Justin Sullivan/Getty Images News

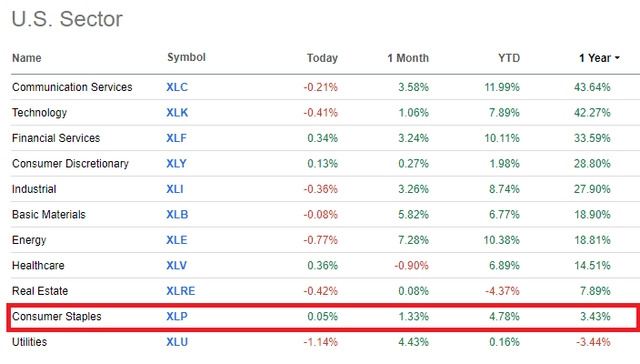

Consumer staples have become the second-worst performing sector after utilities as markets have embraced risk-on trades in recent months and the possibility of a 2024 recession appears to have faded.

Seeking Alpha

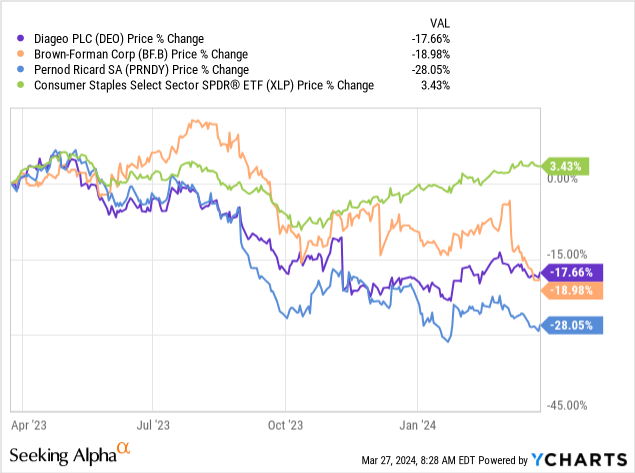

exist The broader market weighed on lower-risk areas of the stock market, with Diageo plc (NYSE:DEO) is also caught between industry woes and company-specific issues related to inventory levels in Latin America.

As a result, despite Diageo’s strong competitive position and industry-leading profitability, its shares have lost more than 17% of their value in the past 12 months.

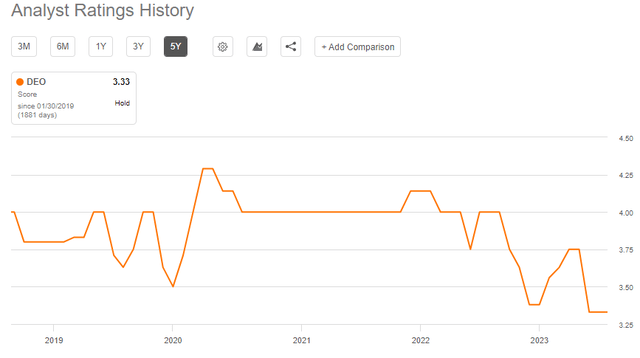

This is not an ideal outcome for any shareholder, but it also significantly improves DEO’s mid- to long-term expected returns, assuming we deal with the temporary issues with the business.Meanwhile, sell-side analysts also raised towel and hastily downgraded the stock in recent months to one of the lowest consensus ratings in the past five years.

Seeking Alpha

Despite the negative sentiment toward DEO, the recent sell-off appears to be overdone for two reasons. On the one hand, this is due to broader selling pressure within the consumer staple spirits segment that has accelerated over the past year. On the other hand, Diageo’s current woes are transitional in nature, and the rapid deterioration in analyst ratings is unjustified in my view.

focus on important things

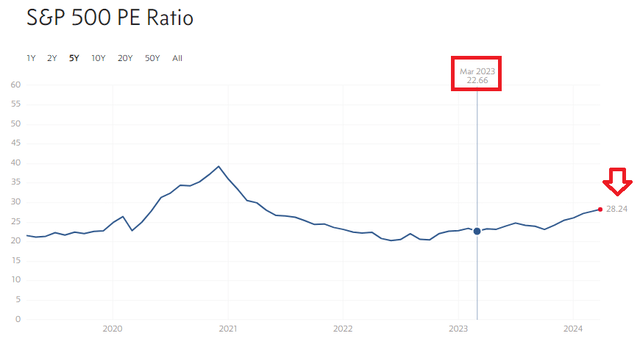

The recent rally in the stock market has been largely driven by risk appetite and has now resulted in the S&P 500’s price-to-earnings ratio rising from 22.7 last March to over 28 today (see below). While the low risk of recession in 2024 goes some way to justifying this, it also creates significant risk for growth stocks.

multpl.com

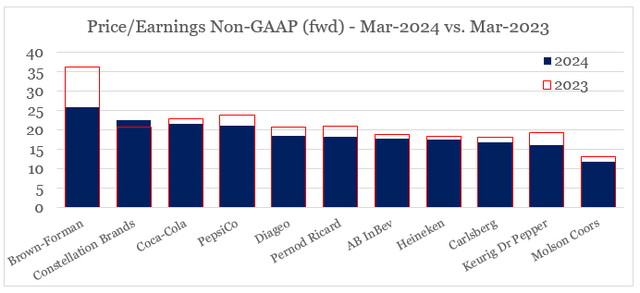

Bucking the trend within the S&P 500, nearly all large-cap and high-quality beverage companies are now trading at a discount to a year ago. Specifically, Diageo is currently priced in line with broader peer averages.

Written by the author using data from Seeking Alpha

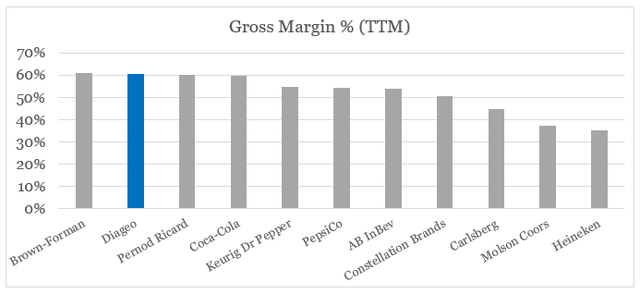

At the same time, DEO’s strong brand portfolio and its leadership position in the high-margin spirits category give the company one of the highest gross margins in the industry.

Written by the author using data from Seeking Alpha

In the medium to long term, this should allow DEO to maintain its industry-leading returns on capital, but short-term pressures related to organic revenue growth and fixed cost projects have been the focus of most investors and sell-side analysts.

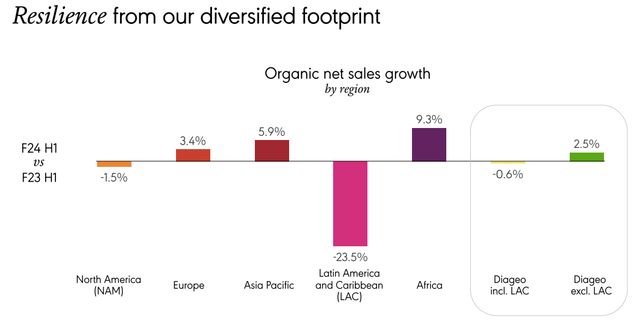

the group’s Organic net sales fell 0.6% In the first half of FY24, organic operating margin declined 167 basis points. (…)

Organic operating margin fell 53 basis pointsexcluding LAC, driven entirely by increased investment in marketing.

Source: Diageo 2024 second quarter financial results

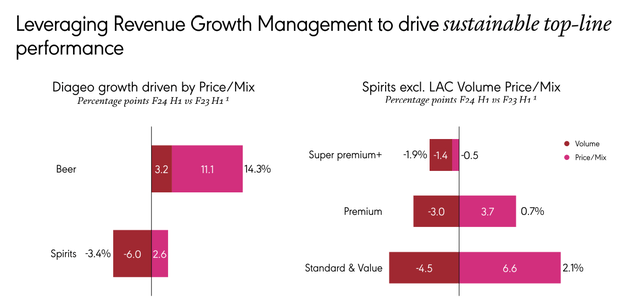

While these are legitimate reasons to avoid DEOs for those with an investment horizon of around a year, they are mostly transitional factors for long-term investors. As noted on the recent conference call, the operating margin headwind was primarily driven by increased marketing investments, which are critical to maintaining brand strength.

Cutting investment in marketing during a period of demand headwinds is not a viable strategy, and while this may temporarily impact operating margins, I don’t see that as a problem. In fact, Diageo’s continued brand investment over the years was the main reason why price/mix growth more than offset sales declines.

Diageo Investor Introduction

Have we found the bottom?

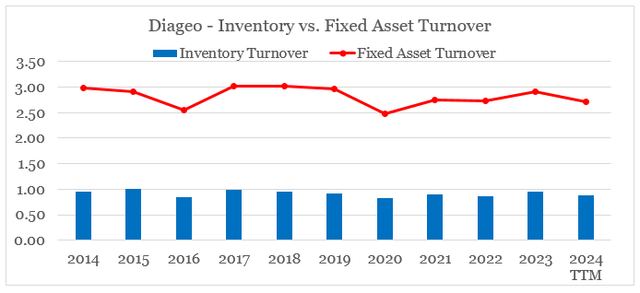

Slow-growing companies like Diageo typically trade based on their realized profitability, as changes in asset turnover are often not large enough to have a profound impact on total return on capital.

On top of that, DEO management has excelled at inventory and capacity management, with minimal changes in the company’s fixed assets and inventory turns, even amid unprecedented demand declines in Latin America.

Written by the author using data from Seeking Alpha

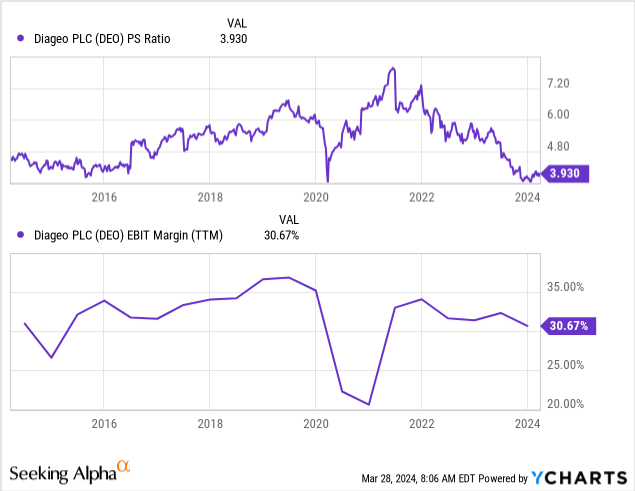

As such, changes in operating margins have been a key driver of Diageo’s valuation multiples, but even if we factor in the recent decline in margins, the current sales multiple of 3.9 seems too attractive to ignore.

Diageo’s business performance is likely to continue to be mixed in the coming months, but management is now confident that sales growth and operating margins will stabilize in the next financial year, which starts in July.

when we enter FY25and an improving consumer environment, we expect to make progress toward achieving our mid-term guidance, our Organic net sales growth trajectory Improvement compared to FY24. We expect FY25 organic operating profit growth to be broadly in line with organic net sales growth.

Source: Diageo 2024 second quarter financial results

On the revenue side, Latin America’s negative impact on the company’s total sales is also slowly fading, while North America is likely to return to growth, with DEO gaining market share in the Scotch whiskey category and tequila gaining momentum.

Diageo investor introduction

While North America was down compared to the prior year, we did achieve sequential improvement as our actions in the region began to show early impact.

Source: Diageo 2024 second quarter financial results

Based on all of this, Diageo’s stock appears to be approaching a bottom, and while any potential recovery in the share price won’t happen overnight, long-term investors can take advantage of the market’s short-term view and the narrative it has created recently.

in conclusion

Temporary demand headwinds and inventory issues have seen Diageo’s share price currently trade at multi-year lows. Despite negative sentiment from sell-side analysts, the company is well-positioned to return to growth in fiscal 2025. The recent sell-off also seems overdone from a profit perspective, as this financial year could mark the bottom for Diageo’s operating margins.