Black Jack 3D

Overview

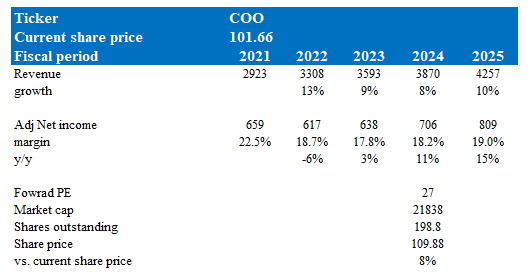

I previously gave Cooper a Hold rating (Nasdaq: COO), because I think the valuation is too high at that time, which is July 2023.I believe my call was correct as the stock has returned sharply to its original levels The forward price-to-earnings ratio has historically traded at multiples of 19-22x, causing the stock price to pull back sharply from about $100 to $75 in just 3 months. As COO’s fiscal year 2023 comes to a close, I wanted to provide an update on the business and my outlook. My recommendation on COO is a Buy rating, with an expected return of 8% in 6 months (annualized return of approximately 16%). My view is that the near-term demand outlook remains very strong and COO has the right products to continue growing. As revenue expands, its margins should also improve, returning to fiscal 2022 levels. Therefore, although 27 times forward PE The multiple remains high compared to history, and I think it’s likely to remain at this level in the short term.

Recent results and updates

Total revenue in the first quarter of 2024 increased 8% on a constant currency (CC) basis to US$932 million, with CooperVision (CVI) sales of US$621.5 million (organic growth of 7%) and CooperSurgical (CS) sales of US$621.5 million. $310 million. Total revenue beat consensus estimates of $916 million. From the income statement, due to the price efficiency of CVI and CSI, the gross profit margin was 67.3%, about 130 basis points higher than market expectations. Adjusted earnings per share also beat the consensus estimate of $0.78. For FY24, management raised revenue guidance to $3847 to $3897 million from the previous range of $3809 to $3877 million, implying organic growth of 7% to 8% from 6% to 8%, with a slight increase at the midpoint . Earnings per share guidance was also raised to $3.50-$3.58 from $3.40-$3.50.

The COO has executed extremely well and started fiscal 2024 with great success, which leads me to believe that this momentum has a good chance of continuing in the near term. Looking back, operating long contact lenses have consistently outperformed the market with high-single-digit (HSD) to low-teens percentage growth (note that management talked about market growth during the earnings call; see source), thus Resulting in sustained share capture, which I think is a strong testament to product fit and distribution capabilities. I expect the Chief Operating Officer will continue to provide strong leadership in high-growth product areas such as torics and multifocals. Management discussed this in depth during its recent conference call, so I won’t repeat them, but I quoted some key statements worth highlighting below. Therefore, my view is that COO is well-positioned to continue growing the contact lens industry for the foreseeable future. In addition to product leadership, COO also owns the field of myopia management.While this is still a small part of the company and growing slowly, the COO has Mishi and glass. My view is that this basically expands the COO’s addressable market, and with their track record of launching the right products, I believe they can repeat the same success they’ve seen in other markets, and I think the recent results are promising of. Note that if not for MyDay’s capacity shortfall, growth in the first quarter of 2024 would have been better as MyDay’s demand is rapidly increasing.

Our market-leading toric design continues to drive demand for this product, reflecting Biofinity’s design and our industry-leading SKU range, which is by far the broadest range of torics on the daily market.

In addition to samples, demand for Biofinity remains strong, led by toric and multifocal lenses. It’s worth highlighting that our Biofinity toric multifocal lenses are booming as eye care providers continue to use them as the primary lens for patients with more complex vision needs that require balancing presbyopia with varying degrees of astigmatism.

It’s going to continue to have strong momentum as you continue to attract wearers, whether new or existing, moving themselves toward everyday wear, toward torics and multifocals.Excerpted from: 2024 First Quarter Earnings Conference Call

As for the CS division, I see it as a cash-generating division that funds the core growth business, CVI. Comparing the divisions, CVI’s FY23 EBITDA margin is about 16%, while CS’s EBITDA margin is about 28.5% (almost double). Management has also done a great job of restoring revenue growth from about 5% to about 10% in fiscal 2023. While some of the growth is driven by M&A, management’s guidance for fiscal 2024 growth of 5% to 7% seems reasonable given organic growth of 8% in the first quarter of 2024. I expect this segment will continue to generate cash for the COO to reinvest in the CVI segment.

All in all, I have to say that the COO has done a great job of delivering continued top-line strength and, importantly, translating that into more consistent top lines. Contact lens demand trends remain strong (per Q1 2024 earnings call), the market itself is growing healthily, and COO has the right products in high-growth segments, which should allow it to continue growing at a similar rate. As the macro backdrop improves, I’m optimistic that growth may even accelerate in the near term, which could translate into upside EPS growth, supporting the current premium valuation.

Our earnings are strong, we have good momentum, our capacity expansion is well underway and demand remains very healthy.Beginning with the 2024 Q1 Earnings Conference Call

Valuation and risk

Author’s valuation model

According to my model, based on a forward P/E ratio of 27x, COO’s near-term valuation is about $110, representing growth of 8% in 6 months (or about 16% on an annualized basis). This target price is based on my growth forecast of 8% in FY24 and 10% in FY25. My fiscal 2024 growth forecast is based on guidance, which I believe is achievable based on Q1 2024 momentum (8% organic growth) and the current demand outlook. As the macro backdrop improves, I believe growth will accelerate in FY25 due to overall improvement in consumer demand. Likewise, I forecast margin expansion in FY24 and FY25. My assumption is that with revenue up nearly 30% from fiscal 2022, COO should at least achieve higher margins than then. Finally, I understand that the forward P/E ratio of 27x I mentioned earlier is high, but given the strong demand outlook, a clear recovery in macro conditions going forward, and a short-term investment horizon of about 6 months, I think the valuation is likely to remain at this level for some time to come. short term.

risk

While I think it’s reasonable to trade at this level, we’ve seen what can happen when the macro outlook turns negative (rates peaking at 5-5.25% in July 2023). Even though the Fed has reinforced its view of tripling interest rates this year (just last night), COO valuations could take another big hit if they go back on their word. One specific risk for the company is if myopia becomes a very serious problem. When myopia can be corrected with contact lenses or glasses, this is good for COO, however, in severe cases of myopia, the patient may undergo surgery (i.e. Lasik) to improve vision. In this case, the need for COO will be affected.

generalize

To summarize this article, the recommendation for the chief operating officer is a buy rating. While COO was previously rated a Hold due to its high valuation, a strong start to fiscal 2024 and better-than-expected revenue and earnings have changed my view. I expect COO to continue to benefit from strong demand for contact lenses, particularly in high-growth segments such as toric and multifocal lenses, and should grow above market levels given its share of high-growth segments. Additionally, MiSight and SightGlass have significant growth potential. There is upside potential, especially if the macro environment continues to improve. The main risk is the potential for a valuation correction if the macro backdrop weakens or the Fed changes monetary policy.