Gaferra

Xtrackers MSCI Japan Hedged Equity ETF (NYSE: DBJP) is a yen-hedged value-weighted ETF that follows the most representative index in the Japanese market.There are many reasons to be optimistic about the Japanese stock market. In our reports, Japan is still the The most overweighted market. However, many unanswered questions about the yen and speculation surrounding the Bank of Japan’s turn will impact how you play the market. important, Data just released about Chundu Japanese union wages rise, these numbers are quite high enough to cause real wages to rise more markedly.Our last report focused on Dollar, we believe the Fed has expressed concerns about the economy.We have recently consolidated this idea by noting how mature wall There may be an important Adding to the impact of the Fed’s policy transmission could change the dynamics. Now we want to talk about what is happening in Japan.

We remain fairly calm on the tranche wage negotiation data as our thinking that money will be saved is the same as before and the rationale for the switch will not materialize as the market expects.This is what happened last time, it may be an inside story, but there is so much money We believe that if the yen tests its limits, the yen is unlikely to move lower even if the Bank of Japan is not willing to engage in stabilizing yen buying. While DBJP still exposes investors to upside risks in the Japanese market, we see no reason not to hedge against the yen through unhedged ETFs for possible upside. At some point, though, yen appreciation will become an issue for Japanese market performance.

DBJP segmentation

expense ratio is 0.45%.Because the yen is being hedged and there is a cost to this, the ratio is higher than Buy Japan Index Directly. This is another reason to look for not to hedge.

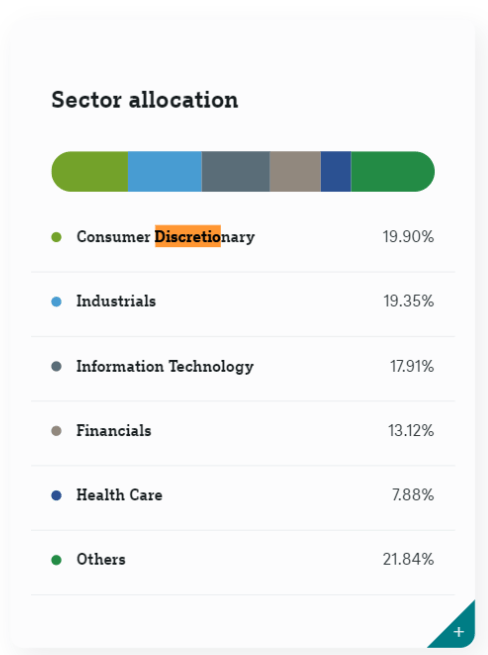

Looking at DBJP’s weightings, they are indeed value-weighted based on market capitalization. There is significant consumer discretionary exposure due to Japan’s large automotive companies, as well as Japan’s many equipment manufacturers, including auto parts makers. And then there’s a lot of IT risk and financial risk.

DepartmentDBJP (etf.dws.com)

A weaker yen helps many consumer discretionary exposures because they have such large markets outside the U.S. and Japan, especially in automobiles. Additionally, they are vertically integrated in Japan, so a lot of the services and goods that go into making the car are paid for in yen. The same argument generally applies to industry.

The financial sector is not benefiting from the current yen situation at all. While other developed markets have experienced large increases in financial risk exposure due to rising interest rates, this has not been the case in Japan. In addition, the insurance reserve portfolio has not benefited from the yields on fixed income and low-risk instruments due to lower prevailing interest rates.

Other exposures have considerable yen-denominated business and may not be affected by rising stock prices as the yen rises, meaning foreign investors would benefit from holding these yen-denominated bonds.

Overall, a stronger yen is not great for the Japanese market as it has a fundamental impact on the average of Japanese listed companies, which is all the more reason to be wary of DBJP as you may see the market do something negative reaction, without even getting anything in return. The comfort of foreign exchange gains. We believe that the broad market still has great potential, as Japan’s PE is still quite low, with the index at around 14x, lower than many other developed markets, and there are still many outstanding corporate governance reforms that have not yet been completed. We go into detail here.

About the Japanese Yen

So what might actually happen to the yen? Many headlines and commentators believe now is the time to raise interest rates. But does the data allow it?

First of all, we noticed a quite significant news. Rengo, Japan’s largest trade union federation, reported that their demand is a salary increase of 5.85%. This number is huge, even higher than last year’s request of 4.49%. Even if their demands are not fully met, wages will provide a significant boost to inflation, which is what Japan wants.

By the way, Japan actually wants inflation. This is not supply-side inflation, which is always bad, but potentially benign inflation in other economies that is missing from Japan’s stagnant economy. Wage inflation is particularly welcome as the Bank of Japan hopes higher wages will start a virtuous cycle into spending. That definitely didn’t happen last year. Wages are rising, but consumption is severely down, and even the export surplus growth brought about by the weak yen is not enough to prevent a technical recession. In other words, the marginal propensity to save is higher. We talked about this last time in the DBJP report. If this happens again, the Bank of Japan will no longer have reason to shift to a more accommodative stance.

Based on the actual inflation data we have seen recently, there is evidence that an easing stance may be on the way.inflation continue to decline, which isn’t actually necessarily what the Bank of Japan wants, but it’s progressing at a slower pace than expected and with lower expected inflation. An expected slowdown in deflation is positive for the yen as it is only slight evidence that conditions may be firming. Ueda also issued a statement on the impact, saying he also believes the data shows this is happening.

Firmer inflation is a good thing because it will give the Bank of Japan some room at the lower bound for interest rates. The combination of low interest rates and the possibility of consumers hoarding cash pushes things into a liquidity trap situation, which is a fragile position and is also bad for the yen, whose low levels have been weighing on consumers, Even the yen is good for export-oriented listed markets.

Another reason why the yen could rise is of course what could happen to the U.S. dollar, but relatedly, yen shorts are a very crowded trade because the yen has been in a short position on many currency pair trades. As the years passed, those bets only grew. Any sustained factors that may support the yen will result in significant unwinding of these leveraged trades.

bottom line

We remain overweight Japanese equities, particularly select Japanese stocks. But we admit that the appreciation of the yen is not a good thing for Japan’s listed giants. It is likely that the easing will last longer than the market expects, but the yen has been pushed so low that any major downside move seems unlikely at this time, so we would not be concerned about yen depreciation. If the yen appreciates, the Bank of Japan will face a double whammy: the market may not like this development in Japanese stocks, and the yen hedges against a fall in value. For investors looking to hold the Japanese market for the long term, we think it makes sense to move away from yen hedging, with a small adjustment on that basis, and towards unhedged ETFs. We will also further consider exiting Japanese large-cap stocks, which have performed extremely well. While their valuations still hold up, and valuations tend to be quite compressed and offer some margin of safety, a more selective approach to Japanese stocks will not suffer from a weaker yen and are also cheap , and perhaps spatial reforms that benefit from governance, make more sense.