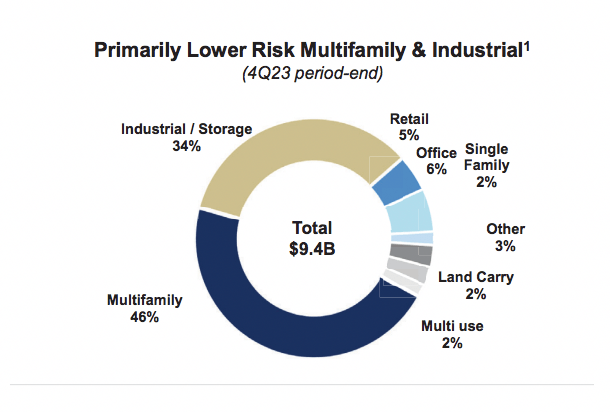

That’s because, unlike most regional banks, CMA is primarily a commercial lender rather than a commercial real estate lender, even with the recent decline in commercial credit. Its commercial real estate loans amounted to just $9.7 billion, or less than 20% of total loans. Additionally, as you can see below, its CRE books have limited office business, and offices are a troubled industry. Office loans account for less than 2% of total loans, and non-performing loans account for only 2.2%. In addition, 40% of its CRE exposure is owner-occupied, reducing vacancy risk. 70% can turn to the ultimate parent company. While CRE’s weakness is an area I watch closely, I think CMA’s risks are fairly manageable.

Allied Signal Corporation

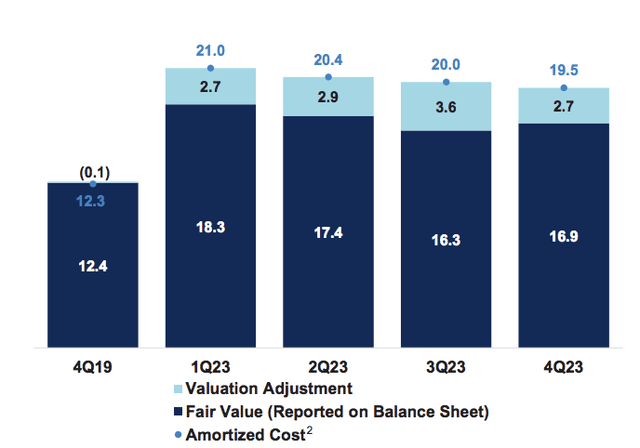

Instead, as I noted, in terms of credit quality, interest rates are the main challenge, with the funding base shifting from NIB deposits to IB deposits, and that pressure looks set to continue this year. In addition, like most banks, CMA maintains a large portfolio of fixed-rate securities. As you can see below, it has been allowing the portfolio to gradually shrink by not reinvesting at maturity, thus generating liquidity. As of Dec. 31, the portfolio incurred approximately $2.7 billion in unrealized losses from rising interest rates. Given the first quarter yield movement, I expect this loss to be similar or slightly higher when the 3/31 financials are released in a few weeks.

Allied Signal Corporation

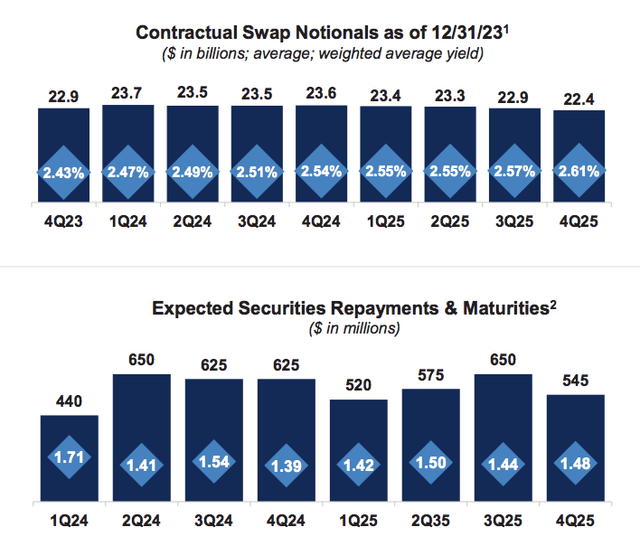

Now, every quarter, some of these low-yielding securities mature and the CMA can use them to repay wholesale funds or fund new loans at higher yields, which will increase NII. The term of this portfolio is 5.5 years, so it’s going to be a long process. While this is a positive, the CMA has also switched most of its floating rate exposure back to fixed rates for several years, with lower yields. While no new swaps were added in 2023, more than $20 billion is already locked in at rates below 3% through 2026.

Allied Signal Corporation

It now appears that the Federal Reserve may cut interest rates 5 to 6 times this year based on market pricing, which will reduce the cost of these swaps. In theory, banks can reduce deposit yields to provide some net interest margin benefits. I increasingly think that more than 3 rate cuts are unlikely, and possibly less, in which case these swaps will continue to cap NII while deposits remain more expensive.

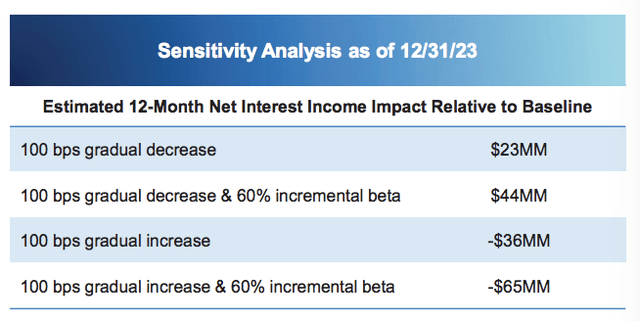

In fact, due to the structure of its balance sheet, the CMA considers lower rates to be more beneficial than higher rates. However, I increasingly think its sensitivity analysis to additional rate cuts is overly optimistic as we continue to see a mixed shift from NIB deposits to IB deposits, with a $2 billion shift likely to occur this year, which could cost $50 million USD, more than offsetting the 100bp extra cut in the best-case scenario. With interest rates rising and the mix changing unfavorably, I think the NII decline could be closer to 15% rather than 11%. The composition of deposits is a major risk that investors should continue to pay attention to.

Allied Signal Corporation

Finally, I would point out that Comerica’s common equity tier 1 (CET1) ratio at the end of the fourth quarter was 11.1%, up from 10.8% in the third quarter, which is quite healthy. The CMA has only $86 billion in assets, so it can continue to exclude accumulated other comprehensive income (AOCI) from its capital calculations. It had $2.7 billion in unrealized losses flowing into AOCI. The CMA’s CET1 ratio is 7.9% (including AOCI), which is not used for regulatory purposes but is useful when considering a bank’s true economic positioning. That’s above the minimum regulatory requirement of 7%, but still low, which is why the bank holds so much capital on a reported basis. I expect it to avoid buybacks until its AOCI CET1 inclusion ratio approaches 9%. At the same time, I think its 5.2% dividend yield is safe.

Now, those questions are less of a concern for investors who are anticipating deeper rate cuts from the Fed. However, I think the risk of a “longer-term higher” interest rate environment is greater than before. The CMA appears to be disadvantaged in this scenario due to years of low interest rate swaps and disappointing deposit mix changes, and NII may not have bottomed yet. While I once thought its profitability was $6.20, it now looks more like $5.20-$5.60. If the Fed cuts rates less than 3 times and deposits decline, we could see gains closer to $5. So with a P/E ratio of 10-11x and pressure from higher interest rates, the stock appears to be fully valued after this run. I prefer banks such as FNB Corporation (FNB) or KeyCorp (KEY) that will be in a better position if interest rates remain higher for an extended period of time and will rotate out of the CMA. CMA offers a safe dividend, but opportunities for appreciation may be limited if interest rates don’t drop significantly.