JHVEPhoto/iStock Editorial via Getty Images

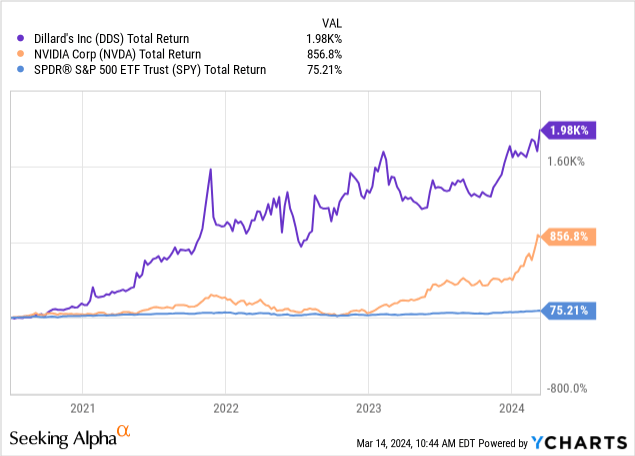

If we could go back in time and buy shares of companies that rode the trends and saw their stock prices soar over the past few years, we would be much richer today.for For example, I wish I had a name like NVIDIA (NVDA) and… Dillard’s (NYSE:DDS)? !

Shares of the once-troubled U.S. retailer have risen about 120% annually since July 2020, for a cumulative gain of about 1,700%. Sortino Ratio Impressive (a measure of risk-adjusted performance) of 4.4, DDS has performed much better than NVDA in the post-pandemic era, both in absolute terms and on a volatility-adjusted basis, while its shares have fallen much less than the California-based company of AI darling stocks (see below).

The last time I published a pessimistic view on Dillard’s was in August 2019, when the company was still fighting all the Various headwinds: From the global economic slowdown to shifts in athleisure and e-commerce trends. In a very unfavorable environment, Dillard’s Department Store continues to report dismal results, even worse than those of its peer Macy’s Department Store (medium size) and Nordstrom (Jiangxi Network) sometimes. At that time, the COVID-19 crisis had not yet spread to the world. In the eight months since my article was published, DDS’s share price fell by more than 50%, just before it began its meteoric rise from the ashes.

After one of the most impressive share price rallies in retail, is DDS worth owning today?

There’s nothing wrong with Dillard’s business

Fundamentally, the retailer’s fundamentals appear to be in much better shape than they were the last time I looked at the company’s financial statements.

First, Dillard’s balance sheet appears to be quite healthy.Cash and short-term investments $956 million most recent quarterGrowth of 20% year over year looks good compared to a stable debt balance of just $321 million (excluding a small amount of lease liability). Inventory of $1.1 billion fell 2%, indicating that Dillard’s is doing a good job moving merchandise.

The balance sheet has been bolstered recently by steady cash inflows. In 2023, Dillard’s generated more than $750 million in free cash flow — an eye-catching number, although down from the $828 million generated in the previous 52-week period. As a result, the retailer was able to distribute up to $620 million in cash to shareholders through dividend payments and stock repurchases. This figure equates to approximately $38 per share per year, or 9% of the current market capitalization.

But the party may be over

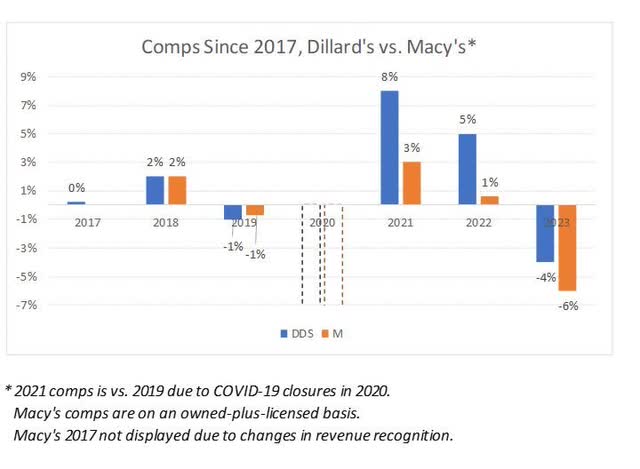

Dillard’s has also been outperforming some of its peers, such as Macy’s, recently. The chart below shows that the Little Rock, Arkansas-based retailer has fared significantly better during its post-pandemic recovery. However, the same chart also helps illustrate the changing trends in stay-at-home habits (think 2021 and 2022) where the good old days may have been forgotten.

DM Martins Research

Last year was a tough one for Dillard’s and most of its competitors, with the company posting corporate results of -4% (the worst in recent memory outside of 2020). During the important holiday quarter, Dillard’s gross margin fell 100 basis points while operating expenses increased 80 basis points as a percentage of sales, resulting in a 15% year-over-year decline in pretax income. The dismal results were driven by what the management team described as a “continued challenging sales environment in the fourth quarter.”

It’s time to sell DDS

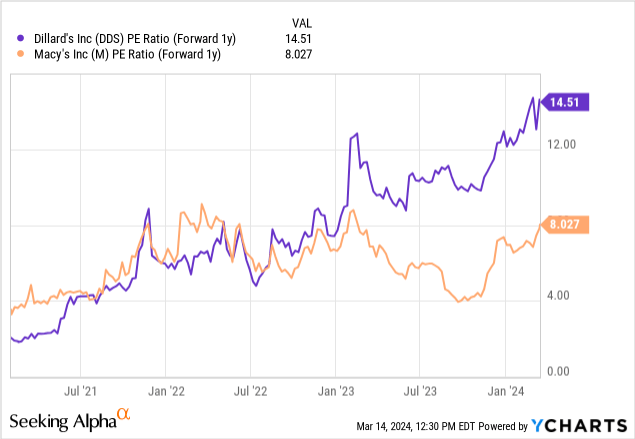

Again, there’s nothing particularly wrong with Dillard’s business. The balance sheet remains strong. Even with annual cash flow declines in 2023, it still looks good right now. The retailer appears to be in a much better position than it was in 2019, especially now that COVID-19 headwinds have fully dissipated.

The problem is that the days of recovery from the epidemic are likely to be a thing of the past. Estimated earnings per share growth rates in 2024 and 2025 are -25% and -9% respectively. Given the poor growth prospects and volatility in the retail space, holding DDS at its current forward P/E ratio of 14.5x (see above) seems to me to be too risky a move, and this is far from eliminated risk.