Serengeti 130

introduce

Now it’s time to discuss a company that I consider to be one of the most undervalued dividend growth stocks.

that company is Huntington Ingalls Industries (NYSE:HII)one of the largest defense builders in the United States and the backbone of the Navy.

I held the company in a Dividend Growth Portfolio for a while before deciding to sell. As weird as this sounds, considering I’d just call it “underappreciated,” my decision is solely based on my being a massive overweight in defense companies.

In fact, I have been bullish on HII for many years and believe that the epidemic problems it faces are only temporary headwinds.

My most recent article on the stock was written on December 6, when I titled it “Huntington Ingalls Is One of the Most Undervalued Dividend Stocks” in the market. ”

Since then, the index has returned 19.4%, about 600 basis points better than the S&P 500’s (SP500) performance of 13.5%.

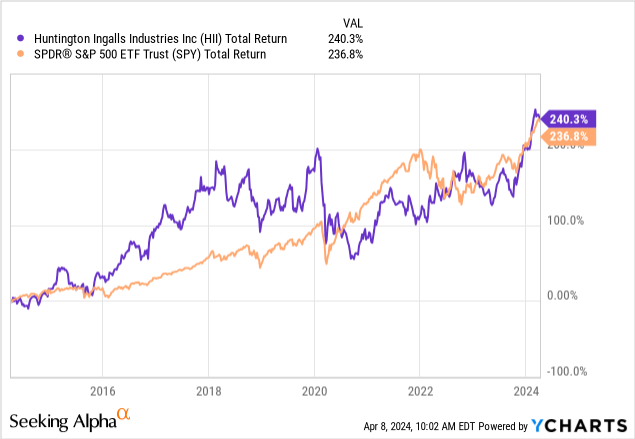

This also puts HII back on top in terms of 10-year performance.

Since April 2014, HII has returned 240%, beating the tech-heavy S&P 500 by several points.

That’s an excellent performance, especially when we consider that HII has been trading sideways for about four years as pandemic-related issues led to operational challenges.

Now, HII is back as it benefits from strong demand, a very favorable long-term outlook, improving operations, and a focus on shareholder distributions.

Even better, despite the recent gains, the stock remains attractive and has a good chance of delivering double-digit annual returns over the long term.

In this article, we will discuss all this and more.

Huntington Ingalls is a special stock

Huntington Ingalls has a market capitalization of $11 billion, much smaller than some of its peers such as Lockheed Martin Corp. (LMT), RTX Corp. (RTX) and Northrop Grumman Corp. (NOC).

However, the company is equally important to the U.S. Armed Forces.

huntington ingalls industries

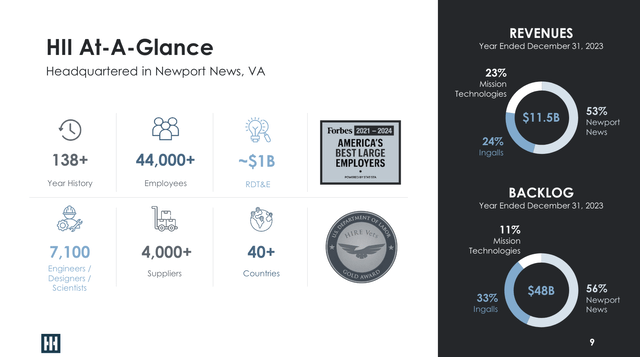

Instead, the company, which was spun off from Northrop Grumman in 2011, is the backbone of the Navy. The company has a backlog of nearly $50 billion and generates revenue in three main areas:

- Newport News (53% of 2023 revenue): The division is the sole supplier of U.S. aircraft carriers and one of two shipbuilders. Speaking of moats, what Huntington Ingalls brings to the table is hard to beat!

- Ingels (24%): The division is the largest supplier of surface combatants to the Navy. In 2023, the index grew 7.1%, outperforming Newport News by 230 basis points.

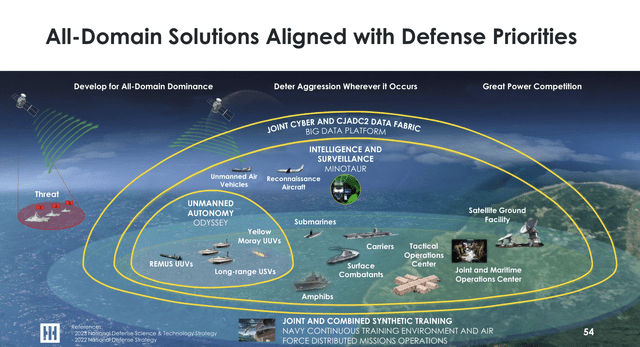

- Mission technology (23%): This segment has been built up through mergers and acquisitions over the past few years, allowing Huntington Ingalls to also compete for high-tech projects. This includes multi-domain technologies and related services that are increasingly important to the U.S. Defense Forces.

huntington ingalls industries

Over the past decade, HII has invested 41% in facilities and technology, with approximately 5% of revenue spent on capital expenditures.

This allows the company to prepare for the future of naval hardware.

For example, HII is optimistic about defense spending despite the uncertainty surrounding the recent budget. Here’s what the company said at its investor day last month:

Now we are very happy to see the president’s budget and strong support for amphibious vehicles. Obviously, this is absolutely critical to our future expectations. So this is a step in the right direction. We had the honor of hosting the senior leadership of the Marine Corps a few days ago, and as you can imagine, they are in a very good position to do this as well. – HII 2024 Investor Day.

Overall, the company sees increasing demand for advanced naval vessels and maritime capabilities as geopolitical tensions escalate and global security threats become more severe.

Keep in mind that while a large metal ship may not scream “high tech” like an advanced Reaper drone or F-35 jets, the Navy allows the United States (and its NATO counterparts) to tackle any part of the world security issues.

In essence, aircraft carriers are mobile military bases. As much as I have faith in advanced military technology and a new space race, the Navy is here to stay.

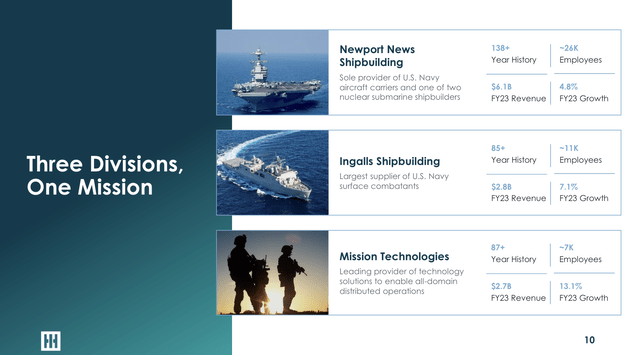

In addition, the company expects U.S. submarine production to grow fivefold after 2040.

huntington ingalls industries

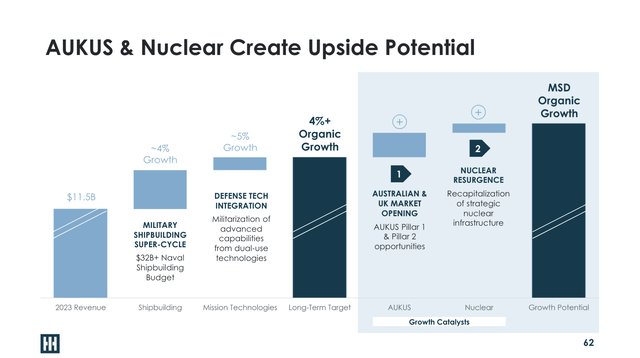

As shown below, driven by AUKUS, the company is expected to achieve long-term organic growth of more than 4%, with mid-single-digit growth potential (security treaty between the United States, Britain and Australia) and nuclear submarines.

huntington ingalls industries

Regarding my previous Nuclear comments, Huntington Ingalls expedited the recruiting process:

As demand for nuclear-powered submarines increases, Newport News Shipbuilding said it will hire 3,000 skilled workers this year and a total of 19,000 skilled workers over ten years. – HII press release.

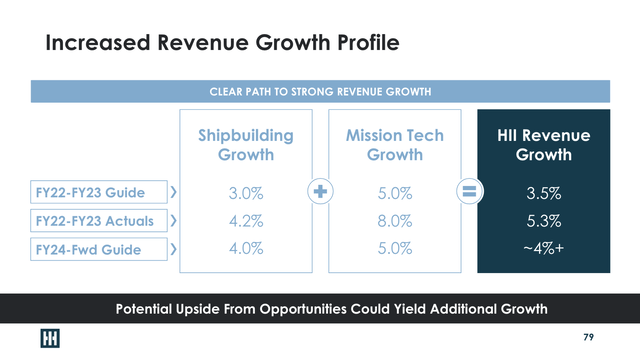

Additionally, the company’s order backlog provides visibility into future revenue, with more than 75% of projected revenue over the next three years already under contract, and guidance indicates a path for continued growth in shipbuilding and mission technologies.

huntington ingalls industries

Even better, Mission Technologies, a heavyweight in C5ISR and cyber and electronic warfare, has a book-to-bill ratio of 1.9x, indicating that for every $1.00 of finished goods completed, the division receives $1.90 of new orders . This is a strong support for future growth.

huntington ingalls industries

Beyond this, the company is actively pursuing additional growth opportunities, including major construction projects, maintenance and modernization projects, and new business acquisitions.

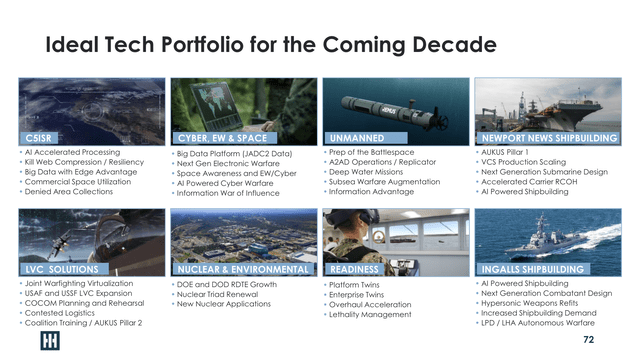

These opportunities include (but are not limited to):

- Modify ships to incorporate new technologies, including hypersonic weapons.

- Work on autonomous ships (smaller, mass-produced weapons).

- Updated nuclear trinity.

- Implement next generation electronics.

- Applying artificial intelligence to ships and shipbuilding processes.

- Promote “big data” applications in C5ISR.

huntington ingalls industries

This may be a silly comparison, but think of HII as a car company, except that there are only two car companies (the other being General Dynamics (GD)) that can afford to buy the cars needed for America’s roads.

HII and GD basically dominate their industries.

Now, the automotive industry is undergoing rapid transformation. Not only do people want more cars, but they also need to update the cars they own with new technology.

To some extent, this is a “forced” increase in demand, which greatly benefits HII.

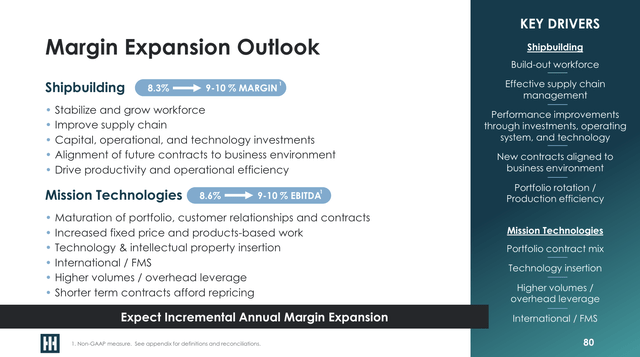

In particular, technology trends are expected to support continued supply chain improvements that will significantly increase profits in the shipbuilding and technology sectors.

huntington ingalls industries

As you can imagine, this is good news for shareholders.

HII shareholders win

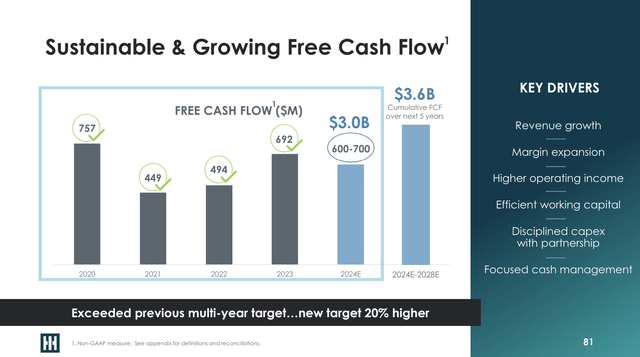

Good growth prospects come with good free cash flow prospects.

Between 2020 and 2024, the company expects to generate $3 billion in cumulative free cash flow.

Free cash flow is expected to grow approximately 20% between 2024 and 2028, reaching $3.6 billion. This is equivalent to approximately 32% of its current market capitalization over the entire period, which averages out to 6.5% per year.

huntington ingalls industries

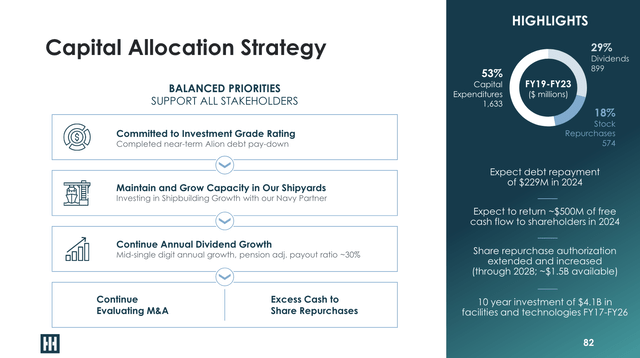

As shown below, this bodes well for shareholders as dividends are among the top three priorities for capital expenditure after maintaining a healthy balance sheet and growing the business.

huntington ingalls industries

Speaking of its balance sheet, the company had net debt of $3.3 billion in 2021 and a leverage ratio of 3.3x. The company started the year with net debt of $2.5 billion and a leverage ratio of 1.9x.

It also has $430 million in cash (part of net debt) and $1.9 billion in liquidity, including its revolving credit facility.

Standard & Poor’s rates the company BBB-, which is an investment grade rating, and I expect it to be upgraded to BBB within the next two years.

Returning to the dividend, investors now face a favorable combination of debt reduction, improving growth, and stronger long-term tailwinds.

Therefore, the dividend outlook is good.

Since 2013 we have provided an annual dividend and We have increased our dividend every year since then.us A guide to mid-single-digit annual dividend growth The net pension-adjusted income payout ratio is approximately 30%. We have increased our dividends to 5.1% and 4.8% in the past two years respectively. – HII 2024 Investor Day (highlights added).

In other words, annual dividend growth rates of 4-7% are expected to be sustained over the long term.

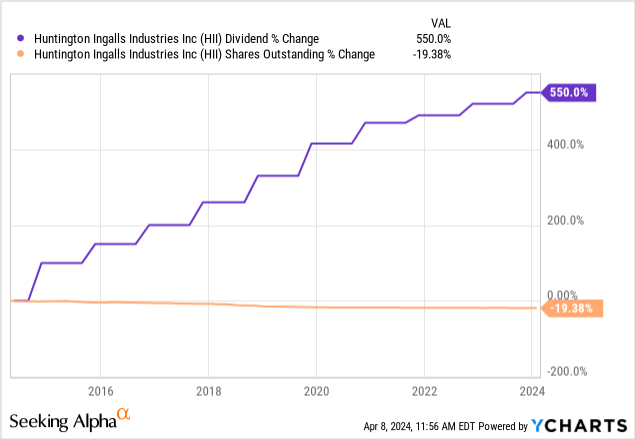

Currently, HII pays $1.30 per share quarterly. This represents a yield of 1.8%.

If we assume the company’s average annual free cash flow yield is 6.5%, then we’re looking at a very favorable cash payout ratio of under 30%.

While HII may not be a high-yield stock, its free cash flow capabilities are impressive, which bodes well for buybacks.

Over the past decade, HII has repurchased 19% of its shares. Going forward, I expect this number to accelerate now that it has a healthier balance sheet and more favorable growth prospects.

Valuation

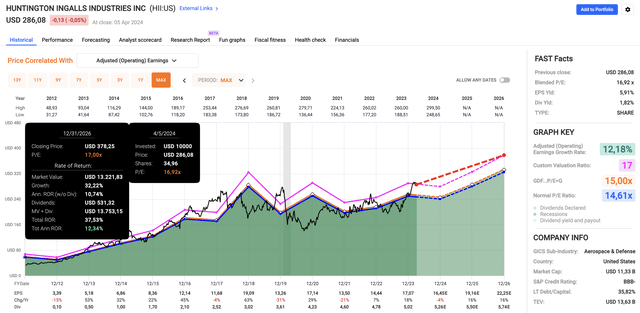

After recent gains, HII currently trades at a combined price-to-earnings ratio of 17 times. This is well above its post-split normalized P/E ratio of 14.6 times.

However, as I wrote in my last article, I think 17x is fair because the company has stronger growth prospects. While earnings per share are expected to be flat in 2024, earnings per share are expected to grow 16% in 2025 and 2026.

quick chart

If you add in the 1.8% dividend, the company has a good chance of returning 12% annually through 2026 (and possibly beyond).

Since 2012, HII has returned 20.6% annually.

But please note that this is a theoretical annual return rate. I can’t guarantee that it will return 12% every year.

My view is that over the long term, I expect an average annual return of 12%. This includes some potential corrections and a stronger rebound.

The only reason I don’t own HII is that I already have close to 25% defense exposure. Most of my holdings provide the technology installed on these ships, so HII is optimistic about its future, which is also optimistic for most major defense builders.

take away

Investing in Huntington Ingalls presents a compelling opportunity in an often overlooked niche of the defense industry.

With a record of resilience and growth, HII has become a key player in shaping U.S. naval power.

The company’s focus on innovation, driven by a strong backlog and strategic investments, provides the foundation for sustained shareholder value.

Despite its recent gains, HII remains attractively valued and is poised to deliver double-digit annual returns.

As geopolitical tensions increase and global security needs escalate, HII’s role in advancing naval capabilities holds a bright future.

HII is an excellent choice in the defense industry for investors looking for stability, growth, and dividend potential.

Advantages Disadvantages

advantage:

- Stable growth potential: Despite the temporary setback, HII shows strong growth potential, supported by accelerating demand and a large backlog of orders.

- Good prospects: HII focuses on naval construction and emerging technologies designed to take advantage of changing defense needs.

- Shareholder return: The commitment to dividends and buybacks underscores management’s dedication to shareholder value.

- Strategic positioning: A key player in naval defense, HII has a massive moat.

shortcoming:

- Department dependencies: HII’s success is closely tied to the defense sector, making it vulnerable to government spending and geopolitical tensions.

- Production is limited: With a relatively low dividend yield, HII may not appeal to income-focused investors looking for a higher yield.

- operational risk:HII is material and labor intensive. That’s a huge headwind during the pandemic.