Partner media/iStock Editorial via Getty Images

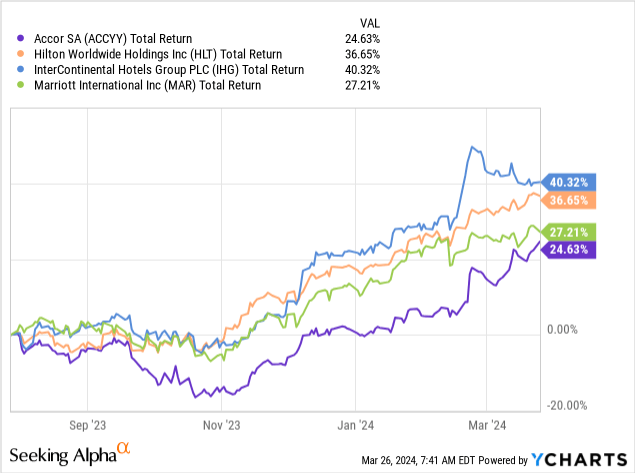

French hotel giant AccorHotels ( OTCPK:ACRFF ) ( OTCPK:ACCYY ) has been doing pretty well since my last update last summer.The stock returned about 25% at the time, a strong performance in isolation, but underperformed by 300 to 1,600 basis points compared to U.S. public companies Peers.

While this performance meant that the stock met my then-set fair value target of approximately €42 per common share (~$9.30/ADS), the performance at the business level was also better than I expected. Since AccorHotels leads my model and still has a large valuation gap compared to peers, the stocks remain attractive overall, so I maintain a Buy rating.

Cyclical headwinds remain largely non-existent

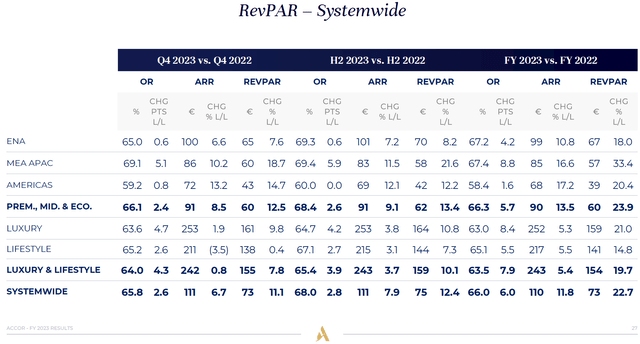

I mentioned in my previous comment that while hotel stocks are a cyclical industry, there is still underlying demand due to the COVID-19 pandemic that could offset the potential negative impact. Economic growth slowed. AccorHotels still doesn’t see any signs of slowing down, which suggests this may well be happening. As a result, RevPAR for both the fourth quarter and the full year of 2023 was €73, an increase of approximately 15% compared to 2019 levels. Since 2022 is still affected by COVID-19 lockdowns, especially in China, this remains a more useful comparison until we make a cleaner comparison to 2023 this year.

Full-year 2023 EBITDA reached an all-time high of €1.0 billion, just over 20% above 2019 levels, growing more than RevPAR as Accor’s hotel base was also about 12% larger than before the pandemic (end 2023 had 821,500 rooms (compared to 821,500 rooms at the end of 2023) (compared to 739.5k in 2019). EBITDA in 2023 is also about 5% above the midpoint of the last guidance (around €950 million), which is a further indication of how strong the performance is in the face of the headwinds of slower economic growth.

While EBITDA is now comfortably above pre-COVID levels, margins of 20% are still about 40 basis points below 2019 levels. This is because the number of rooms actually owned or leased by AccorHotels is relatively small and has a negative impact on revenue compared to the vast majority of hotels owned by third parties and operated under management or franchise contracts, which have an EBITDA margin of around 70%. contribution is disproportionate. %). The segment’s EBITDA margins were in the high-single-digit region last year due to rising costs, compared with around 20% in 2019.

Potential demand remains to be met

Although rising interest rates continue to pose headwinds to economic growth, AccorHotels’ business showed resilient data at the end of 2023. In the fourth quarter, occupancy rates increased across all of its business units, with combined occupancy reaching 65.8%, an increase of approximately 260 basis points year-over-year.

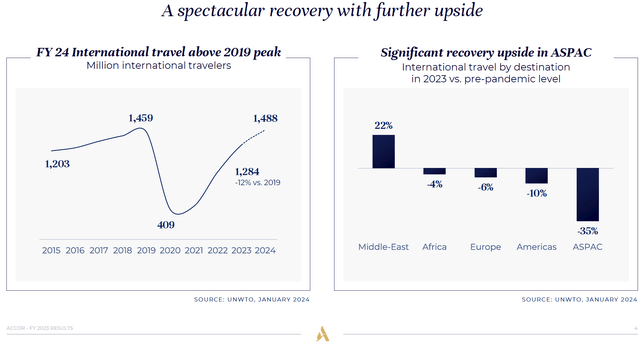

Source: AccorHotels 2023 fourth quarter results presentation

While this is an improvement, it is still approximately 310 basis points below the level reported by AccorHotels in Q4 2019 (68.9%), as international travel last year remained 12% below 2019 levels. With a full recovery expected this year, that means underlying demand can continue to offset the usual headwinds of a business cycle. Since this number is only based on a roughly 80% recovery in international tourist arrivals from China on the last earnings call, I expect this to continue to be a modest driver beyond 2024.

Source: AccorHotels 2023 fourth quarter results presentation

As last time, Accor’s management targets an average annual EBITDA growth of 9-12% between 2023 and 2027. In addition to continued growth brought about by the recovery from the COVID-19 epidemic, AccorHotels also faces certain structural headwinds. One of these is related to its loyalty program, stable well-known brand and direct sales capabilities (which generate higher margins compared to booking through third-party portals). This combination typically results in better occupancy, room spend and profitability compared to independent hotels. Therefore, global hoteliers like AccorHotels are gaining market share as many independent hoteliers choose to convert to branded hotels (around 50% of AccorHotels’ new openings last year). This should lead to above-average unit volume growth over time.

Last year, Accor reported net unit growth of 2.4%, in line with management’s guidance for 2-3% growth but below the company’s mid-term target of 3-5%. One point I’ve made in past reports on InterContinental Hotels Group (IHG) peers is that higher interest rates could act as a headwind to unit volume growth. The reason is that higher interest rates mean higher financing costs for new hotel construction. This should dissipate as interest rates begin to normalize lower this year, supporting modest expansion to achieve management’s growth goals.

Finally, I would point out that AccorHotels still has a relatively high proportion of rooms operated under an owned/leased model (approximately 2.1%), Marriott (~0.8%) and IHG 2.6% of the total). (~0.4%). Since the new hotels will operate under management/franchise contracts, this ratio should move closer to peers over time. Since these rooms also have higher profit margins (since AccorHotels does not incur operating expenses associated with the day-to-day operations of these hotels), its EBITDA margins should also expand, further supporting earnings growth.

As mentioned, 2023 EBITDA is about 5% higher than my model. Furthermore, AccorHotels’ cash conversion rate (i.e. EBITDA to free cash flow) last year was 59%, well above my forecast of over 50% and management’s mid-term target of over 55%. Therefore, recurring free cash flow in 2023 of €596 million was also well ahead of my previous expectations.watching consensusmy previous estimates for 2024 and 2025 EBITDA are also now around 5% lower than estimates as Accor’s business performs better than expected.

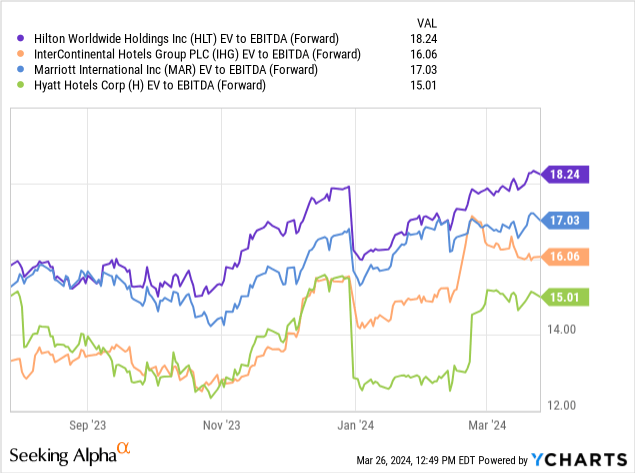

Updating this and increasing my long-term EBITDA growth by one percentage point (to better reflect the growth dynamics of the companies mentioned above), raises my fair value estimate to just over €47 per share (~$10.20 per ADS) . This equates to an EV/EBITDA multiple of approximately 13x, which is still a significant discount to US listed peers.

Now, I think AccorHotels operates a larger number of rooms under management contracts (55% of the total), so a discount relative to its peers is appropriate. Managed rooms essentially allow Accor to take a cut of room revenue and a cut of hotel profits, while franchised rooms take a direct cut of room revenue. As a result, Accor’s earnings profile is more cyclical than its peers, with Hilton (~23% of managed rooms), Marriott (~36%) and IHG (~28%) all having lower proportions of rooms under management contracts.

That said, I would point out that the valuation gap has actually widened since our last report. While this has contributed to Accor’s recent underperformance, it has also given it an increasingly attractive valuation relative to its peers, with shares currently trading at around 12x EV/EBITDA multiple (based on 2024 estimates), compared with peers trading in the range of 15 to 18 between times. Since these stocks also present a sound stand-alone investment case, I believe Accor is the most attractive global accommodation stock right now, and on this basis I maintain a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.