smart partner

Commercial Banking Stocks (NASDAQ: CBSH), founded in 1966 and headquartered in Kansas City, Missouri, provides retail, asset management, mortgage banking, investment, corporate and trust products and services to individuals and businesses.

Although this is one of those businesses that enjoys Slow but steady growth coupled with conservative capital management and ample liquidity, prices do not reflect the opportunity here. Regardless, interested investors should pay close attention to future developments, as this situation may change.

Business & Portfolio

CBSH is on the lower end of the scale as a regional bank, with assets of $31.7 billion, a loan portfolio worth $17.2 billion, a deposit base of $25.4 billion, and a market capitalization of $6.91 billion.

While the bank relies heavily on loans to generate revenue, it’s worth noting that its card transactions and trust fee businesses also In 2023, expenses accounted for 19.55% of total interest and non-interest income, with these two sources contributing almost equally last year.

Now, its lending business is well diversified, considering it has 141 branches in Missouri, Kansas, Illinois, Tulsa, Oklahoma and Colorado. To give a sense of the geographic makeup of its loan portfolio, 31% is allocated in Kansas City, 25% is allocated in St. Louis, and 44% is allocated in the remaining regions. Despite its relatively small size, it’s worth noting that the company holds significant market share in Kansas City and St. Louis (12% and 7% of deposits, respectively).

The portfolio is also diversified by customer type, with 65% of borrowers being businesses and 35% being consumers.

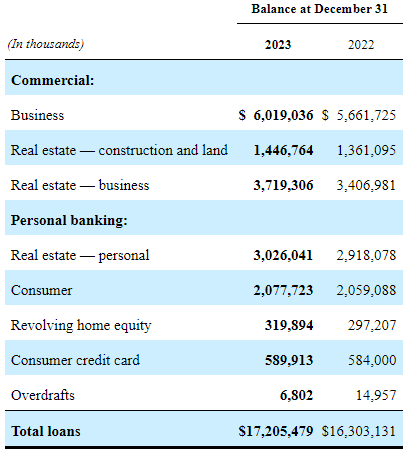

Finally, its commercial real estate exposure is relatively small:

10-K

Performance

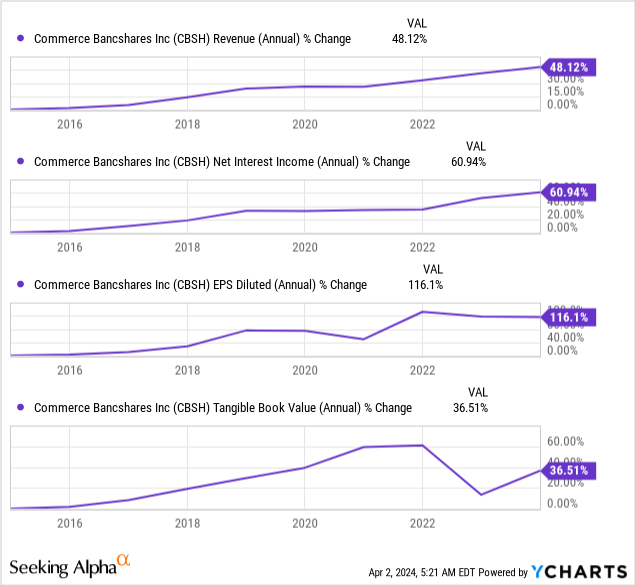

Looking at the long-term performance first, I like what I see. While the business has expanded slowly over the past 10 years, it has also remained stable for the most part, as the chart below shows:

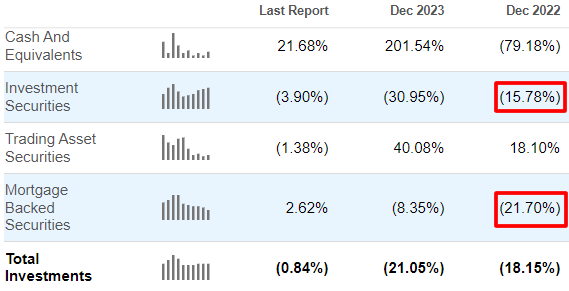

Tangible book value did shrink somewhat recently, but that’s to be expected because the value of investment securities and MBS (which together account for about 42% of total assets) fell in the same year that interest rates began rising rapidly. Below, you can observe the year-over-year changes in these two values:

Seeking Alpha

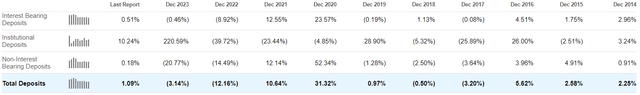

That being said, I think CBSH has done a good job of deposit growth over the past 10 years (here are the year-over-year changes during that period):

Seeking Alpha

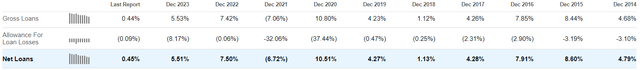

Not surprisingly, it has also managed to grow its loan portfolio:

Seeking Alpha

Now, the bank has naturally experienced growth in its loan portfolio yield over the past three years; it ended 2021 at 3.67%, 2022 at 4.18%, and 2023 at 5.9%.

But what is interesting is that its net interest margin has expanded, showing that it is an asset-sensitive business; it will be 3.67% in 2021, 4.18% in 2022, and 4.46% in 2023.

As a result, instead of experiencing net interest margin compression like many other banks, it actually expanded its net interest margin; 2.58% in 2021, 2.85% in 2022, and 3.16% in 2023. It was not uncommon for banks to have net interest margins >3% two years ago, and now margins are down 100 basis points.

Turning to profitability, interest income increased to US$1.4 billion by the end of 2023, an annual increase of 38.3%. In addition, net interest income reached US$998.1 million, an annual increase of 5.93%. In addition, non-interest income increased by 4.85% to US$573 million compared with the same period last year.

However, expenses exerted enough pressure that net income fell slightly to $477 million, down 2.3%. As a result, diluted earnings per share also declined, albeit by 0.8%. On the bright side, tangible book value partially recovered, reaching $2.8 billion; a 20% increase from the same period last year. Finally, ROA grew 4 basis points annually to 1.49%, and ROE fell to 7.94%, down from 17.31% the previous year (for context, ROE in 2022 reflects a lower equity base and nearly the same net profit margin as in 2023 profit).

Solvency and Liquidity

Before we discuss prices, let’s examine a few things about solvency and liquidity levels.

First, as of the end of December 2023, CBSH’s primary ordinary interest rate is 15.25%, an annual increase of 112 basis points. To put it into context, the minimum capital requirement is much lower at 4.5%. Secondly, the total capital rate was 16.03%, an increase of 114 basis points from the previous year, which was much higher than the minimum requirement of 8%. Finally, its primary leverage ratio increased 91 basis points from the same period last year to 11.25%, which was also far higher than the lowest level of 4%.

So we’re looking for a very well-capitalized business. But what about capital costs? This is where CBSH really shines, with the average deposit interest rate being only 1.44%. While this is obviously much higher than the 0.18% and 0.07% enjoyed in 2022 and 2021 respectively, it is still incredibly low. This is thanks to its reliance on interest checks and money market deposits (76.8% of total deposits). While wholesale funds are currently more expensive for banks at 3.83%, they hold 17.4% of interest-bearing liabilities and only increase total liability costs to 1.86%, which is still impressively low.

But keep in mind that banks’ reliance on interest checks and MMA deposits can lead to an unstable deposit base. Having said that, the LDR is only 66.31%, and there is still a large safety margin here. While this ratio is partly due to the bank’s choice to tie funds to AFS securities (30.5% of total assets), it also has a large amount of cash and equivalents set aside (9.9% of total assets).

Although its loan-to-deposit ratio is so low, it is worth demonstrating the resilience of its loan portfolio by mentioning a few key points of its credit quality as of the end of 2023:

- 0.31% of business loans received a Special Mention rating

- 2.48% of commercial loans are rated subprime

- 0.35% of personal bank loans are in arrears for more than 90 days

- 95.7% of real estate personal loans are issued to individuals with Prime FICO scores and above (660-719)

- 93.2% of consumer loans have Prime and above FICO scores

- 94.8% of revolving home equity loans are rated Prime and above

- 83.2% of credit card debt has Prime and above FICO

- Reserve coverage ratio is 0.2%

- Write-offs increased by $12 million annually to $31.1 million, and the write-off rate increased to 0.19% from 0.12% in 2022.

Dividends and Valuation

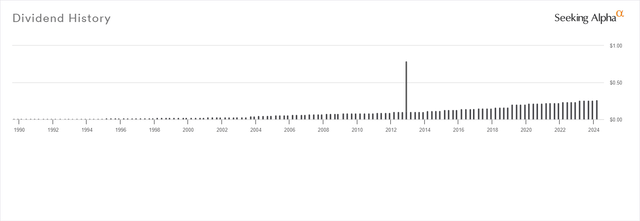

CBSH currently pays a quarterly dividend of $0.27 per share and has a forward yield of 2.06%. Although the yield is lower, here are some things to consider.

First of all, the dividend payout ratio in 2023 is 28.24%, which is an increase of 214 basis points compared with the same period last year during a period of increased industrial pressure. Stock dividends have actually increased compared with the same period last year; the dividend payout ratio in the past five years has also been quite low, and the dividend payout ratio for the same period in 2020 The highest rate is 35.32%.

Second, the company has raised its dividend for 55 consecutive years:

Seeking Alpha

This is very impressive. If it maintains at least the same pace as it has over the past decade (during which time distributions have more than doubled), potential shareholders could benefit from a stable and attractive income stream going forward.

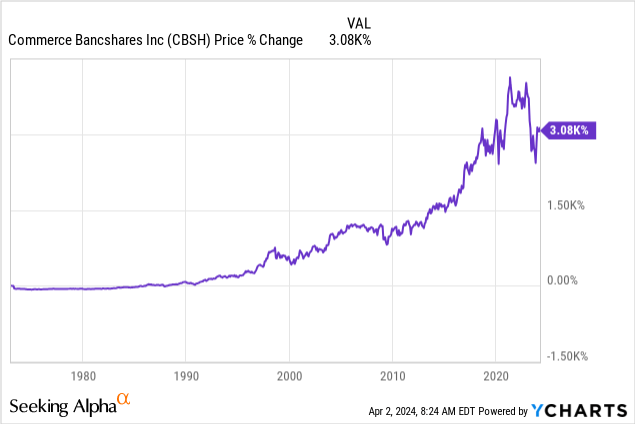

However, current yields suggest you may have figured something out by now. The price you have to pay to own a piece of that business is very high. Clearly, the market has shown appreciation over the years:

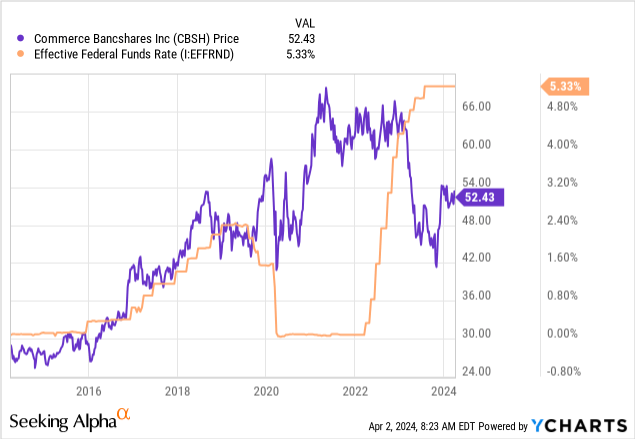

Because of the asset sensitivities we observed above, profitability here won’t take as big a hit as other banks when interest rates start to rise in 2022. And the market seems to be responding well, not punishing BCSH as harshly as it would if rates start to rise in 2022. The federal funds rate begins to rise:

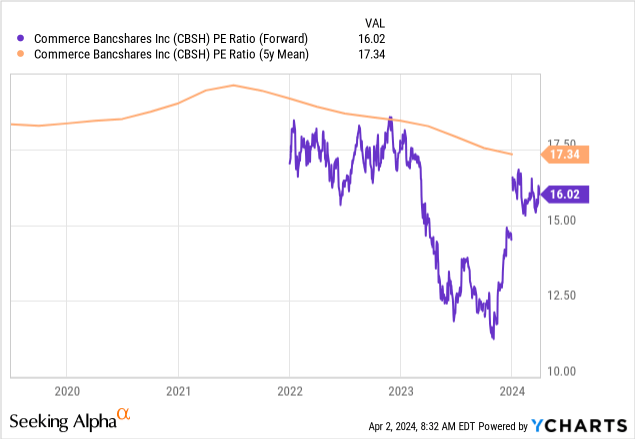

Therefore, the stock price has a lot of support and is unlikely to be undervalued in the short term. Currently, the forward P/E ratio is well below its 5-year average:

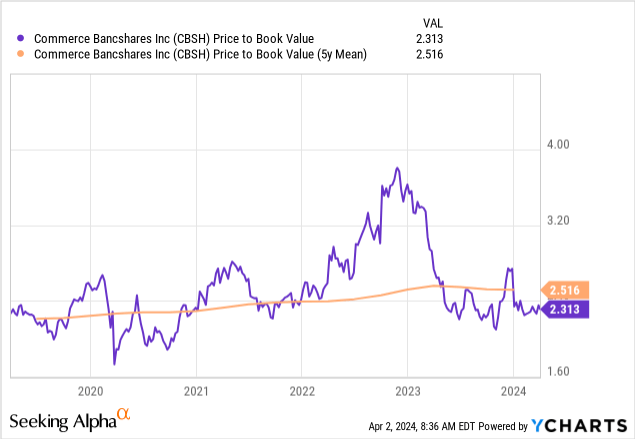

The same goes for the book value premium:

Obviously, a business that can perform well in a variety of interest rate environments and relies heavily on services for intangible revenue can go some way to justifying a higher premium, but that’s too high for me. Even if tangible book value returns to 2021 levels, the premium will still be substantial.

risk

This brings me to what I consider the most important risk with this stock. The lack of upside from a clear margin of safety represents opportunity risk. It’s a good business, but it’s growing relatively slowly, and the market will likely continue to be slow to appreciate its growth. The dividend yield is too low to effectively reduce opportunity costs.

Another risk you should be aware of relates to changes in interest rates. If they start to fall, as many experts predict, and liabilities reprice more slowly than interest-earning assets, the bottom line could be temporarily affected, and CBSH could experience a net interest loss, although liability-sensitive banks enjoy higher profit margins. Poor compression. This is unlikely to go unnoticed and the share price may decline somewhat.

judgment

All in all this is a great business but not so great for the price, my review for it is catch at present. I believe the share price is unlikely to drop significantly in the short term, but you never know, so I’ll keep an eye on it. Keep in mind that the fair value of nearly half of assets has a significant impact on tangible book value, so the current premium is very high. Therefore, when interest rates start to fall (excluding any future retained earnings), there is a good chance that TBV will rise to pre-2022 levels. If the market doesn’t overreact to this quickly enough, an opportunity may come. who knows? It’s best to wait and see what happens.

What’s your opinion? Do you own shares in this company? If I may ask, what is your cost basis? Also, if you liked this post, please let me know because it means a lot to me. Thank you for reading!