Jacobs Stock Photography Ltd/DigitalVision via Getty Images

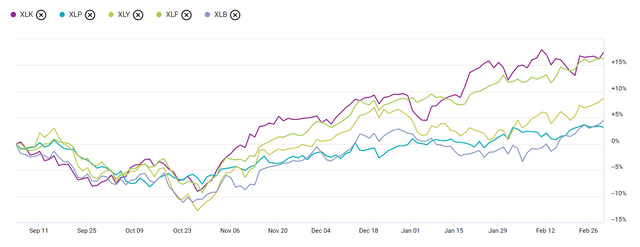

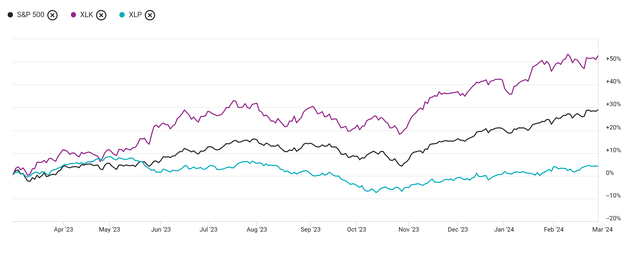

When the stock market is in a booming “risk-on” phase like it is now, consumer staples are one of the industries that lags behind. Among SPDR’s 11 featured industries, Staples (NYSE:XLP) yes Ranked third from bottom on the charts over the past six months. Energy only (XLE) and utilities (XLU) has poorer returns.

However, there may be an industry rotation at some stage; as leaders consolidate/retreat, lagging industries should catch up. XLP was the best-performing sector last week and ranked second over the past five days. This could be the start of a change and an opportunity to benefit from a rotation.

SPDR Overview

11 sectors according to SPDR Fund page“represents the entire S&P 500 Index.”

SPDR area (State Street)

them All are passively managed and have the same portfolio composition using a modified “market capitalization” approach. Additionally, they are both highly liquid, have large AUM and have very low expense ratios of 0.09%. The SPDR is a very reliable and simple way to rotate sectors, or as the fund page states, “You can purchase 11 select sector SPDRs with weights consistent with the S&P 500, or use your own weights to meet specific Investment Objectives.”

Track performance

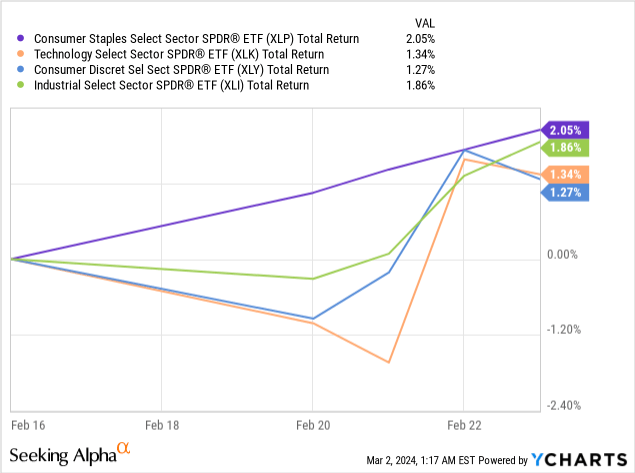

Here’s how the SPDR industry performed last week (February 18-22).

XLP beat the “hot” sector, which is a big change from the past six months when XLK and XLF outperformed.

SPDR Performance Chart (State Street)

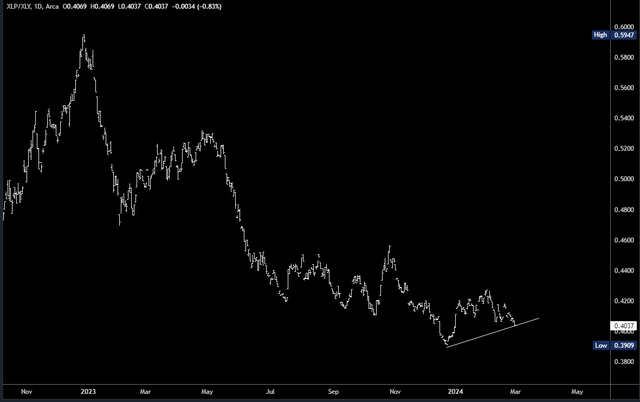

XLY falls somewhere in the middle and tends to outperform XLP during bull markets. However, after falling sharply in 2023, the XLP/XLY ratio has hit higher lows for two months in a row.

XLP/XLY (Trading View)

This rare outperformance suggests a rotation is underway. The question is how long it will last.

Why XLP Can Outperform

There are many reasons for industrial rotation. Economic cycles or phases will have a significant impact on stock market trends. There may also be fundamental catalysts such as the artificial intelligence boom, interest rates, etc…

Additionally, assuming no significant changes in drivers, rotation may be the result of an industry becoming overvalued, technically strained, and falling out of favor, making underperforming industries more attractive. That seems to be the case now. Just look at how far XLK has come compared to XLP last year.

XLK v XLP (State Street)

XLK currently has a price-to-earnings ratio of 34.80. XLY also has a high price-to-earnings ratio of 26.5, and while XLP cannot be considered “cheap,” its price-to-earnings ratio of 22.97 is at least realistic.Multiple extensions Can Raising that to 25 in a frothy market is obviously unlikely to fully catch up with the likes of XLY and XLK.

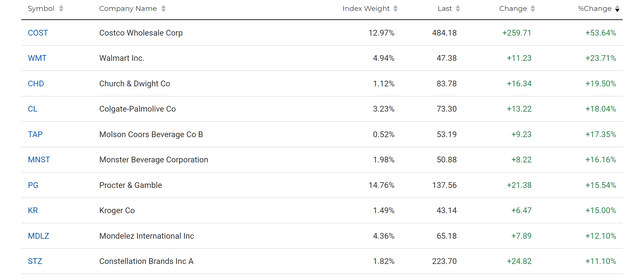

XLP’s top 10 stocks are about what you’d expect, as it holds the largest market capitalization stocks in the sector.

XLP Top Holdings (State Street)

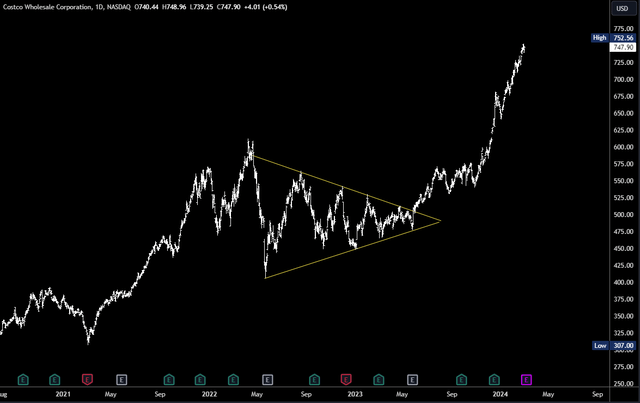

Costco (COST) has contributed heavily to XLP’s returns, with a weight of 12.99%, and has seen shares rise more than 50% in the last year since breaking out of a triangle consolidation.

Costco chart (Trading View)

XLP holds 38 stocks in total, and as this table shows, no stock has performed close to COST over the past year.

XLP top performer (State Street)

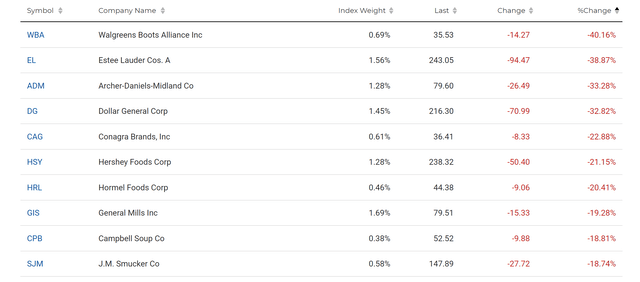

Thankfully, the worst-performing companies are lightly weighted.

XLP performs worst (State Street)

However, these stocks remain a drag, and the composition of the portfolio doesn’t suggest big gains ahead. In fact, XLP’s outperformance often means it holds up better when other industries come under pressure.

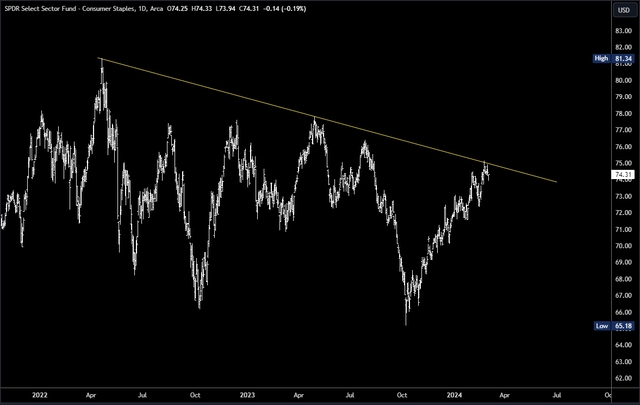

What I really want to see as a sign of a strong period is a breakout of a downtrend. XLP has been seeing lower highs since 2022, and a breakout of trendline resistance near $75 could lead to a test of highs at $81.34.

XLP Chart (Trading View)

A sustained trend above all-time highs looks unlikely – this is not a growth industry that can command a high P/E ratio. Even so, a move to $81.34 would still represent a gain of about 10% from current prices, and would likely be safer than chasing hotter sectors.

in conclusion

XLP’s performance has improved slightly of late as other “hot” sectors look stretched. This rotation may be temporary, but if the trendline near $75 can be broken, it may signal relative strength in the longer term and suggest that accumulating XLP before it tests $81 would be beneficial.