Natalie_Meese

We previously covered Affirm (NASDAQ:NASDAQ: AFRM) in January 2024 downgraded the stock to Hold due to excessive optimism, up +175.9% since the bottom in October 2023.

Although fintech continues to show profitable growth, we do not believe The stock’s dizzying premium at the time was sustainable. Combined with increased short interest, we believe a deep pullback is likely in the near term.

Currently, AFRM has retraced -19.7% since our last article, and we believe the margin of safety has improved based on fintech’s improving margins and management’s promising fiscal 2024 guidance.

Combined with the stock’s continued moderating FWD valuation, we believe the fintech is slowly growing towards its growth premium, with FY2025/FY25 likely to prove its proof-of-concept as a prudent and successful BNPL fintech platform.

AFRM investment thesis more attractive after recent pullback

Despite the uncertain macroeconomic outlook, AFRM has performed very well, attributable to its continued growth in annualized growth rates Total merchandise volume reaches $30B (Quarterly growth of 33.9%/ +31.5% YoY), its number of active consumers will reach 17.1 million by Q2 2024 (+2.0 million quarter-on-quarter/+2.4 million year-on-year).

On top of that, the fintech’s adjusted operating profit continued to grow to $93 million (+55% QoQ/+250% YoY), with adjusted margins at 16% (+QQ 4 percentage points/year minus +32%).

on the one hand, Consumer Financial Protection Bureau Subprime credit scores for BNPL users typically range from 580 to 669, while non-users’ credit scores are consistently higher, with near-prime credit scores ranging from 670 to 739, the report said.

This is part of the reason why AFRM was established, “because Credit card cannot be used“, the fintech company also chooses its own proprietary ITAC credit quality score to “analyze consumers’ attribute characteristics and predict the willingness and ability to repay loans. “

On the other hand, while we ourselves have been skeptical, AFRM management has clearly been relatively successful at managing consumer and portfolio risk.

This is attributed to the fintech’s relatively reasonable 30+ days delinquency rate As of February 2Q24, growth rates were 2.4% (quarter-on-quarter/year-on-year), 1.4% over 60 days (-0.1 points quarter-on-quarter/year-on-year), and 0.7% over 90 days (quarter-on-quarter/year-on-year), lower than in 2019 Fiscal year average.

Compared to other fintech peers:

- SoFi (SOFI), as of fiscal 2023, has a 30+ day delinquency rate of 0.9% and an overall delinquency rate of 2.5%.

- PayPal (PYPL) has a delinquency rate of 1.4% over 30 days, 1% over 60 days, and 2.2% over 90 days.

- As of February 2024, the average interest rate among other major credit card lenders was 3.2%.

Additionally, while AFRM’s net charge-offs have increased to $151.31 million (up 131.7% QoQ/9.4% YOY), we are not overly concerned as several fintech and traditional banks have also The same has been reported from the pandemic period.

These developments demonstrate that management’s prudent approach in controlling loan volume has had the desired effect of reducing the credit risk of the loan portfolio.

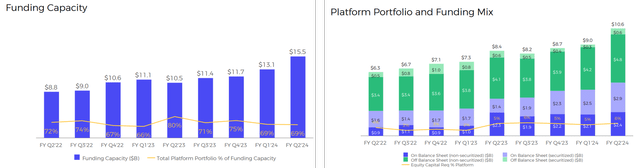

AFRM’s funding capabilities and loans held on its balance sheet

Seeking Alpha

The same story played out in AFRM’s ability to expand external financing to $15.5B in its latest quarter (up 18.3% QoQ/47.6% YOY), demonstrating the fintech’s ability to sustainably grow its loan portfolio without having to be overly reliant on its balance sheet .

Finally, management also provided an optimistic outlook for fiscal 2024, with GMV exceeding $25.25B (up 25% year-over-year) and adjusted operating margin exceeding 11% (up 15.6 percentage points year-over-year), which means its monetization and operational scale will be improved.

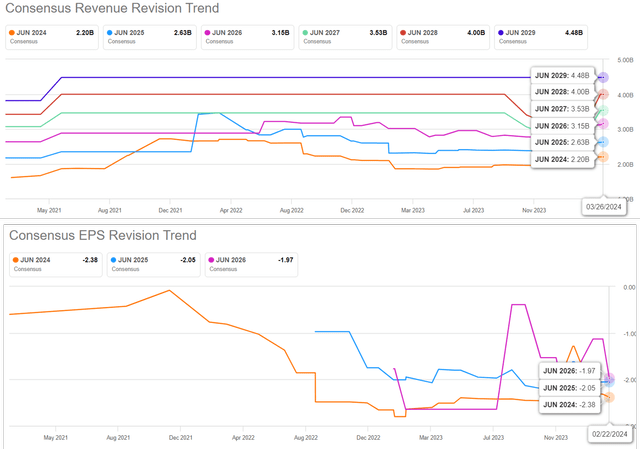

Consensus forward estimate

Seeking Alpha

Perhaps this is why the market remains largely optimistic about AFRM’s prospects, as it is expected to post a relatively stable CAGR of +25.7% through FY2026 and generate positive free cash flow from FY2024 onwards.

So, is AFRM stock a buy?sell, or hold?

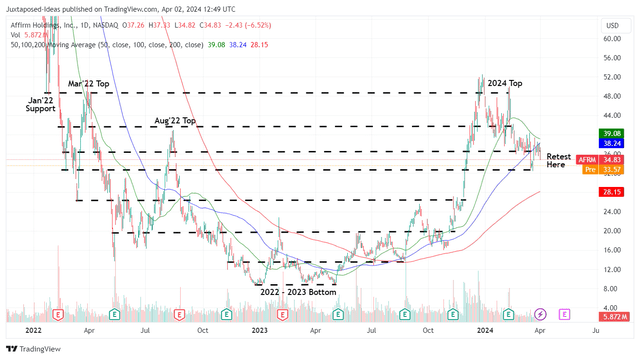

AFRM 2-Year Stock Price

trading view

Currently, AFRM has retraced significantly -31.9% since its 2024 peak, and the stock currently appears to be retesting previous support at $30.

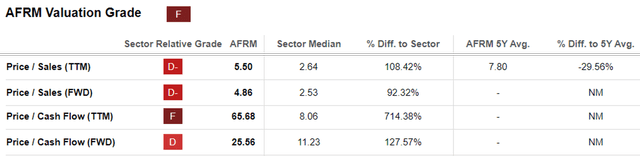

AFRM Valuation

Seeking Alpha

Based on the stock’s inability to sustain its upward momentum and AFRM valuing FWD price/sales at 4.86x, FWD price/cash flow at 25.56x, compared to the previous article’s valuation of 7.32x/49.14x and the 3-year The price/sales average is 10.98x, clearly the market is waiting for fintech to grow to its premium valuation

The same situation is seen among fintech peers, including SOFI’s FWD price/sales of 3.16x and UPST’s 3.93x, while their 3-year averages are 5.38x and 8.05x respectively.

Much of AFRM’s headwinds may be attributed to the uncertainty of the macroeconomic outlook and the unlikely realization of GAAP profitability in the near term.

At the same time, with the Fed already eyeing three rate cuts in 2024, we may see further pressure on fintech companies’ profit margins, although rising loan originations as borrowing costs moderate may provide a good balance and This was further helped by a strong labor market.

With AFRM’s nascent BNPL platform and uncertain soft landing, we can understand why the stock has pulled back since the peak of the super pandemic and a 2024 top.

However, we believe there is a huge opportunity for investors with a higher risk tolerance, as the stock appears to be well supported at current levels, offering interested investors a higher boundary of safety.

At the same time, we believe that as AFRM achieves first-year adjusted operating profits, headwinds over the next few years may dissipate as the macro outlook normalizes, further solidifying its turnaround in the coming years.

As a result, we upgrade AFRM to Buy, suitable for investors with a longer-term investment trajectory, especially as the recent pullback makes it attractive.