Parady Kisiliku

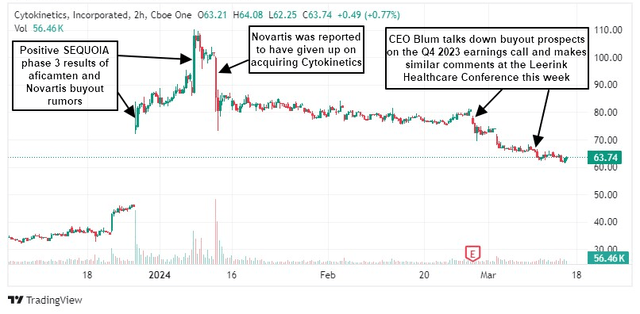

shares Cell dynamics (NASDAQ: CYTK) is down 40% from early January highs as bullish investor sentiment driven by aficamten’s positive Sequoia Phase 3 results and takeover speculation weakens, initially after new rumors of a Novartis exit surfaced. Chief Executive Officer Blum recently discussed acquisition prospects during an earnings call in late February and at this week’s Leerink Healthcare conference.

Seeking Alpha, TradingView

The stock has fallen more than 20% since my late December 2023 article, in which I highlighted aficamten’s very strong SEQUOIA Phase 3 results and said the company was an attractive takeover target.

Bloom has been unusually forthright in his comments since late February, making it clear that the company has not initiated a sale process.The comments are unusual because CEOs and other senior executives typically decline to comment on takeover rumors. This often allows takeover speculation to continue and the stock to be bought at a relatively strong price.

What does CEO Bloom say?

CEO Robert Blum made the following remarks during the 2023 fourth-quarter earnings call in late February (emphasis added):

While we will not and cannot comment on specific speculation, let me clarify one thing, We have neither initiated nor ongoing sales process. However, as a fiduciary responsible to our shareholders, I can assure you that we will thoroughly evaluate the options presented. As you just heard me say, We continue to advance business development discussions. We are optimistic about the progress of these discussions and we are committed to building a sustainable specialty cardiology company that executes on our goal of bringing new medicines to patients first.

Later on the phone he said:

Our priority remains business development. You know, we have been focusing on Japan trading of aficamten. We are in active discussions with multiple parties and I am pleased with the progress of transaction activity.

Here’s what Bloom said at the Leerink conference:

We recognize that there is a narrative surrounding Cytokinetics that heralds an acquisition, and we do not deny that, but we also recognize that we can maximize shareholder value in different ways than just through acquisitions. As a means of exit to reward shareholders, we believe we can double or even triple our potential to increase shareholder value because it makes it possible for us to be able to control our own things while also recognizing that we have an obligation and a fiduciary responsibility to do the best we can. Things that are conducive to serving shareholders. So we will respond to inquiries and at the same time we will manage what we can manage.

From these comments, we know that the company has not initiated a sales process, nor is there an ongoing sales process, and the way he structures business development discussions points to partnerships in specific regions such as Japan. An announcement of such a partnership deal could lead to a further deterioration in M&A sentiment and a decline in the company’s value as it would give up part of the network economy to potential partners.

What’s next for cell dynamics?

I established a position at Cytokinetics in mid-January and shared with my subscribers my reasoning for this decision – which was driven entirely by expectations for the acquired company. However, I do acknowledge that a deal is unlikely in the short term and some patience will be required.

The rumor at the time was Novartis (NVS) has left but other companies have joined the bidding process – Amgen (AMGN) and Johnson & Johnson (JNJ), there have been no new rumors in the past two months.

Either way, aficamten is a very attractive asset with at least similar properties and probably better than it Bristol-Myers Squibb Company (BMY) Camzyos (mavacamten). A simpler titration process, better top-line efficacy across trials, and a seemingly improved safety profile make it an attractive candidate for patients with obstructive hypertrophic cardiomyopathy (‘oHCM’) and potentially patients with non-obstructive HCM. Select (see the December article I linked to for additional analysis and data comparisons). Unlike the rest of the crowded and large specialty drug market, Camzyos and aficamten are the only ones on the market and near-market, respectively, and don’t have much competition in development.

In the absence of an acquisition, the focus will turn to aficamten’s data presentation starting next quarter. The company shared the most relevant information about the SEQUOIA trial in its headline press release in late December, and we should see more detailed data provided and released throughout the year that should shed more light on aficamten’s efficacy and safety. Sex and how it compares to Camzyos.

aficamten is expected to submit regulatory applications to the FDA and EMA in the third quarter and fourth quarter respectively.

There are also some smaller early-stage candidates happening this year – results from a Phase 1 trial of another cardiac myosin inhibitor, CK-586, will be available in the second quarter, and a Phase 1 trial of the cardiac troponin activator CK-136 Also completed in the second season. second season.

There are some outside catalysts this year coming from Camzyos. In addition to Bristol-Myers Squibb’s quarterly sales update (more on Camzyos in the next section of this article), we should also see Phase 2 results for Camzyos in heart failure with preserved ejection fraction (HFpEF). Phase 2 results from Camzyos will reveal additional and potentially significant market opportunities in the cardiac myosin class and should have meaningful implications for aficamten given the similarities between Camzyos and aficamten.

More important events are expected in 2025 – potential FDA and EMA approvals and commercial launch of aficamten, as well as results from the MAPLE-HCM trial of aficamten in patients with obstructive HCM, which could further improve its clinical profile. The MAPLE-HCM trial is comparing aficatan to beta-blockers, and Cytokinetics expects to show the superiority of aficatan monotherapy in terms of efficacy and safety. As a reminder, in the SEQUOIA trial, aficamten was studied above standard of care and the initial labeling will be based on this.

On the external front, Bristol-Myers Squibb is expected to report Phase 3 results for Camzyos in patients with non-obstructive HCM and a strong readout for aficamten in the same population.

Cytokinetics is just a year behind in the non-obstructive HCM cohort, as the company expects to complete enrollment in the ACACIA-HCM trial in 2025 and report data in 2026. However, such a catalyst is still far away in the next 12-18 years. months.

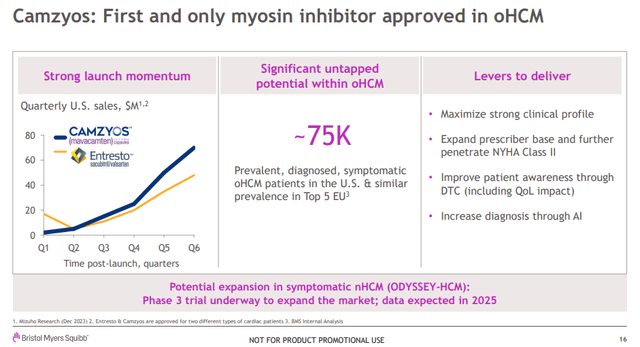

Camzyos sees strong performance in 2023, good growth prospects

Camzyos achieved net sales of $88 million in the fourth quarter of 2023, a very significant increase from $68 million in the previous quarter.Back in January, Bristol-Myers Squibb highlighted the adoption of Camzyos and how it compared to the launch numbers of other drugs Novartis (NVS) Entresto’s global net sales in 2023 will reach US$6 billion.

Bristol-Myers Squibb Investor Introduction

The launch of Camzyos outside the U.S. is another important lever Bristol-Myers Squibb has pulled this year, and it should help accelerate its sales growth in the coming quarters, although Bristol-Myers expects sales outside the U.S. in the second half Contributions will increase. Pricing and reimbursement times vary by country.

These numbers and comparisons are very encouraging for Cytokinetics and aficamten as they confirm there is an unmet need and a larger market, and it’s great to see Camzyos adoption improving after an initial slow start.

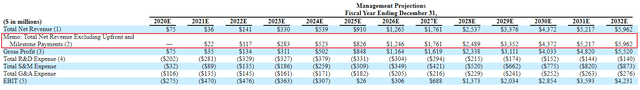

Entresto’s sales in its third year on the market were $507 million (of which $297 million was in the United States). Camzyos sales in the United States this year are likely to reach or exceed $500 million. I think there is a good chance of meeting or exceeding Myokardia’s sales forecast. SEC Filings Net income will be $523 million in 2024 after announcing $13.1 billion in acquisitions. This target is achievable, although Camzyos is approved in April 2022 and Myokardia’s forecast includes (modest) sales contribution as early as 2021.

Cardiomyopathy SEC Filing

With the potential addition of non-blocking HCM to the Camzyos label and the rise in HFpEF, I think Myokardia’s $13.1 billion price tag may be justified and that Cytokinetics can create value at current levels and acquire similar or potential acquisitions of higher prices.

risk

With the stock trading in the mid-60s, I believe most of the acquisition premium is already beyond Cytokinetics’ valuation, but based on the company’s actions, further declines are possible.

By company behavior, I mean other comments by CEO Bloom or other senior executives downplaying the prospect of acquisitions and potential partnership decisions. For example, Blum has made it clear that the company intends to partner with Japan’s aficamten, and I would expect such an announcement to have a short-term negative impact on Cytokinetics’ stock price, not just because it reduces the likelihood of an acquisition in the near term but also because it reduces the company’s exposure to the Japanese economy. participation.

Other risks include:

- aficamten’s SEQUOIA data presentation and publication were not well received by the investment community or showed efficacy or safety data not included in the December 2023 top-line press release.

- Delays in NDA and MAA submissions and regulatory setbacks for aficamten, such as delayed decisions by the FDA and EMA or one or the other agency (or both) to reject Cytokinetics’ application, whether for bureaucratic reasons, manufacturing issues, safety or efficacy issues.

- If approved, aficamten’s label may look similar to Camzyos or have the same warnings and REMS procedures. Based on the company’s comments, it seems it’s expecting a better label than Camzyos, and at least less hassle than Camzyos’ REMS plan.

- Even after the 40% cut in the stock price, Cytokinetics’ valuation still implies higher sales expectations for aficamten, which could be lower than expected if the company launches aficamten as a standalone entity.

- The company is financially strong with approximately two years of cash runway and active market products in the fourth quarter and current quarter of 2023, but without the Cytokinetics acquisition it could be further diluted in the coming years following the approval and launch of aficamten .

in conclusion

Cytokinetics’ share price has now fallen to a level that I think is very attractive. I’m more cautious about near-term acquisition prospects following CEO Bloom’s recent comments, but I still view the company as one of the most attractive acquisition targets in the biotech industry.

I still think Cytokinetics’ standalone value is in the $94-$108 range, and expect the acquisition price to be at least in that range, and possibly/likely higher, as I believe the company wants to be at least slightly higher than Bristol-Myers Squibb’s price Some Bristol-Myers Squibb pays for cardiomyopathy.