John M. Lund Photography

Stop me if you’ve heard this before: A new closed-end fund is going public at $8.25 a share, the highest price in the eight days since the securities hit the market was more than $75.Just last Friday, the deal The 65% range closed just below the middle of the range, around $59. Nvidia(NVDA) and game stop (Society of General Mechanical Engineers) have children? No, this is not a meme stock. In fact, it’s not even a stock. It is a closed-end fund, Destiny Tech100 Inc. (NYSE:DXYZ). Closed-end funds shouldn’t soar like stock IPOs, even if their largest holding is Elon Musk’s SpaceX.

When I first started digging into this “unknown financial object,” I saw it called an ETF on one of my charting systems. Another source. The source did not list the location of the fund’s holdings, only where the financial statements are placed. For a stock! So, since the investment community has not yet figured out what this is, I will sort out the ABCs of Lilac Garden. As for how to evaluate, my true evaluation is “Go and see for yourself, and be careful when deciding to buy.” Because while I may buy some stock, it’s more about tracking it in my “spec” account, which is short for speculation.

As I explain below, it’s a unique way for “normal people” like me to invest in a basket of 100 potential big winners, all of which are currently private companies. At worst, it may end up being only as good as investing in a private equity business. Historically, this means early entrants get the best returns, and the cycle ends when “anyone” can enter. When the police show up in a classic crime movie, it results in the public ultimately feeling like they’re the ones holding the purse strings.

Nonetheless, my approach to investing is that any investment has the potential to go up for any reason. The difference between hypothetical security “ABC” and real DXYZ is the risk of significant loss. This is a function of two factors: what price movement occurs when you own DXYZ, and more importantly, the proportion of DXYZ to the total portfolio assets. For me, I’ll buy something at around 1% off just to watch. So when I factor in the fact that I will own it, coupled with the very negligible size of my initial position, converting that rating to “Seeking Alpha Terms” leaves me holding DXYZ. Now, let’s explore what this is and why I ended up in this situation. Yes, that’s a SpaceX pun.

What is DXYZ?

DXYZ is a held closed-end fund, which means it trades on the stock exchange but represents a portfolio or basket of securities rather than a single company. So it’s a fund, but different from a traditional “open-end” mutual fund or ETF. This difference comes from the fact that shares of closed-end funds are fixed, so the basic concepts of supply and demand are a big factor. The fundamental value of the securities in the DXYZ portfolio (i.e., these 100 private companies) is not “marked to market” on a daily basis. So how is their value determined? Buyers and sellers in the market decide what the price will be. Just like a single stock.

DXYZ has 10.88 million shares outstanding, giving it a market capitalization of $644 million as of Friday.This puts it near the top quartile in terms of assets under management There are 418 closed-end funds in the US market.

The fund aims to reach a target of 100 companies, although the number currently in the fund is only about 1/4 of that number. These are all pre-IPO companies, and the Destiny website claims that “for many companies in the pre-IPO stage, there is a real opportunity to achieve 10x to 50x returns.”

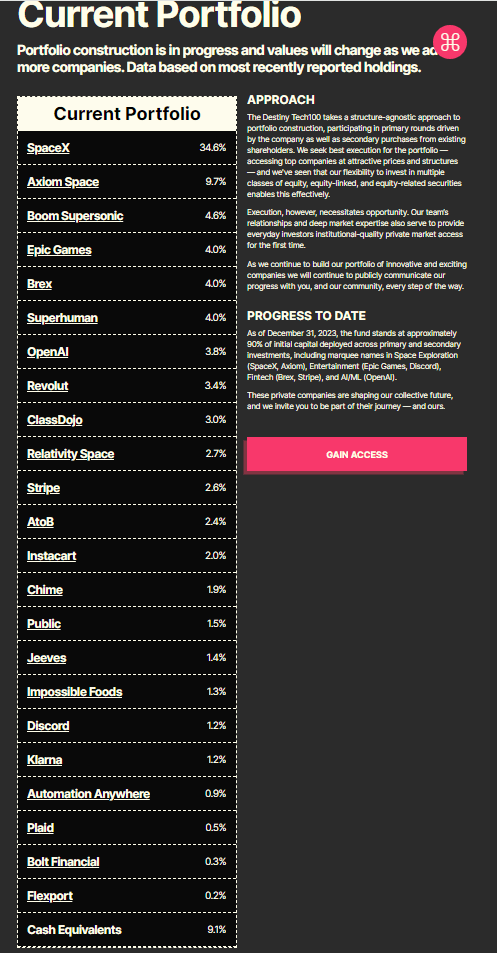

Holdings: A ‘who’s who’ of private companies, all in one report

I don’t know what this list of private companies will look like, but I’m impressed by the opportunity for Lilac managers to own a piece of it. SpaceX accounts for more than 1/3 of the fund so far, but I suspect that may drop as the portfolio fills out. Even if not, there are plenty of chances to win here.

destiny.xyz

this link The DXYZ website does a good job of detailing the process they use to set up a fund, which is much higher than the level of description provided by many closed-end funds and ETFs. This is a big advantage for me.

And, this link points to DXYZ’s filing on December 31, 2023 Provide some useful additional information. It is issued before the securities go public. Note that the fund lost 7.3% in 2023, 50% below the Nasdaq’s return. As of the end of last year, the fund’s stock price was down 23% since its inception on May 12, 2022, while the Nasdaq was up nearly 20%. I view this as a positive given the cyclical nature of private equity discussed below.

What is the reward potential of DXYZ?

Artificial intelligence is now more than a buzzword. This is our future, we just don’t know which way it will go. There will be winners, big winners, and there will be losers. Perhaps the most attractive feature of Lilac Garden is the nature of private equity investing itself. While traditional equity investing focuses on diversification to spread risk, I have always viewed private equity differently. Here, you know the risk is extremely high, but if you spread the risk across 100-plus companies, it may only take a handful of companies to scale up enough to offset any failure that occurs in the rest of the group.

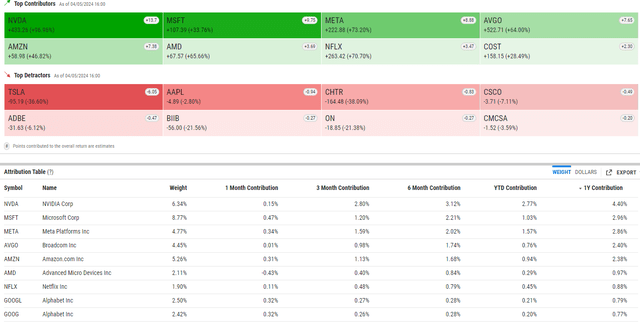

Frankly, the Nasdaq 100’s performance over the past six months has been more like private equity than a standard, evenly distributed pattern of stock market winners and losers. This is a snapshot of the past 6 months. Note that the big winners in green have all contributed dominant dollar amounts per share (in the QQQ ETF), as shown above, and in the percentage “vesting” in the bottom table, not just over the past half year, but over the past year. Year.

Y chart

The Nasdaq 100 is up 23% over the past six months, but more than half of that (13%) came from just 8 of the 100 stocks. This “feast or famine” outcome is probably more common and pronounced in the private equity world, so to me DXYZ is either an enticingly small position, or a true “token” position, or even smaller , just in time for it to appear on the My Collections screen.

What are the main risk factors for holding DXYZ?

While DXYZ represents the next step in the democratization of investing, where any investor can try to profit from the future earnings of private companies, I don’t think the biggest risk lies in the funds themselves. It depends on how investors use it. Just like meme stock investors who refuse to sell after life-changing gains, I’m always wary of seeing investors extrapolate past gains. That said, there’s some history here, and despite the disclaimer, private equity and venture capital are different beasts, and as I’ve compared here, the market isn’t indexed as precisely as the S&P 500.

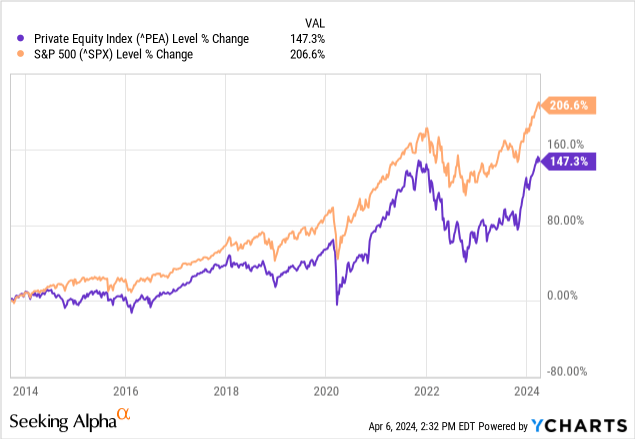

The S&P 500 has performed well over the past 10 years or so. The same goes for private equity.

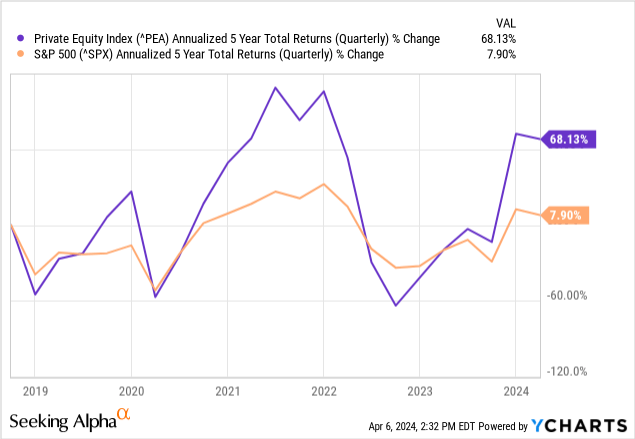

However, when we look at rolling returns as usual to find the return path rather than just a snapshot, we see 2 past irrelevance. These are annualized 5-year total returns. So yes, your eyes don’t deceive you. The private equity index has risen by approximately 100% per year for five consecutive years, and has also fallen by 60% per year for five consecutive years. All this is just in the past 10 years!

There’s a cycle here, and I wouldn’t be surprised to see private equity near the top of the cycle. This is exactly when I expect funds like DXYZ to debut: their ability to ride the wave of greed and FOMO in the asset class. This is why for my own money, I insist on prioritizing position sizing in most assets over what I actually own. This may sound strange to some, but simply put, a 10%-20% position in anything but Treasuries will likely provide more reward and risk than a 1%-2% position in anything .

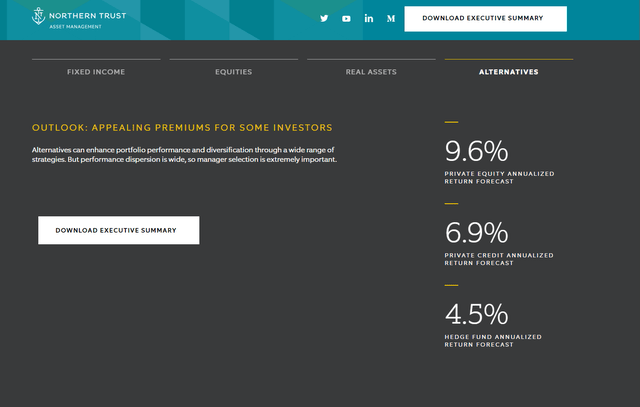

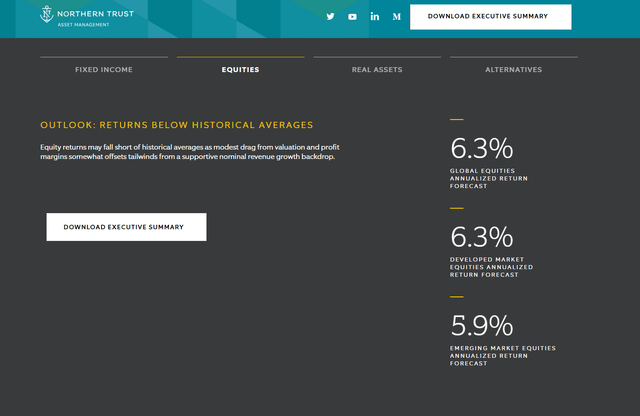

Looking ahead, Northern Trust expects annualized long-term returns for private equity to be 9.6%, compared with 6.3% for global equities. My only reaction is that private equity generally has higher returns than common stocks. The question is whether there is a plus or minus sign before that carriage return.

Northern Trust Network Northern Trust Network

The expense ratio here is also high, at 2.5%, which is much higher than most funds, but not too high for a closed-end fund. My take on the expense ratio: Completely overvalued by investors, especially my industry peers. If you buy an S&P 500 index fund and hold it for 20 years, the expense ratio is undoubtedly the key factor.

But this is a commoditized investment. This is a unique investment and you get what you pay for. McDonald’s and that fancy steakhouse have different prices, but some people may prefer one over the other. If you pay some money and get more in return, or at least more “potential” returns, I really don’t care what I’m paying for it, at least as high as a 2-3% expense ratio. No doubt others will disagree, and they do. This is how the market is formed.

What I’m doing in DXYZ

I would start with 0.5% of my total portfolio, with an eye on increasing it to 1%, and then to 5% if I can after I get some unrealized gains. But I’m willing to lose most of that 1% position because I see potential upside beyond the small amount of risk I’m taking.

By the way, every investment decision I make involves a similar calculation, and I think this is the one thing missing from many investors’ processes. That’s why I keep bringing it up.

Therefore, DXYZ gets a Buy rating from me right out of the gate. But as they say, size matters, and my position size here is going to be very low at the moment as I look to see if this first-of-its-kind listed security has the potential it seems to have.