tupungato

Crocs (NASDAQ: CROX) appears to be a little-known company, and given its industry (footwear retailer) and controversial product, may not make for a tempting argument – vs. Several articles on how their brands achieved billionaire status Selling “ugly shoes”. Crocs stock has proven to be an excellent investment and continues to be attractive.

CROX stock currently trades at an attractive valuation level of around 10.7x NTM P/E, which combined with a solid track record of execution and growth makes it an interesting subject for compounding given the company’s growth and good prospects, and likely to sustain Its free cash flow and its compounding effect for shareholders.

Great business model and great history

Looking at Crocs’ business model, we can summarize it as selling shoe designs, e.g. Casual styles such as clogs and sandals have a high added value due to their brands and multiple partners.

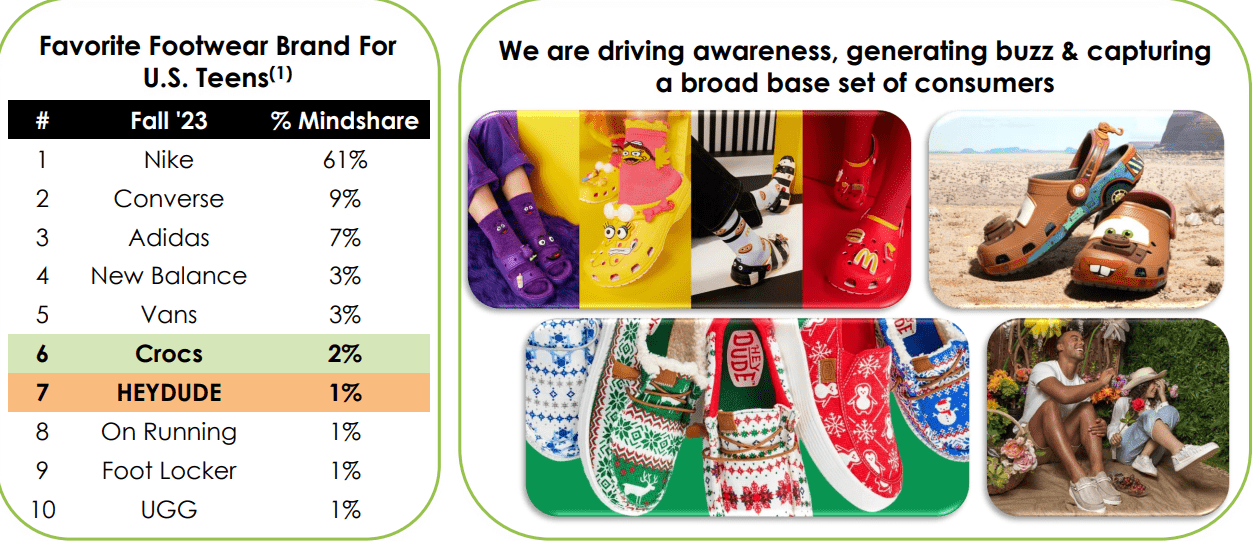

With this brand strength and brand strategies such as leveraging partnerships to develop themed shoes e.g. Cars movie with Disney Pixar and Even the NBACrocs has successfully strengthened its market over time, as shown in the table below.

Crocs Investor Presentation

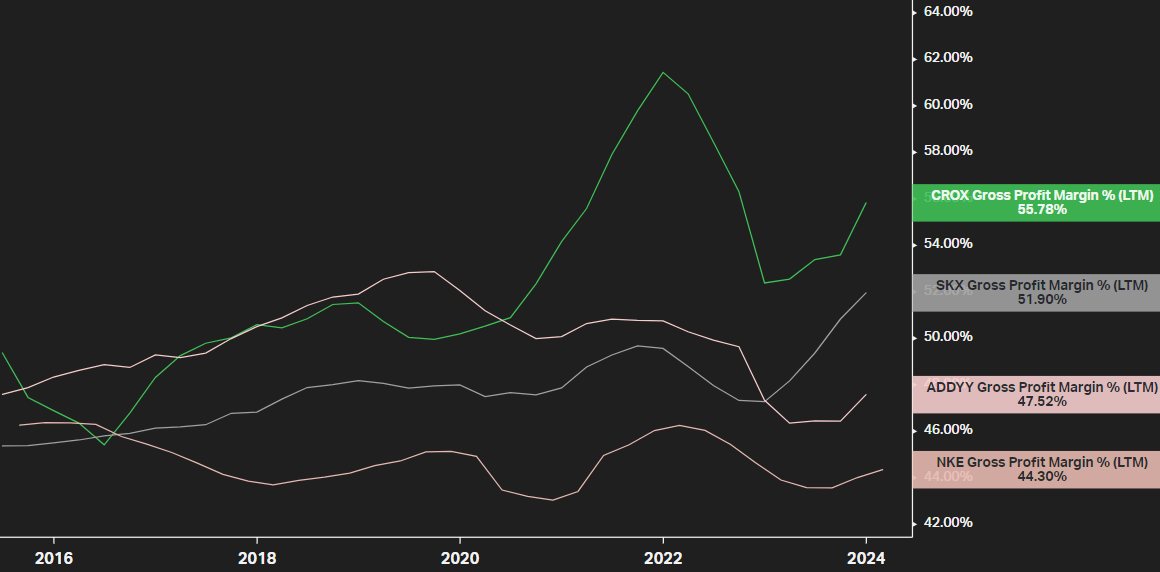

Producing relatively “simple” but high-added value products is directly reflected in its financial position. Its profit margins are higher than those of its peers. For example, LTM’s gross profit margin reached 55.7%, compared with 51.9% for Skechers (SKX) and 44.3% for Nike (NKE).

coyfin

The same goes for operating margins, which at 27% outperform peers such as Birkenstock, Deckers, and Steve Madden.

One piece of news worth mentioning is that at the end of 2021, the company announced Acquired HEYDUDE for US$2.5 billion, to complement its product portfolio. first, The market did not give this acquisition a presumption of innocence.That, coupled with some weak quarters, resulted in Crocs stock falling more than 70% from its November 2021 peak. One of the concerns about Crocs is its leverage, which is around 2.1x. But as promised, the company delivered and maintained healthy cash generation, being able to repay about $1.2 billion since the acquisition, with a debt-to-EBITDA ratio of 1.3x in the fourth quarter.

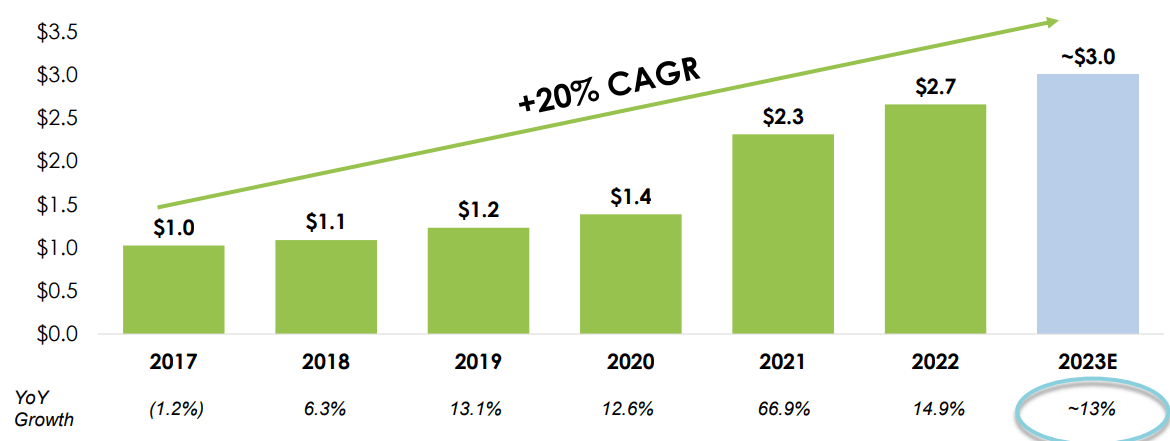

Even without acquisitions, the company’s transformation in mid-2017 has turned Crocs into a compounding machine, with revenue growing at a CAGR of 20% between 2017 and 2023, with the brand hitting the $3 billion mark, considering HEYDUDE earns $3.96. In 2023, HEYDUDE will account for 24% of the group’s revenue.

Crocs brand revenue growth (Crocs investor presentation)

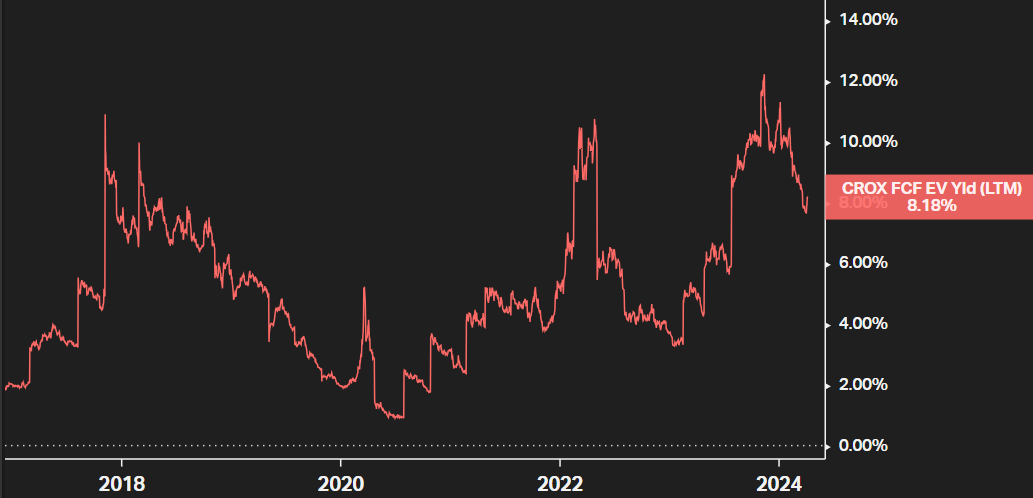

Free cash flow yield (free cash flow/EV), a metric that highlights the robustness of Crocs’ business model and its cash generation capabilities, is 8.18% LTM, which is quite attractive considering its peers or other companies. Even free risk rates.

coyfin

Based on this information, I believe that Crocs has successfully established a very interesting business model in recent times. Given the track record, the capital allocation priorities mentioned in the company’s presentation appear feasible and should benefit shareholders: 1. Brand growth investment, 2. Debt repayment, 3. Return of capital to shareholders.

One achievement already mentioned that illustrates this capital allocation efficiency is its ability to deleverage post-acquisitions, using the cash it generates to pay down debt. Now that Crocs has reached its leverage target (debt to EBITDA ratio), it may return to buybacks. In 2023, the company paid down $666 million in debt and repurchased $175 million worth of Crocs stock (at an average cost of $104).

The future of Crocs

According to the latest earnings call, the company still believes Crocs is a scale business that can easily reach the $5 billion brand level, but given the changes in the supply chain scenario, that is no longer possible by 2026. Another factor mentioned during the earnings call was the company’s positioning in 2024. The CEO said Crocs has a “strong pipeline of licensed product partnerships” that they will introduce throughout the year.

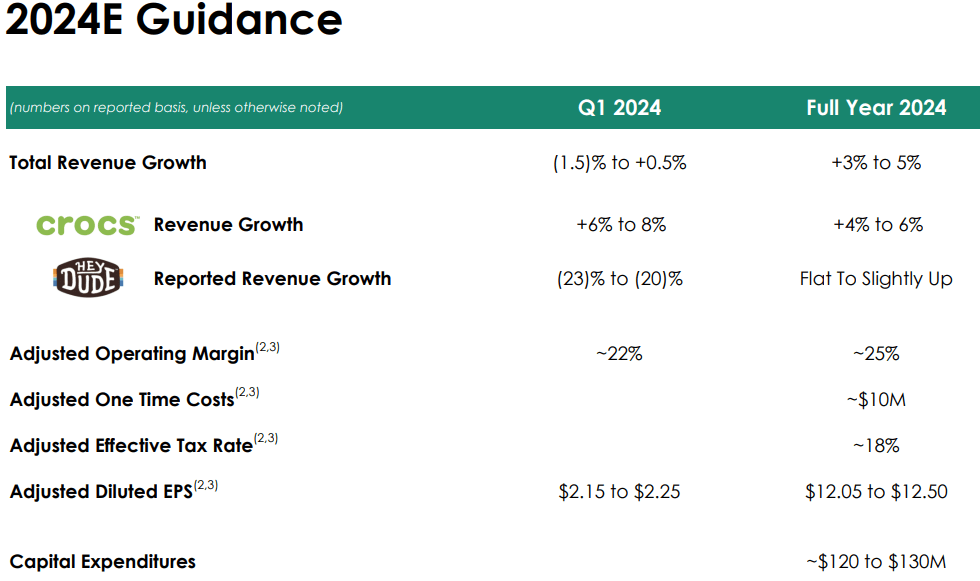

But the biggest influence on my forecast, not just market forecasts but guidance on the long-term continuation of these gains, is the guidance for 2024. The company’s forecast paints a complex 2024, with margins under greater pressure, particularly in the first half of 2024, driven by HEYDUDE and growth in investment and SG&A. Although HEYDUDE’s margins are under pressure, some initiatives have been taken, such as reducing the brand’s inventory, which fell from $169 million to $104 million in the year-over-year comparison. By taking these actions, the company can ensure it doesn’t have too many products in inventory, helping access, sales and price.

The guidance still considers an EPS floor of $12.05, which gives us a forward P/E of approximately 11.1x.

Fourth quarter earnings report

Regarding profit margins, I believe Andrew Rates’ speech summed up the mid- to long-term expectations well:

We still think our company’s operating margins are in the mid-20s. But it won’t be higher than 26% every year. We believe it is prudent to invest incremental capital from time to time to create capabilities that enable us to grow in the future. ” —Andrew Rees, CEO, Crocs

Some Risks of Crocs Papers

While the strength of this article is its business model (and its attractive valuation), I think the main risk is related to its market segment. Crocs, as a retail and fashion business, is very sensitive to certain factors, such as subtle moments in the macroeconomic situation and changes in trends.

Factors such as Citizen debt increasesDisposable income, unemployment and inflation directly impact Crocs’ business, and while a U.S. recession is no longer a consensus, worse times in other parts of the world could impact the company’s international expansion, such as a weakening economy in China. Nonetheless, this risk is inherent in most papers, and economies are cyclical.

Fashion trends, on the other hand, make me more conservative in maintaining Crocs’ finances. In recent years, the company has managed to create a strong brand and even push (and be pushed by) some fashions, for example in Asian countries.One that illustrates this is “Wooden Followers” (or “Dongmen”), a subculture in China.

So while it’s a niche that can continue to expand, especially given management’s great job introducing new licensed products, diversification, etc., it’s also a niche that’s subject to trends – if in a few years After this trend changes and the company doesn’t know how to pivot its products into new fashions, net sales may struggle.

The market underestimates the potential of Crocs

I don’t think Crocs’ paper really needs a complicated DCF, it could be a paper about not overthinking it and looking at P/E ratios, business models and prospects. Regardless, in order to determine a fair price for Crocs stock, I established a DCF.

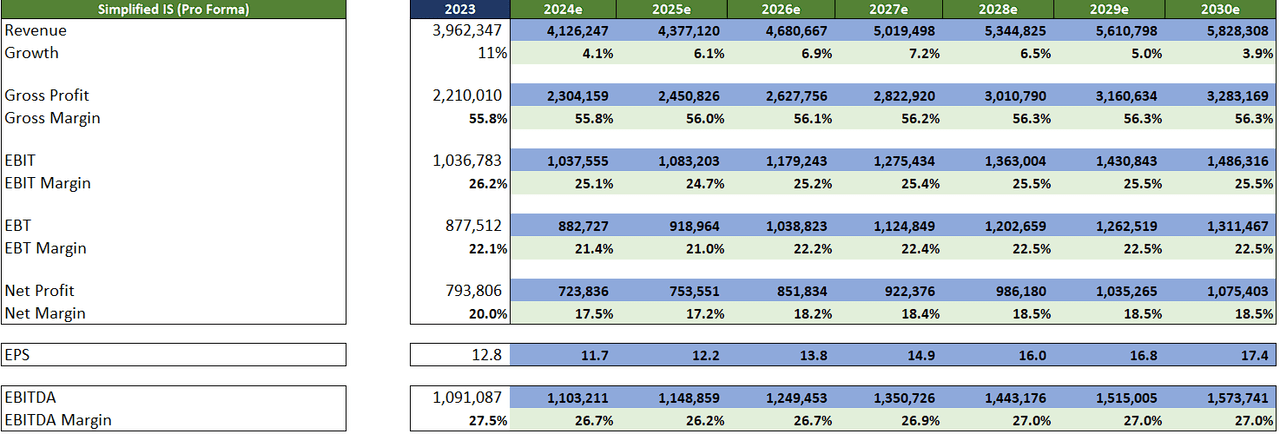

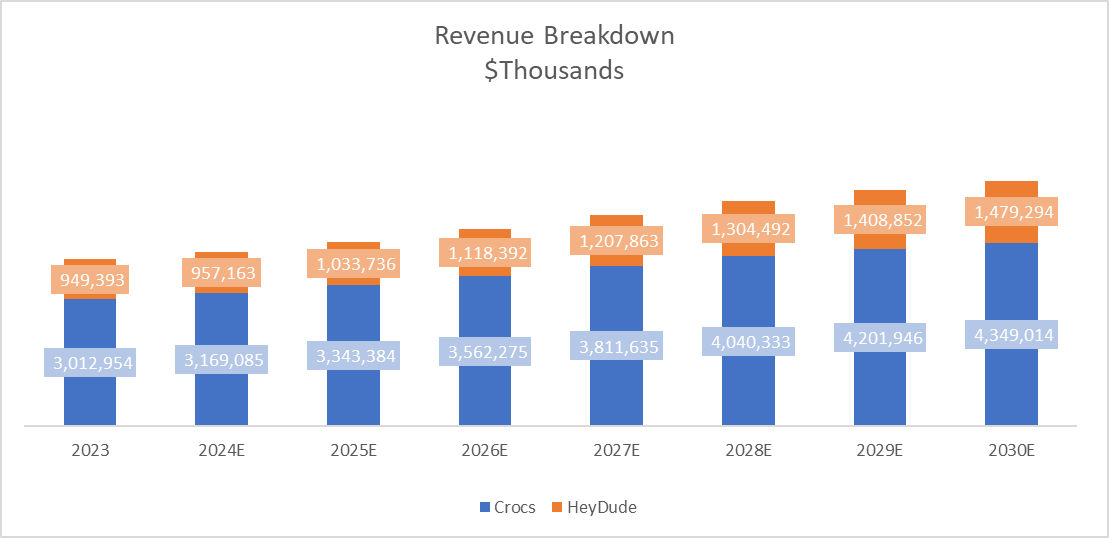

Most of my assumptions are conservative, based on 2024 guidance (slightly lower EPS in my forecast) and other aspects covered in the Crocs Outlook section. I draw attention to the fact that while the company (including HEYDUDE) will reach $5 billion in revenue in 2027, over the long term, revenue growth will remain weak despite accelerating from 2025 to 2027.

Authors and Crocs

It’s worth noting that using more conservative short-term growth assumptions, HEYDUDE’s revenue share declines in my model until mid-2027, when it returns to 24% and starts growing slightly more than Crocs, Reach 25% by 2029. This lower growth (and lower operating margins than the main brand) is another reason for market distrust.

Authors and Crocs

Other DCF locations include:

-

CapEx: ~-3.2% of revenue in 2024 (at the upper end of guidance), declining to -3% (closer to recent history) and 2.5% after 2030 to match lower projected growth and reflect a more mature company .

-

Final growth rate: 2%, reflecting a situation close to inflation, that is, a situation without growth and efficiency gains, only price transmission.

-

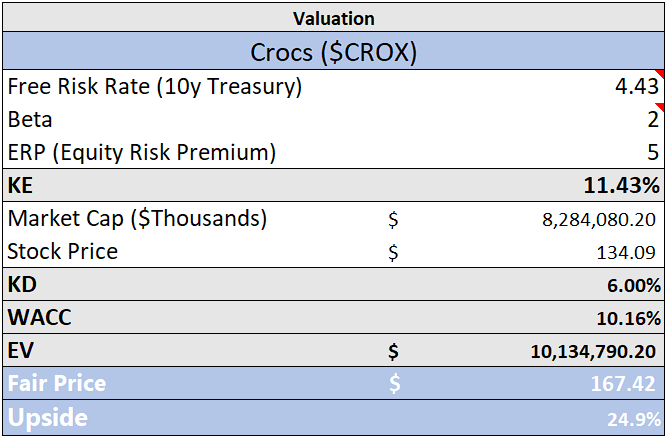

WACC: 10.16%, calculated through a free risk rate of 4.43% and an ERP of 5%, KE is 11.4%.

Based on these assumptions, discounting the projected cash flows, a fair price for CROX stock is $167.4, indicating an upside of approximately 25%.

Author; Koyfin (Beta); CNBC (U.S. 10-Year)

While this isn’t a huge upside, it already shows that Crocs stock has a reasonable margin of safety and how pessimistic the market’s assumptions are that they expect a company that has managed to deliver interesting growth to emerge. Moderate growth in recent years.

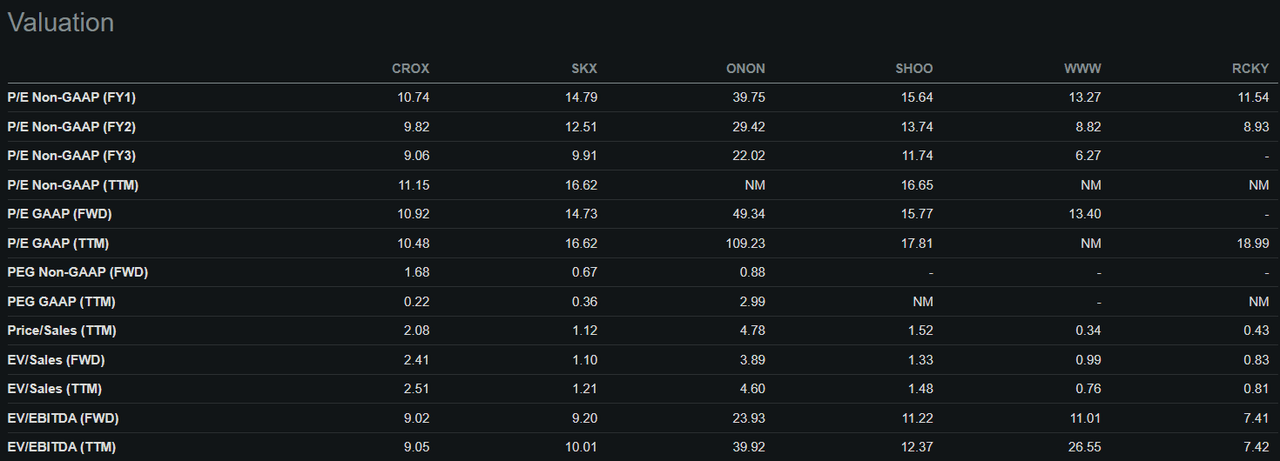

Looking at multiples, the results are similar: Crocs has the lowest price-to-earnings ratio, FWD, among its peers, according to seeking alpha’s valuation table.

Seeking Alpha

bottom line

Therefore, I believe Crocs’ thesis combines an attractive valuation (measured by different metrics) with a strong company that has been able to develop a large moat in recent times (primarily brand power/awareness) , and should be able to sustain interesting growth over the next few years, possibly even beating market expectations.

This leads to the view that Crocs should be a company that can deliver value to shareholders over the long term, not only through growth in free cash flow, but also through leveraging it for buybacks (and/or dividends). These factors justify my “Buy” rating on the company.