59 yuan

We previously reported on Devon Energy (NYSE:DVN) in December 2023, discusses why its inherent undervaluation could be a gift for investors with a long-term investment trajectory, while a potential recovery in the macroeconomic outlook could trigger eventual normalization Its stock valuation and price.

Most importantly, management continues to execute brilliantly, further proving why it shouldn’t be as beaten down and underappreciated as it has been thus far.

In this article, we discuss why DVN’s investment thesis remains attractive and warrants our reaffirmation of a Buy rating while crude oil prices are likely to continue to rise.

With management able to effectively execute on balance sheet deleveraging, shareholder returns, and working capital efficiency improvements, it’s clear that the oil/gas producer remains highly attractive in this regard, further from the inherent undervaluation compared to peers. Fueling the oil/gas producer’s appeal.

Tiandi Network Investment Theory Still attractive here, further helped by a healthier balance sheet

Currently, DVN reported earnings on its Q4’23 earnings call, which included Adjusted earnings per share were $1.41 (Month-on-month -14.5%/ -15% year-on-year) and operating cash flow of $1.7B (-10.5% QoQ/YY).

Readers must note that month-on-month/year-over-year fluctuations are primarily attributable to fluctuations in fuel spot prices and Realize price fluctuationsof which oil prices were US$76.98 (-3.5% month-on-month/-0.5% year-on-year), liquefied natural gas was US$19.67 (-5% month-on-month/-19.1% year-on-year), and natural gas was US$2.02 (+0.4% month-on-month/-49.6% year-on-year) ).

However, this headwind was well balanced by an increase in total DVN oil production to 662 MBoe/d (-0.4% QoQ/+4% YoY) through the most recent quarter, and management has reiterated that similar production will be achieved in 2024 level.

In addition, readers must note that these actual prices have significantly improved compared to before. Realized oil prices in Q4 2019 $56.89, compared with $17.54 for LNG and $1.83 for natural gas, further benefiting from lower prices from producers WTI breakeven price $40.

Given its superior profitability, we are not surprised by the continued improvement in DVN’s balance sheet, with long-term debt of $5.67B (-8.2%/-19.4% YoY vs. $7.04B in FQ1’21) and modest net Debt to EBITDA of 0.7x (inline QoQ/+0.2x compared to FQ4’22; 0.5x/-0.7x from FQ4’22 levels) FQ1’21 level is 1.4x).

Meanwhile, the producer has been buying back shares, having repurchased 17 million shares during the LTM period and 41 million shares since the second quarter of 2021. On top of that, the 5-year dividend growth rate is +21.67%, compared with 2.55% for Exxon Mobil (XOM), 6.25% for Chevron Corp. (CVX), and the industry median of +5.04%.

It’s clear from these numbers that Tiandi Network has leveraged much of its cash flow during the pandemic, both through deleveraging and shareholder returns, thanks to strategically fixed variable dividends.

As evidence of its improved profitability and healthier balance sheet, management also approved a 10% increase in the fixed dividend to $0.22 per share, further demonstrating its shareholder-centric commitment.

WTI crude oil price

market insiders

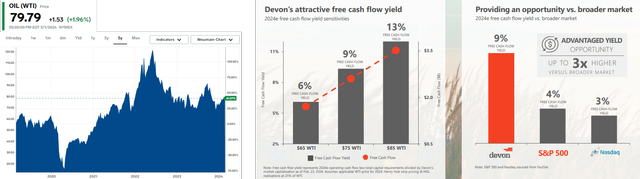

Readers must also note that we may see DVN’s free cash flow generation exceed expectations in 2024, as WTI crude oil spot price As of this writing, it has climbed back to around $80.

Based on management’s fiscal 2024 guidance, we could see producers offering free cash flow yields close to 11% if WTI stabilizes at current levels, or close to 13% if WTI hits $85 Cash flow yields, which are further aided by $3.45B of expected tighter capex (-6.7% (YoY)) at the midpoint

With OPEC+ expected to extend previous production cuts into Q2 2024 due to uncertainty in the geopolitical climate, we may see WTI crude maintain upward momentum in the near term, with the Fed anticipating a further shift in H1’24 promote and Demand from Chinese people continues to increase.

Consensus forward estimate

Seeking Alpha

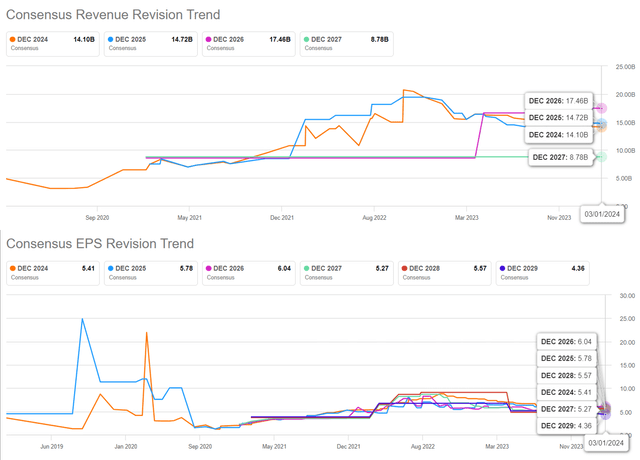

The same optimism is reflected in consensus forward forecasts, which expect DVN to post revenue/profit CAGR of +4.6%/+1.9% through fiscal 2026.

This compares to the previous forecast of -10.3%/-8.7% and historical growth rates of +1.5%/+20.8% for fiscal 2017 and 2023, respectively. This revision may be attributed to the EIA’s forecast Crude oil prices By 2025, the price will remain at a high of $79.48, compared to $60 in 2019.

Tiandi Network Valuation

Seeking Alpha

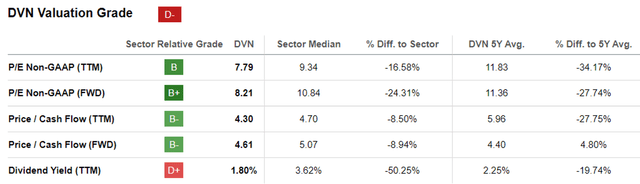

Due to the positive mid-term benefits, we can understand why the market has temporarily raised the valuation of DVN. The FWD P/E ratio is 8.21 times and the FWD price/cash flow is 4.61 times, which is higher than its 1-year average of 7.72 times/4.01 times and closer to the industry median. Counting 10.84x/5.07x.

Most importantly, based on DVN’s enterprise value of $33.95B and proven reserves of 1.81M BOE in 2023 at the time of writing, DVN’s enterprise value to proven reserves ratio of 18.75x remains essentially undervalued.

Compared to XOM’s 26.2x, CVX’s 27.2x, and Occidental Petroleum Corporation’s (OXY) 20.5x, its enterprise value/2023 proven reserves are $443.86B/16.92 million barrels of oil equivalent, $302.62B/11.1 million barrels of oil equivalent and $81.83 are B/3.98M BOE respectively.

So, is DVN stock a buy?sell, or hold?

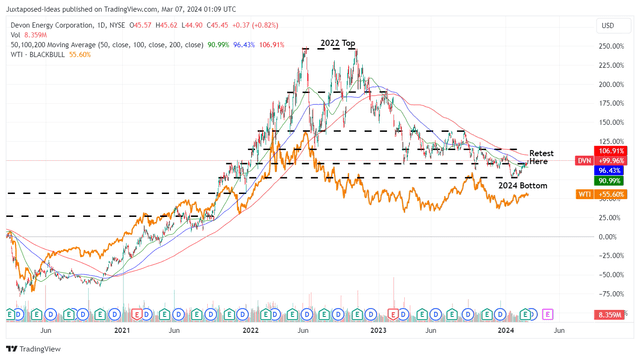

DVN 2Y stock price

trading ideas

Currently, DVN has successfully rebounded from the 2024 bottom while retesting the previous $45 resistance at the time of writing.

The stock’s correlation with WTI spot prices also suggests that a 2024 bottom of $41 could hold, assuming OPEC+ can establish a $80 floor for crude oil.

With the last announced quarterly dividend of $0.44 per share, DVN investors may also expect the dividend yield to expand to 3.9% based on the current share price, compared with the industry median of 3.66%.

We could also see modest upside potential of about 10% from the mid-point price target of $49.50, based on a consensus fiscal 2026 adjusted EPS of $6.04 and a FWD P/E valuation of 8.21x.

Opportunistic investors may also look for a speculative re-rating of its FWD P/E valuation, bringing it closer to pre-pandemic levels of 18x, implying an extremely bullish long-term price target of $108.70.

We maintain a Buy rating on DVN stock due to its attractive risk/reward profile at current levels and its inherent undervaluation.