Sofinavit Inkau

We previously reported on Crocs, Inc. (NASDAQ: CROX) in December 2023, discussed why the stock’s recovery from its October 2023 bottom may not be sustainable.This was attributed to slower growth of its core brands and HeyDude Results were disappointing, compounded by slowing sales in North America.

Since it no longer offers a compelling growth story and has no dividend, we believe the stock will trade sideways at best until management can deliver compelling sales growth.

In this article, we discuss why we changed our previous Hold rating to Buy as CROX management provides promising guidance for HeyDude’s sales recovery in the second half of 2024 and strong cash flow is well put to use Retirement on deleveraging and stock counting.

Combined with its valuation discount, we may see the stock Assuming FWD’s P/E ratio rerates closer to its historical average and industry median, it could double in the coming years.

CROX investment thesis has improved significantly and the worst is behind us

Currently, CROX reports top/bottom line revenue of $960.1 million (-8.1% QoQ/+1.6% YoY) and adjusted EPS of $2.58 (-20.6% QoQ) on its Q4 2023 earnings call /-2.6% year-on-year), the figures for fiscal year 2023 are $3.96B (annual growth of 11.5%) and $12.03 (annual growth of 10.1%) respectively.

The main reason for the year-on-year growth is the strong demand for its core brand Crocs. The brand’s revenue in the fourth quarter of 23 was US$732.45 million (-8.3% quarter-on-quarter/+9.9% year-on-year), and revenue in fiscal year 2023 was 3.01B. USD (+13.5% year-on-year).

This nicely balances HeyDude’s flat sales of $227.64 million in Q4 2023 (-7.8% QoQ/-18.4% YoY) and $949.39 million in FY23 (+5.9% YoY).

This is primarily due to the market digesting oversold inventory in 2022, resulting in soft wholesale sales, leading HeyDude to lower its fiscal 2023 HeyDude sales guidance during its 2Q23 earnings call.

Despite so, CROX’s balance sheet continues to improve, with the management consistently deleveraging to long-term debts of $1.64B (-14.1% QoQ/ -28.3% YoY), triggering a lower debt-to-EBITDA ratio of 1.69x by the latest One quarter.

In comparison, the growth rate in 3Q23 was 1.98x, and the growth rate in 4Q22 was 2.93x, which was close to the 1.34x reported in FY2019.

While the stock doesn’t pay a dividend, shareholder returns have been excellent, with management writing off 1.52 million shares / 2.4% of its outstanding shares in the last 12 months and 8.86 million shares / 12.6% since FY19 .

Therefore, while we remain unsure of HeyDude’s synergy potential, we believe CROX excels in both managing inbound receipts ordered prior to acquisition and the challenging price matching of gray market goods.

Especially because we observe continued improvement in its sell-through rate, with HeyDude inventory levels easing to $104 million (-6.3% QoQ/-38.4% YoY) and ASP stabilizing at $30.65 (up 3.2% QoQ/YO) to the most recent quarter.

At the same time, CROX management made optimistic forward-looking comments, in which HeyDude inventory correction may be completed in the first half of 2024, and sales in fiscal 2024 will be “flat to slightly higher” year-on-year.

With the worst of HeyDude’s headwinds behind us, we can also understand why management provided relatively promising fiscal 2024 headline adjusted EPS guidance, with the midpoint coming in at $12.27 (up 1.9% year over year) versus consensus estimates of $11.95 (-0.6% y/y).

Coupled with growing international demand for CROX products, fiscal 2023 revenue was $1.38B (+24.3% year-over-year), well balancing the decline in domestic sales, which was $2.57B (+5.7% year-over-year), compared with fiscal 2022 With year-on-year levels of +38.7% and +62% year-on-year, we believe its prospects remain bright.

Crokes Valuation

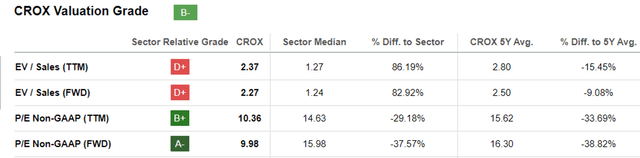

Seeking Alpha

Due to these promising developments, we believe the pessimism in CROX stock valuation may be overdone, as FWD EV/sales discounted is 2.27x and FWD P/E is 9.98x.

In comparison, the pre-epidemic average was 1.74 times/20.64 times, and the industry median was 1.24 times/15.98 times.

Even compared to consumer discretionary stock peers such as VF Corporation (VFC) at 1.19x/14.61x, Nike (NKE) at 2.95x/27.64x, and On Holding AG (ONON) at 5.43x/60.04x, it’s clear that CROX is undervalued here, and its prospects may become brighter as the HeyDude headwind dissipates.

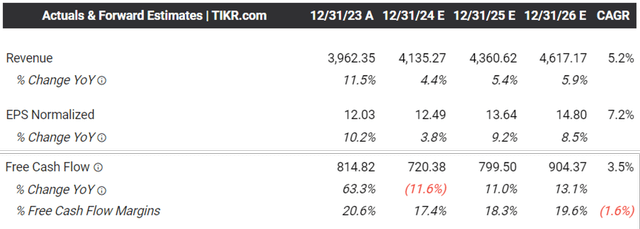

Consensus forward estimate

Tikkel Pier

The same upgrade is also observed in consensus forward forecasts, with CROX expected to post better profit expansion at a CAGR of +7.2% through FY2026.

This compares with the previous forecast of +4.28%, although this is a significant slowdown from the historical growth rate of +105% from fiscal 2017 to fiscal 2023.

If anything, CROX’s expected earnings expansion likely won’t pale in comparison to VFC’s -4.8%, although significantly behind NKE’s +14.5% and ONON’s +37.4% over the same period, meaning We may see a rating upgrade for CROX at a valuation close to VFC’s future.

Additionally, readers may want to note that CROX’s free cash flow generation is expected to remain exemplary over the next few years, allowing management to consistently pay down debt to its leverage target of 1x to 1.5x, with $875 million still remaining on its shares Repurchase Authorization.

So, is CROX stock a buy?sell, or hold?

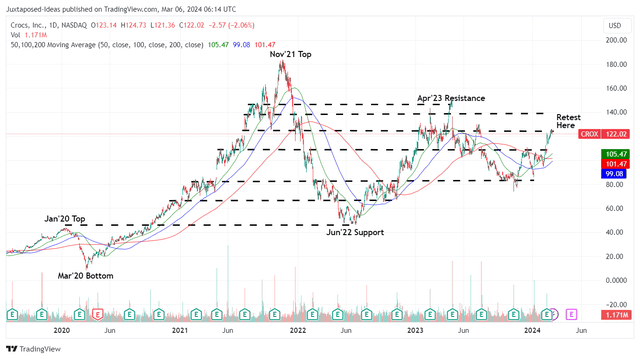

CROX 4-Year Stock Price

trading ideas

With excellent shareholder returns, a healthier balance sheet, and promising forward guidance, we can see why CROX was able to quickly break above the 50/100/200 daily moving averages while retesting previous resistance at $120.

Based on fiscal 2023 adjusted EPS of $12.03 and a discounted FWD P/E valuation of 9.98x, the stock appears to be trading close to our fair value estimate of $120.00.

Based on consensus FY2026 adjusted EPS of $14.80 and a speculative re-rating of FWD P/E close to the 5-year average of 16x, we could also see CROX providing nearly double upside to our long-term price target of $236.80 potential. The industry median is 15.98 times.

We are cautiously re-rating CROX stock to Buy due to the attractive risk/reward ratio at current levels, but do not have a specific entry point as it depends on individual investor dollar cost averaging and since the stock went public investment trajectory since then. Reversal may take a while.