Ivan Pantic/E+ via Getty Images

February 27 was not a particularly pleasant day for shareholders. henry schein & co. (NASDAQ: HSIC). Shares in the company, which focuses on providing health and dental products to customers, fell nearly 4% after administration declare Covers financial performance for the last quarter of fiscal year 2023. Granted, the quarter’s numbers themselves were disappointing. However, guidance for fiscal 2024 is upbeat, suggesting the worst of the company’s troubles may be behind it.

Considering how difficult 2023 is and management’s inability to meet analysts’ expectations by the end of the year, the market doesn’t appear to be taking forward guidance that seriously. But if the company can deliver on those promises, future upside could be solid.

difficult quarter

Before When the market opened on February 27, Henry Schein’s management team Announcement of financial results Covers the last quarter of fiscal year 2023. Revenue for the quarter was $3.02 billion.In addition to being down 10.5% from the $3.37 billion reported in the same period a year ago, management reported sales figures that were about $20 million lower than analysts’ figures. Look forward to.

The company has experienced pain in nearly every category. For example, global dental revenue fell 10.9% from the same period last year due to an 11.3% decline in merchandise sales and a 9.7% decline in equipment sales. The global medical situation is even worse, and sales plummeted 17%. From a sales perspective, the company’s only bright spot involves the global technology and value-added services categories it operates in. Revenue for the quarter increased 7.1% compared with the same period last year.

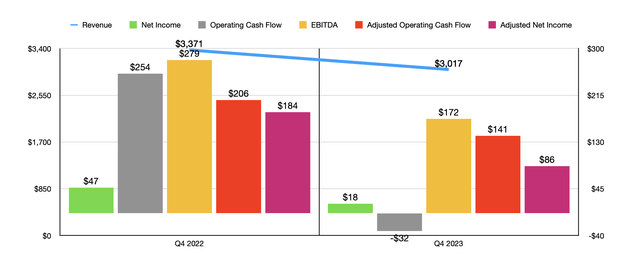

Author – SEC EDGAR Data

The decline in revenue brought about a decline in profits. Earnings per share totaled just $0.13. This was down from the $0.34 per share reported in the fourth quarter of 2022 and $0.33 below analysts’ forecasts. After adjustments, the situation is better. Adjusted earnings per share were $0.66, well down from $1.35 in the final quarter of 2022. However, it was still lower than analysts’ expectations of $0.04 per share.

Clearly, falling revenue is part of the reason for this. However, the company was also hit by rising selling, general and administrative costs. These accounted for 26.7% of sales in the last quarter of 2023, up from 22.6% in the last quarter of 2022. Unfortunately, management didn’t provide any real details on how this happened. We do not have an annual report available yet. But we do know that this has been a cost issue for the company for some time. Management attributed this largely to higher operating costs related to payroll and payroll-related activities, higher facilities-related costs and consulting fees in both divisions as the company seeks to cut costs over the long term.

As a result of these disappointing earnings, overall net income was just $18 million, while adjusted profit was $86 million. Both were down from the company’s revenue of $47 million and $184 million a year ago. Other profitability indicators also took a hit. Operating cash flow fell to negative $32 million from $254 million. If we adjust for changes in working capital, the decline was smaller, from $206 million to $141 million. Finally, the company’s EBITDA fell from $279 million to $172 million.

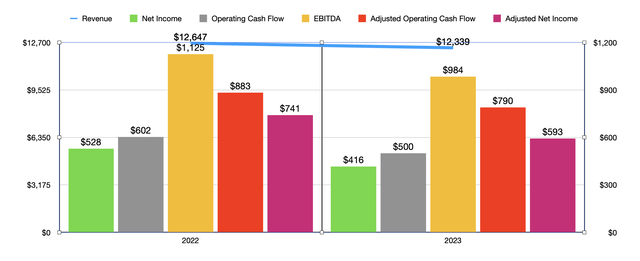

Author – SEC EDGAR Data

I would say the last quarter of 2023 is going to be the most brutal for the company. But overall, 2023 is not a pleasant year. In the chart above, you can see the company’s revenue, profit, adjusted profit, and certain cash flow measures for the current year relative to the prior year. By all accounts, the situation is getting worse year by year.

That’s why I think investors should be somewhat pleased with current expectations for the future, but should also remain cautious. You see, in releasing earnings for the final quarter of fiscal 2023, management said revenue this year should be 8% to 12% higher than in 2023. At the midpoint, that translates to sales of $13.57 billion.

In terms of profitability, management expects adjusted earnings per share to be in the range of $5 to $5.16. That would be well above the $4.50 per share in adjusted earnings reported in 2023. This means that, assuming no change in share count, net profit would have been $664.2 million. Beyond that, management said EBITDA should be at least 15% higher than in 2023. If we take the low end of that ratio, that would mean a reading of $1.13 billion. No guidance was given on operating cash flow. But if the adjusted figure also grows at 15%, it would mean $908.5 million.

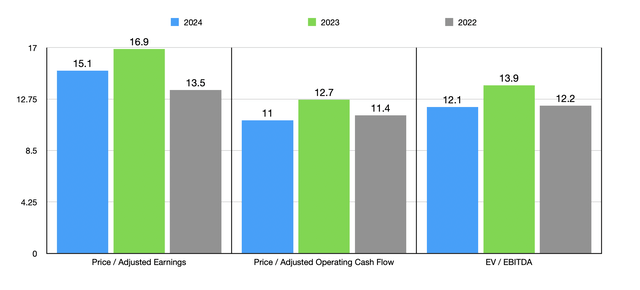

Author – SEC EDGAR Data

Using these numbers, valuing a company becomes fairly simple. In the chart above, you can see how the stock is priced using historical data for 2022 and 2023, as well as estimates for 2024. The stock does look particularly attractive from a long-term perspective. I wouldn’t exactly call it a home run prospect. But the stock does look cheap enough to justify some upside.

Of course, we should also look at how the stock is priced compared to similar companies. In the table below, I compare the company to five similar companies. Looking at the price-to-earnings ratio, only one of the five companies is cheaper. Three of the five are cheaper when using operating cash flow multiples. When using the EV vs. EBITDA approach, only two of the five end up being cheaper.

| company | price/yield | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| Henry Shane | 16.9 | 12.7 | 13.9 |

| Cardinal Health (CAH) | 43.2 | 7.0 | 14.3 |

| Owens vs. Minors (OMI) | 50.4 | 2.5 | 9.4 |

| Patterson Corporation (PDCO) | 13.9 | 38.9 | 8.3 |

| Cosmic Health (COSM) | 96.7 | 16.2 | 41.6 |

| Adaptive Health (AHCO) | 75.8 | 3.2 | 44.4 |

Another thing to like is that management is so optimistic about the future that they’re not afraid to allocate large amounts of capital to buy back stock. While I would prefer to allocate capital in other ways, especially since the stock isn’t terribly cheap, this is a vote of confidence that management is saying the future is brighter and the stock price will be higher. Throughout 2023, the company repurchased 3.2 million shares. A total of $250 million was spent. With $265 million remaining in the stock repurchase program, it would not be surprising to see further material purchases this year.

take away

All things considered, I’d say Henry Schein, Inc. appears to be a solid company. Yes, 2023 has not been a pleasant year. But current expectations are for attractive growth in 2024. The stock isn’t the cheapest around, but it’s priced enough to warrant a degree of optimism. This is true both on an absolute basis and relative to similar companies. Due to all of these factors, I think a soft “Buy” rating on Henry Schein, Inc. currently makes sense.

Editor’s note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks.